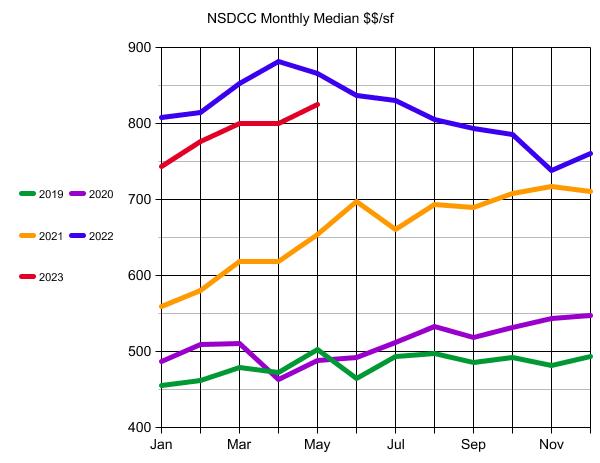

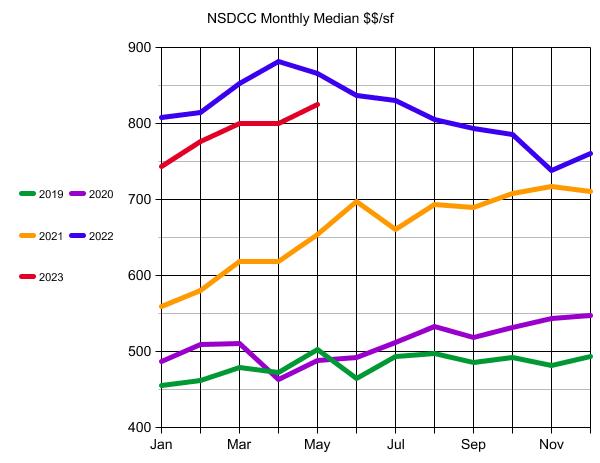

NSDCC Pricing Comeback

Anyone who thought the long slide last year was just the beginning has to be sorely disappointed now.

This is the greatest comeback of all-time!

Anyone who thought the long slide last year was just the beginning has to be sorely disappointed now.

This is the greatest comeback of all-time!

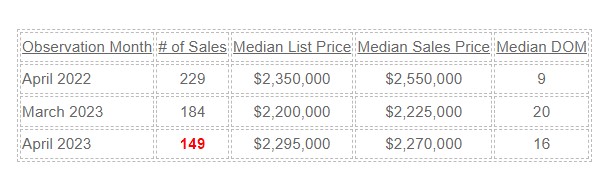

Here is the early count on April sales between La Jolla and Carlsbad, with YoY and MoM comparisons:

There will be some late-reporters but April sales won’t get up to the 184 sales we had in March – which will probably end up being the best month of 2023 (remember that next year). There are only 148 pendings today so the May sales will most likely be under the March and April counts too.

The pricing doersn’t look that much different than last April when the frenzy was peaking. Just more people paying under list, instead of the majority paying over list.

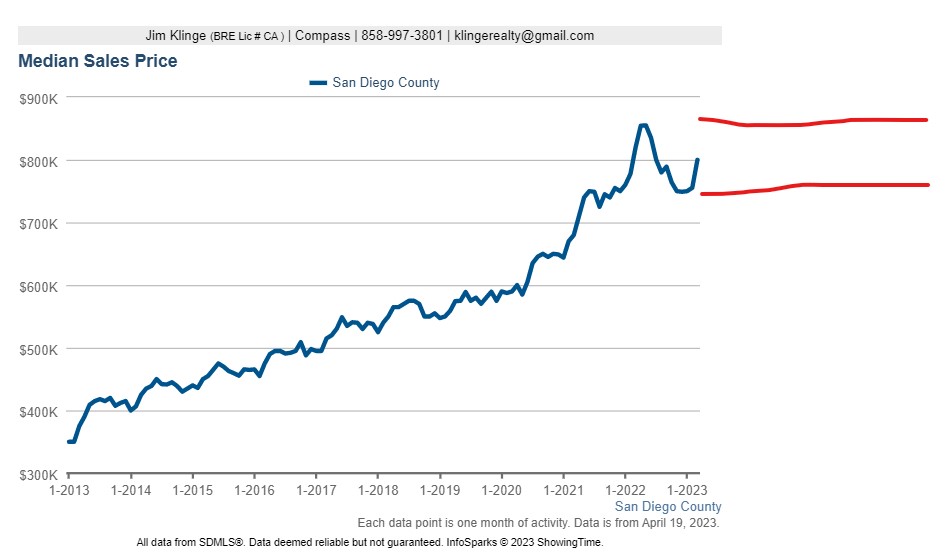

Here is the county’s median sales price:

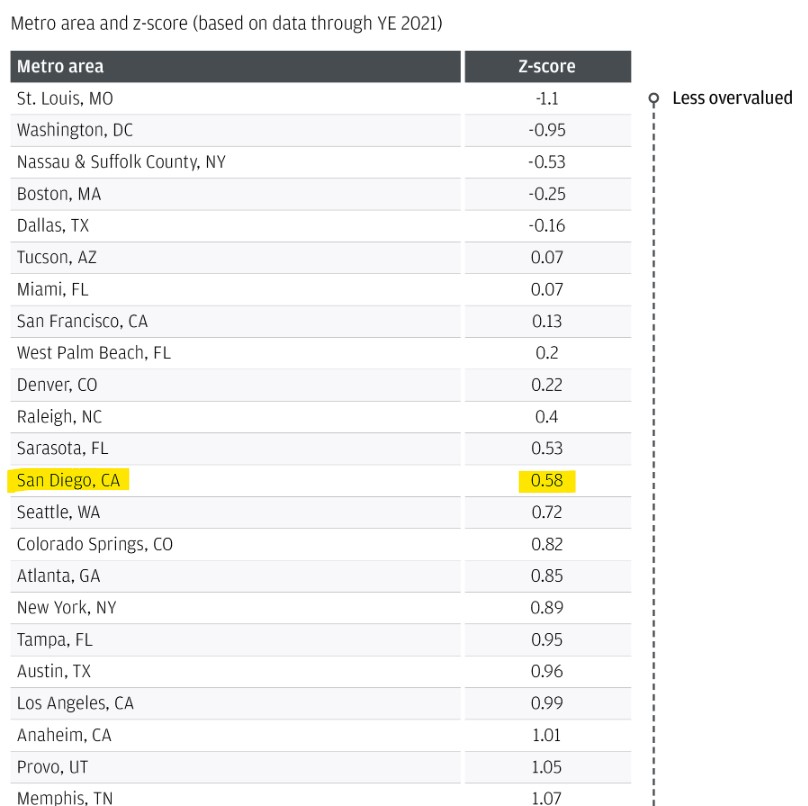

Price-wise, we are back to where we were at the end of 2021, so the data above should still be in the ballpark. Glad to see that San Diego isn’t considered as wildly overvalued – it’s expensive here and people can afford it, apparently.

I like that the J.P. Morgan guys who wrote this article are focused on the individual metros! The more affluent areas will keep losing population to the more affordable towns, and the balance will be determined by how many rich people move here. Could it balance out nicely?

An excerpt:

The end of the U.S. housing market’s pandemic-induced volatility seems in sight.

A recent and telling stabilization of single-family home sales—surprising in the face of high mortgage rates—has us expecting prices to finish bottoming out across the nation by the end of this year or in early 2024.

By the second half of 2024, we believe, the national housing market will return to a pre-pandemic historical norm in which residential home prices climb slowly and steadily, keeping modestly ahead of the rate of inflation.

However, we also expect each city’s path back to normalcy to be very different.

Last fall, as the housing market was cooling, we said that national statistics, while informative, would fail to tell the whole story. We expected cities to experience widely differing drops in home prices based in large part on how overheated their particular housing markets were at the start of 2022, before interest rates rose.

Subsequent home price drops have been dispersed, and in the general direction we anticipated.

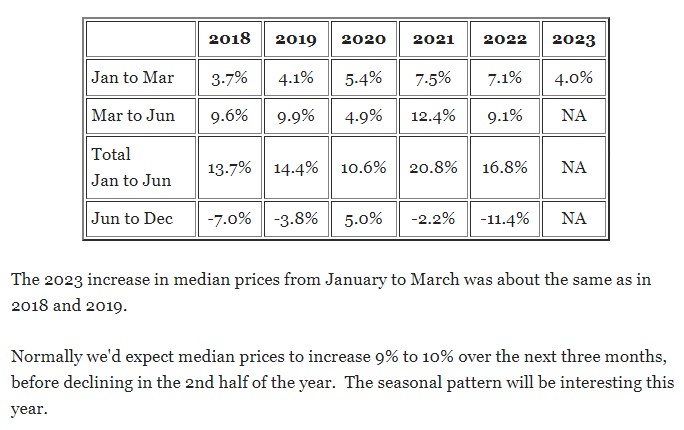

Link to Article by JPMorgan ChaseBill charts the seasonal flow of the national median home price below:

His full article:

https://www.calculatedriskblog.com/2023/04/the-normal-seasonal-pattern-for-median.html

San Diego County doesn’t have the drastic weather changes which impact sales in other parts of the country, but there are some fluctuations….at least before Covid. This graph is interactive:

For buyers who want to pay less, the pricing is more favorable in the off-season. But you have to ask yourself – with the inventory being so bleak during the selling season, how much worse will it be in winter?

Thankfully, it only takes one!

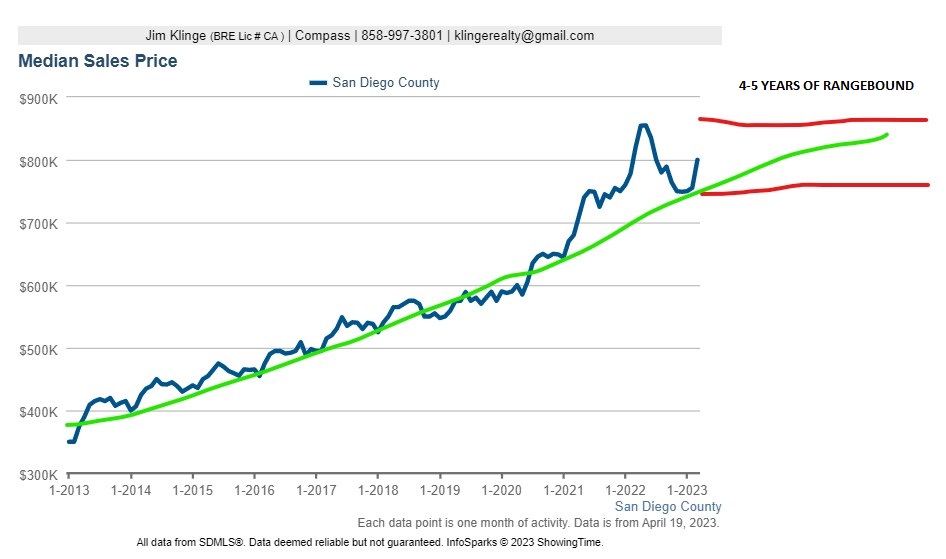

Where do home prices go from here?

Hopefully, it will be more predictable than it has been lately!

The Fed’s insistence on raising rates just to see if they can tank the economy should keep a ceiling in place. The buyer pool is already limited to only those who can qualify and have big money, and the generational wealth transfer should be very active between now and 2026 when the estate-tax/gift rules go backwards.

But there isn’t much hope for more inventory, and the limited number of homes for sale should keep a pricing floor in place. It should mean that the overall pricing trend stays rangebound for the next few years – which will be BORING!

But it will be best thing that could ever happen.

If the frenzy conditions settle down and buyers and sellers can make sound financial decisions based on facts and logic, it wouldn’t be a bad thing!

The return of seasonality will keep pricing in check too. The graph shows how the median price usually peaks in the middle of each year, and then is flat or glides downward to the next selling season.

The 2020-2022 Covid-Frenzy price trend was just about straight up!

Mark is one of the best appraisers in the county:

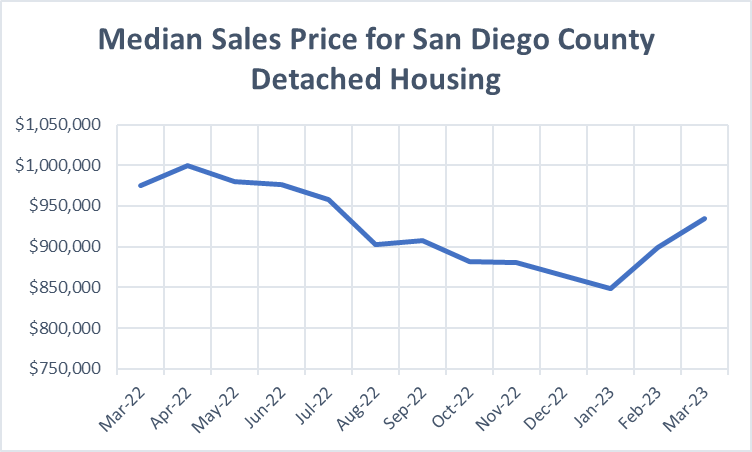

The median sales price for a detached home in the county continues on a seasonal climb. According to our MLS (depicted on the chart below) the median detached home price in March was $934,500. While the median price is down 4.2% from last March when the median price was $975,000, it is up 3.9% from February’s median price of $899,000.

Limited inventory is helping push prices higher, however it is still critical for sellers to price their home right. Multiple sources and personal experience have shown that pricing a home realistically based on local market data will help it sell quickly in today’s market. The danger of overpricing a home is having extended days on market, buyers questioning what may be wrong with a home that has not sold. This likely will result in price cuts and a steeper discount than if the home was initially priced at market.

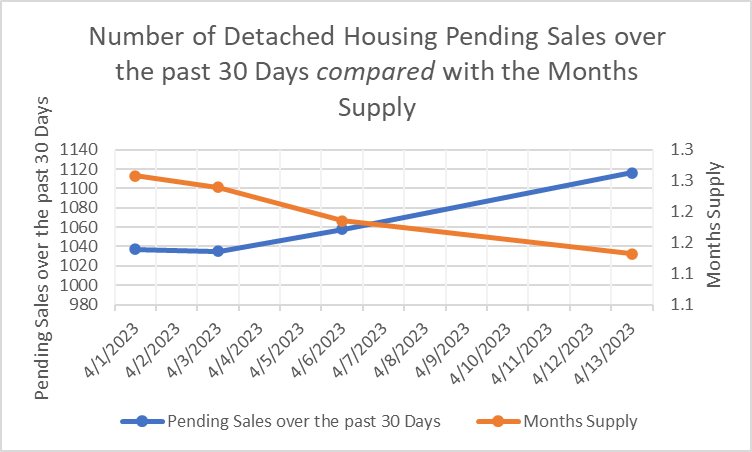

Data from our MLS on the chart below shows the trending increased number of detached housing pending sales over the past 30 days compared with the months supply of housing. It reflects a market with high liquidity, meaning sellers who priced their homes right can expect an offer within a few weeks, at or near their list price.

I would be grateful to help take care of your contacts who are seeking a real estate appraisal to establish a date of death value for estate tax purposes. The IRS has specific guidelines on establishing a fair market value for tax reporting purposes, so it is important to get it right the first time! Appraisals tailored to specific IRS guidelines are my specialty and I am ready to provide your referrals with the best service available, just pass along my contact information and I will do the rest.

Best Regards,

Mark Melikian

858-945-8996

RealEstateValuations@outlook.com

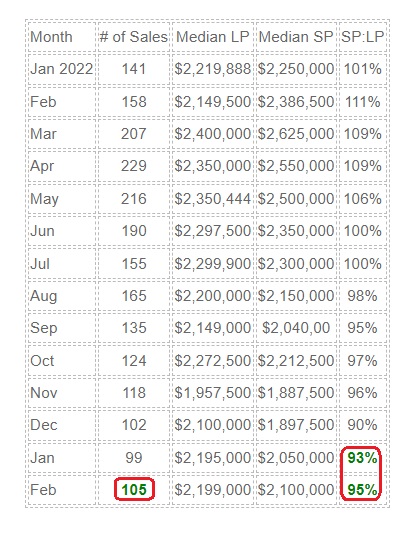

When it comes to anticipating the direction of the real estate market, the median pricing isn’t nearly as informative as these indicators – Number of Sales and SP:LP.

We are used to seeing the sales increase early in the year, but it could have been different if higher rates had broken the market. But it looks like we’re going to survive, especially when you see the SP:LP rising:

NSDCC Monthly Sales

Last February, March, and April were scorching hot, and the market’s about-face in the second half of 2022 looks very orderly, in hindsight. Both the number of sales and SP:LP ratios were declining until recently, and now they make the rest of spring look promising.

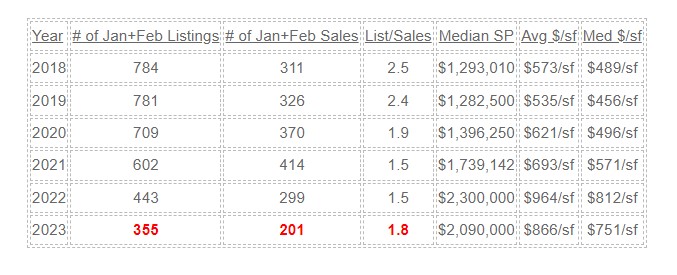

Combining the January and February stats gives us the larger sample sizes to better identify the trends.

The sellers are doing a phenomenal job at restricting the supply, and there have been enough buyers to keep the momentum going. The current listings/sales ratio is better than it was in the years before the frenzy, in spite of much higher pricing. Compare today’s pricing to 2021:

There were 78 of the 201 sales that were all-cash (39%).

It would help if there was more innovation in the mortgage world. You can get a 5-year fixed jumbo at 5.625% today, but with everyone buying their forever home, how many will want short-term money?

Without creative financing or lower rates, we will likely be on a long bumpy road for years to come.

We have an unusual obsession with home pricing – I say unusual because nobody cares that our measuring devices are deeply flawed and regularly give the wrong impression. With the stakes being so high, you’d think homebuyers would investigate thoroughly – but everyone just wants to grab and go!

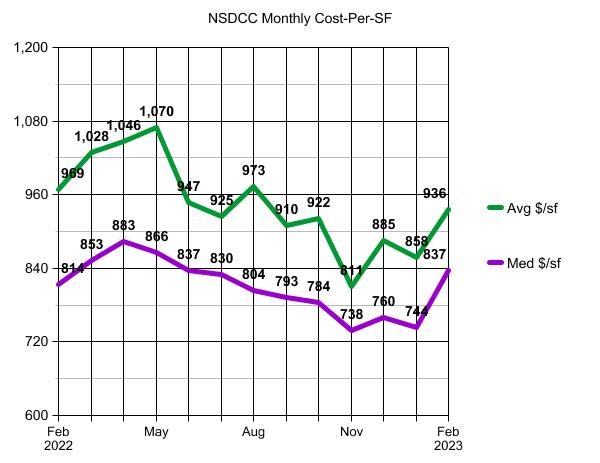

You can see in the graph above how the smaller sample sizes cause more volatility – Encinitas only had 19 houses sold in December, and ten closings in January – so the 10% to 15% bounces up and down aren’t good representations of the pricing trend.

This is a better look at the trend – the average and median $$/sf for houses sold between La Jolla and Carlsbad, and this includes the 70 sales so far this month:

The upward trend should continue as more of the premium products come to market this spring.

I predicted that there wouldn’t be a sale under $2,000,000 in the Davidson Starboard tract in La Costa Oaks after we closed the Plan 2 in October. The first new listing there since is coming soon, priced at $2,899,000 and they should get all the money:

https://www.compass.com/app/listing/7657-sitio-algodon-carlsbad-ca-92009/1253018741329889369

I know they paid $1,999,919 in 2019, but there have been others that have closed for a million dollars over their 2019 purchase price. The Plan 3 layout probably isn’t as popular as the Plan 2, and the backyard is filled with a pool. But this street is a culdesac and it has the best south and west views which only come up occasionally for sale. It’s been so long since we’ve had an offering like this that I wouldn’t be surprised if she has 100+ people look at it next week – in spite of all the doom!

Realtors are known to comfort buyers who have lost a bidding war by saying, “There will be others”.

But will there be?

Especially for those at the entry level of every market….where the action is the hottest.

Above are the NINE houses that sold under a million dollars between La Jolla and Carlsbad in 2022. Those on the list with a street name that starts with Don are mobile homes in Rancho Carlsbad – which by itself might make you scratch your head when you see mobiles selling for as much as $830,000!

It’s early in the new year, and of course everyone thinks that home prices are coming down fast so this problem will be cured shortly (NOT!).

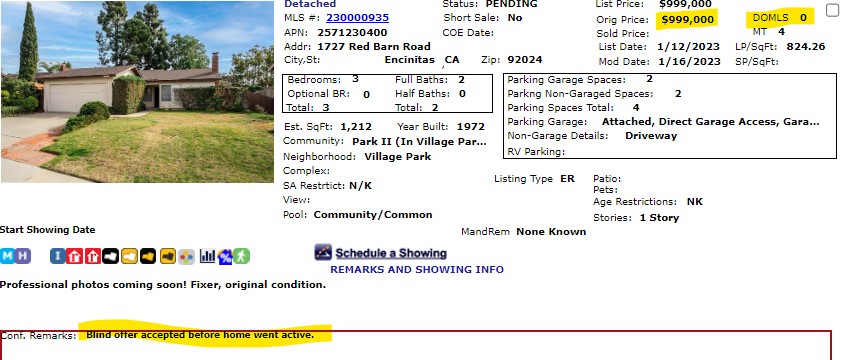

So far in 2023, this is the ONLY listing of a NSDCC detached-home priced under $1,000,000:

Oh, you want a decent home too? It’s even worse for the picky buyers.

Buyers can expect that pricing of decent entry-level homes this spring will start around these numbers:

Carlsbad: $1,250,000

Encinitas: $1,350,000

Carmel Valley: $1,800,000

RSF, Solana Beach, Del Mar, La Jolla: $2,000,000+

And good luck getting your hands on one!