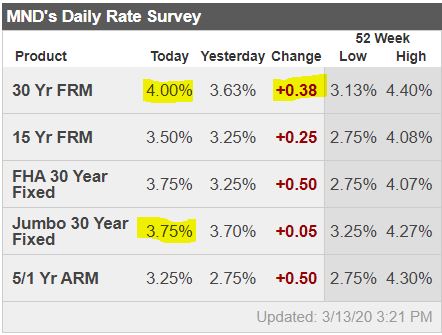

Rates changing from 2.875% to 4.0% in less than a week – wow!

There is some hope that the Fed will throw more money at the MBS market next week. From MND:

With all that in mind, some smart people are convinced the Fed will announce such a balance sheet juicing at or before next week’s meeting. A subset of those smart people are convinced the Fed will make MBS a part of that new “true QE” (which will likely involve a higher monthly dollar amount than we’ve seen previously). I haven’t been keen to agree with this point for a few reasons.

The Fed wouldn’t want to increase refi demand in an already overloaded market. Or if they do, they’re dumb. The Fed also would probably wait to see if spreads heal on their own, which is only in question due to the super low Treasury yields we’re currently seeing. Otherwise, the precedent has been well established for MBS to not freak out to the extent they require Fed intervention since 2012. Even then, there was no telling if the problem would have self corrected, but the Fed left nothing to doubt with QE3 in September 2012 (which specifically targeted MBS, as if to say “don’t worry… we won’t let spreads blow out”).

Those have been my counterpoints anyway. Now today, watching MBS spreads blow out yet again, it’s starting to look like the market is attempting to force the Fed’s hand. I’m not saying to count on a new round of Fed MBS buying, but I am saying I wouldn’t rule it out as of today.

The 10-year yield closed under 1.0% today, so a spread of 3% seems overly cautious and rates should settle down next week.

If rates don’t come back into the mid-3s, I’d expect home buyers to get real comfortable on the sidelines and only consider homes for sale that are a perfect match for their wants and needs.

Sellers – offer to pay down the buyer’s mortgage rate. You’ll be one of the few doing it!

0 Comments