Olivenhain Estate

This is one of the best values we’ve seen all year if you don’t mind having more than two acres. See the whole Bubbleinfo TV collection here:

This is one of the best values we’ve seen all year if you don’t mind having more than two acres. See the whole Bubbleinfo TV collection here:

One of the main reasons that the real estate market could levitate at these price points is the monumental wealth transfer between baby boomers and their kids. A major tax advantage is closing out at the end of 2025, and those with a healthy portfolio will be letting it flow – another opinion on it here:

Unless Congress acts, on Jan. 1, 2026, the estate, gift and generation-skipping transfer (GST) tax exemption amounts will be cut in half. A decrease in the exemption amount could result in significant additional transfer taxes for families with federally taxable estates. However, there is still ample opportunity for high-net-worth families to plan to utilize the current exemption amounts. This article will explore potential wealth transfer opportunities to capture and utilize the exemption amount before it may be lost.

In 2017, the Tax Cuts and Jobs Act (TCJA) doubled the existing estate and gift tax exemption amounts from $5.6 million per person (or $11.18 million per married couple) to $11.18 million per person (or $22.36 million per married couple), indexed for inflation annually. In 2023, the estate and gift tax exemption amount is $12.92 million per person (or $25.84 million per married couple).

The TCJA is set to expire at the end of 2025. Let’s assume that the estate and gift tax exemption amount has increased to $14 million by this time (due to adjustments for inflation). In that case, if Congress does not act, the exemption amount would decrease to about $7 million per person or $14 million per married couple. This loss in exemption amount could increase overall transfer taxes for certain families by millions of dollars.

We’ve been in a similar position in prior years and have seen that congressional gridlock can make reaching an agreement on preserving or increasing the exemption extremely difficult. While it is uncertain what, if any, tax-related legislation will come out of Congress in 2024 and 2025, it may be wise to explore one’s options to use the current existing exemption well before 2026.

If you can afford to use a portion or all of your existing exemption amount before Jan. 1, 2026, the amount used now cannot later be taken away from you. It has also been confirmed that if you use more exemption during life than is available at death (due to the decrease), the IRS cannot impose estate tax on those “excess” gifts as part of the taxpayer’s taxable estate when they pass. (Please note that there are some minimal exceptions to this rule for certain types of gifts made within three years of death.)

In addition, it’s important to note that when using your exemption during your life, you use it from the “bottom up.” This means that if you have $12.92 million of exemption and you use $6 million by making a gift (leaving you with $6.92 million), if the exemption amount is then cut in half, the $6 million of exemption you have used is considered to come out of the remaining amount, not the amount that was taken away.

In the above example, if you make a $6 million gift and the exemption amount is cut in half from $14 million to $7 million, you will have only $1 million remaining for future gifts or to shield assets from taxes upon your death. Consequently, locking in the exemption amount that may be taken away requires large gifts close to or at the full exemption amount before the amount potentially drops.

Read the full article here:

https://www.kiplinger.com/retirement/estate-tax-law-changes-how-to-prepare

As the real estate market continues to ‘normalize’ and we get used to a perpetually low-inventory environment, these are factors that will greet the players in 2024:

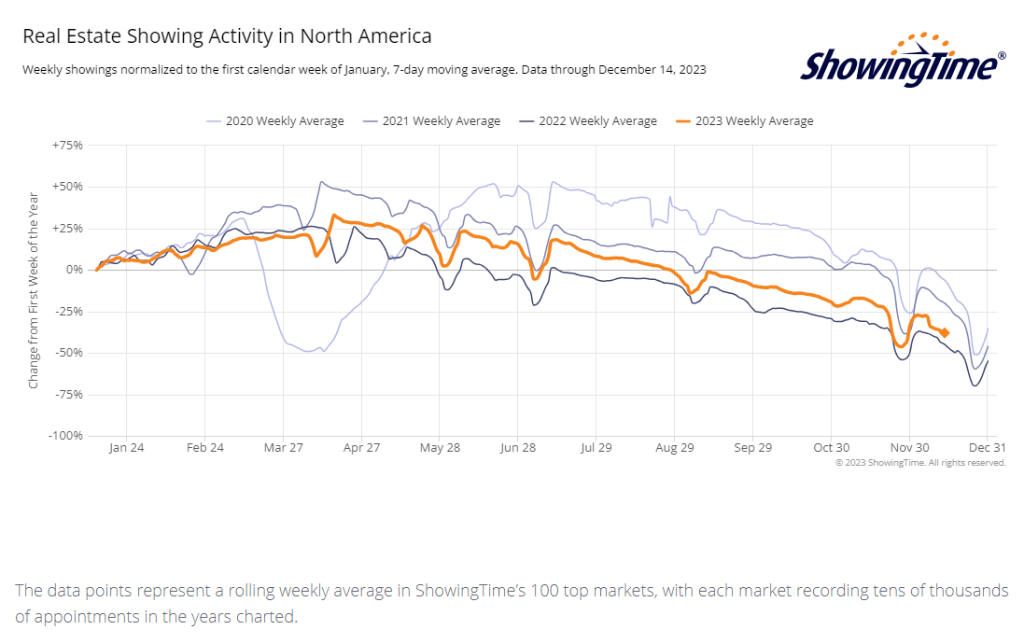

In the graph above, it looks like the national market gets off to a similar start every year. Over the last three years, the showings peaked in early-April, and then dwindled down.

The market intensity should be red hot in the first quarter of 2024! But will the pricing cause sales?

The reasonable sellers in early 2024 should be greatly rewarded.

Traditional real estate being manipulated by billionaires. Hat tip to Anna for sending this in!

The digital renderings of North Bayshore, a massive proposed development in Mountain View, California, are crowded with glistening buildings and cheerful, animated pedestrians. There’s a lot to show off, including 7,000 new homes, three distinct neighborhoods, and nearly 300,000 square feet of retail and community space. Notably, though, the gleaming images don’t bear any hints of the company behind the whole endeavor: Google.

Companies like Google and Facebook’s parent, Meta, conquered the digital realm a long time ago, setting the ground rules for how we search, interact, and shop online. Not content to stop there, however, these firms are now making huge bids to expand their reach. They want to be landlords, too.

This is what a surge in listings looks like.

We won’t see a hundred new listings hit the market in one day….it will be two here, three there, four over here, etc. and pretty soon the buyers will think about stepping back to see where it might go.

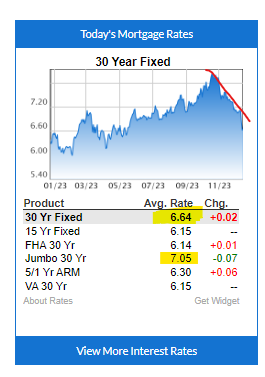

If rates can slip into the high-5s by next month, the early-2024 market will be on fire….

Survey-based rate indices haven’t yet had time to account for the massive drop in mortgage rates this week, but rest assured, it was special. That’s no surprise if you saw our coverage yesterday, which pointed out that it was the biggest drop in a 45 day window that we’ve ever measured.

When rates drop that much, that quickly, there’s always some risk that we’ll see a corrective bounce. Sometimes such corrections only erase a small amount of the improvement over a day or two. Other times they can be the start of weeks of gradual increases. Either way, we usually have some indication of that resistance within a few days of the final crescendo.

This time, however, the mortgage rate drop is sticking the landing. Wednesday and Thursday were the big movement days and now today has seen almost no movement at all. The average lender is effectively right in line with yesterday afternoon’s latest levels.

While this turn of events can’t predict the future, it is a more reassuring set-up for the days and weeks ahead. Speaking of weeks, we probably won’t know what the next leg of this journey truly looks like until the 2nd week of January after the next Consumer Price Index (CPI) comes out.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-12152023

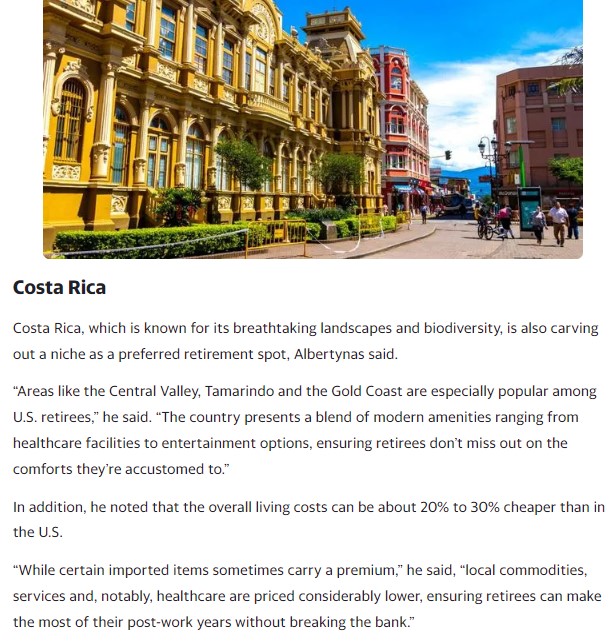

How about retiring to a location outside of the USA?

https://finance.yahoo.com/news/4-places-retire-just-us-170042837.html

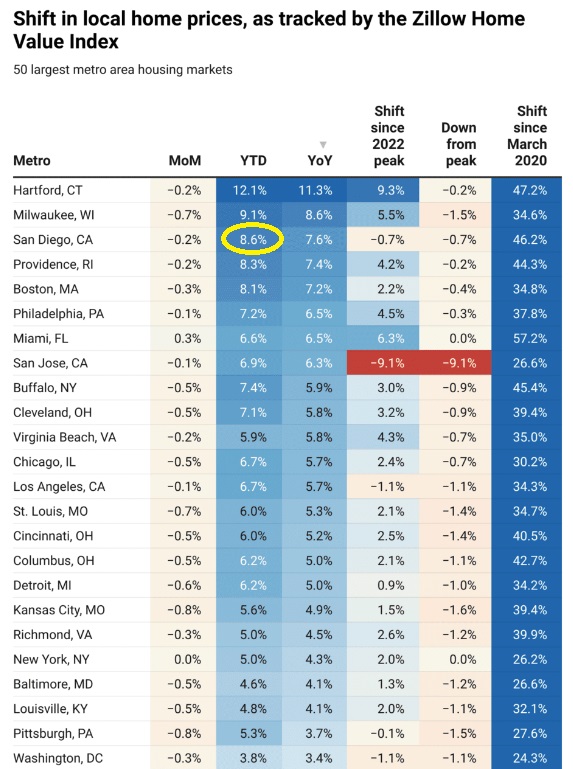

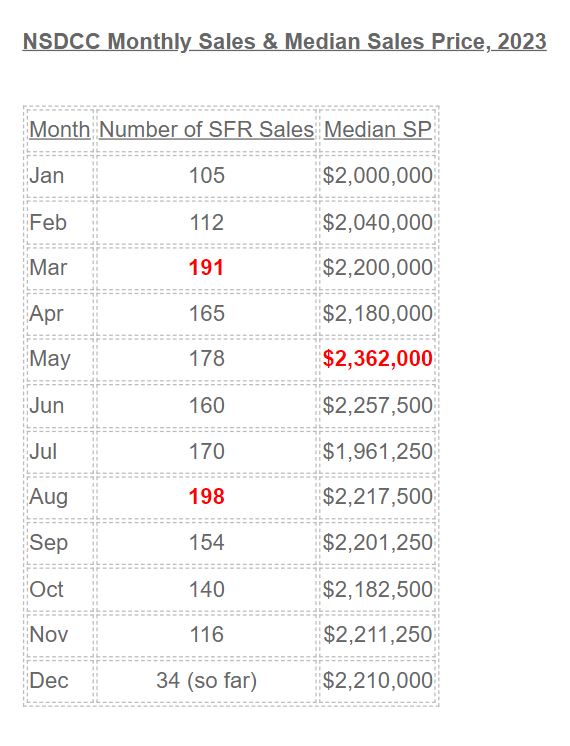

The big difference between last year and now is that the 2023 pricing has been on a slow steady climb, instead of the tumult caused last year by the sudden upward shift in mortgage rates.

San Diego is leading all the higher-end luxury markets for YTD pricing!

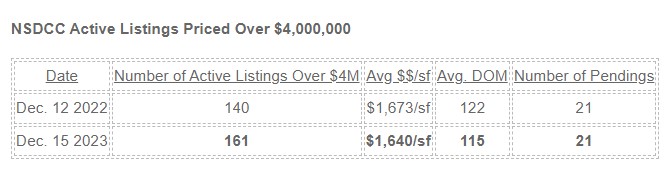

Another comparison where it counts – on the higher-end, where active (unsold) listings are sure to pile up quickly in a soft market. But not yet, and if we’ve made it through this stretch, then the future market with lower rates should survive ok too:

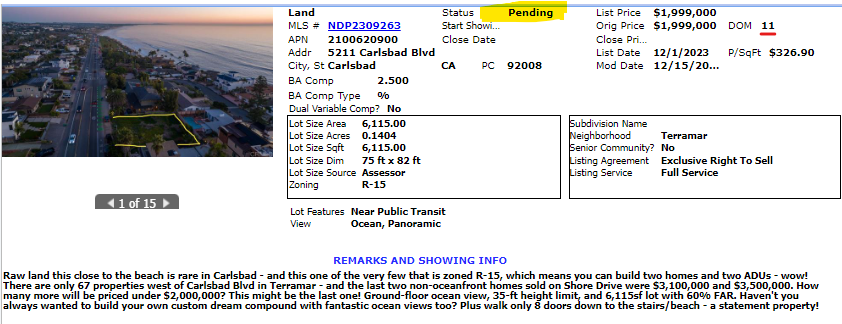

Our vacant-land listing went pending today too!

This may be the only time we ever tour a house at this price point!

The highest-priced La Jolla residential sale ever was $24,700,000 (8466 El Paseo Grande) in 2020.

Now there are three for sale in the $30,000,000s!

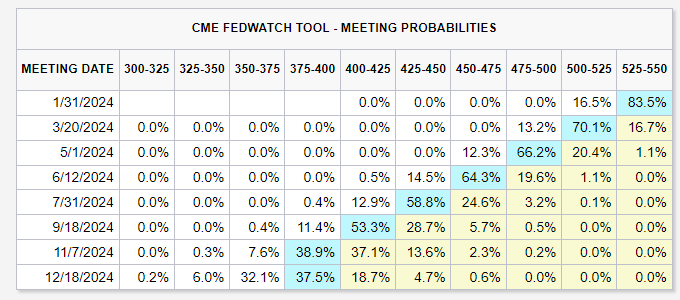

Yesterday, Jay Powell shocked the world by declaring three rate cuts in 2024! It was Fed speak of the most unusual order – open and transparent, instead of the opaque mumbling of previous chairmen.

The predictions are for rate cuts early in 2024 too. The CNBC survey showed a 90% probability of a rate cut at the Fed’s March meeting, and 100% chance at the May meeting. This Fedwatch Tool below thinks they will all be in the first half of 2024:

What does it mean for the 2024 Spring Selling Season?

Real estate prognostications are usually wild guesses without any supporting data. But next year looks more predictable than ever – and we’ll be able to track it closely.

Let’s consider how 2023 played out:

In June, I mentioned that 2023 got off to a very fast start, and that March would have the highest sales count of the year – which means buyers and sellers were active in January and February!

We had a mid-summer surge too, and the August sales beat out those in March by a nose.

Because the price points are so much higher these days, every property is a luxury home that appeals to the affluent. It means the homes for sale need to be spruced up more than ever, which takes planning and preparation for weeks and months.

We already know that our team will be listing homes for sale on January 18th and 25th, and there should be many more others doing the same. With the 2023 inventory being so bleak, the pent-up buyers will be noting the lower mortgage rates and be on the prowl early.

We will do our annual January inventory contest to give everyone a feel for how the number of homes for sale is breaking early in 2024. Between the number of January listings and the results of our listings, you’ll have quality data on how the 2024 market is unfolding!

My guess is that there will be 10% more listings in January, and combining that with lower mortgage rates could set off a mini-frenzy!

Pricing was steady this year, and it should bump around by the same +/-5% in 2024. It’s probably not worth it to try to predict your purchase or sale by the price history – it will bounce around just because the metric is flawed.