It wasn’t a surprise to hear that smaller no-name mortgage companies were retreating from the marketplace due to the extreme volatility.

The mortgage business has become dependent upon the Fed’s support to backstop the agency market (Fannie/Freddie), which leaves the non-conforming (jumbo) lenders wondering what they will do with their funded loans in the coming weeks – can they sell them to somebody?

It’s another story when one of the big banks who have been the foundation of the jumbo market, Wells Fargo, Bank of America, and Chase, are starting to quiver as well. Seen on the internet this morning:

Several correspondent investors are exiting the business or are no longer accepting new applications due to volatile market conditions. Additionally, many wholesale investors have now fully suspended operations or temporarily revised guidelines, and correspondent jumbo investors are beginning to tighten credit requirements. Investor availability and guidelines are expected to change often as market volatility continues.

Notable non-conforming investor restrictions effective today, 3/27:

Wells Fargo Non-Conforming (Jumbo)

The following transactions will be ineligible on all new locks, relocks and renegotiations:

-

- Cash-out refinances

- Investment properties

- LTV/CLTVs > 80%

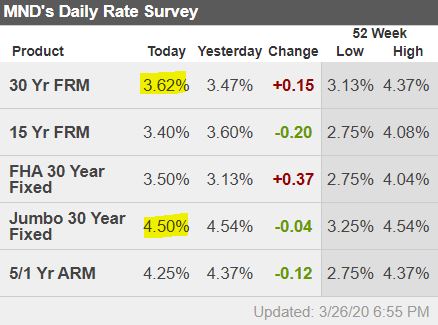

You can’t blame Wells for being more conservative, but let’s hope they and other banks keep the jumbo loans coming. The jumbo rates – which were about the same as agency rates a couple of weeks ago – have stayed since after the Fed bought enough agency MBS to bring down the conforming rates back into the mid-3s. The jumbo rate is almost 1% higher:

Hat tip to Mark for sending in this additional article on the topic:

(Bloomberg) — One of the largest U.S. mortgage firms catering to riskier borrowers slashed 70% of its workforce, signaling a deep slowdown in that business.

Angel Oak Mortgage Solutions, which specializes in so-called non-qualified mortgages that can’t be sold to Fannie Mae or Freddie Mac, cut almost 200 of its 275 employees amid the coronavirus pandemic, said Sreeni Prabhu, co-chief executive

officer of the firm’s parent, Angel Oak Cos.

“The world has dramatically changed,” Prabhu said. “We have to slow down and re-underwrite in the new world that we’re in. That’s going to take some time.”

Angel Oak’s main mortgage unit said earlier this week that it would pause all originations of loans for two weeks “due to the constant shifts and the inability to appropriately evaluate credit risk.” But the scope of the job cuts, which affected a broad swath of the firm’s sales staff, means the firm faces an uphill battle when it returns to the market.

A near shutdown of economic activity across the country has caused severe pain across the $16 trillion U.S. mortgage industry. The home-loan market that played a central role in the last financial crisis has been roiled anew as lenders brace for a growing slate of soured obligations and struggle to obtain financing to issue new loans.

The Atlanta-based company still has access to financing from its existing lenders and plenty of capital, Prabhu said, putting it in a good position to expand its mortgage business once the market for non-government-backed loans returns. The widespread job cuts don’t suggest a broad retreat from the market, he said. Some lenders to mortgage providers, including Flagstar Bancorp Inc., have scaled back or stopped funding non-traditional loans as the crisis escalates.

Riskier Loans

Angel Oak is primarily known for its riskier lending arm, which is one of the leaders in funding non-qualified mortgages. Such loans include those made to borrowers who verify their incomes with bank statements instead of tax returns and others who may have recently filed for bankruptcy or had a previous foreclosure that hurt their credit scores.

Angel Oak Mortgage Solutions funded some $3.3 billion of non-QM loans in 2019, making it one of the biggest lenders in the space. In January, Angel Oak’s mortgage units said they planned to fund more than $8 billion of home loans in 2020, but the total is now likely to be perhaps a quarter of that, Prabhu said.

The coronavirus pandemic has brought non-QM lending to a virtual standstill industrywide. Many non-QM borrowers are self-employed, making them among the hardest hit by a broad slowdown in business activity.

Citadel Servicing Corp., another top non-QM lender, said it was halting originations for 30 days, and Mega Capital Funding Inc. told brokers last week that it was suspending its programs for those mortgages “for the foreseeable future,” according to a notice seen by Bloomberg.

it’s just a matter of time before I get my sweet lower rates.

I am patient. Besides, what is the worst that will happen? payoff my loan sooner?

suck it banks!! give me my cheap money.

@just some guy I, for one, am rooting for you. Please report back when you finally lock and what rate.