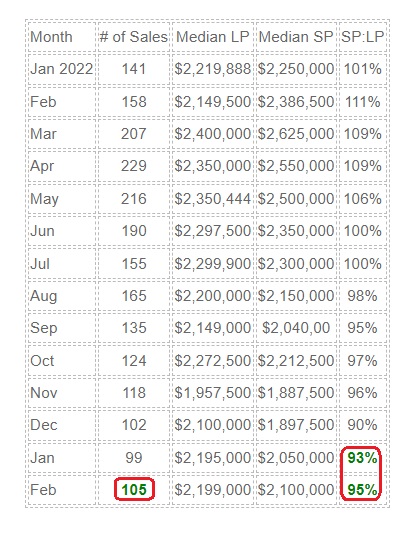

When it comes to anticipating the direction of the real estate market, the median pricing isn’t nearly as informative as these indicators – Number of Sales and SP:LP.

We are used to seeing the sales increase early in the year, but it could have been different if higher rates had broken the market. But it looks like we’re going to survive, especially when you see the SP:LP rising:

NSDCC Monthly Sales

Last February, March, and April were scorching hot, and the market’s about-face in the second half of 2022 looks very orderly, in hindsight. Both the number of sales and SP:LP ratios were declining until recently, and now they make the rest of spring look promising.

The house where Biden was speaking last night:

https://youtu.be/hqceRD_zb_A

I was at the Dole estate for a 2016 Romney fund raiser. This comes close.

I suspect the LP is too slow to recognize the new realities. I also suspect we have run out of all cash/high down buyers.

I also suspect we have run out of all cash/high down buyers.

We will reflect back on the covid era for decades.

1. Those who needed a larger house went out and bought one in the first year or two at whatever price it took to get it – no matter how crazy.

2. Those who didn’t move decided to remodel instead; running up the parts & labor fees to astronomical levels.

3. Everyone got a mortgage at 3% or less.

All are in their forever home, whether they like it or not.

Boomers are staying until the end.

The onerous capital-gains tax has frozen up both the longtimers and investors.

The difficulty of moving out of state is substantial, and nobody wants to leave SoCal anyway.

Multi-gen sounds good but try living together or getting an ADU for a resonable cost – hahaha.

It’s a freaking mess, and it’s only going to get worse. The inventory will keep going down until boomers leave the state or pass away, and they will hold out as long as they can before succumbing to either.

Extended lifespans and technology are going to keep Boomers and Cuspers in their forever homes far longer than any real estate expert can imagine. Old supply will keep getting older.

Oh, and did I mention how hard it is to get a mortgage?

Both supply and demand are getting squeezed like never before.