NextGen

Our new listing in San Marcos!

This beauty is better than a new home and features the preferred NextGen – a home within a home! Mom/grandma gets her own primary suite downstairs and then the main primary suite is upstairs with the other two bedrooms plus loft (could be 5th br). Plus a separate office downstairs too! Extra-large backyard with premium turf, 3-car tandem garage, central A/C, PAID SOLAR, new carpet, and conveniently located where you can easily hike the nearby hills or get to the beach in about 15-20 minutes – wow!

941 Lindbergh Dr. San Marcos

4 br plus den and loft/4.5 ba, 3,274sf

YB: 2023

LP = $1,699,000

Open 12-2 this Saturday and Sunday!

https://www.compass.com/listing/941-lindbergh-drive-san-marcos-ca-92069/1851946694564174441/

The NextGen granny flat downstairs

The competition is stiff among newer homes nearby – this is all in one square mile:

Buyers Beware

I wrote a purchase contract for a buyer this week.

There were 41 pages.

Let’s add that to the list of hurdles for buyers in 2025.

- There are several search portals that display home listings publicly and free of charge. But it doesn’t make it any easier to find a good home to buy – and these days it feels harder because you have to weed through so many duds that it gets boring and it’s hard to stay interested.

- Mortgage rates have doubled, yet the prices for the great homes keep going up. How is that possible?

- Touring open houses seems like a good idea. But buyers keep hearing the same thing – to get access to their off-market inventory, you have to sign a 3-month binding contract with the agent on duty. You finally sign with someone, only to get emails of more duds that hit the open market a day or two later.

- If you find a halfway-decent home, it will probably be in the first seven days it’s been on the market. It’s when the listing agent goes into full defensive mode and all communication turns vague because they are so afraid of saying the wrong thing. There are no rules of engagement. Just make an offer and send it into the black hole and maybe you’ll hear something.

- The listing agent does respond (finally), with the news that there are multiple offers. Please submit your highest-and-best offer while you’re agreeing to their 5-10 minor terms that tilts the table entirely towards the seller.

- Win or lose the bidding war…..you can’t help but feel used and worn out. The process took 3-5 days with no helpful communication whatsoever, and frustration turns into indifference. Good luck with getting that escrow to close!

- Along the way, buyers have signed a 41-page contract plus 3-5 more pages for counter-offers. Thanks to the electronic signature that speeds the buyer through the process in seconds, nobody reads more than 2-3 pages max. Hope nothing goes wrong!

- You had to commit to a buyer-agent yet have no idea what to expect from them. Then the seller and listing agent would only pay part of the buyer-agent compensation, so now the buyers get stuck with paying part of that too (even though the seller had ample equity and could have paid it).

- The bullying has just begun. After the home inspection reveals several unknown items, the seller and listing agent tell the buyer to kiss off. “It’s sold as-is, and if you don’t like it then cancel so we can sell it to someone who is serious”. You buyer-agent shrugs, but finally they throw you a few bucks towards the project.

- Seller demanded additional occupancy for 7 to 60 days after closing for FREE, with no security deposit. Oh, you didn’t catch that part? It was on page 44.

- Once possession is delivered, it quickly becomes clear that you bought a turd. The staging is gone, the home wasn’t cleaned, and the sellers left junk behind – including a few shelves of half-used paint cans. The plan to clean the carpets gets tossed, and the list of repairs and improvements needed immediately is drawn up. Oh, here’s the $25,000 to $50,000 that every house needs once a buyer closes escrow! Didn’t that blog guy talk about that?

It pathetic, and buyers deserve better.

Can you imagine it getting worse?

A law professor has filed an appeal to the NAR Settlement. She brings up a technical point and there is a chance the settlement will unravel:

We’re going to go back to the drawing board with the NAR Settlement?

At least the brokerages should have their armies of lawyers involved this time. Maybe NAR and the brokerages win this round? But the State of California has already codified the buyer-broker agreement needing to be signed before the buyers can be shown houses!

What a mess.

Let’s skip to the end of this horror flick.

Once the DOJ chimes in, the likely outcome is for it to be illegal for sellers to pay the buyer-agent commission. One more time, buyers will feel screwed because now they have to pay for representation, but at least they will be more diligent about who they hire (if anyone).

We will be advancing further down the path towards single agency. Hopefully, an auction house steps in to relieve us from this misery!

Jackson and David

Getting A Deal

Earlier, I was preparing for the appraisal of our 1,944sf listing on Birdie, which is in escrow for $1,125,000.

I always bring the comparable sales with me to help out the appraiser. They want to use comps whose square footage are within 10% of the subject property, so I plugged in a tight 1,700-2,100sf range to get the best examples.

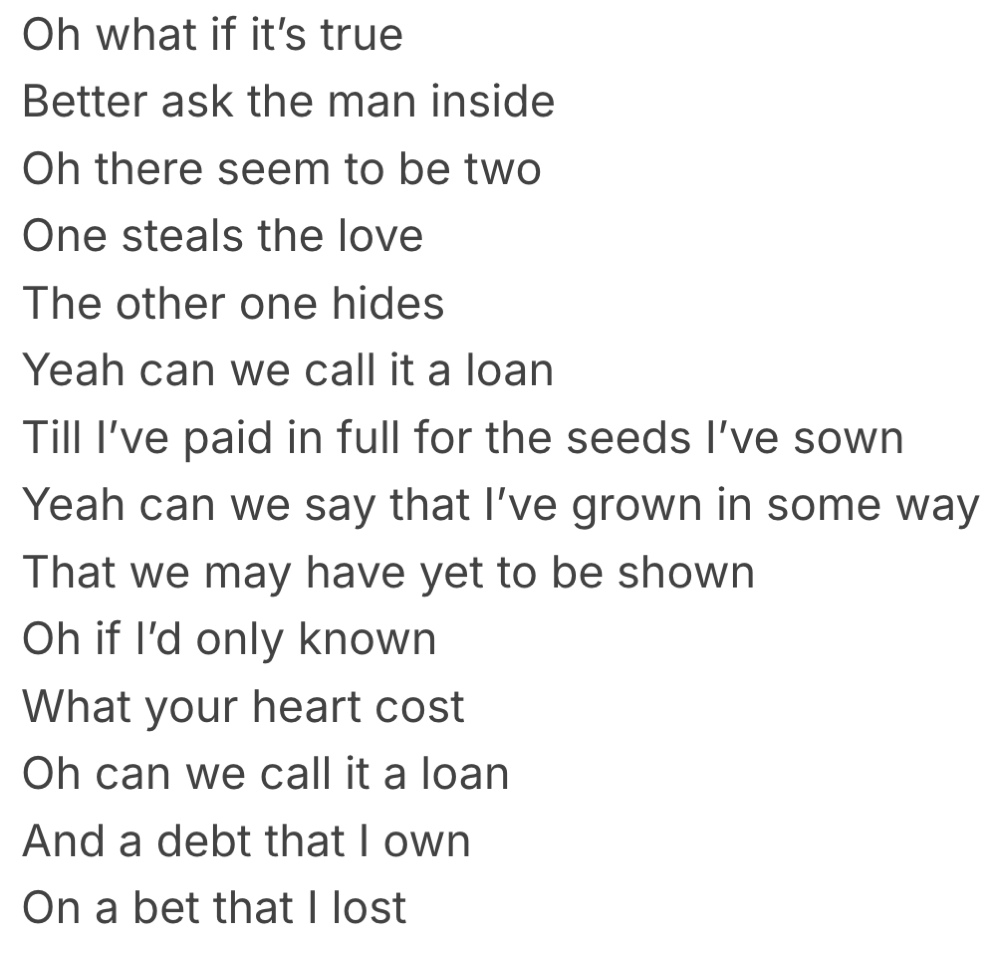

The home above was the first on the list.

It sold in February for 40% less than mine?

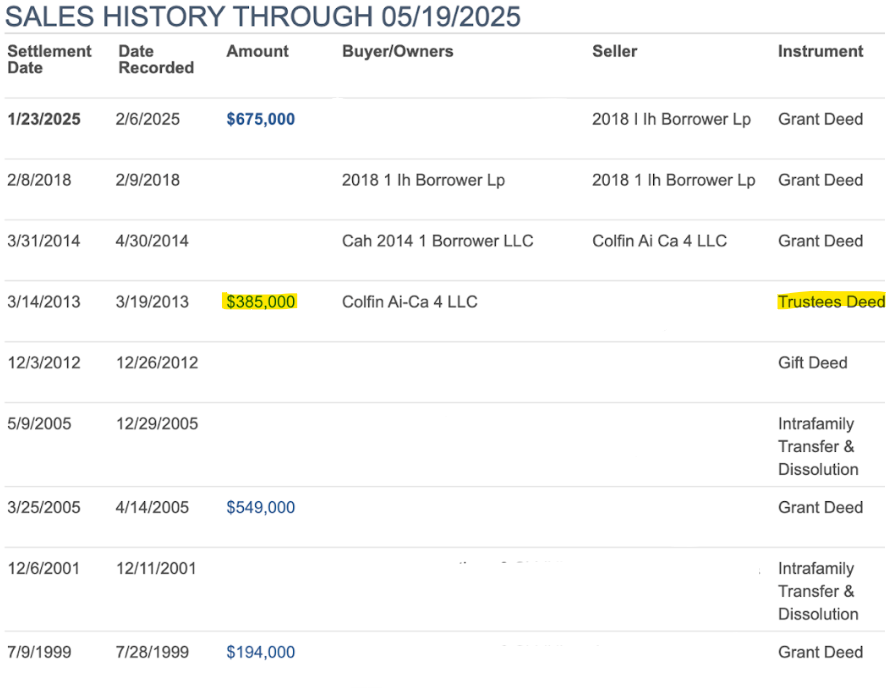

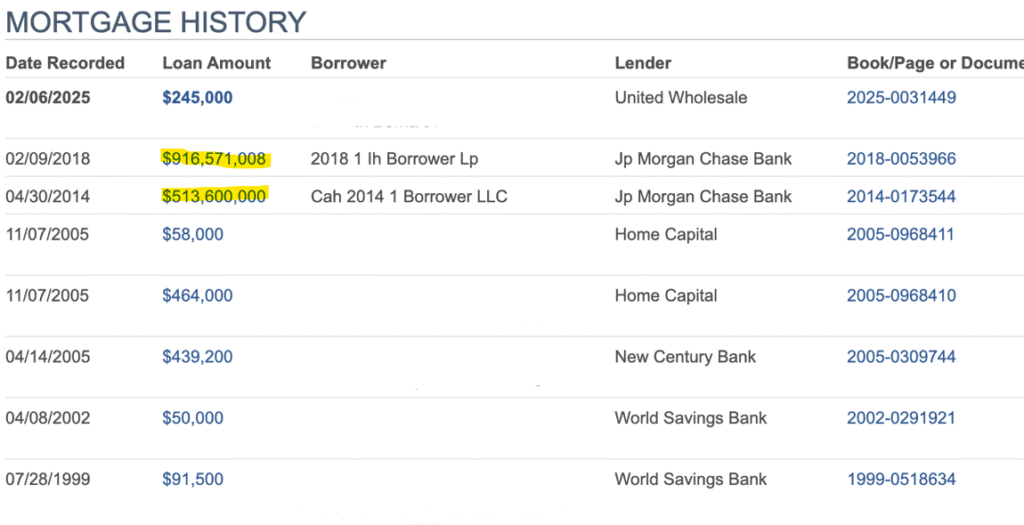

Let’s check the sales history first:

A conglomerate foreclosed on the previous owner in 2013?

They had it rented for $2,400/mo. and they sat on it until now.

The seller was the infamous Invitation Homes, who has plenty of horsepower:

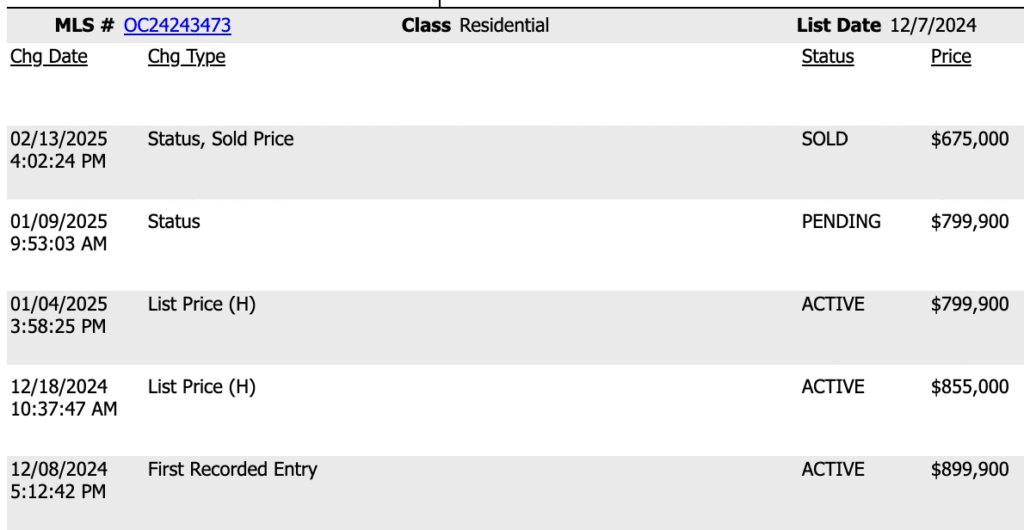

This was a fairly straight-forward sale that was offered on the MLS and anyone could have bought it. The timing over the holidays wasn’t ideal, but because the seller had plenty of equity, they lowered the price early and often:

Here’s what it looked liked when sold:

https://www.compass.com/listing/1809-avenida-segovia-oceanside-ca-92056/1727153224339587161/

The new owner installed new windows and roof plus a few interior items and is now trying to rent it for $4,199 per month.

Are you looking for a deal? This is a good example of how to do it! Especially the part about buying a home that needs everything, and then working over the seller for a reduction/credit once you have it tied up in escrow.

Price Cuts?

Everyone is wondering if home prices are going to come down, so the mainstream media is happy to juice the conversation with a sexy headline – which, if you are a casual reader, will make you think that lower prices are on the way. Then they throw in a quote from a real estate expert:

San Diego metro, which includes all of San Diego County, ranked 15th in the 20-city index — a big change considering the region had the fastest-rising home prices in the U.S. for six months from late 2023 into the start of 2024.

The fastest-rising markets in March were New York, up 7.96%; Chicago, up 6.5%; and Cleveland, up 5.9%.

Zillow economist Orphe Divounguy said the share of nationwide listings with a price cut in March hit their highest rate in six years. He said homes were taking longer to sell, resulting in some sellers slashing prices.

“A price correction is expected,” he wrote, “(which will) result in a modest recovery in sales over the coming year, with Zillow forecasting sales to continue bouncing along the bottom.”

It’s not that simple.

The national statistics will probably prove him right, but what will those mean to the local home buyer or seller? Nothing. But it might sell some newspapers!

Let’s drill down just a little.

If you want to get a screaming deal on a dump or fixer, your time has arrived. You will probably spend the next 3-12 months of your life wrestling with the city to get permits, battling with contractors to get what you want (and what you paid for), and you will likely spend more money than ever expected. A lot more.

You might end up thinking that buying a creampuff was a better idea.

Most will prefer to buy a nice home. One that is move-in ready, and has the more-modern conveniences so it will last you for the foreseeable future without having to fix anything.

Are those going to have price cuts too?

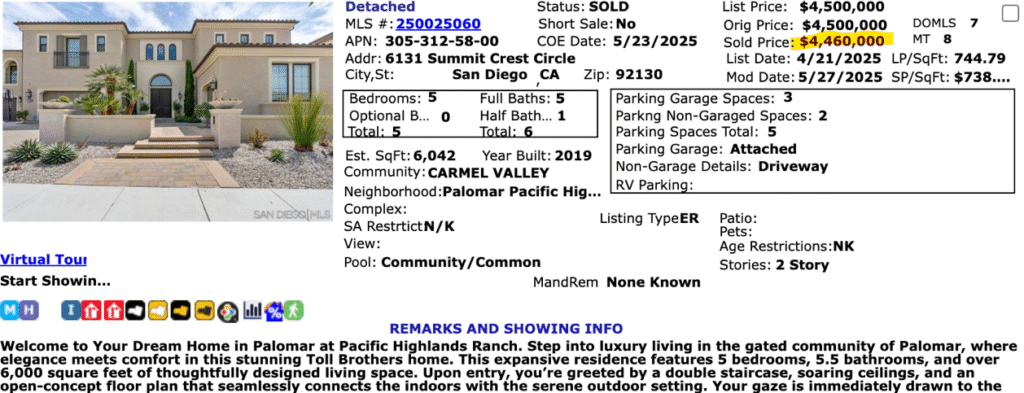

Here’s an example that’s fresh off the hotsheet this morning:

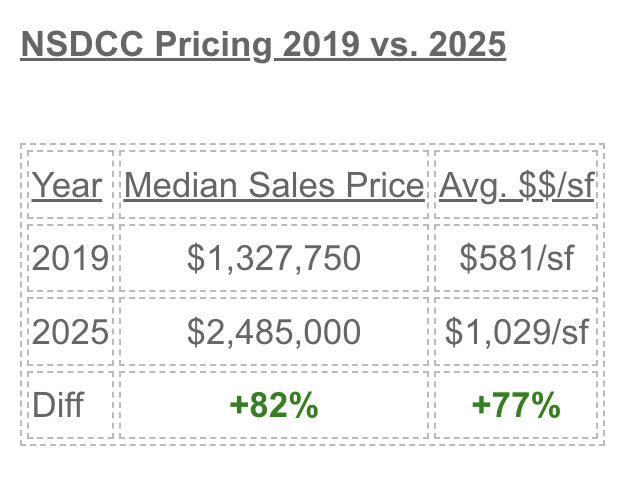

The seller had to discount $40,000, but hey, that’s a price cut! They still sold it for 85% more than they paid for the home when it was new in 2019, which is in line with stats we saw earlier this week.

The discounts will be on the homes that most people don’t want to buy.

Get Good Help!

Jim and Donna

View this post on Instagram

This is my best attempt at the polished, professonal content….

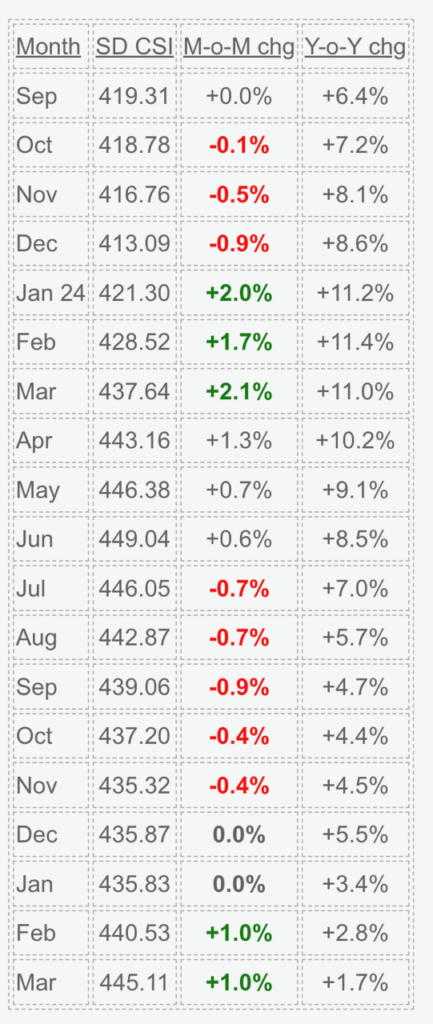

SD Case-Shiller, March

San Diego Case-Shiller Index, March

The back-to-back 1% gains will probably be as good as it gets in 2025, and we could wind up with a negative percentage overall for the year.

The change has been 1% or less (+/-) for the last eleven readings.

Welcome to Flat City.

Percentage change between January and December:

2019: +4.7%

2020: +12.4%

2021: +24.0%

2022: -1.0%

2023: +9.0%

2024: +3.2%

~~~~~~~~~~~~~~~~~~~~~~~~

“Home price growth continued to decelerate on an annual basis in March, even as the market experienced its strongest monthly gains so far in 2025,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “This divergence between slowing year-over-year appreciation and renewed spring momentum highlighted how the housing market shifted from mere resilience to a broader seasonal recovery. Limited supply and steady demand drove prices higher across most metropolitan areas, despite affordability challenges remaining firmly in place.”

Natalie’s First Tour

This is the beginning of Natalie’s career as a realtor! My impression of her? She is catching on to everything very quickly, and she has the drive and ambition (look at her dance career) that makes the difference between good and great agents.

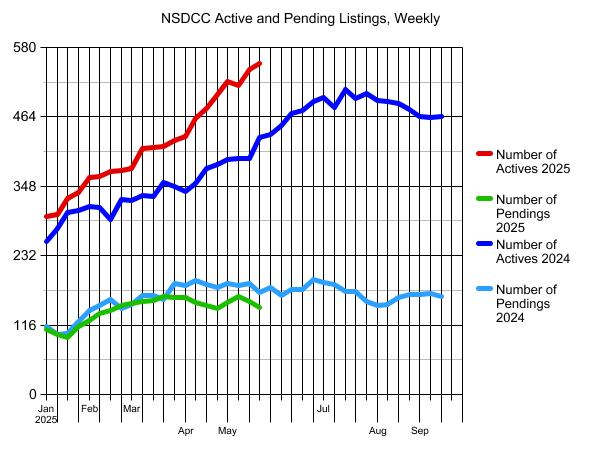

Inventory Watch

The assault on the record book continues!

We have the most homes for sale since before covid – when pricing was less:

Yet, 500+ homeowners are scoffing at those gains – they want more!