Inventory Watch

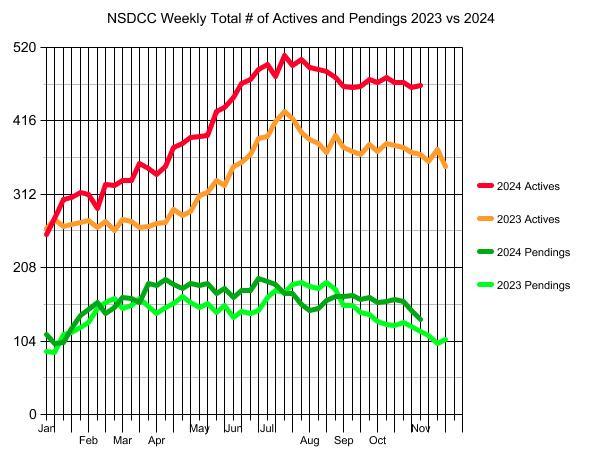

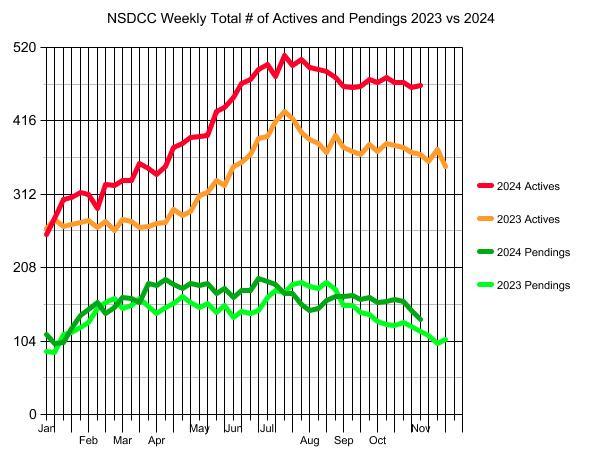

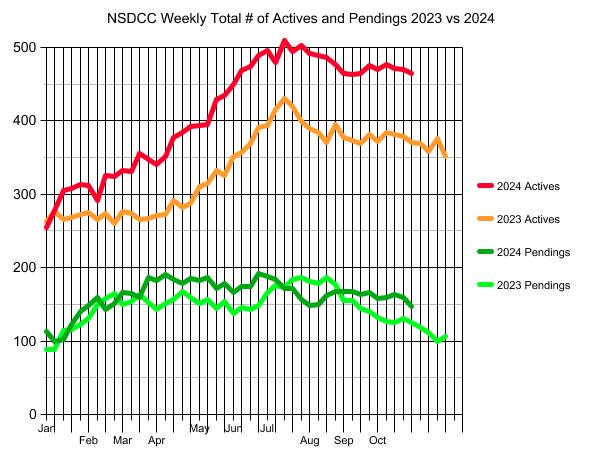

A slight uptick in the inventory count in the last week – today’s sellers aren’t quitters!

If the election noise starts to settle down, today might be the best day of the year to get a deal!

A slight uptick in the inventory count in the last week – today’s sellers aren’t quitters!

If the election noise starts to settle down, today might be the best day of the year to get a deal!

The current market conditions are fascinating.

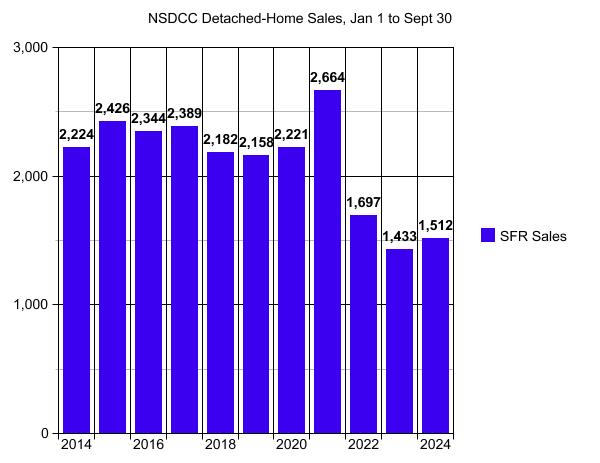

There were 141 NSDCC listings that went pending in October, and 44 of them have already closed escrow! It leaves 133 listings in the pending category so the closed sales in November and December probably won’t set any records, but if there were 100 closings each month then I’d be impressed.

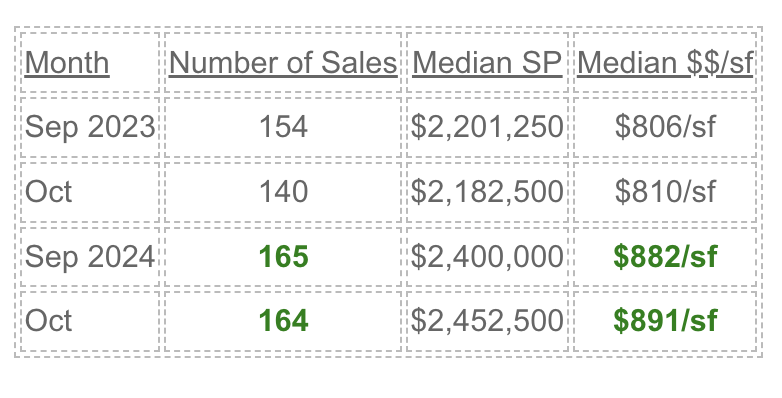

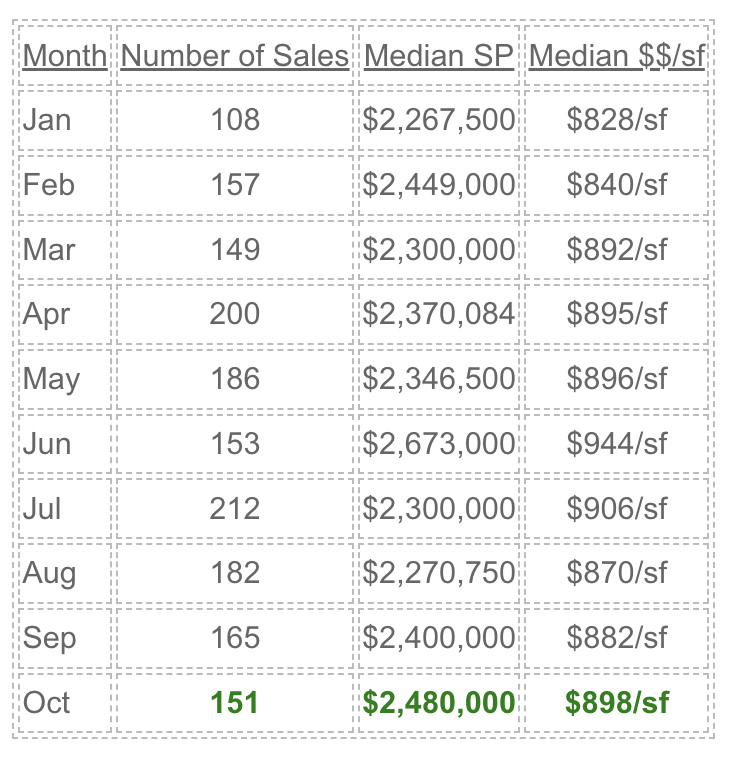

How about the closed sales? Smoking hot, compared to last year:

It all points to the 2025 Selling Season being robust, to say the least. It is going to start in January, and there might even be sellers who want to get a jump on it and list their home in December!

Here’s one more category (rich people fleeing) to add to my reasons why 2025 is going to bust loose:

A growing number of wealthy Americans are making plans to leave the country in the run-up to Tuesday’s election, with many fearing political and social unrest regardless of who wins, according to immigration attorneys.

Attorneys and advisors to family offices and high-net-worth families said they’re seeing record demand from clients looking for second passports or long-term residencies abroad. While talk of moving overseas after an election is common, wealth advisors said this time many of the wealthy are already taking action.

“We’ve never seen demand like we see now,” said Dominic Volek, group head of private clients at Henley & Partners, which advises the wealthy on international migration.

Volek said that for the first time, wealthy Americans are far and away the company’s largest client base, accounting for 20% of its business, or more than any other nationality. He said the number of Americans making plans to move abroad is up at least 30% over last year.

David Lesperance, managing partner of Lesperance and Associates, the international tax and immigration firm, said the number of Americans hiring him for possible moves overseas has roughly tripled over last year.

A survey by Arton Capital, which advises the wealthy on immigration programs, found that 53% of American millionaires say they’re more likely to leave the U.S. after the election, no matter who wins. Younger millionaires were the most likely to leave, with 64% of millionaires between 18 and 29 saying they were “very interested” in seeking so-called golden visas through a residency-by-investment program overseas.

https://www.cnbc.com/2024/11/01/wealthy-americans-plans-leaving-united-states.html

Hat tip to Lance!

Roam CEO Raunaq Singh has a bold plan to unlock housing affordability: Connect homebuyers with home sellers who have mortgages eligible to be “assumable,” enabling buyers to take over the existing mortgage, including its presumably much lower mortgage rate.

Back in September 2023, Singh launched Roam, a real estate portal that resembles Zillow.com or Realtor.com. However, Roam exclusively showcases homes currently for sale with loans eligible to be assumable. One of the challenges with assumable mortgages is that, typically, most conventional mortgages are not assumable. However, if specific requirements are met, most loans insured by the Federal Housing Administration (FHA) and loans backed by the Department of Veterans Affairs (VA) or the United States Department of Agriculture (USDA) are eligible.

As of today, Roam’s listing website exclusively showcases homes currently for sale with assumable loans in Arizona, Georgia, Florida, Illinois, Colorado, Texas, North Carolina and South Carolina. Singh says that these eight states represent nearly 50% of the country’s market share of assumable mortgages. The company, a licensed real estate brokerage in these five states, aims to expand to more states, including Ohio, in the near future.

When a seller in those states lists their home for sale, Roam then cross-checks it with proprietary mortgage data. If that mortgage is eligible to be assumed, it’s listed on Roam’s site.

On Roam’s site, you’re asked to fill out a simple questionnaire. Then you’re taken to a portal for your selected market.

The Clear Cooperation Policy isn’t going anywhere, at least not for now:

The MLS Technology and Emerging Issues Advisory Board opted not to make a recommendation about CCP or take any other action. But they did turn over the feedback they received to the NAR leadership team, who said they will consider it.

Any of the brokerages who dislike the policy are probably at least thinking about leaving NAR. Compass has been the most vocal opponent of the CCP, and our management has to be considering all the options right about now. New York City agents are not members of NAR, and there isn’t any law or regulation that insists on membership. It is a trade organization.

Are we willing to leave the MLS too?

It would be a gutsy move.

It is the only way to completely control our own destiny, because the class-action lawsuits will keep coming and NAR will keep making settlements on our behalf. It would be too big of a disruption to happen in the near term, but it seems like brokerages leaving the NAR and the MLS is inevitable.

The biggest change? I’d have to be Jim the Broker-Associate!

Last October, there were 140 NSDCC sales with a median sales price of $2,182,500 ($810/sf).

This month’s final count should be 160+ sales and a median sales price that’s +10% above last October!

Statistically, the political circus hasn’t caused ANY drop off in sales or pricing!

It probably means the momentum will be hot going into January too!

Sounds like a fair compromise to me – if they can get around the construction-defect litigation that seems to come with every new complex. Two-story is preferred vs. three-story:

Owning a home has long been a core part of the American Dream. Today, however, there simply aren’t enough affordable options, and that ideal is increasingly out of reach. There’s a sensible way to address this shortfall, but it requires moving beyond the antiquated vision of a big house with a fenced yard in the suburbs.

The new American Dream should be a townhouse — a two- or three-story home that shares walls with a neighbor. Townhouses are the Goldilocks option between single-family homes in the suburbs and high-rise condos in cities.

Though townhouses have long been perceived as starter homes for young couples who hope to later move to a larger place, developers say that stereotype is changing. Today, townhouses are popular options for many kinds of households — couples with one child, single parents, people who live alone, couples in their 30s and 40s with no kids, and empty nesters in their 50s looking to downsize. People are drawn to the low-maintenance lifestyle and the sense of community. Many people don’t want to isolate themselves in suburban homes where they have minimal contact with neighbors and are fully dependent on a car.

“We absolutely love our next door neighbors,” said Katherine McKay, 40, who lives in a townhouse in Silver Spring, Md., with her wife. They met their neighbors — a retired couple — when they were all outside one evening on their back decks. They immediately bonded over the fact that they all enjoy having just enough space for a “postage stamp” garden. “Our townhome is 1,700 square feet. I don’t want more to clean.”

Link to free articleGreat advice from long-time Compass agent from Atlanta – if the house you just saw isn’t a 4 or 5, then forget it immediately:

What would a frenzy of inventory look like?

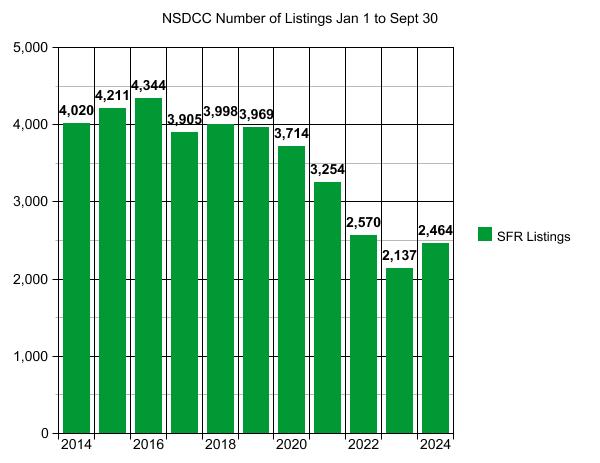

There has only been a 15% year-over-year increase in the number of homes for sale in 2024, which isn’t that noticeable, especially to the casual observer. Plus, the top-quality homes still get swept off the market quickly, so there aren’t many great listings lying around unsold.

For an frenzy of inventory to be dangerous, it would take so many new listings to hit the market that there aren’t enough buyers to grab all the top-quality homes for sale.

There will always be the half-baked offerings looking to get lucky.

There is only a problem when the great homes aren’t selling (aka switching to a buyer’s market).

Though there has only been 15% more listings this year, the current active inventory is about 30% higher than last year. There is the sign that buyers are being more picky, and that the pressure on pricing is rising. Sellers either need to do more sprucing up, or sharpen their price. Some need to do both.

I have said before that I thought the market had been so dry that the pent-up demand would absorb a 15% to 20% increase in the number of homes for sale. Well, here we are! There have been 6% more sales this year, which didn’t pick up ALL the extra supply – just the best ones for sale.

I think we will call 2024 the year of equilibrium where the supply and demand has been more balanced than in recent years. I’ll resist calling it a ‘normalization’ because nothing feels normal these days! But statistically it looks like a decent balance.

What would happen if/when the flood comes?

If 15% to 20% was reasonably absorbed this year and it balanced the supply and demand, then any increase in 2025 above that would be nervous time.

How much growth above the 2024 homes for sale can the market endure?

I’m going to say not much more, and it’s why sellers should get out while they can in early 2025.

Adding ANY more inventory in 2025 above this year’s number of homes for sale would only get absorbed if rates drop to 6% or lower – which could happen – and the political circus dies down.

If the 2025 NSDCC inventory matches, or slightly exceeds, the 2024 red line below, then we should be fine. If it pops higher – and especially if it pops higher in January – then stagnation could set in as buyers wait-and-see where it goes.

You’ll be able to watch it all transpire right here at bubbleinfo.com!

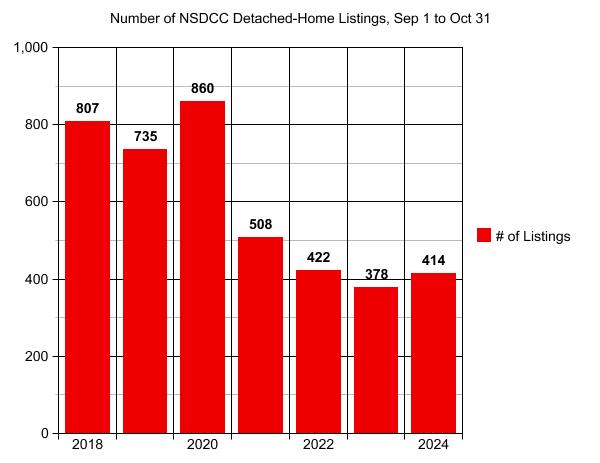

I thought the run-up to the election would cause potential home sellers to wait it out.

Wouldn’t it make sense to NOT list your home in the month or two before the most contentous election in history? Certainly home sellers would have foresight and believe that buyers would be distracted. Everyone would be doing the wait-and-see!

Nope – and we’re not done with new listings this month. There will probably be another 10-20 homes go on the market before Friday (plus late-reporters).

It means that a surge of listings is in the works.

Our stager told Donna yesterday that she is already getting booked up for January. Our regular contractors have been voicing the same thing – they are very busy, and getting busier.

How about this as an indicator:

I already have three listings signed for January/February, and another 2-3 in the works. Never before have we had a January listing signed in October!

It means the first quarter of 2025 is going to be insane – a frenzy of inventory!

Get Good Help!