by Jim the Realtor | Aug 22, 2024 | Over List

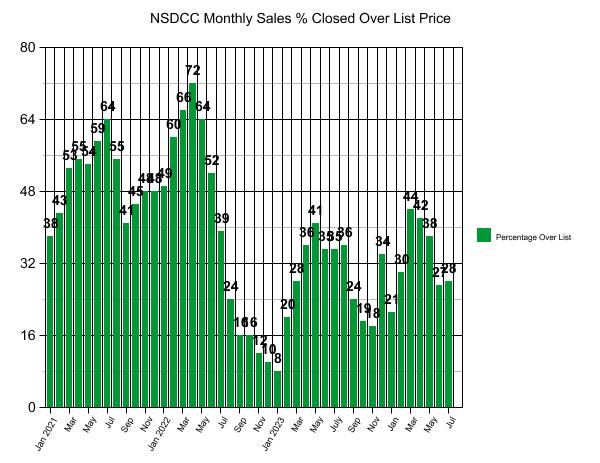

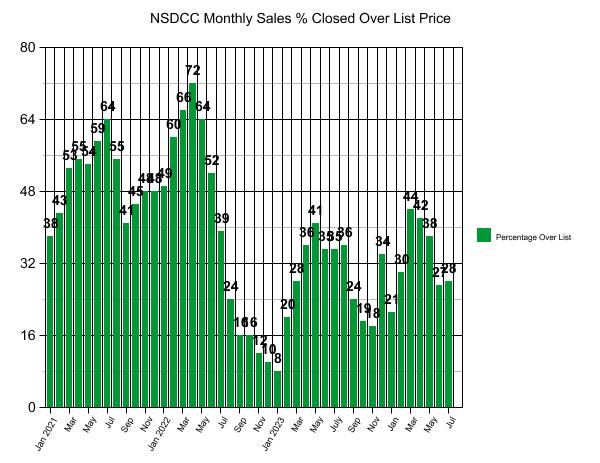

The trend of paying over the list price appears to have stabilized.

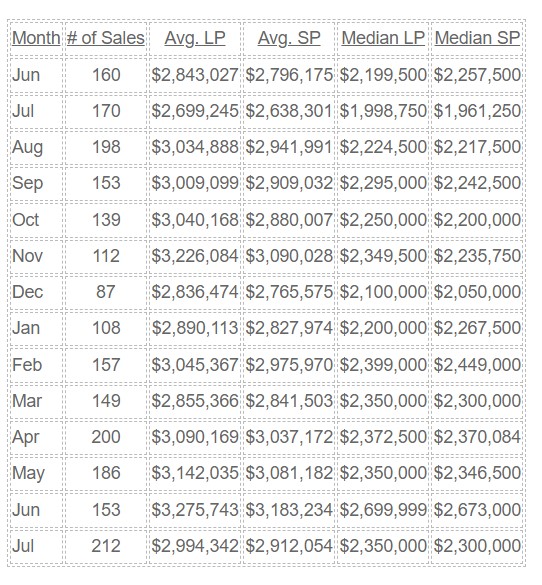

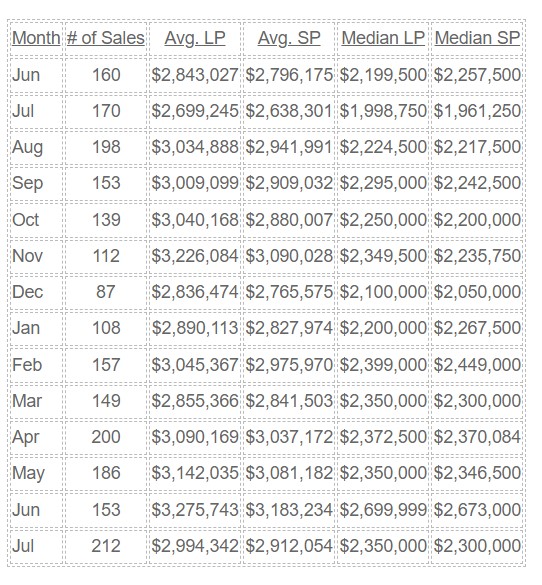

The 212 July sales makes it look like there was quite a surge after a couple of slower months, so buyers must have gotten excited! But the median price has settled in at $2,300,000:

The median sales price probably won’t change much the rest of the way in 2024, but sales could bounce around. There have been 110 NSDCC closings so far in August, so it won’t get close to 200 sales this month. But there is a bit of a surge going on right now so September closings could be decent.

by Jim the Realtor | Aug 21, 2024 | Jim's Take on the Market, Where to Move |

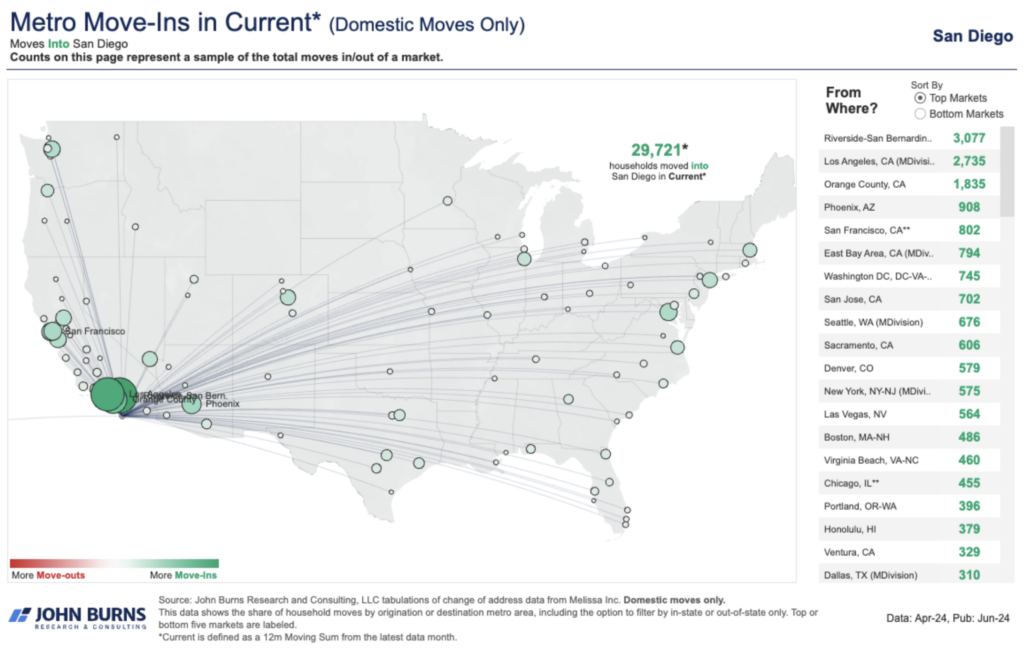

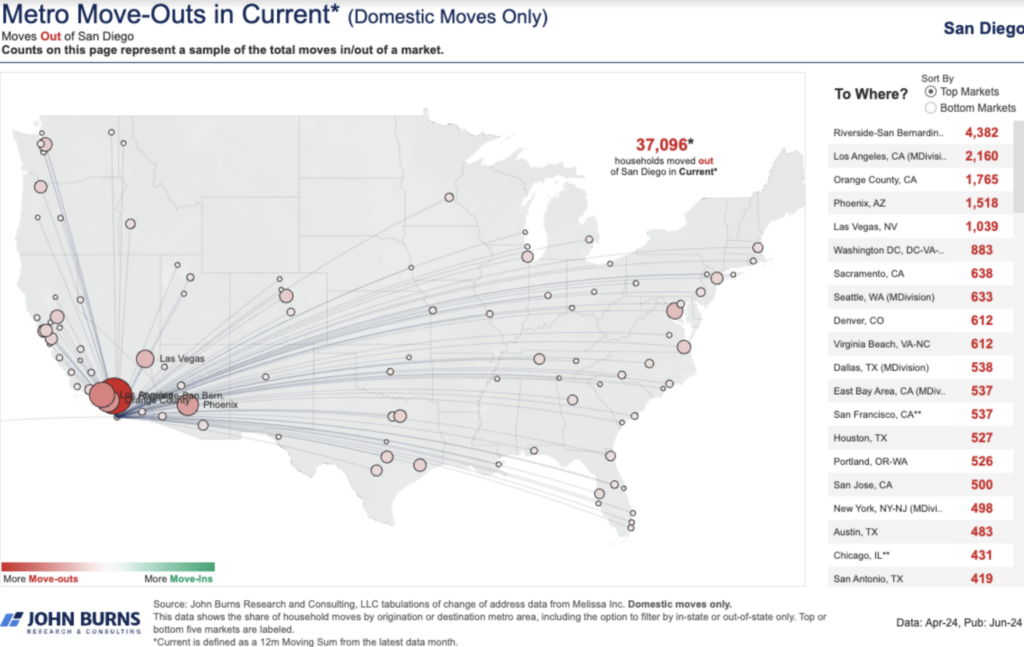

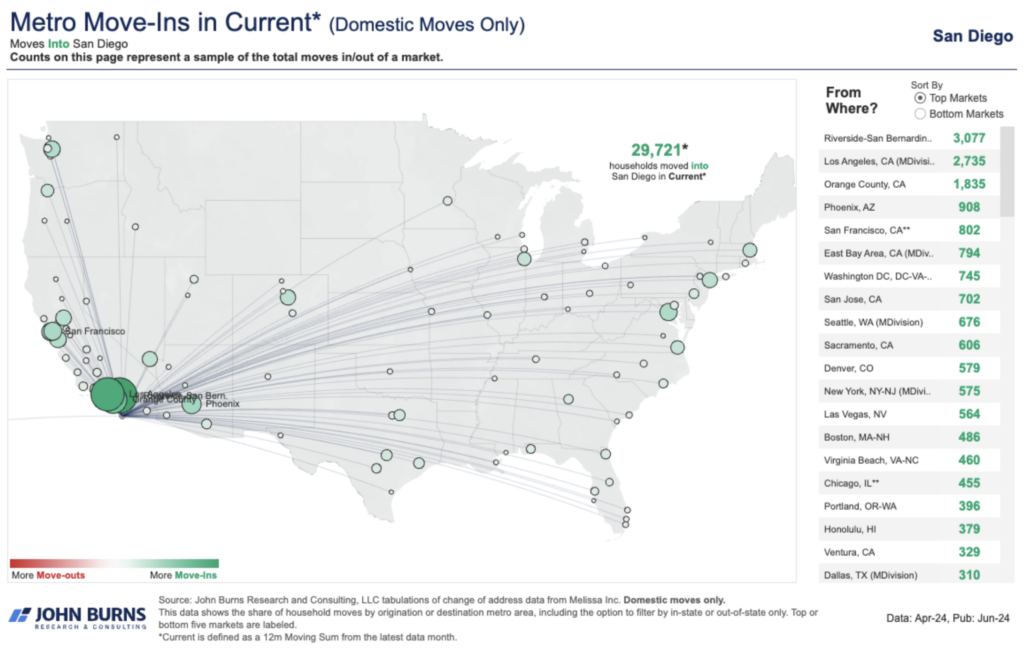

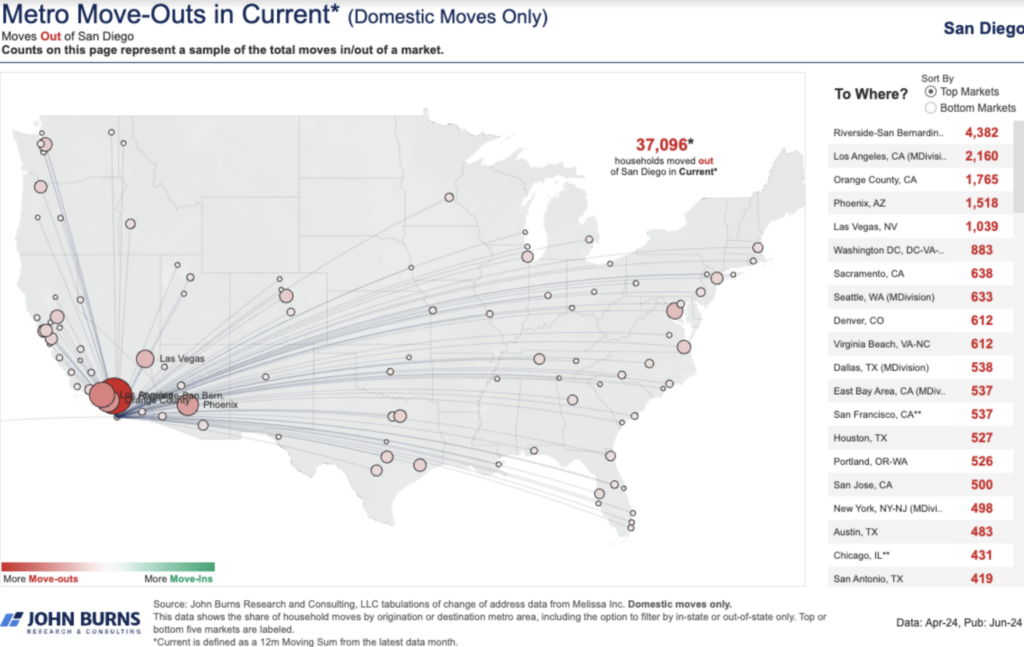

There are more people leaving the San Diego metro area than are moving into the area, and it’s incredible to see how both lists have virtually all the same towns. No Nashville, no Florida, and no Carolinas either!

It’s interesting that no one wants to move to Ventura, but hundreds of them are coming this way!

The areas are similar:

https://en.wikipedia.org/wiki/Ventura,_California

(hat tip to John at Compass-owned Chartwell Escrow for providing this information)

by Jim the Realtor | Aug 21, 2024 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying

We are going to hear more about making home ownership more affordable. An op-ed:

https://www.cnbc.com/2024/08/20/op-ed-the-case-for-a-40-year-mortgage.html

An excerpt:

Homeownership has long symbolized the American Dream, embodying stability, wealth creation, and community investment.

Yet, for millions of Americans, especially younger generations and first-time homebuyers, that dream is slipping away. Rising home prices, stagnant wages, and restrictive mortgage terms have made it increasingly difficult to take that crucial first step onto the property ladder.

To address this, I propose a bold new approach: a 40-year mortgage using the Federal Home Loan Bank (FHLB) system as the framework, with federal subsidies for first-time homebuyers who complete financial literacy training.

There’s no magic in the 30-year mortgage term — it was born during the Great Depression when life expectancy was also around 60 years. Today, with life expectancy nearing 80 years, a 40-year term aligns better with modern realities.

Critics may argue that a longer mortgage term increases the total interest paid, but the benefits of affordability and access outweigh this drawback. For many, the alternative is indefinite renting, which builds no equity and leaves families vulnerable to rising rents and economic displacement. A 40-year mortgage allows more people to begin building equity sooner, offering a pathway to long-term financial stability and sustained human dignity — a key element of the American Dream. A pathway up the repaired economic aspirational ladder in America.

He makes a quick reference to buying down the interest rate here:

To further support first-time homebuyers, I propose federal subsidies for mortgage rates between 3.5% and 4.5% for those who complete certified financial literacy training. Subsidies would be capped at $350,000 for rural mortgages and $1 million for urban markets, reflecting the varying costs of homeownership across the country.

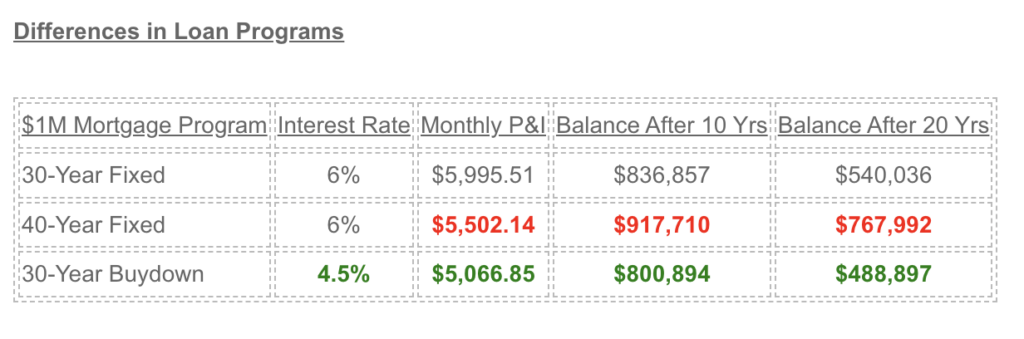

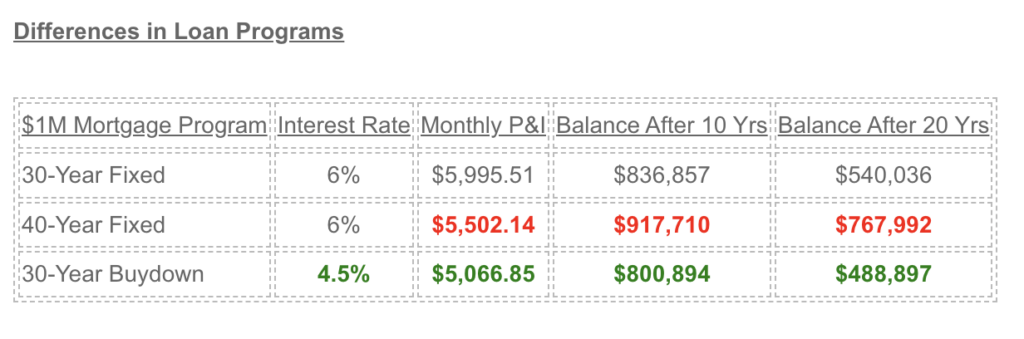

Let’s use math to help make the decision on which way to go on a $1,000,000 loan:

The 40-year mortgage is a waste of time – there isn’t enough monthly savings, and the overall amount of interest paid over the 40 years is $2,641,025. If saving $493 per month on a $1,000,000 loan is a big deal, you probably shouldn’t be buying a home that expensive. The unexpected maintenance and improvements will cost more than that.

But the interest-rate buydown does make a significant difference, especially with reducing the balance faster, which should be every homeowner’s goal. They will include mortgage and budget training with any federal subsidy program, and I’ll sum it up in one sentence: Pay additional sums with your regular payment every month, and/or refinance to a 10-year or 15-year mortgage as soon as possible (both have the same rate, which is usually 1/2% lower than the prevailing 30-year rate).

by Jim the Realtor | Aug 20, 2024 | Commission Lawsuit, Why You Should List With Jim |

This is a real possibility now:

Bill Colson, who is preparing to sell his Maryland home next year and purchase a retirement home outside Blue Ridge, Georgia, believes the changes will create more costs.

Colson, who is 57 years old and retired from the Navy, said a Realtor in Maryland advised him to offer the standard 6% commission split between his agent and a buyer’s agent when selling his home. But in Georgia, Colson said another Realtor told him to be prepared to pay his own agent out of pocket to make a potential offer more competitive.

It means Colson would be responsible for paying out commissions for both transactions, which would have been unthinkable to many homebuyers and sellers before the changes.

“If you want to stand out, you’re going to have to pay,” Colson said.

“In the end, we may end up paying something like 9%,” he said. “Instead of making things better, it just got a lot worse.”

https://www.cnn.com/2024/08/19/business/real-estate-commission-changes-wellness/index.html

by Jim the Realtor | Aug 19, 2024 | 2024, Commission Lawsuit, Why You Should Hire Jim as your Buyer's Agent, Why You Should List With Jim |

Whenever I have a buyer who loses out on a bidding war, I try to get them right back on the horse. Thankfully, there are several houses sitting around that aren’t not selling in the $3 million range, so we made another offer yesterday.

First, I went to the open house and discussed for 30 minutes the state of the market (soft and picky), the good and bad features of the home, the sellers’ motivation, and generally built rapport with the listing agent who I had never met.

His listing of a 5,000sf tract home on a smaller lot has been for sale since April.

I mentioned that people don’t need a house this big. Buyers would rather spend less on a house that still suits their needs without the extra bedrooms, library, wine tasting room, etc. He mentioned that he had comps, and I pointed out that nobody else is coming to the open house. The market has changed.

The list price is $3,598,000.

We offered $3,150,000 with closing in two weeks.

I mentioned in my email that since the sellers had paid $2,100,000 in 2020, that they would experience 50% appreciation in four short years, or 100% cash-on-cash return on their $1 million down payment when they bought it, which is unheard of in the history of real estate.

He called me this morning.

He said that they are willing to counter $3,575,000, or $23,000 below list.

Don’t think that this market is going to get easier. The amount, and the quality of help will be going down further with the new rules. It will make it harder and harder to put deals together.

Get Good Help!

by Jim the Realtor | Aug 19, 2024 | Inventory

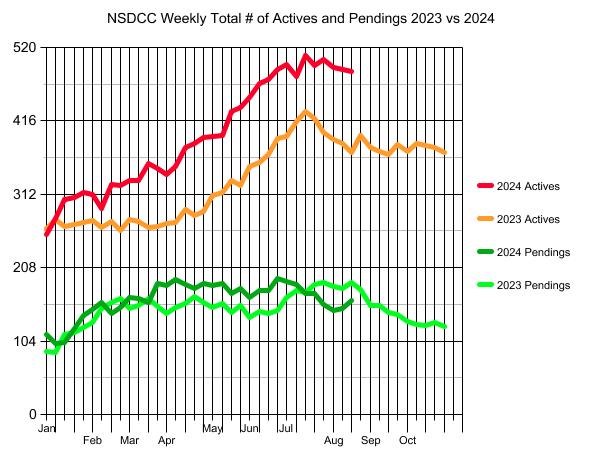

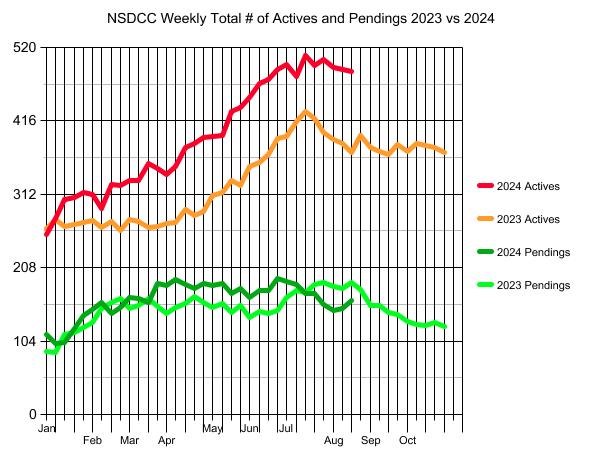

An interesting uptick in the pendings count. It was probably from a few longer negotiations during the wild two-day drop in mortgage rates to around 6%.

By the time the Fed gets around to lowering their rate, it will all be priced in and there probably won’t be much impact. For those waiting for lower rates, don’t be surprised if they don’t get much better than 6%, and I think you can probably get that today by having the seller buy down your rate with a point or two.

(more…)

by Jim the Realtor | Aug 19, 2024 | About the author, Commission Lawsuit, Realtor, Realtors Talking Shop, Tips, Advice & Links |

It’s going to be tough on the newer agents going forward.

The commission lawsuit stuff isn’t the big concern. Sales are likely to keep dropping, and at the same time the better agents are picking up market share. There aren’t enough sales to go around for every realtor to pick up an occasional sale, let alone make a living.

If you’re an agent and you find yourself saying to prospects, “Let me know if you have any questions”, then there are things you can do to up your game.

The best thing you can do is immerse yourself in the Dale Carnegie Sales Course. I completed it early on, and it made all the difference.

Embrace your only job, which is to say the right things, the right way, at the right time.

It never fails when I’m doing open house, and I’m talking it up with attendees.

When I ask them, “Would you like to buy it”, it gets a chuckle every time because they have never heard that before at an open house. We are supposed to be professional sales people, yet consumers have never heard an agent ask them if they want to take action.

If you catch yourself wanting to say, “Let me know if you have any questions”, just know you need to be more creative. Try out my two favorite open-house questions, and use them early on, not once they have seen the house and are heading for the door:

- Have you been looking around much lately?

- Have you seen anything you liked?

Their answers to those questions will send you down a natural path of other questions that reveal where they are in the process.

If they say, “Oh, we’re just neighbors”, that’s fine.

Resist the urge to hit them with, “Are you thinking of selling?”

A consultant would say, “Have you thought about moving?

Every homeowner has thought about selling, and getting their hands on the money they have tied up in the home’s equity. But when they think about moving, it thrusts them into the Big Three: Going through all the stuff, fixing up the house, and where to go.

Listen carefully to their response, and then say, “If you could get assistance with all three of those things, would it be helpful?”

Come work with us – I’ll teach you the ropes.

by Jim the Realtor | Aug 18, 2024 | Why You Should List With Jim |

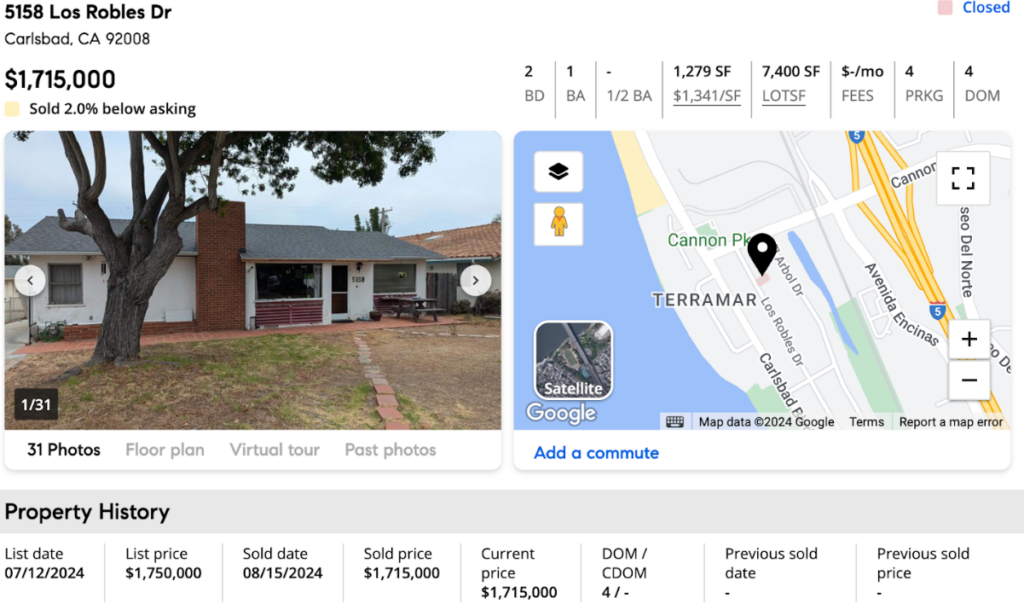

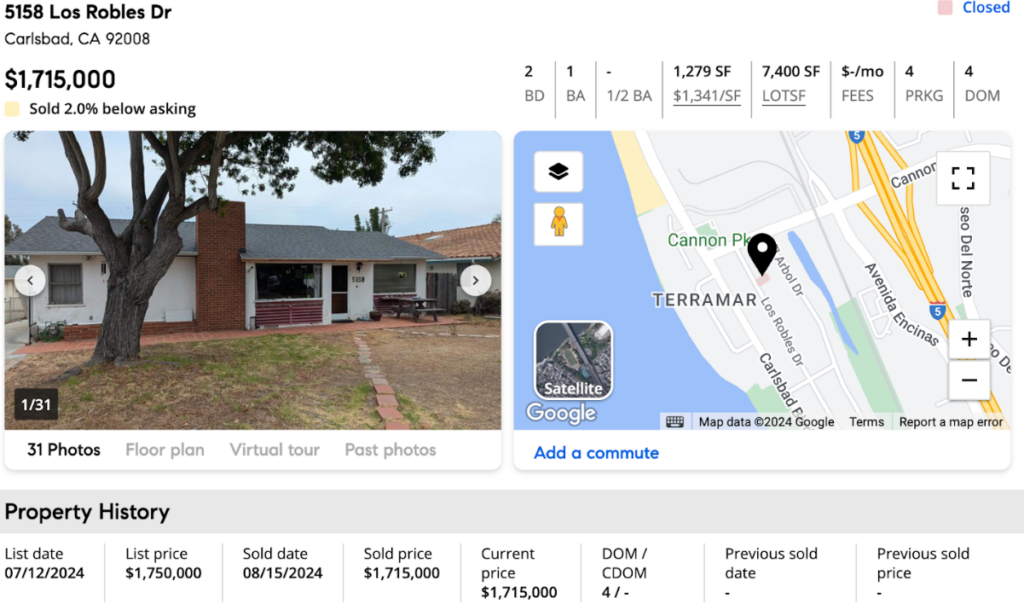

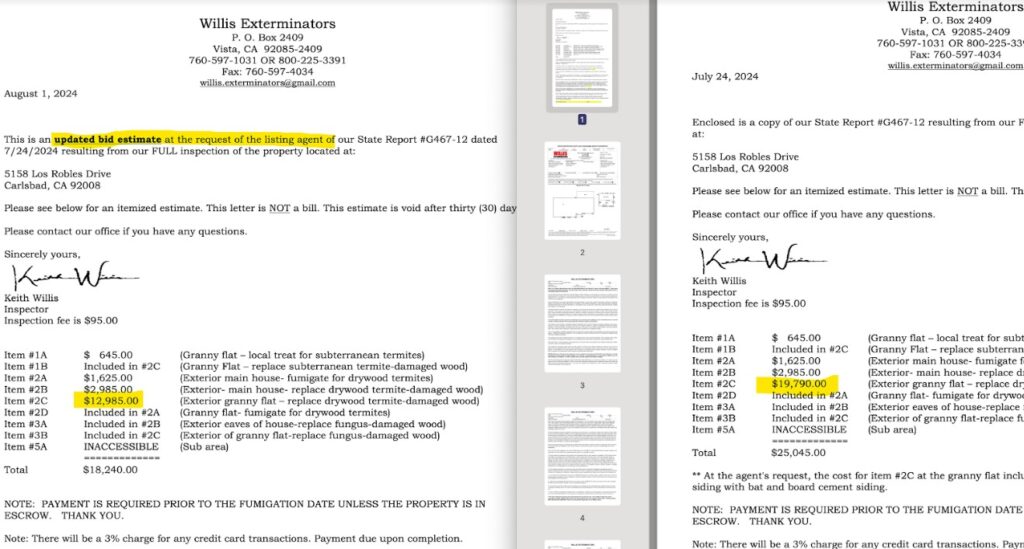

On Thursday, we closed escrow on our latest listing in Terramar.

Other than the new roof and furnace, the house hasn’t been touched in 30 years – and it looked rough. As it has been happening more and more, we only received one offer in spite of the intense interest early on. It was a cash offer at $10,000 over list – and we took it…..before they changed their mind.

It is a standard business practice for buyers to tie up a property, and then go to work on getting a big price reduction after getting contractor quotes. Sellers can get annoyed, but think of the potential consequences. If we don’t handle this delicately, the buyers could walk – and then we are left with a big bag of goo (all reports get disclosed to the next buyer).

You never know how close a buyer is to cancelling, but we assume that their current enthusiasm is much less than it was in the beginning. In this case, they asked for a $80,000 price reduction!

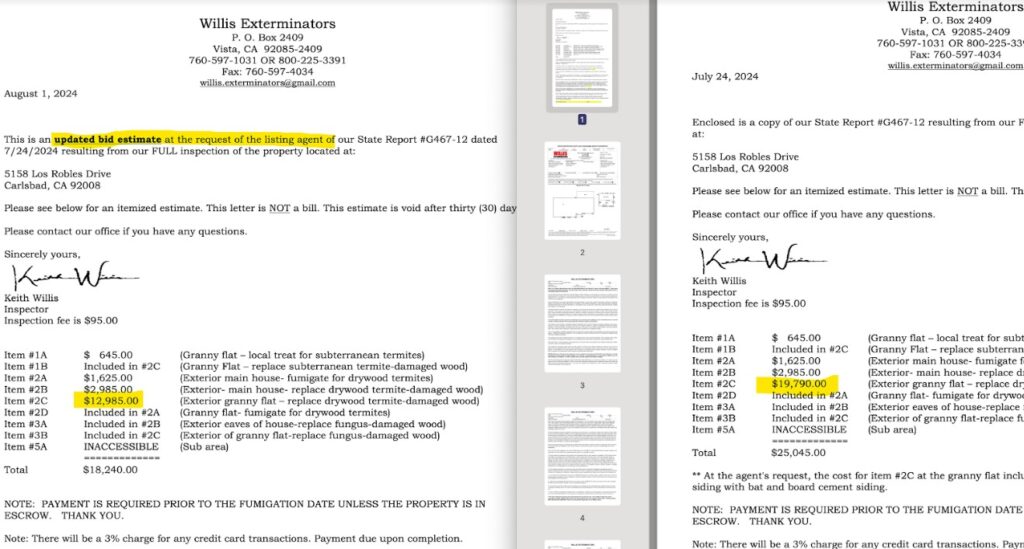

Donna did a tremendous job of dissecting their requests and making suggestions. She noted that their termite report called for the premium siding to used on the back house, so she asked them to quote it using standard wood siding too:

Plus they submitted these quotes:

Plumbing: $15,000

Electrical: $7,120

Foundation repair: $7,250

Pool removal: $26,250 for the fancy choice ($16,400 for the basic plan)

Their five quotes added up to $80,000+, so they did a good job of justifying why they should get the price reduction. Donna gently got them to agree that there were other options available and that we had priced in the condition at the start.

We didn’t think we could do any better going back on the open market so she and the seller agreed to a $45,000 reduction. Market conditions are already squishy and nobody wants a fixer – let’s make the deal with these people. The key was meeting them MORE than half way with a full explanation.

They went for it!

Could we have done less for them? Maybe, but it’s always a gamble when the market is soft. Donna’s thorough yet friendly approach is our insurance policy that keep deals together!

by Jim the Realtor | Aug 18, 2024 | About Natalie, Where to Move |

Last month we went to Madrid to see the last of the 62 sold-out shows of the Karol G worldwide tour.

On the way back, we stopped in Lisbon for a look around. It has been touted as having weather most similar to San Diego’s, and it was true. Through the Golden Visa program you can invest money and get citizenship within a few years, and the cost of living appeared to be quite lower than here. Though the cost of real estate looks familiar:

You can search for more homes for sale here: https://www.realestate.com.au/international/pt/lisbon//

Much like with realtors, there are really good travel agents who provide valuable insight into the process. We employed a travel agent to set up the best tours, and it worked out great.

One tour took us on an e-bike ride from the beach to the top of the hill:

At the top of the hill, the travel guide said she would have a picnic set up, and I envisioned baloney sandwiches on a blanket like we did when I was a kid. Instead, we were treated to a fantastic surprise:

If you are thinking about moving to Europe, give Lisbon strong consideration – we loved it!

by Jim the Realtor | Aug 17, 2024 | 2024, Bidding Wars, Why You Should Hire Jim as your Buyer's Agent, Why You Should List With Jim

This will probably be the day that the real estate world changes forever. It will end up being the day that more paperwork buried the participants, which we’ll get through but it will take a few months before consumers get comfortable with it.

I’d like to memorialize the day with a story from the field. I mentioned that we made an offer last Sunday on a hot new listing in Carlsbad. We finally had a conclusion yesterday.

My buyer offered $3,730,000, which was $230,000 over the list price, and had an 80% down payment.

We lost.

We found out when the auto-notification was received that it had been marked pending. We had to wait for five days, and that’s how it ended – nice.

Those who think it looks easy to just go out and buy a house without any help, good luck to you. It is probably easier these days to buy an overpriced house that has been on the market for weeks, but if you want a good buy, don’t be surprised if it is hotly contested. For the rest of time.