The average 30yr fixed quote for a top tier scenario was around 6.75% on Friday and was up to 6.87% by Tuesday afternoon. More than a few lenders are already back to 7%.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-02212023

We have an unusual obsession with home pricing – I say unusual because nobody cares that our measuring devices are deeply flawed and regularly give the wrong impression. With the stakes being so high, you’d think homebuyers would investigate thoroughly – but everyone just wants to grab and go!

You can see in the graph above how the smaller sample sizes cause more volatility – Encinitas only had 19 houses sold in December, and ten closings in January – so the 10% to 15% bounces up and down aren’t good representations of the pricing trend.

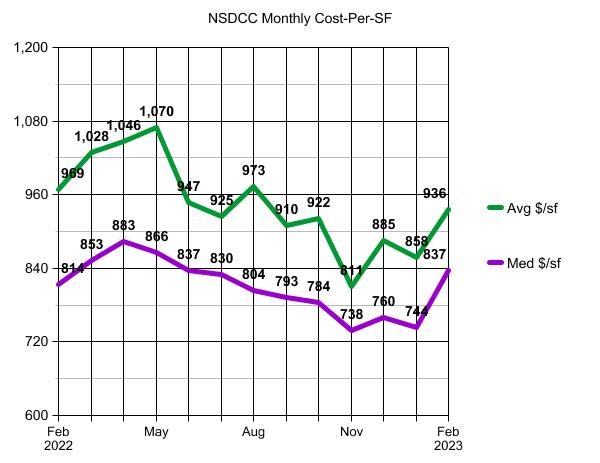

This is a better look at the trend – the average and median $$/sf for houses sold between La Jolla and Carlsbad, and this includes the 70 sales so far this month:

The upward trend should continue as more of the premium products come to market this spring.

I predicted that there wouldn’t be a sale under $2,000,000 in the Davidson Starboard tract in La Costa Oaks after we closed the Plan 2 in October. The first new listing there since is coming soon, priced at $2,899,000 and they should get all the money:

https://www.compass.com/app/listing/7657-sitio-algodon-carlsbad-ca-92009/1253018741329889369

I know they paid $1,999,919 in 2019, but there have been others that have closed for a million dollars over their 2019 purchase price. The Plan 3 layout probably isn’t as popular as the Plan 2, and the backyard is filled with a pool. But this street is a culdesac and it has the best south and west views which only come up occasionally for sale. It’s been so long since we’ve had an offering like this that I wouldn’t be surprised if she has 100+ people look at it next week – in spite of all the doom!

Do you need help with finding your next home!

For those who can stay around here, it’s easier – and I can help you.

How about those of you who want to leave San Diego County – how can you find good help?

We are part of a national referral network known as Married at Compass – a vetted group of married agents around the country. Here’s our website:

We’d love to introduce you to our friendly partner agents in other areas!

After a tremendous performance that could be ranked as good as any show ever, she ended the gig with this ballad to her daughter just nine days after September, 11, 2001. We were there:

This has to be the best ending to a concert video ever. I love how they show the escorting of the talent after the show, an art form that is all about shielding the fans away from any direct contact and getting out alive.

How bad could it get? What else could happen?

The market could deteriorate into a cash-only environment, where the buyers and sellers who can avoid mortgages altogether are the only players left. If mortgage rates get into the 7s and 8s, the temptation for financed buyers and sellers to wait it out will be overwhelming.

Sellers who are downsizing/leaving town are home buyers who won’t care much about mortgage rates because the only way it makes sense for them to move is to pay cash for their next home. Especially those who are older.

There are plenty in this category, thankfully!

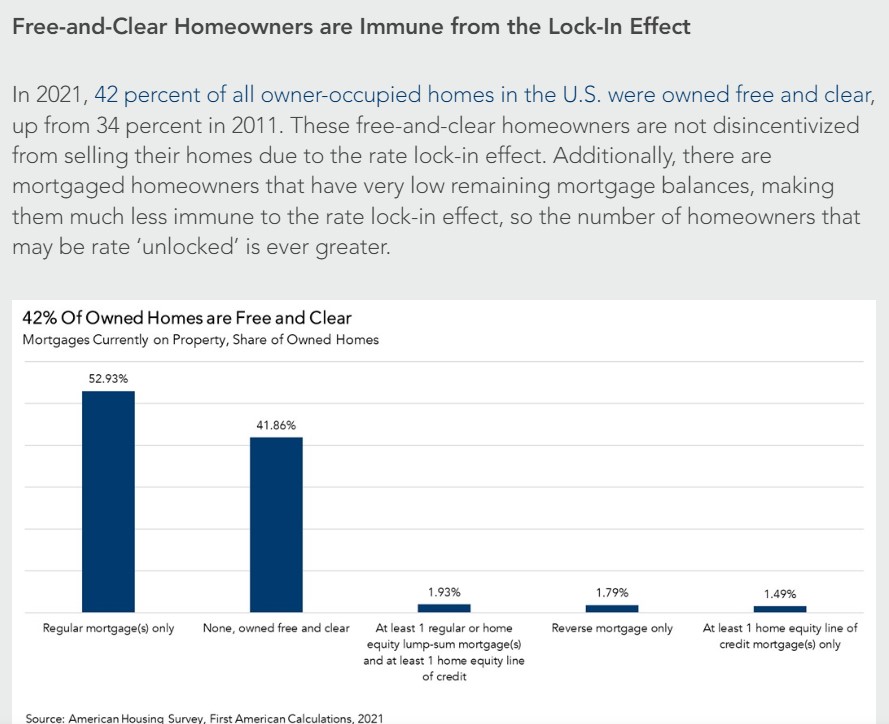

From FATCO:

Of those who owned their home free and clear, nearly 78 percent were owned by homeowners aged 55 or older. Not surprisingly, older homeowners are more likely to own their homes free and clear. As the Baby Boomer generation, which is larger than any generation before it, has aged, the share of homes owned free and clear has increased. This gives some hope that while many existing homeowners remain rate locked-in, there is a large cohort of older homeowners who are not. However, older households are typically less likely to move than younger ones, which is especially true as seniors today increasingly age in place. So, while some portion of the free-and-clear inventory will come to market in the next decade, it will likely trickle in slowly.

Free-and-Clear Homeowners May Hold the Key

As demand for homes starts to inch up as we approach spring home-buying season, a key question is, will there be more inventory for those potential home buyers to buy? Existing-home inventory makes up the bulk of available home inventory, and many existing homeowners refinanced into sub-3 percent mortgage rates over the course of the pandemic. But there’s a large group of homeowners who are not deterred by higher mortgage rates—those without a mortgage on their existing home or those with a small remaining balance. These homeowners may hold the key to unlocking more supply and, in turn, more home sales.

Local sales recently have been purchased all-cash about a third of the time. As sales drop further, the percentage of all-cash sales should end up at half or more of the total sales – and help to provide a floor.

Remember when the inventory tanked in 2020 when everyone was afraid of catching the bug?

Once the pandemic was over, we’d get back to the regular flow of homes for sale, wouldn’t we?

But the intensity seemed to increase as time went on, finally spinning out of control when mortgage rates went up. The resulting debris field is causing fewer people to want, or need, to sell.

For most, staying put seems like the best option, at least for now.

Buyers can probably endure another year on the lease. But potential sellers are getting closer and closer to being too old to move. If there isn’t a clear path to living for another 5-10 years (and hopefully longer) in your new town, you’re probably going to decide to live it out where you are.

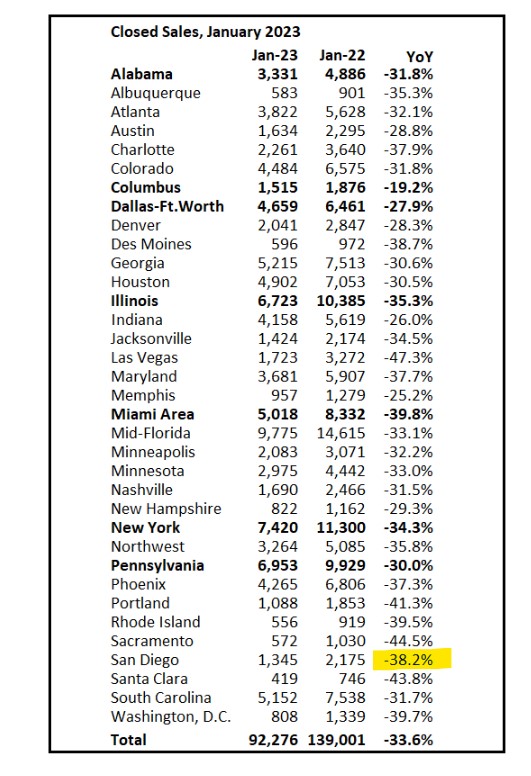

The NSDCC YoY change in January was only -17%, so only half as bad as San Diego in general. But the first 15 days of February are -20% YoY, so the local inventory isn’t exactly getting better.

The drop from 2019 is 55%!

Last year the NSDCC sales were the lowest on record. We were already thinking that if the 2023 sales could get to 80% of that number, it would be great. But if mortgage rates spend the next ten months over 7%, what will be the annual sales count for this year? Maybe 50% – 60% of last year?

On November 9th, 2022, the average lender was quoting 30yr fixed rates well over 7%. On day later, that figure dropped to 6.625%. It was one of the best individual days for rates on record and it was driven by an economic report that showed an unexpectedly large drop in inflation.

Inflation and several other key sectors of the economy had pushed the Federal Reserve to hike rates at the fastest pace in decades. When it looked like the data might provide some relief, rates quickly moderated.

Strangely (or so it seemed at the time), the Fed was highly reluctant to read too much into several months of generally more palatable data. They said it was too soon to draw any conclusions other than “it’s a start.” With that, markets hesitated to push longer term rates any lower until the data made an even stronger case of that.

Unfortunately, the data since then has made a case for rates to turn around and head right back up toward previous highs. February has been particularly brutal in that regard and today was just the latest example. In fact, today’s reports aren’t typically regarded as top tier motivations for rate movement, but the market is so defensive to begin with that it doesn’t take much of a bump to create a snowball of momentum.

The average 30yr fixed quote for a top tier scenario was around 6.75% on Friday and was up to 6.87% by Tuesday afternoon. More than a few lenders are already back to 7%.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-02212023

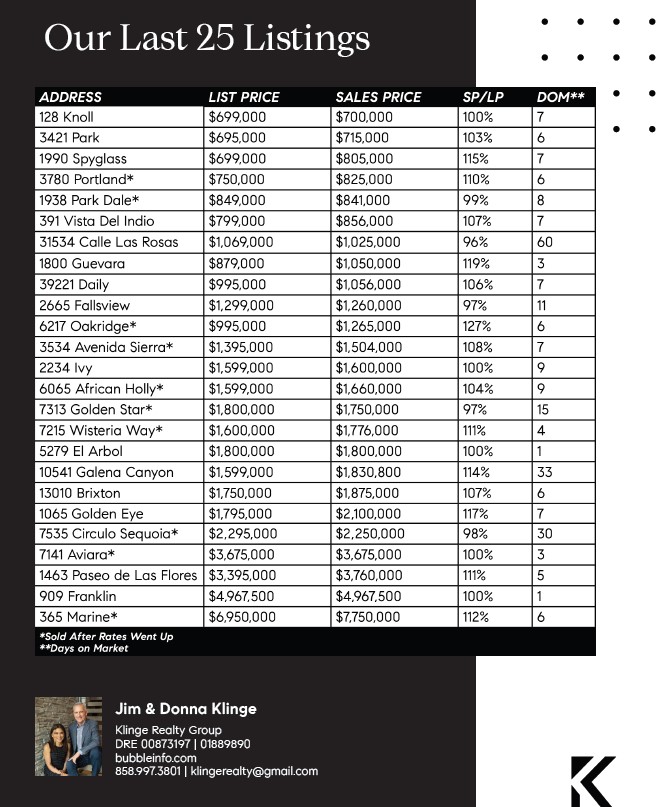

Are you thinking about selling your home and are trying to identify the strategies used by listing agents to get you top dollar with minimal inconvenience?

Are you finding that agents aren’t real specific about how they do their business, and just want you to trust that because they sold houses in the past that they can do it again?

Here is my specific strategy to achieve top-dollar sales with minimal inconvenience: 1) Do a minor tune-up of the home prior to hitting the open market, 2) Price attractively, 3) Make the home easy to see via the open-house extravaganza, 4) Allow all buyers to bid it up, 5) Treat buyers and agents with respect and deliver full transparency that encourages participation.

Here are the results of our last 25 listings:

None of these were priced artificially low to generate a bidding war. When a property is ‘attractively priced’, it means the presentation is worthy and it causes buyers to want to see it in person.

I have not come across any agent who sells homes like I do, and rarely do I ever meet an agent who has any strategy about handling multiple offers.

It happened again yesterday – the listing agent said on the phone that he had 3-5 offers, so I asked how he planned to handle it. Literally, he said, “I don’t know”, to which I replied, “How about doing a highest-and-best round?” He said, “Well we will probably counter the best 2-3 offers”.

Why he would eliminate any buyer is beyond me – I always counter every buyer because who knows how much higher they might go when asked.

In further discussion, he made it sound like none of the offers received were full price, and later I sent him a text that we were sending in a full price offer. Two hours later, he sends a text back that said, “It sounds like the seller wants to move forward with the first offer he got”.

This is the standard procedure in the realtor business – just grab one.

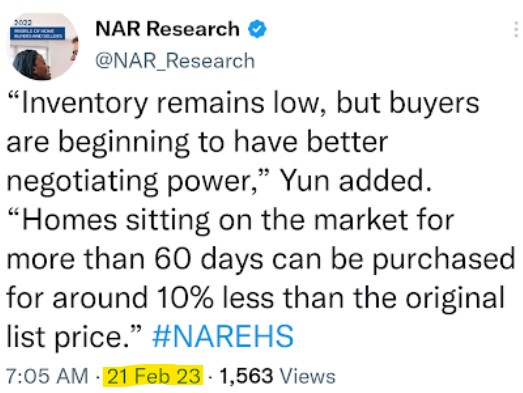

If your listing languishes on the market, it gets worse. Even the chief economist says so:

You want to sell early – during the first week on the market – when urgency is highest, and not languish for weeks or months just to take less later. In case everything goes right and multiple offers are received, you want an expert who creates a proper bidding war. In 2023, when buyers are more tempted to cancel and move on, you want your escrow handled in a way that it closes successfully, and on time.

Your eventual sales price can vary 5% to 20%, depending on your listing agent.

Get Good Help – hire Jim the Realtor!

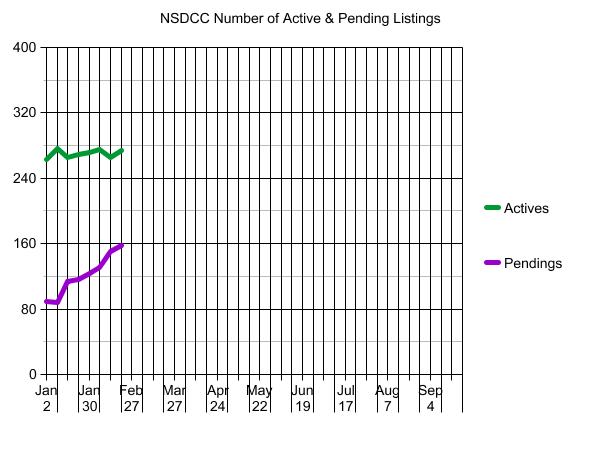

Let’s revisit yesterday’s graph and add the sales to compare the relative health of the market.

If higher mortgage rates were stopping home buyers, then sales would plummet, especially in relation to the number of listings. But if the number of listings plummets too, and we’re down to just the most serious buyers and sellers, we can still have an orderly market:

NSDCC Listings and Sales Between Jan 1 and Feb 15

| Year | |||

| 2019 | |||

| 2020 | |||

| 2021 | |||

| 2022 | |||

| 2023 |

The local market isn’t in shambles or falling apart.

The number of buyers AND sellers are much lower than they were previously, but they are acting in concert and fairly similar to the frenzy years. By the time the late-reporters log in, this year’s L/S will get down to 1.8 or 1.7 which is remarkably similar to the hottest frenzy years of all-time!

Our buyers had to beat out four other offers to get a great deal on this La Costa gem on a huge 13,696sf pie-shaped lot at the end of the cul-de-sac.

2112 Sereno Ct., Carlsbad

3 br/2.5 ba, 1,801sf

YB: 1978

No HOA

0.31-acre lot

LP = $1,299,000

SP = $1,290,000

This charming 3 bedroom, 2 1/2 bath home is in the La Costa neighborhood of Carlsbad. The gated property is located at the end of a beautiful cul-de-sac. The home features a lovely living room with vauted ceilings, a dining room overlooking the lush yard, an eat-in kitchen with granite countertops and hardwood floors throughout most of the home. The family room, located off the kitchen, is perfect for gatherings and has access to the patio and hot tub. The primary suite has 2 large closets and vaulted ceilings. The home sits on a large 13,696 square foot lot with plenty of room for a pool and RV/boat. Located close to shopping, restaurants, La Costa Resort, beaches and the I5. This private oasis is the perfect place to call home!

As you can tell in the graph above, there hasn’t been a flood of inventory (yet), and the number of pendings is rising steadily. All of the frenzy conditions are in place this year, just like they were since the pandemic broke out and inventory plunged.

The casual observers will struggle to notice, however.

With so few homes for sale, it won’t be as obvious how hot the market is…or could be!

NSDCC Number of Listings Between Jan 1 and Feb 15

| Year | ||

| 2019 | ||

| 2020 | ||

| 2021 | ||

| 2022 | ||

| 2023 |

When is the best time to sell? When no one else is!