Here is where Yun replied earlier about their mistaken analysis:

https://www.bubbleinfo.com/2018/02/02/lawrence-yun-responds-part-2/

From Bloomberg:

Adam Blaylock was pretty sure he overpriced his Santa Clara, California, home by offering it in February for $1.48 million, since tax deduction changes would keep buyers away. But within a week, the 1,280-square-foot ranch-style house was in contract for $155,000 above asking.

The $1.5 trillion tax overhaul President Donald Trump signed in December capped mortgage-interest deductions on loans up to $750,000, down from the prior limit of $1 million. It also set a $10,000 maximum for state and local tax deductions, which were previously unlimited. Those provisions prompted one of the most powerful lobbying groups — the National Association of Realtors — to warn that home prices in some high-end markets would tank.

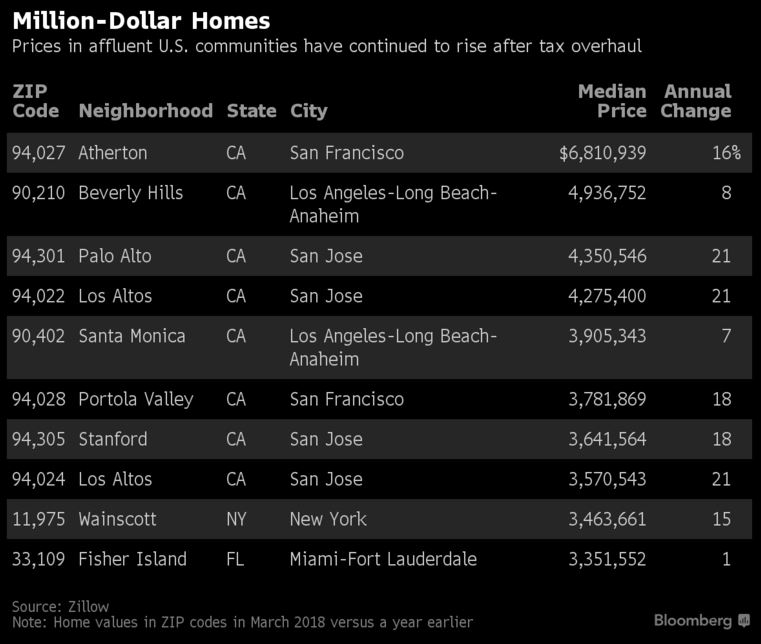

So far though, those areas have proven to be resilient. There are 308 U.S. ZIP codes that have homes with median values in excess of $1 million — more than 92 percent of them saw their median home prices increase in March from a year earlier, according to data from online real estate database Zillow.

“We are seeing the opposite of what was expected,” said Aaron Terrazas, senior economist at Zillow. “We have certainly not seen the doomsday predictions play out.”

Median home values nationally rose 8 percent in March compared with a year earlier, while neighborhoods of San Francisco and San Jose, California, have increased more than 25 percent. Prices in affluent areas in Delaware and New York, such as the Hamptons, also surged more than 20 percent.

NAR said in January “high cost, higher tax areas” would likely see price declines as a result of the tax changes. Specifically, the group forecast a 6.2 percent dip in New Jersey and declines of 4.8 percent in Washington D.C. and New York. Nationwide, NAR said it expected home prices to rise between 1 percent and 3 percent in 2018.

The Realtors weren’t alone in their grim projections. Sixty-three percent of economists surveyed by Bloomberg in November predicted reduced demand for home purchases.

The outlook has improved since then.

‘Horror Story Estimates’

NAR Chief Economist Lawrence Yun said the group is now predicting a 4 percent gain in home prices across the country in 2018. While some taxpayers in California, a high-tax state with high home prices, may face increased tax burdens, that’s not damping interest in homes, he said.

There’s “consistent multiple bidding for $1 million homes after the tax reform,” he said.

Yun says NAR expected a big decline in prices based on earlier iterations of the tax overhaul. In addition, home prices have been supported due to a persistent housing shortage, he said.

I tried to calculate the impact of tax reform on monthly costs. Looks like about $700, or 20%, on a $1m house.

https://encinitasundercover.blogspot.com/2018/05/tax-reform-increases-cost-of-typical.html

Just a flesh wound….

More from the cheerleading side:

https://www.keepingcurrentmatters.com/2018/05/10/5-ways-tax-reform-has-impacted-the-2018-housing-market/

Seems like these fancy bubble charts need a qualitive counterweight related to what I guess we’d call “quality of money.” That is, last time, it was a bunch of bullsh*t racking up the sales, this time it’s sidelined money based on production*, more or less, moving the sales charts. Also, if you draw a trend line of the Case Shiller index from years before the first bubble, to now, it should conform with a steady long-term trend, minus the idiot noise. That long term trend line will generally stick to the quality money, I expect. I haven’t looked lately, but I’m betting it does.

Just my lazy opinion, the variables are dizzying, and I could be wrong.

*doing something of value

“I tried to calculate the impact of tax reform on monthly costs. Looks like about $700, or 20%, on a $1m house.”

Assuming a family of four, this would mean skipping one family trip to Disneyland per year. I’m not certain potential buyers in San Diego will react favorably to that…

Kids: Dad, why do we live in Redlands?

Dad: It was either this, or only going to Disneyland twice a year.

Kids: Although we’re young, we understand, father. Thank you for loving us.

“$700 per month”

That’s a huge drop in the bucket.

Oh, per month! My bad.

Still, owning decent property in Southern California means “no tears.” We ask ffor everything we get, and see it coming from waaaaaaay down the road.

“Hi” bullet train. Make yourself at home, sanctuary city. Welcome, homeless granny flats for grannies who aren’t yours.

It’s like when one of those crazies jumps a zoo fence, and begins being eaten by a polar bear. Don’t cry. Don’t beg for mercy. You made your choice, and issuing a fuss only means you’re messing up someone’s rightful meal.

Don’t go out like that. Be a good snack.

You best pray you aren’t within sight of the Brown Bullet. If you can see you will hear it.

My everlasting question:

Why would we want to create fast, cheap transportation for drug mules, 2-bit gang members, and homeless populations? You can shoot an offending gang member in LA, and be back in Oakland before the police have filed a report. You can transport a fortune in cocaine to some schizophrenic who will do your bidding. The only skill he needs is carrying a backpack, and sitting still for a few hours. Are you homeless and suffering pressure from a repeated focused police sweeps in San Francisco? Organize your brethren via Facebook, jump on a bullet train and rehome yourself and you troop in Santa Monica by the afternoon.

When you have super fast transportation for everybody with a pulse, you undermine communities, effectively turning towns into bus depots, and create a platform for imported instant drama for local police.

Conclusion: just cuz ya can, don’t mean ya should.

See: New York City