by Jim the Realtor | Mar 31, 2020 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

Lenders have been pulling back on their willingness to loan money around the fringes:

Any loan that’s not right down the middle of the conventional spectrum raises questions about how it will impact lenders as they navigate what is easily the largest and fastest surge of forbearances the mortgage market has ever seen. Every loan raises questions. Due to their servicing rules or risk profiles, some loans raise more questions than others. Those loans have been absolutely demolished by an absence of investor demand. To reiterate, lower demand among investors = higher rates.

In essence, despite extraordinarily high prices on the bonds that underlie the top tier mortgage debt, much of the mortgage market is broken by the volatility and uncertainty surrounding COVID-19. Some parts will heal quickly as bondholders better understand their forbearance protections. Other parts will face a tougher road due to the impending recession (high LTVs especially). In all cases, TIME and STABILITY (in markets, the economy, and epidemiology) will be required before rates and product offerings return to where they were.

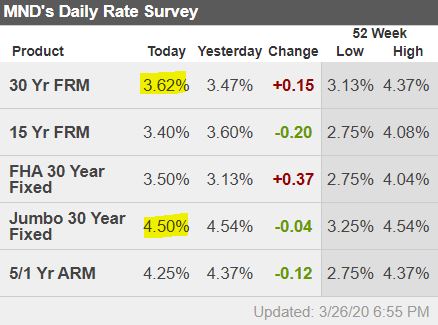

In just the last 2-3 weeks, many loan programs have been cut back or eliminated. The biggest impact on our market will be jumbo loans (>$701,500) which now need at least a 20% down payment in almost all cases – especially those loan amounts over $1,000,000.

As recently as three weeks ago, you could have bought a house for $2,500,000 with a 10% down payment.

Link to MND Article

More sellers are retreating as well.

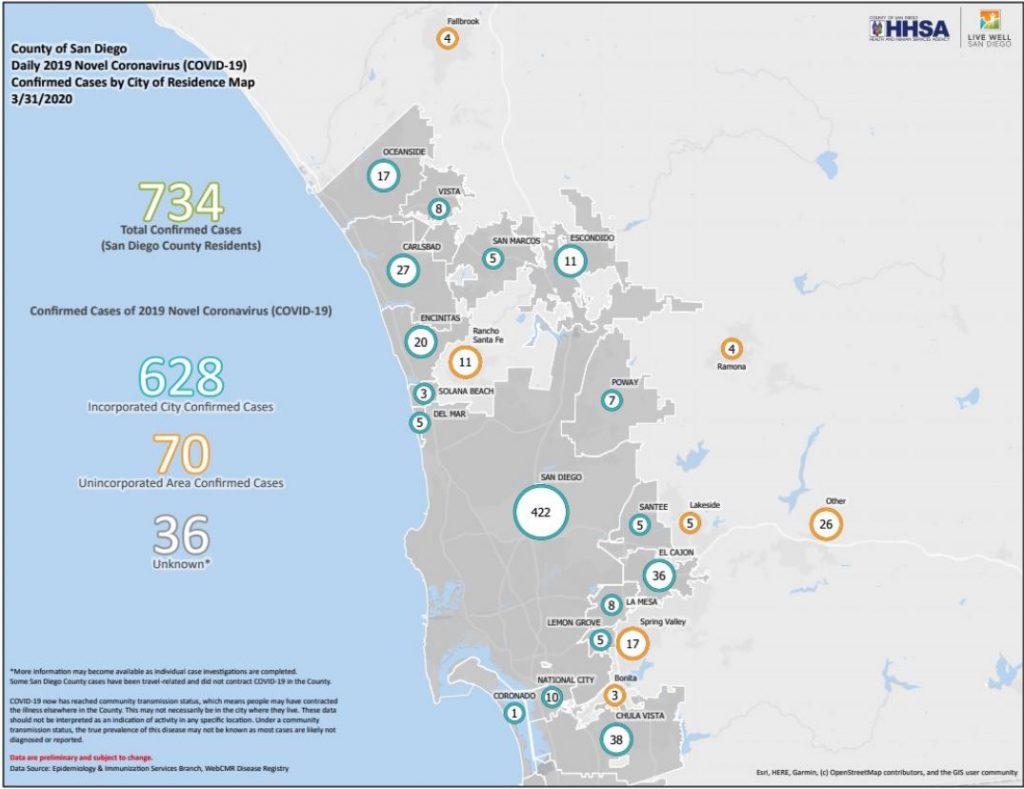

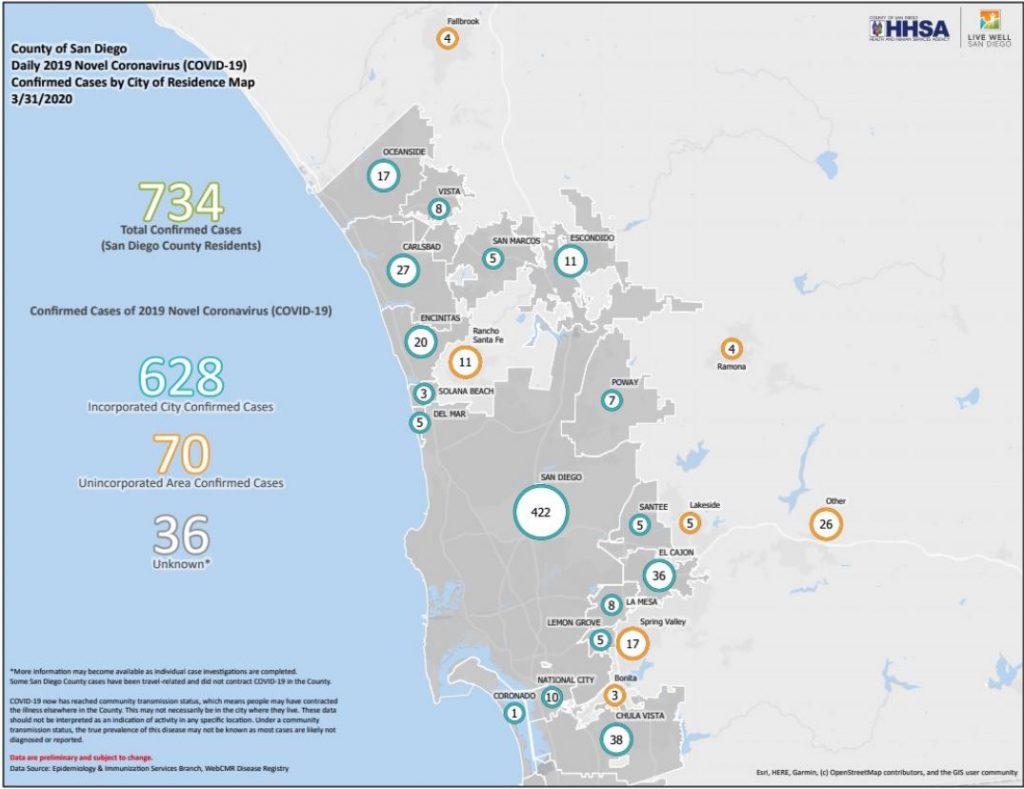

In the 71 days between January 1st and March 11th, there were 99 detached-home listings between La Jolla and Carlsbad that were cancelled, withdrawn, or put on hold.

In the twenty days since March 12th, there have been 106 houses taken off the market.

by Jim the Realtor | Mar 27, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News |

It wasn’t a surprise to hear that smaller no-name mortgage companies were retreating from the marketplace due to the extreme volatility.

The mortgage business has become dependent upon the Fed’s support to backstop the agency market (Fannie/Freddie), which leaves the non-conforming (jumbo) lenders wondering what they will do with their funded loans in the coming weeks – can they sell them to somebody?

It’s another story when one of the big banks who have been the foundation of the jumbo market, Wells Fargo, Bank of America, and Chase, are starting to quiver as well. Seen on the internet this morning:

Several correspondent investors are exiting the business or are no longer accepting new applications due to volatile market conditions. Additionally, many wholesale investors have now fully suspended operations or temporarily revised guidelines, and correspondent jumbo investors are beginning to tighten credit requirements. Investor availability and guidelines are expected to change often as market volatility continues.

Notable non-conforming investor restrictions effective today, 3/27:

Wells Fargo Non-Conforming (Jumbo)

The following transactions will be ineligible on all new locks, relocks and renegotiations:

-

- Cash-out refinances

- Investment properties

- LTV/CLTVs > 80%

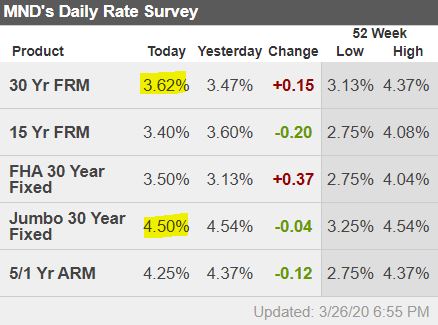

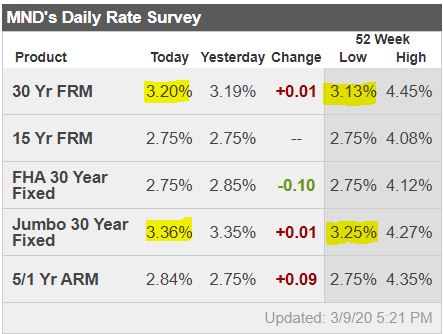

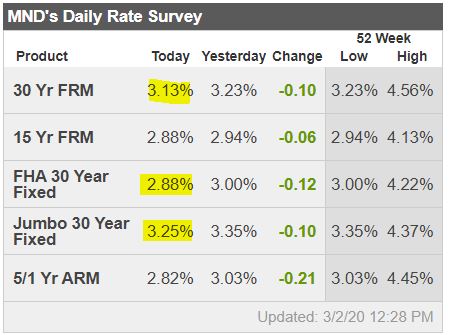

You can’t blame Wells for being more conservative, but let’s hope they and other banks keep the jumbo loans coming. The jumbo rates – which were about the same as agency rates a couple of weeks ago – have stayed since after the Fed bought enough agency MBS to bring down the conforming rates back into the mid-3s. The jumbo rate is almost 1% higher:

by Jim the Realtor | Mar 25, 2020 | Jim's Take on the Market, Mortgage News, Virus |

Lenders won’t report late payments to credit bureaus! Hat tip to Susie:

SACRAMENTO – Governor Gavin Newsom today announced that financial institutions will provide major financial relief for millions of Californians suffering financially as a result of the COVID-19 outbreak.

“Millions of California families will be able to take a sigh of relief,” said Governor Newsom. “These new financial protections will provide relief to California families and serve as a model for the rest of the nation. I thank each of the financial institutions that will provide this relief to millions of Californians who have been hurt financially from COVID-19.”

Governor Newsom secured support from Citigroup, JPMorgan Chase, U.S. Bank, and Wells Fargo and nearly 200 state-chartered banks, credit unions, and servicers to protect homeowners and consumers.

Under the Governor’s proposal, Californians who are struggling with the COVID-19 crisis may be eligible for the following relief upon contacting their financial institution:

90-Day Grace Period for Mortgage Payments

Financial institutions will offer, consistent with applicable guidelines, mortgage payment forbearances of up to 90 days to borrowers economically impacted by COVID-19. In addition, those institutions will:

- Provide borrowers a streamlined process to request a forbearance for COVID-19-related reasons, supported with available documentation;

- Confirm approval of and terms of forbearance program; and

- Provide borrowers the opportunity to request additional relief, as practicable, upon continued showing of hardship due to COVID-19.

No Negative Credit Impacts Resulting from Relief

Financial institutions will not report derogatory tradelines (e.g., late payments) to credit reporting agencies, consistent with applicable guidelines, for borrowers taking advantage of COVID-19-related relief.

Moratorium on Initiating Foreclosure Sales or Evictions

For at least 60 days, financial institutions will not initiate foreclosure sales or evictions, consistent with applicable guidelines.

Relief from Fees and Charges

For at least 90 days, financial institutions will waive or refund at least the following for customers who have requested assistance:

- Mortgage-related late fees; and

- Other fees, including early CD withdrawals (subject to applicable federal regulations).

Click here for details on how to apply for relief. Loans held by a financial institution may be serviced by another company.

Please note that financial institutions and their servicers are experiencing high volumes of inquiries.

Link to Gav’s Press Release

by Jim the Realtor | Mar 13, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News, Mortgage Qualifying, Why You Should List With Jim

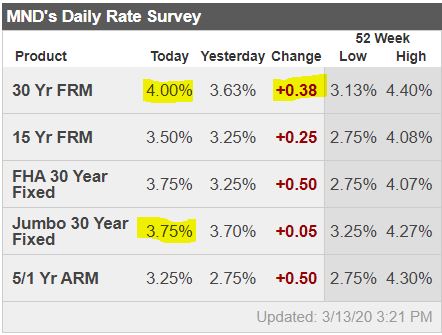

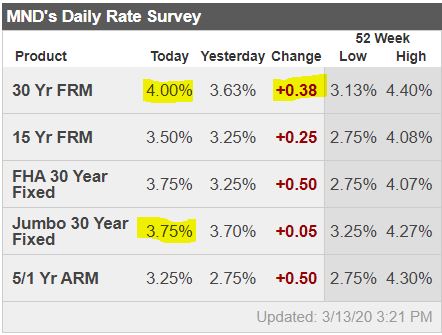

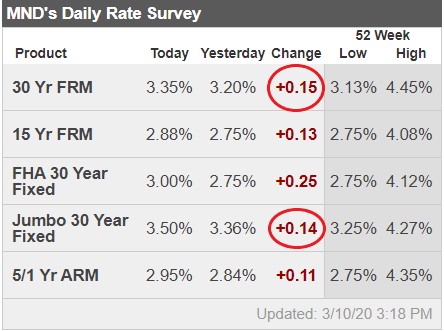

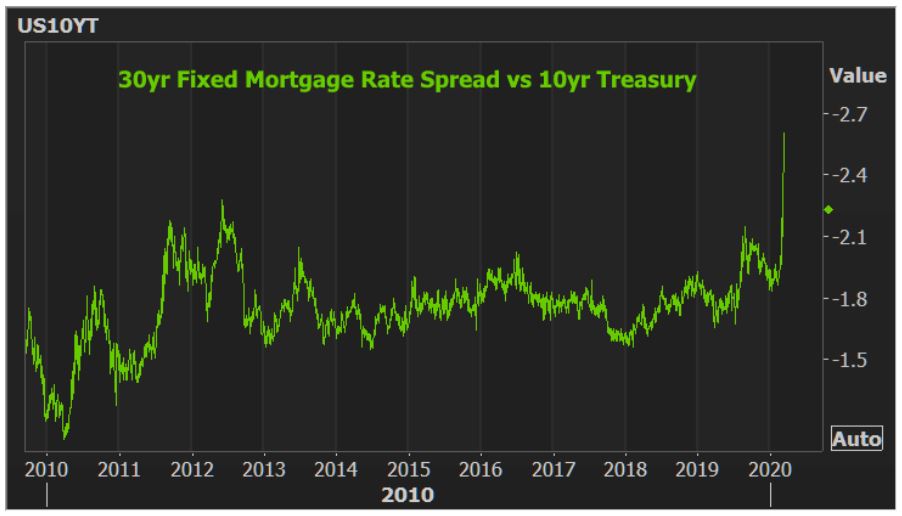

Rates changing from 2.875% to 4.0% in less than a week – wow!

There is some hope that the Fed will throw more money at the MBS market next week. From MND:

With all that in mind, some smart people are convinced the Fed will announce such a balance sheet juicing at or before next week’s meeting. A subset of those smart people are convinced the Fed will make MBS a part of that new “true QE” (which will likely involve a higher monthly dollar amount than we’ve seen previously). I haven’t been keen to agree with this point for a few reasons.

The Fed wouldn’t want to increase refi demand in an already overloaded market. Or if they do, they’re dumb. The Fed also would probably wait to see if spreads heal on their own, which is only in question due to the super low Treasury yields we’re currently seeing. Otherwise, the precedent has been well established for MBS to not freak out to the extent they require Fed intervention since 2012. Even then, there was no telling if the problem would have self corrected, but the Fed left nothing to doubt with QE3 in September 2012 (which specifically targeted MBS, as if to say “don’t worry… we won’t let spreads blow out”).

Those have been my counterpoints anyway. Now today, watching MBS spreads blow out yet again, it’s starting to look like the market is attempting to force the Fed’s hand. I’m not saying to count on a new round of Fed MBS buying, but I am saying I wouldn’t rule it out as of today.

The 10-year yield closed under 1.0% today, so a spread of 3% seems overly cautious and rates should settle down next week.

If rates don’t come back into the mid-3s, I’d expect home buyers to get real comfortable on the sidelines and only consider homes for sale that are a perfect match for their wants and needs.

Sellers – offer to pay down the buyer’s mortgage rate. You’ll be one of the few doing it!

by Jim the Realtor | Mar 12, 2020 | Jim's Take on the Market, Market Buzz, Market Conditions, Mortgage News, Virus |

Statement from FHFA Director Mark Calabria on Coronavirus

FOR IMMEDIATE RELEASE

3/10/2020

?Washington, D.C. – “To meet the needs of borrowers who may be impacted by the coronavirus, last week Fannie Mae and Freddie Mac (“the Enterprises”) reminded mortgage servicers that hardship forbearance is an option for borrowers who are unable to make their monthly mortgage payment. For borrowers that may be experiencing a hardship, I encourage you to reach out to your servicer. The Enterprises and the Federal Home Loan Banks continue to provide support to the secondary mortgage market, and the UMBS market continues to operate at its normal level.”

The Federal Housing Finance Agency regulates Fannie Mae, Freddie Mac and the 11 Federal Home Loan Banks. These government-sponsored enterprises provide more than $6.3 trillion in funding for the U.S. mortgage markets and financial institutions.

by Jim the Realtor | Mar 10, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News

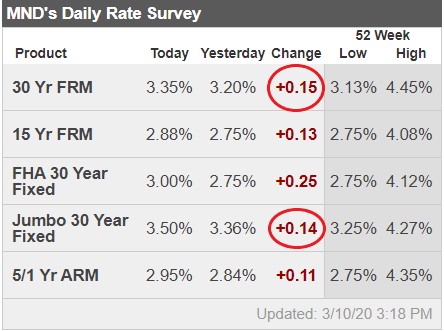

Did you lock? If not, you only lost an 1/8% (or so) today. Tomorrow!

Mortgage rates have exploded higher over the past day and a half as the bond market sends threatening signals about a big picture bounce off the recent lows. This is made all the more jarring by the timing and the scope of the movement, as well as the circumstances surrounding it. What does that mean?

First off, the scope is huge, considering the 10yr Treasury yield (the most widely cited benchmark for the bonds that underlie mortgage rates) hit 0.318% late Sunday night. While the 10yr doesn’t dictate mortgage rates, its movement speaks to the general momentum for all longer-term rates in the US. 0.318% was more than 1.0% below the previous all-time low seen in 2016, and it only took 8 business days to cover that entire 1.0%.

The drop in Treasury yields coincided with decent pricing in the mortgage-backed-securities (MBS) that underlie mortgage rates, which in turn allowed lenders to offer all-time low mortgage rates at some point in the past several business days. For many, it was first thing Monday morning. For others, it was in the previous week. Either way, the average lender has been at or near all time lows on a few occasions over the past 6 business days.

This is why the move is jarring. From all-time lows early yesterday morning, rates have moved up to the highest levels in more than a week for most lenders. The average lender had been able to quote rates as low as 3.125% during the best few hours, but they’re now back up in the 3.375% neighborhood.

http://www.mortgagenewsdaily.com/consumer_rates/938306.aspx

by Jim the Realtor | Mar 9, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News |

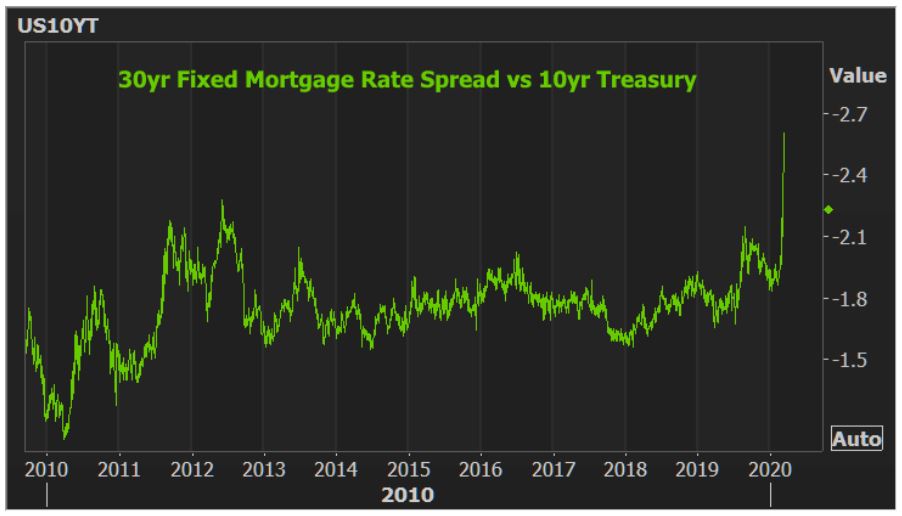

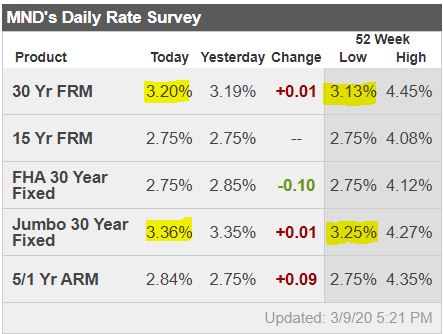

Even though the ten-year yield has plummeted, mortgage rates have been slow to follow – they actually went up a little today. Today, we heard the all-time best excuse, which explained everything:

“We’re too busy“, said the mortgage industry, which is code for ‘we are going to milk this for extra profits!’

Historically, the conforming mortgage rates could be calculated by adding 1.75% to the 10-yr, but today that would get us 2.25% mortgage rates. Here is their greed meter – unprecedented spread here:

Here’s what Ted said at MND:

Financial markets are in total disarray, some lenders are not accepting new loans or locks, and lock pricing engines are crashing repeatedly due to excessive volume. If this sounds like a mess, it is. While this panic won’t subside overnight, if you like your current pricing and lender is locking loans, why not lock? There’s no logic or reason in this market now, who knows what the mood will be tomorrow/next week?

Futures are in positive territory currently, so it appears we may have seen the worst for now.

If the mortgage industry doesn’t feel like sharing the wealth, then you might as well lock your rate.

http://www.mortgagenewsdaily.com/consumer_rates/938153.aspx

by Jim the Realtor | Mar 3, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News |

Does this mean mortgage rates will get into the mid-2s? Probably not – the 10-year yield hasn’t moved much, and mortgage lenders are slow to match any declines. But we could see 2.75% this week!

The Federal Reserve announced an emergency rate cut Tuesday of half a percentage point in response to the growing economic threat from the novel coronavirus.

The move was the first such cut since the financial crisis. It comes amid a volatile patch on Wall Street and amid a steady stream of hectoring from President Donald Trump, who has called for lower rates to stay competitive with policy at other global central banks.

“The coronavirus poses evolving risks to economic activity,” the Fed said in a statement. “In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate.”

Link to CNBC article

by Jim the Realtor | Mar 2, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News, Mortgage Qualifying

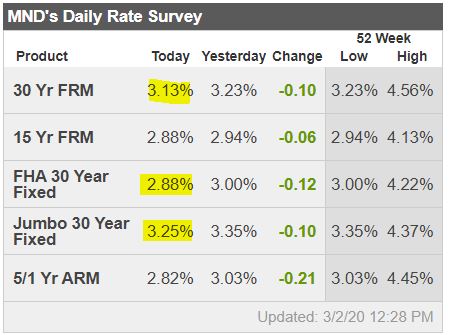

Mortgage rates officially hit all-time lows this morning. Even so, it continues to be the case that Treasury yields (often referred to as the basis for mortgage rates) are falling much faster. That’s because Treasuries aren’t actually the basis for mortgage rates. They’re simply a very important source of guidance and momentum in the bigger picture for all kinds of rates.

When rates are this low and when they’ve fallen this fast, the question of locking vs floating is about as prevalent as I ever see it. The easiest advice for those willing to take some risk is to float and continue to watch Treasury yields (specifically, the 10yr). Since mortgage rates have been lagging so badly, they should be able to hold fairly steady for a day or two even if the 10yr signals a bounce. Of course this requires preparation and planning. Be sure your mortgage is ready to lock and to have a realistic idea of your ability to make that happen in a matter of a few hours or less on any given day. In other words, if you’re floating, make a “locking game-plan” with your friendly neighborhood mortgage professional.

Link to Article

by Jim the Realtor | Feb 28, 2020 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

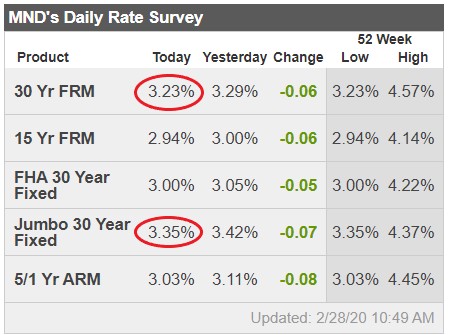

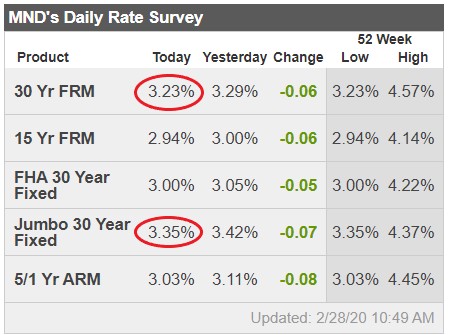

The MND’s survey above are today’s rates with no points, which means that homebuyers who are willing to pay a point or so will be getting a mortgage rate starting with a 2!

While there is certainly a big concern about the coronavirus affecting the world economy – and putting a dent in the down payments – these record-low rates should keep homebuyers engaged!