by Jim the Realtor | Aug 8, 2017 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying

It’s hard to lower the down payment on a jumbo loan so any effect on the coastal regions is probably minimal, but this suggests that the stronger buyers are giving way or running out:

Seen at CR and MND:

LINK

An excerpt:

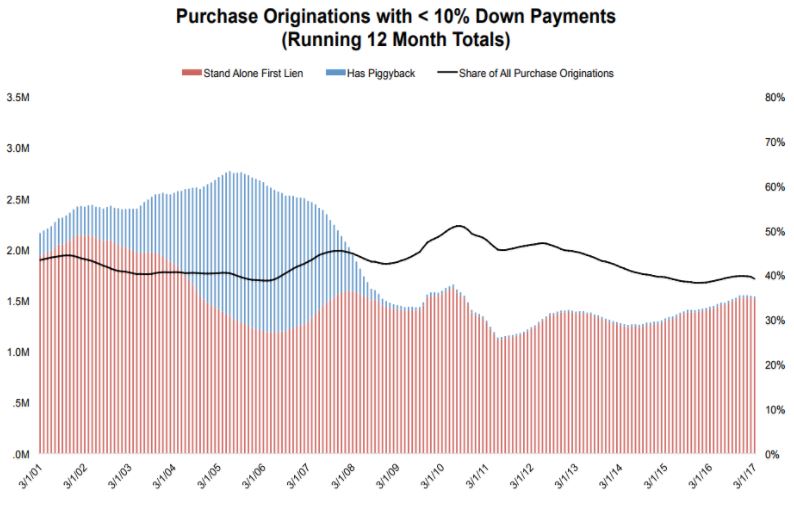

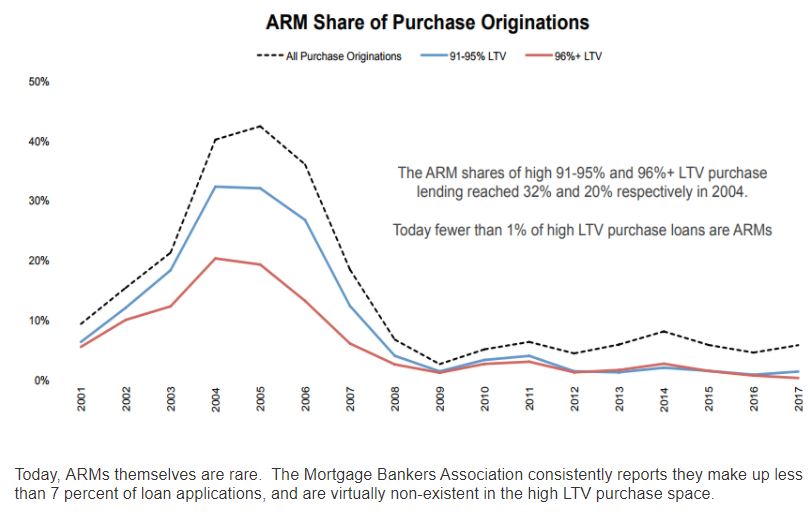

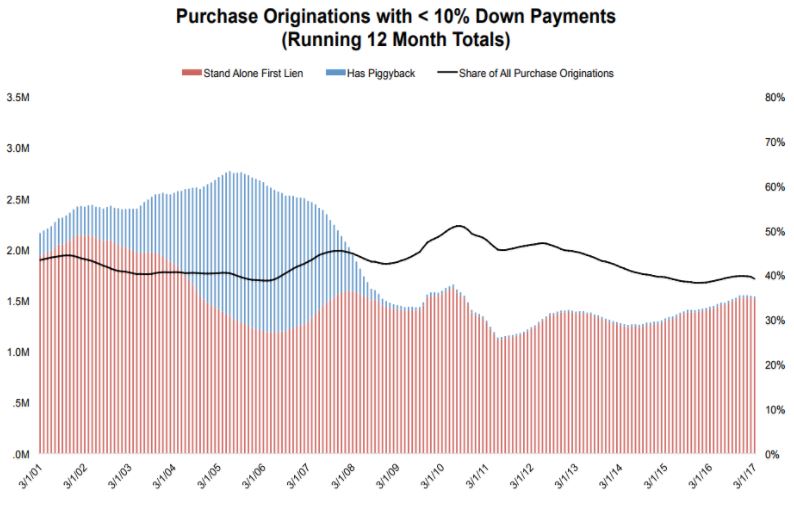

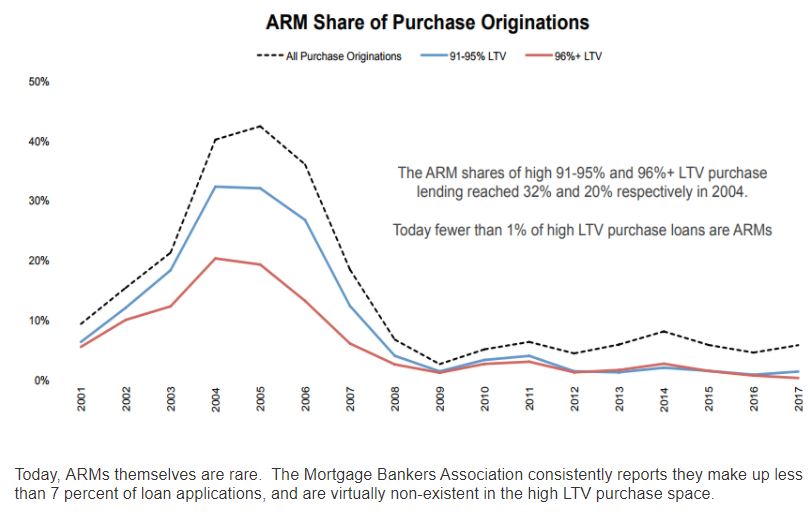

This month, in light of much commentary and speculation on the re-emergence of purchase loans with loan-to-value (LTV) ratios of 97 percent or higher, Black Knight looked at low-down-payment purchase lending trends, gaining some early insight into the performance of these products. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, in general, low-down-payment purchases are on the rise, but this does not necessarily mean a return to the practices – and risks – of the past.

“Over the past 12 months, approximately 1.5 million borrowers have purchased homes using less-than-10-percent down payments,” said Graboske. “That is close to a seven-year high in low-down-payment purchase volumes. The increase is primarily a function of the overall growth in purchase lending, but, after nearly four consecutive years of declines, low-down-payment loans have ticked upwards in market share over the past 18 months as well. In fact, they now account for nearly 40 percent of all purchase lending.

The bulk of the growth has not been among the various three-percent-or-less down payment programs that have been reintroduced in the last few years, but rather in five-to-nine- percent down payment mortgages. This segment grew at twice the rate of the overall purchase market in late 2016, whereas lending with down payments of less than five percent grew at about the market average.

Read more at http://www.calculatedriskblog.com/2017/08/black-knight-mortgage-monitor-low-down.html

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This is good news:

by Jim the Realtor | Jul 24, 2017 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

The Wall Street Journal published this article about the mortgage-interest deduction having little – or no – impact on the decisions made by homebuyers:

LINK

Of course, the N.A.R., who is beholden to our lobbyists, refuses to consider any changes. The N.A.R. spent $64,821,111 last year on lobbying – we should quit paying them and spend that money on a rocking real estate portal that benefits all realtors!

Instead, our beleaguered president shuffled up to the podium one more time to vomit the usual beliefs, whether true or not:

The mortgage interest deduction, backed by the influential nationwide lobbying of real-estate agents and home builders warning against precipitous price drops, has survived decades of attacks and is extremely unlikely to vanish this year.

William Brown, president of the National Association of Realtors, said that removing incentives for homeownership, including the mortgage interest deduction, would be a mistake.

“Studies comparing our housing market to that of a foreign country offer an apples-to-oranges scenario that often isn’t constructive,” Mr. Brown said in a statement. “What we know for sure is that home values would suffer if the mortgage interest deduction disappeared, potentially putting homeowners under water.”

Curbing the deduction would give cash buyers an advantage, said Robert Dietz, chief economist at the National Association of Home Builders.

President Donald Trump has promised to protect the mortgage interest deduction. But even under the plans from Mr. Trump and congressional Republicans, the deduction could lose some of its punch.

With mortgage rates so low, the actual benefit isn’t what it used to be. In addition, wouldn’t rising rents and getting rich quick be bigger motivators than the MID? Have you noticed that you never hear banks arguing for the MID?

by Jim the Realtor | Jul 17, 2017 | Jim's Take on the Market, Market Buzz, Mortgage Qualifying |

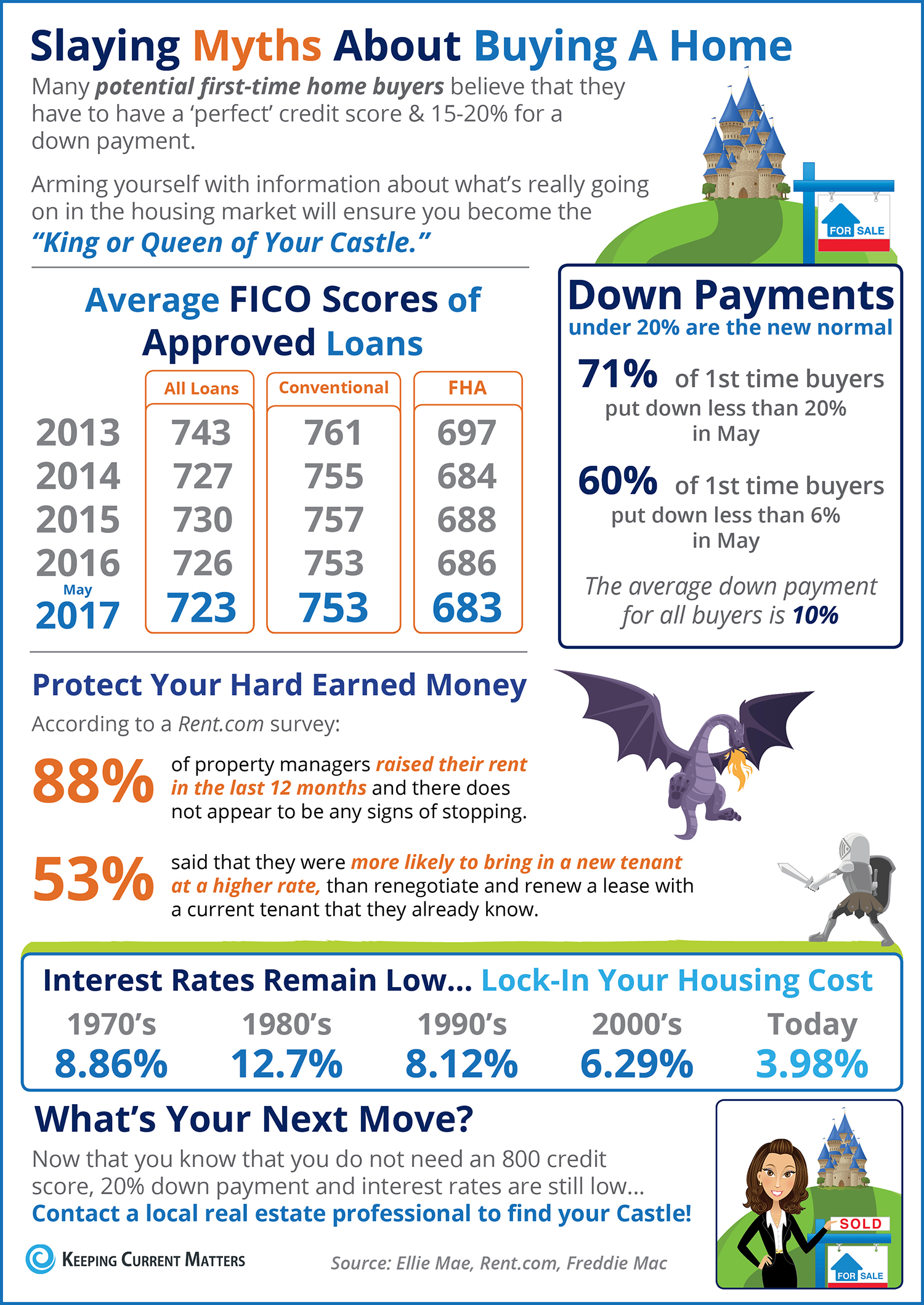

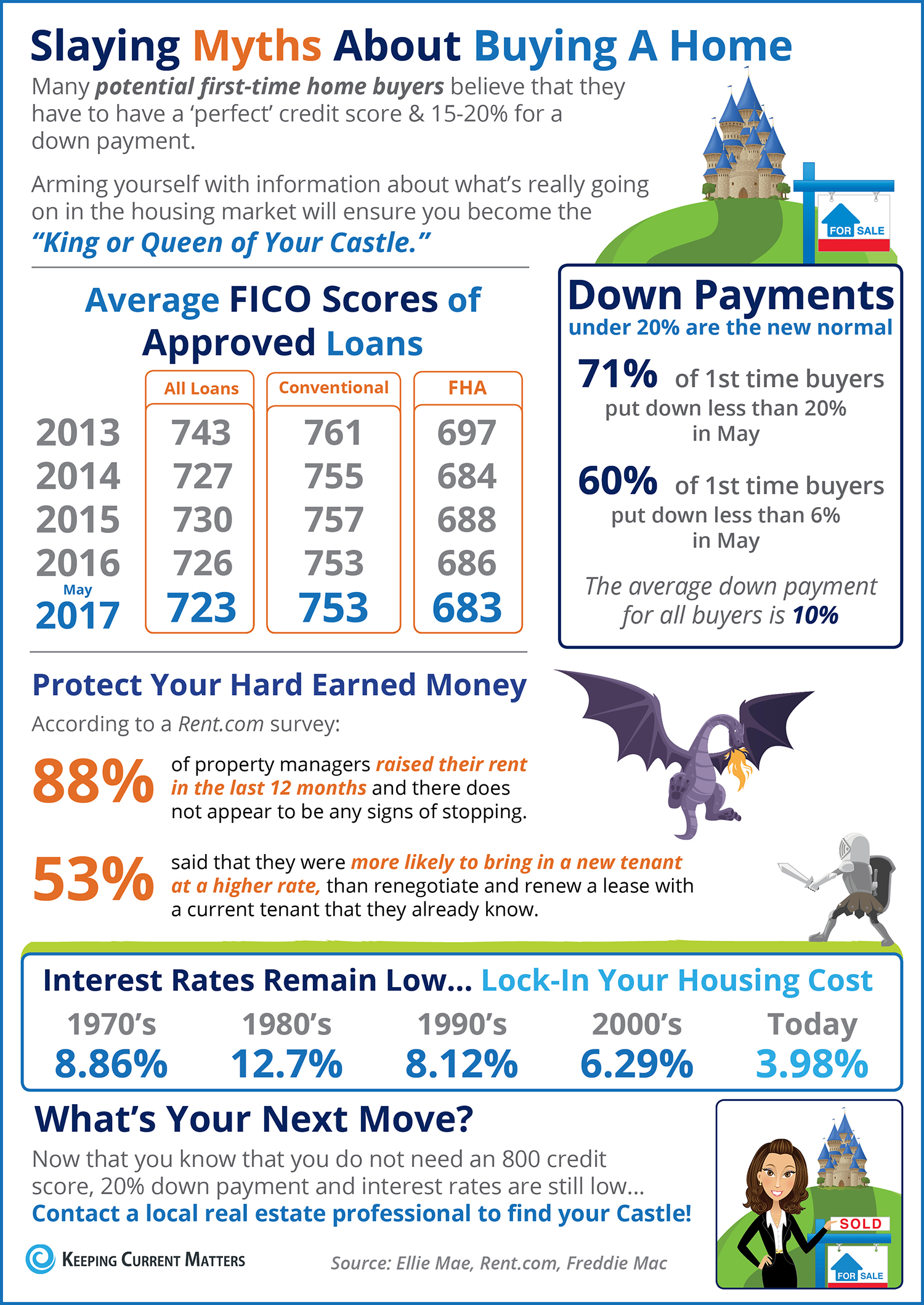

It looks like we are cycling through all the buyers with big down payments, and giving the less-fortunate folks a chance…

by Jim the Realtor | Jun 14, 2017 | Interest Rates/Loan Limits, Jim's Take on the Market, Market Buzz, Mortgage News, Mortgage Qualifying

Rates are under 4.0%, no points! From MND:

Mortgage rates fell convincingly today, though not all lenders adjusted rates sheets in proportion to the gains seen in bond markets (which underlie rate movement). Those gains came early, with this morning’s economic data coming in much weaker than expected. Markets were especially sensitive to the Consumer Price Index (an inflation report) which showed core annual inflation at 1.7% versus a median forecast of 1.9%.

Core annual inflation under 2.0% is a hot topic–especially today–considering that’s one of the Fed’s main goals. This afternoon’s Fed Announcement did acknowledge the recent drop in inflation, but continued to suggest it was being held down by temporary factors. The Fed also officially unveiled its framework for decreasing the amount of bonds its buying (though it didn’t announce a start to the program yet).

Bottom line: Fed bond buying is one of the reasons rates are as low as they are. Markets know the Fed will eventually enact this plan and they’ve accounted for that to the best of their ability. But as the Fed actually goes through the steps toward enacting the plan, it causes some upward pressure for rates. That was the case this afternoon, but bond markets were nonetheless able to hold on to a majority of improvement seen this morning. As such, the day ended with most lenders offering their lowest rates in exactly 8 months (a few days following the presidential election).

by Jim the Realtor | Jun 14, 2017 | Encinitas, Jim's Take on the Market, Market Buzz, Mortgage Qualifying, Sellers Waiting For Comeback, Strategic Defaults |

John South of Drop Mortgage and George Flint of Triumph Capital wait for waves off Encinitas. The group of mortgage industry professionals meet weekly on the beach for a morning surf before work.

From the wsj.com

An excerpt:

Lenders say there is an untapped market among borrowers with good credit scores like self-employed workers who don’t have proper income documentation, or for responsibly made loans to borrowers with credit problems that have had bankruptcies in the past or had to sell their home for less than it was worth.

If they are successful in recruiting brokers, lenders believe the market potential for both types of loans could reach $200 billion annually.

A big hurdle: finding the right kind of brokers and instructing them in the lost art of making a subprime loan. Some are returning to the industry for the first time since the crisis. Others like Mr. Boyd have never been in it.

“I knew a mortgage was a loan for a house,” said Mr. Boyd, who was recruited by his boss, Jon Maddux, after selling him a Calvin Klein suit at a local outdoor mall. “I came in just a blank slate.”

Before he co-founded Drop Mortgage, the parent company of FundLoans, in 2014, Mr. Maddux ran the website YouWalkAway.com between 2008 and 2012. The site charged homeowners on the brink of foreclosure $995 to learn how to leave their debt behind.

Mr. Maddux said his experience advising down-and-out homeowners is today helping him pitch them loan products. Drop Mortgage and FundLoans made about $200 million in subprime and alternative documentation loans in 2016, funding them by selling them to hedge funds and other Wall Street investors.

“I’ve seen what caused these people to walk away and I don’t want to be a part of that,” he said.

Subprime mortgages are typically made to borrowers with a credit score of around 660 or lower, at interest rates ranging from 6% to 10%. Alternative documentation loans, or Alt-A loans, are made to borrowers with higher credit scores but who use bank statements or other less conventional ways to prove their income.

Read full article here:

LINK

by Jim the Realtor | May 19, 2017 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

When the day comes that you hear the big banks pushing for reduced-doc loans, you’ll know that the top of the market is near:

http://www.reuters.com/article/us-bank-of-america-mortgages-idUSKCN18E37J

The head of Bank of America Corp, the United State’s fourth-biggest mortgage lender, said on Thursday banks would be able to supply a bigger share of funding for home purchases if the standard down payment for buyers was cut to 10 percent from 20 percent.

The vast majority of mortgages are underwritten to strict standards set by the U.S. government or quasi-government entities Fannie Mae and Freddie Mac. While down payment requirements can vary, they offer fairly little latitude to lenders that do not want to take all the risk themselves. As a result, many prospective homebuyers who cannot come up with a 20 percent down payment are unable to get a loan.

“Our goal – going back to regulatory reform – is should you move the down payment requirement from 20 percent to 10? It wouldn’t introduce that much risk but would actually help a lot of mortgages get done,” Chief Executive Officer Brian Moynihan told CNBC in an interview Thursday.

Bank of America was the top U.S. mortgage lender ahead of the 2008 mortgage crisis, causing it to face greater losses, both from defaults and litigation, than any other bank. Under Moynihan, who took the helm at the start of 2010, the bank has tightened lending standards and executives regularly use the motto “responsible growth” in public speeches.

Save

Save

by Jim the Realtor | Apr 23, 2017 | Jim's Take on the Market, Mortgage Qualifying

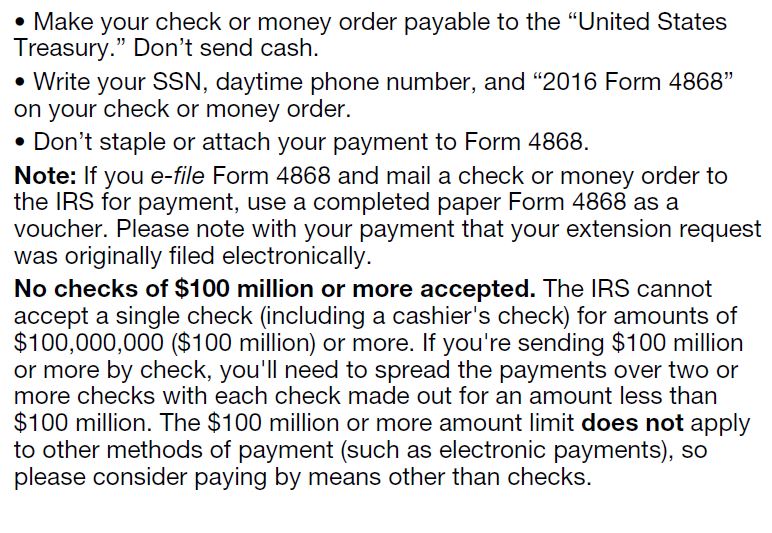

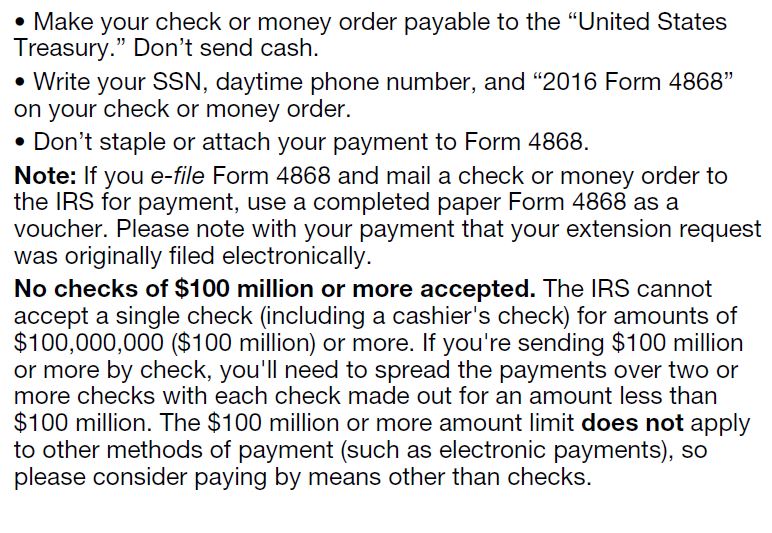

Did you file an extension for your 2016 tax returns, and are trying to buy a house? Have you released your financing contingency yet?

Here’s what you have to do to qualify for a mortgage:

Yes, “Tax Day” has passed, and lenders and investors must consider filed taxes in their underwriting decision. For example, LHFS issued a reminder regarding 4506 transcripts. Loans dispersed on or after April 18th will require the 2015 and 2016 returns or all the following:

Evidence of filing a Tax Extension (IRS Form 4868-Application for Automatic Extension of Time to File U.S. Individual Income Tax Return) filed with the IRS; Tax liability reported must be compared to the borrower’s tax liability for the previous 2 years as a measure of income source stability & continuance. An estimated tax liability that is inconsistent with previous years may make it necessary to require the current years return to proceed. IRS Form 4506-T Transcripts confirming “No transcript available” for the applicable tax year; and Returns for the prior two years.

If you owe additional taxes and sent in an amount with your extension, don’t be surprised if your lender will want to see evidence of that too. Also note:

If you are sending in $100 million or more in taxes, I’ll be happy to drive your money to the post office!

by Jim the Realtor | Jan 27, 2017 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

The Gaylord-Hansen Team of Caliber Home Loans had a seminar yesterday to discuss the details of their mortgage of the future – and they have it now!

The goal is to make the obtaining of a mortgage completely digital, and gather the documentation needed to fund a loan without the borrower having to cough up loads of paperwork.

Here is how they’ve improved the requirements of getting a mortgage:

- Income from your tax returns has been verified with the IRS for years. But now Caliber not only pulls your income from the IRS, but they also conduct an automated cash flow analysis. If the computer says the borrower qualifies, no other underwriting is needed. Yes, we have had DU for years (designated underwriting), where the computer give the preliminary approval. But those are based on income that was inputted by the lender. With the new system, once the borrower has authorized the process, it goes untouched by human hands, making it fraud proof – a big plus!

- The borrower’s credit history is pulled from the three bureaus, and the credit behavior gets analyzed automatically. If the computer signs off, that’s it – no other human touch needed.

- Equifax and other companies do the employment verifications, where they contact your employer directly to verify that you still work there. Lenders usually handle those themselves, but much better to have a third-party be responsible.

- Your down payment/cash-to-close is verified automatically by Yodlee. The borrower is emailed a verification form that authorizes Yodlee to check the balances of your designated accounts automatically.

- If the automated appraisal system scores the house at 2.5 or under on a scale of 1-5, then no formal appraisal is required in person. The house may get looked at by satellite or drone to prove it’s still there.

- Everything from start to closing is signed electronically, and stamped by a virtual notary who pops up on your screen. They are using thumbprint verifications too, and anticipate going to retina scans.

- The funding of your loan can happen in eight days!

The mortgage underwriting process has always been the one-size-fits-all package, which wasn’t really fair to the best qualifiers. Now those borrowers with sterling histories won’t be dragged through the same rigors – instead, you are rewarded with speed and simplicity!

by Jim the Realtor | Nov 8, 2016 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

Changes this month by the California Housing Finance Authority will help more K-12 public school employees land their first home.

The Extra Credit Teacher Home Purchase Program — once restricted to teachers — is now available to all administrators and support staff such as aides, bus drivers and custodians in public schools, charter schools and district offices.

Education professionals can now receive down-payment assistance of up to $15,000 in “high-cost” counties such as Riverside and San Bernardino. The loan, at 2.5 percent interest, does not require payments until the home is sold, refinanced or the principal loan has been paid, explained finance authority spokesman Eric Johnson.

“People always think government programs are for low income people, but we’re really for low and moderate income residents,” Johnson said. “It’s the missing middle – people with good jobs who have sometimes been priced out of the housing market.”

Applicants must have a minimum credit score of 640. Those making more than $91,000 per year are excluded from the program. The home sales price cannot exceed $400,000.

Read full article here:

http://www.pe.com/articles/home-817823-riverside-teachers.html

CalHFA has several assistance programs:

http://www.calhfa.ca.gov/homebuyer/programs/

by Jim the Realtor | Nov 3, 2016 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

Dropping the required owner-occupied ratio from 50% to 35% should open up more opportunities for condo buyers and sellers, but yes, the mortgage guidelines are getting easier and easier.

Owner occupied units are defined as principal residences, secondary residences, or units that have been sold to purchasers who intend to occupy them as a primary or secondary residence. A principal residence refers to a dwelling where the owner maintains or will maintain their permanent place of abode, and which the owner typically occupies or will occupy for the majority of the calendar year. A secondary residence refers to a dwelling that an owner occupies in addition to their principal residence, but less than a majority of the calendar year. A secondary residence does not include a vacation home.

Conditions to Lower Owner Occupancy Percentage to as low as 35 percent

Existing projects (greater than 12 months old) with an owner occupancy percentage of at least 35 percent and less than 50 percent are eligible for approval under the following circumstances and subject to the following conditions:

- Applications must be submitted for processing and review under the HUD Review and Approval Process (HRAP) option.

- Financial documents (see Section 2.1.6) must provide for funding of replacement reserves for capital expenditures and deferred maintenance in an account representing at least 20 percent of the budget; and

- No more than 10 percent of the total units can be in arrears (more than 60 days past due) on their condominium association fee payments (as defined in Section 2.1.5 of the Guide; and

- Three years of acceptable financial documents (see Section 2.1.6) must be provided.

http://portal.hud.gov/hudportal/documents/huddoc?id=16-15ml.pdf