We are going to hear more about making home ownership more affordable. An op-ed:

https://www.cnbc.com/2024/08/20/op-ed-the-case-for-a-40-year-mortgage.html

An excerpt:

Homeownership has long symbolized the American Dream, embodying stability, wealth creation, and community investment.

Yet, for millions of Americans, especially younger generations and first-time homebuyers, that dream is slipping away. Rising home prices, stagnant wages, and restrictive mortgage terms have made it increasingly difficult to take that crucial first step onto the property ladder.

To address this, I propose a bold new approach: a 40-year mortgage using the Federal Home Loan Bank (FHLB) system as the framework, with federal subsidies for first-time homebuyers who complete financial literacy training.

There’s no magic in the 30-year mortgage term — it was born during the Great Depression when life expectancy was also around 60 years. Today, with life expectancy nearing 80 years, a 40-year term aligns better with modern realities.

Critics may argue that a longer mortgage term increases the total interest paid, but the benefits of affordability and access outweigh this drawback. For many, the alternative is indefinite renting, which builds no equity and leaves families vulnerable to rising rents and economic displacement. A 40-year mortgage allows more people to begin building equity sooner, offering a pathway to long-term financial stability and sustained human dignity — a key element of the American Dream. A pathway up the repaired economic aspirational ladder in America.

He makes a quick reference to buying down the interest rate here:

To further support first-time homebuyers, I propose federal subsidies for mortgage rates between 3.5% and 4.5% for those who complete certified financial literacy training. Subsidies would be capped at $350,000 for rural mortgages and $1 million for urban markets, reflecting the varying costs of homeownership across the country.

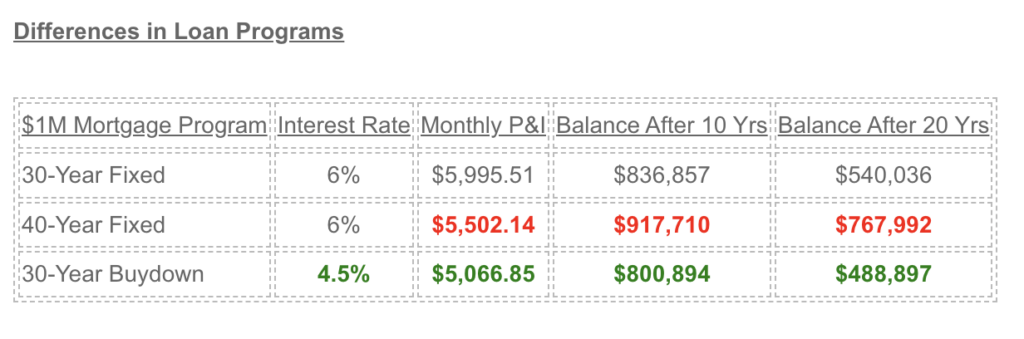

Let’s use math to help make the decision on which way to go on a $1,000,000 loan:

The 40-year mortgage is a waste of time – there isn’t enough monthly savings, and the overall amount of interest paid over the 40 years is $2,641,025. If saving $493 per month on a $1,000,000 loan is a big deal, you probably shouldn’t be buying a home that expensive. The unexpected maintenance and improvements will cost more than that.

But the interest-rate buydown does make a significant difference, especially with reducing the balance faster, which should be every homeowner’s goal. They will include mortgage and budget training with any federal subsidy program, and I’ll sum it up in one sentence: Pay additional sums with your regular payment every month, and/or refinance to a 10-year or 15-year mortgage as soon as possible (both have the same rate, which is usually 1/2% lower than the prevailing 30-year rate).

0 Comments