by Jim the Realtor | Nov 25, 2018 | Jim's Take on the Market, Slowdown, Tax Reform, Thinking of Buying? |

This talking-head guy was trying to create a ruckus about the new limit on SALT deductions being the cause of the real estate slowdown, but he backed into what will be the real effect.

Higher mortgage rates and the limit on SALT deductions might keep those who are money-conscious from moving up, which means fewer higher-end sales.

But fewer sales don’t automatically mean lower prices.

The affluent pay the price to get the home they want, and those not so fortunate lower their sights and buy a cheaper house (which is very unlikely if you’ve ever looked at million-dollar houses and then try to price-down and consider those in the $800,000 range).

These guys want to put labels on it like The New Normal, but home sellers will adapt the old normal – pay my price or close, because I’m not giving it away:

Fleming: This is the new normal for the housing market from CNBC.

by Jim the Realtor | Nov 7, 2018 | Jim's Take on the Market, Local Government, Tax Reform, Why You Should List With Jim

This is a real estate blog, not political, but legislation gets passed that affects real estate decision-making.

Here is what the HW said we can expect from the new HofR:

https://www.housingwire.com/articles/47337-mba-lobbyist-heres-what-a-democrat-led-house-means-to-us

But let’s go back to the tax reform passed in December.

Nobody has brought this up yet, so I’m just speculating.

The original proposal was to change the 2-out-of-5-year residency requirement to five out of the last eight years in order to get up to $500,000 tax-free profit.

This provision was conceded, and all the talk centered around the lowering of the MID and the limits on the SALT deductions.

But when the final bill was passed, they didn’t change the residency requirement to the five-out-of-eight version. It is still the two-out-of-five requirement today.

If the Democrat-led House of Representatives decides to re-visit the tax reform, there will be a lot of yelling and screaming. But if they cut deals in the end to pacify everyone, it’s the five-out-of-eight requirement could be one of the concessions – because there wasn’t any resistance to the change last time.

It won’t matter to long-time homeowners, but for those who purchased in the last 2-3 years and were thinking of moving up or out with tax-free profit, this could hamper the plan.

Thinking of selling now, just in case? Contact Jim the Realtor!

by Jim the Realtor | Aug 12, 2018 | Jim's Take on the Market, Prop 13, Tax Reform |

I’d sure like to see the research that makes the C.A.R. think this idea will bring a flood of inventory because Prop 60/90 already cover this issue. The realtor bashing alone might be enough to sink this proposition:

Would it be a merciful end to the “moving penalty” or a giveaway to rich homeowners and real estate agents?

Proposition 5, which California voters will decide on this November, allows homeowners age 55 and up to receive a major break on their property taxes when they move homes. Sponsored by the California Association of Realtors, the initiative attempts to address a problem familiar to many Californians of a certain age: You want to move from your empty nest, but you’re scared of the new taxes you’d have to pay on a downsized property.

That dilemma is a byproduct of Proposition 13, the landmark 1978 initiative that capped how much local governments can levy homeowners on escalating home values. If you bought your home in 1988, you’re still paying property taxes based of the value of your home when the Soviet Union was still in existence. It’s a pretty great deal. But try to move into a different—and invariably more expensive—home at today’s prices, and your property taxes will jump dramatically. Those property tax bills could be tough for older homeowners on fixed incomes to afford.

“These are largely larger family homes,” said Steve White, president of the Realtors association. “If these folks were able to sell, then folks in (younger) generations would be able to purchase.”

The Realtors argue that Prop. 5 will induce more senior homeowners to sell their homes and buy new ones. Obviously that’s good for their commissions. But beyond allowing older homeowners to perhaps move closer to their children, the Realtors argue it would bring a flood of new homes to the market perfect for younger households starting their families.

Prop. 5 is opposed by local governments and public employee unions such as teachers and firefighters, who say the initiative is a costly giveaway to wealthy homeowners and the real estate industry. There are plenty of property tax protections already in place for senior homeowners who truly want to downsize. Because of a similar proposition passed decades ago, homeowners age 55 and up can buy a new home of equal or lesser value to their current property anywhere in their own county and retain their Prop. 13 property tax savings. Prop. 5 would allow senior homeowners to buy more expensive homes anywhere in California and still get a large tax break.

“What the real estate industry is really trying to do with this measure is turn the market and drive up prices so their end profit is really to their benefit,” said Dorothy Johnson, an advocate for the California State Association of Counties, which oppose the measure.

The Realtors could not have been pleased with the analysis Prop. 5 received from the Legislative Analyst’s Office, which voters will see included in their sample ballots this fall. It concludes that Prop. 5 would eventually costs local governments and schools $2 billion a year in revenue, and that the vast majority of Baby Boomers who would benefit from the initiative were likely going to move anyway. In other words, the initiative was not likely to induce a lot of people to move or result in lower home prices.

That’s partly why the Realtors have pursued a somewhat odd political strategy—while pushing for Prop. 5’s passage this fall, they’re already planning to put a very similar initiative on the ballot in 2020. That initiative would provide the same property tax breaks for older homeowners, but would also close some Prop. 13 loopholes to lessen the cost on local governments.

Link to Article

by Jim the Realtor | Jul 28, 2018 | Jim's Take on the Market, Tax Reform |

H/T daytrip!

If you rent out your entire home or even a room in your home (or your vacation property) for at least 15 days in a given year, you can get a surprising tax break under Trump’s new federal tax law!

How it works: As a short-term landlord, you can get around the new law’s caps on deductions for property taxes and mortgage interest.

Example of Deducting Property Tax: Let’s say that your annual property taxes total $14,000. Trump’s new law lets you deduct a maximum of $10,000 of combined property taxes and state and local income taxes. Say you rent out 50% of your home for half the year, but use the home yourself for the other half of the year. You can deduct 50% of that six months’ worth of property taxes–25% of th total property tax bill, or $3,500, on federal Schedule E, “Supplemental Income and Loss.” You can also deduct $10,000 on your Schedule A for itemized deductions, giving a total deduction of $13,500 rather than just $10,000.

Example of Deducting Mortgage Interest: Under the new law, for any first or second home you bought after 2017, you can deduct interest on up to $750,000 of the mortgage loan (compared with the $1 million previously). But rental property has no such cap. So if you rent out, say, 50% of a home that carries a $900,000 mortgage, you can deduct interest paid on the first $750,000 of the loan, as well as interest on half the remaining $150,000.

Note: Even if you opt for the standard deduction, rather than itemize–which means you can’t take the standard type of property tax and mortgage-interest deductions–you can still take deductions corresponding to the amount of time your house or a portion of it was rented out.

The recent changes to the tax law are very new, and it’s unclear how the IRS will interpret them, so talk to a professional to make sure you’re in the clear. Give him/her this link:

https://www.irs.gov/pub/irs-pdf/p527.pdf

Link to Book

by Jim the Realtor | Jul 10, 2018 | Jim's Take on the Market, Tax Reform |

Big money is big money – a change in tax rate won’t cause rich families to uproot everything and move to an inferior place. What is more likely to cause millionaires to move? “The tax policy changes examined in this report are very modest compared to the life-impact of marital dissolution.”

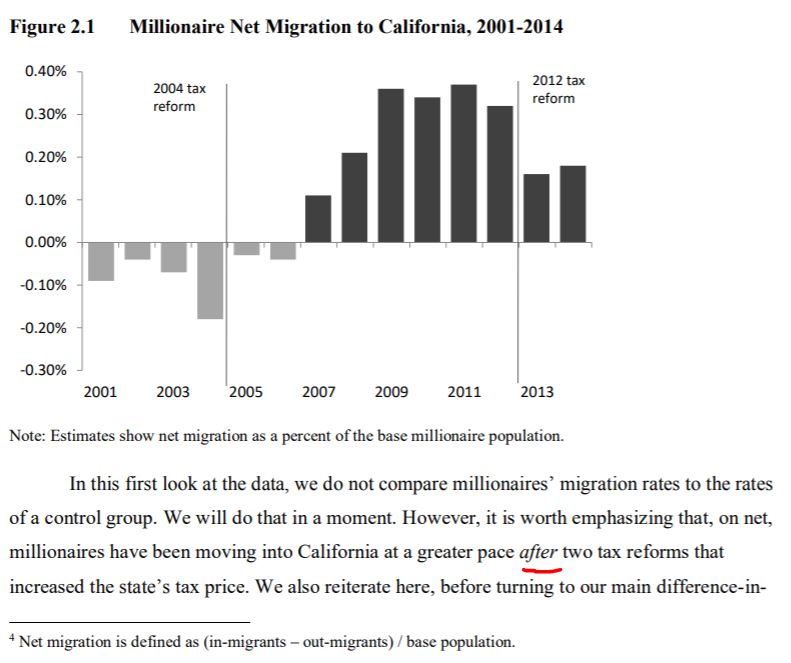

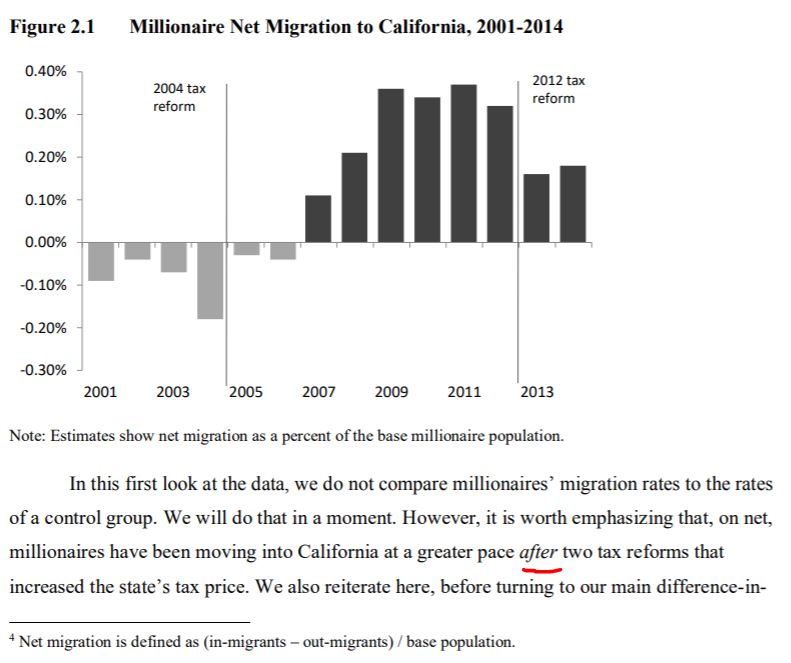

Far more millionaires move into California than leave, despite the state’s highest-in-the-nation income-tax rate, a new study shows.

Researchers at Stanford University’s Center on Poverty and Inequality and the Franchise Tax Board sought to answer the question: Does California’s top state income-tax rate, now 13.3 percent on people earning $1 million a year or more, drive the wealthy to leave for low-tax states?

Short answer: No, except on the far margin.

The researchers reviewed 25 years of California tax returns from all high earners and found that more wealthy people relocate after a divorce.

Republicans regularly cite anecdotes of businesses owners and wealthy people decamping to low-tax states such as Nevada or Texas. But the study shows million-dollar earners moved to California even after voters raised income taxes in 2004 and 2012:

“We often think that the only way for a state to be ‘competitive’ is to be like Texas—a low-tax, low-infrastructure, low-services state. But the reality is that the most competitive places in the U.S., the leading drivers of the economy, and the centers for top talent are New York and California—and they have been for generations, despite higher taxes on top incomes.”

by Jim the Realtor | Jun 6, 2018 | Jim's Take on the Market, Tax Reform |

Geez, they’re no fun…..

The Treasury Department and the IRS announced in Notice 2018-54 that they intend to propose regulations aimed at countering the efforts of California and other states in their attempts to help taxpayers get around the new $10,000 cap on state and local tax deductions.

Beginning with the January 2018 tax year, “The Tax Cuts and Jobs Act” (TCJA) limits the deduction of state and local taxes from an individual’s federal taxes to $10,000. For California and other high property value states that is likely to expose many taxpayers to an increase in their federal taxes.

In response, some state legislatures are considering proposals that in effect allow a tax payer to pay their state and local property taxes into funds that could be characterized as “charitable contributions” and thus be fully deductible on their federal tax returns. The “charitable” funds would then transfer the “contributions” to the state and local authorities to satisfy the taxpayers’ liabilities.

While this seemed like a way for saving many taxpayers from increased tax bills, the Treasury and IRS are saying not so fast. They remind all that federal law supersedes state law for federal tax law purposes, and that new regulations will be drafted to make this very clear to taxpayers.

by Jim the Realtor | May 10, 2018 | Jim's Take on the Market, Tax Reform |

Here is where Yun replied earlier about their mistaken analysis:

https://www.bubbleinfo.com/2018/02/02/lawrence-yun-responds-part-2/

From Bloomberg:

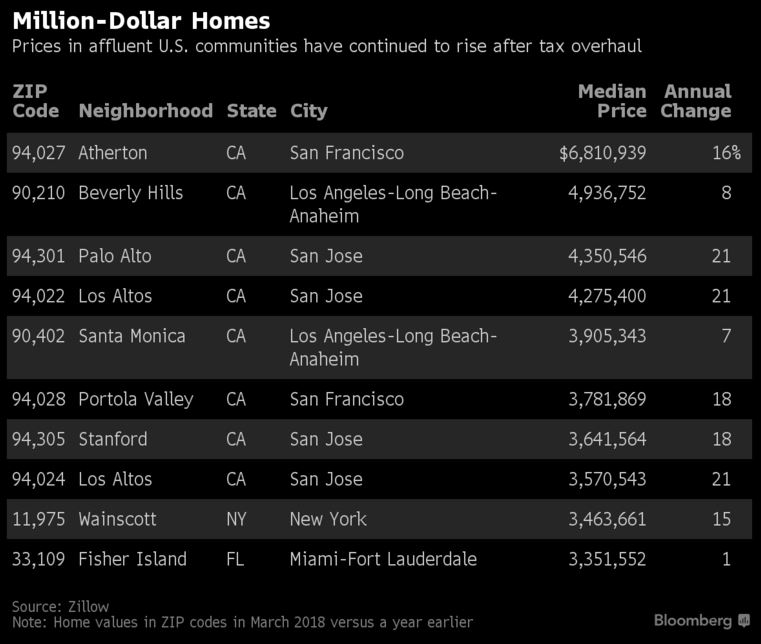

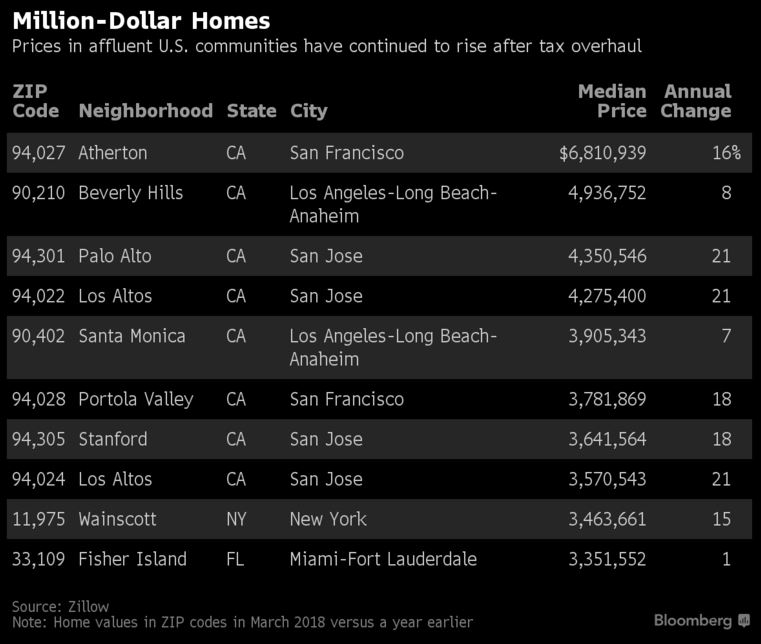

Adam Blaylock was pretty sure he overpriced his Santa Clara, California, home by offering it in February for $1.48 million, since tax deduction changes would keep buyers away. But within a week, the 1,280-square-foot ranch-style house was in contract for $155,000 above asking.

The $1.5 trillion tax overhaul President Donald Trump signed in December capped mortgage-interest deductions on loans up to $750,000, down from the prior limit of $1 million. It also set a $10,000 maximum for state and local tax deductions, which were previously unlimited. Those provisions prompted one of the most powerful lobbying groups — the National Association of Realtors — to warn that home prices in some high-end markets would tank.

So far though, those areas have proven to be resilient. There are 308 U.S. ZIP codes that have homes with median values in excess of $1 million — more than 92 percent of them saw their median home prices increase in March from a year earlier, according to data from online real estate database Zillow.

“We are seeing the opposite of what was expected,” said Aaron Terrazas, senior economist at Zillow. “We have certainly not seen the doomsday predictions play out.”

(more…)

by Jim the Realtor | Mar 3, 2018 | Jim's Take on the Market, Tax Reform |

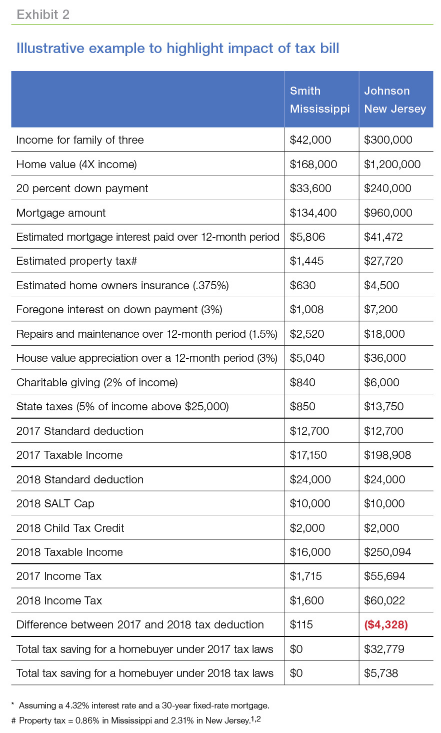

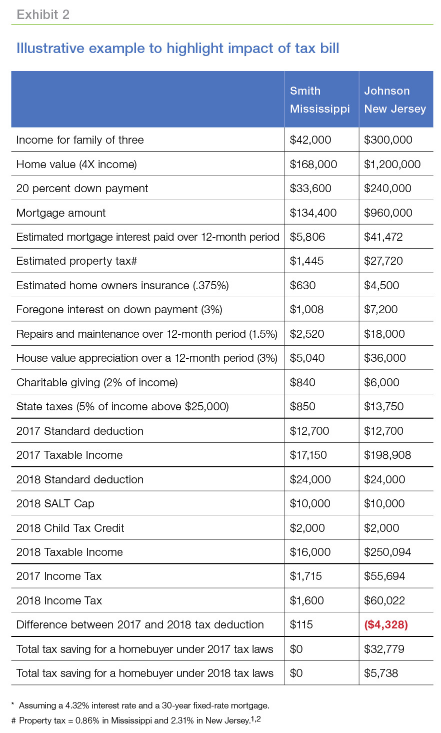

An example of the tax-reform impact on the $1.2-million buyer, who we guessed might be affected the most from the recent tax reform:

Freddie Mac looked at the possible effects of the Tax Cuts and Jobs Act of 2017 in an earlier edition of its Outlook economic forecast. This month it takes that analysis granular – right down to two families, the Smiths and the Johnsons, both in the market to buy a house. The Smiths are a median income family living in Mississippi while the Johnsons are high income earners living in New Jersey. Each family has one kid and each plan to spend four times their income on a home.

The Smiths would see little impact from homeownership under the new tax law.

Their taxable income would decrease from $17,150 in 2017 to $16,000 in 2018 as the much larger standard deduction makes up for the elimination of or caps on many deductions that might earlier been itemized. The Johnson’s on the other hand, see their taxable income rise from $198,908 to $250,904. The Smiths enjoy a $115 reduction in their income taxes while the Johnson’s pay $4,300 more.

Freddie Mac quotes a study by Zillow that found only around 14 percent of homes in the U.S. are “worthy enough” for a new homebuyer to benefit from itemizing deductions; down from 44 percent under the previous tax rules.

But the bottom line is that the new tax law does not stand in the way of the Smith’s homeownership decision, while for the Johnsons the tax savings from owning a home would go from $33,000 to $5,000. Freddie Mac speculated that the Smith family could put off buying a home for longer than if the tax bill had not been enacted.

If the entire amount of the lost tax savings were reflected by the same amount in lower home prices, that would be a 1 percent reduction in the Johnson’s market and much less in other parts of the country. However, economic models usually compare the user cost of housing with renting. If rents remain unchanged, then house prices may fall to reflect higher homeownership costs such as property taxes or higher interest rates. Under the new law higher property taxes would further impact taxes among those who itemize (because of the cap) while higher interest rates would affect everyone.

Freddie Mac concludes that the direct impact of the tax bill will be limited in terms of national house prices. Certain markets with higher average incomes (and thus more households likely to itemize deductions) and property tax rates may see larger direct impacts on house prices ranging as high as around two percentage points. But the largest effect on prices will come through higher mortgage rates, which impacts all households irrespective of tax laws.

Freddie Mac’s economists also reviewed refinancing statistics for the fourth quarter of 2017. Cash-out refinances, those transactions where the new mortgage balance was at least 5 percent higher than the old mortgage, represented 63 percent of the total, down from 89 percent in the previous quarter but still a significant increase from the 44 percent in the 4Q17.

Homeowners cashed out an estimated $14.8 billion in net home equity in 2017 dollars, during the quarter, down from $19.0 billion in Q4 2016. This is a far cry from the $102 billion cashed out at the peak, in the second quarter of 2006.

The average reduction in interest rates enjoyed by those who refinanced first liens in the fourth quarter was 65 basis points. A year earlier the savings averaged 105 basis points.

Freddie Mac said the relatively low rate reduction (the average was 190 basis points in Q2 2013) reflects the high percentage of refinances for consolidating other debt or for home improvements. The average cash out amount over the last few quarters has been around $55,000.

Link to Article

by Jim the Realtor | Feb 2, 2018 | Forecasts, Jim's Take on the Market, Tax Reform |

I sent yesterday’s post to Lawrence – and this was his reply:

Home values falling 8% to 12% were based on taking away all of the deductions- no MID and no property tax deductions.

Fortunately, MID is set at $750,000 and $10,000 for state and local tax deductions. With these in place in the final tax bill, we have not said of those price declines. Our forecast is for a 2% price gain nationwide. You, nonetheless, bring a good point that there are still many consumers thinking of what we had said earlier. We’ll work in getting the updated info out more aggressively.

I thanked him for his response.

Are potential home buyers going to bother with calculating the specific impact of tax reform, and then not buy a house if they don’t like the result? Or would they spend less on a house?

Californians are used to heavy taxation. I’m guessing they will shrug off a few thousand more in taxes if it means getting the right home.

For those who want to estimate their taxes, and are WSJ subscribers, here’s a basic calculator:

http://www.wsj.com/graphics/republican-tax-plan-calculator/

by Jim the Realtor | Jan 31, 2018 | Jim's Take on the Market, Market Conditions, Realtor, Tax Reform |

Yunnie and the National Association of Realtors still haven’t released any math or formulas on how they came up with their conclusions, and it appears he is just shooting from the hip. There is no factual evidence that points to the tax reform causing lower prices and sales – it is theoretical only.

He is the lead voice for the realtor body – and we deserve better.

Lawrence Yun, NAR chief economist, says “Another month of modest increases in contract activity is evidence that the housing market has a small trace of momentum at the start of 2018. Jobs are plentiful, wages are finally climbing and the prospect of higher mortgage rates are perhaps encouraging more aspiring buyers to begin their search now.”

Added Yun, “Sadly, these positive indicators may not lead to a stronger sales pace. Buyers throughout the country continue to be hamstrung by record low supply levels that are pushing up prices – especially at the lower end of the market.”

NAR says home prices increased over 2017 by 5.8 percent, the sixth year in which the increase exceeded 5.0 percent, blaming an uninterrupted supply and demand imbalances throughout the country for the rapid growth. While tight inventories are still expected to put upward pressure on prices in most areas this year, Yun says price growth will probably shrink, and some states could even experience a decline, because of the negative effect the changes to the mortgage interest deduction and state and local deductions under the new tax law.

“In the short term, the larger paychecks most households will see from the tax cuts may give prospective buyers the ability to save for a larger down payment this year, and the healthy labor economy and job market will continue to boost demand,” said Yun. “However, there’s no doubt the nation’s most expensive markets with high property taxes are going to be adversely impacted by the tax law.”

Added Yun, “Just how severe is still uncertain, but with homeownership now less incentivized in the tax code, sellers in the upper end of the market may have to adjust their price expectations if they want to trade down or move to less expensive areas. This could in turn lead to both a decrease in sales and home values.”

Yun does anticipate a slight increase (0.5 percent) in existing sales this year (5.54 million), on top of the 1.1 percent increase last year. Single-family housing starts are forecast to jump 13.3 percent to 961,000, which will push new home sales up 15.3 percent to 701,000 (608,000 in 2016).

Pending sales were mixed on a regional basis, with the worst performance in the Northeast where the PHSI fell 5.1 percent to 93.9 in December, and is now 2.7 percent below a year ago. Contract signings in the Midwest were also down, but by a more modest 0.3 percent, dipping to 105.0, but remaining 0.3 percent higher than December 2016.

The other two regions saw contract signings increase; by 2.6 percent in the South to 126.9, and 1.5 percent in the West to 101.7. The Midwest finished the year 4.0 percent above the previous December.

Link to Article