Yesterday, Jay Powell shocked the world by declaring three rate cuts in 2024! It was Fed speak of the most unusual order – open and transparent, instead of the opaque mumbling of previous chairmen.

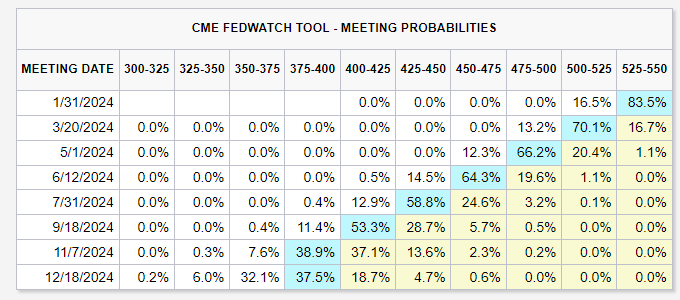

The predictions are for rate cuts early in 2024 too. The CNBC survey showed a 90% probability of a rate cut at the Fed’s March meeting, and 100% chance at the May meeting. This Fedwatch Tool below thinks they will all be in the first half of 2024:

What does it mean for the 2024 Spring Selling Season?

Real estate prognostications are usually wild guesses without any supporting data. But next year looks more predictable than ever – and we’ll be able to track it closely.

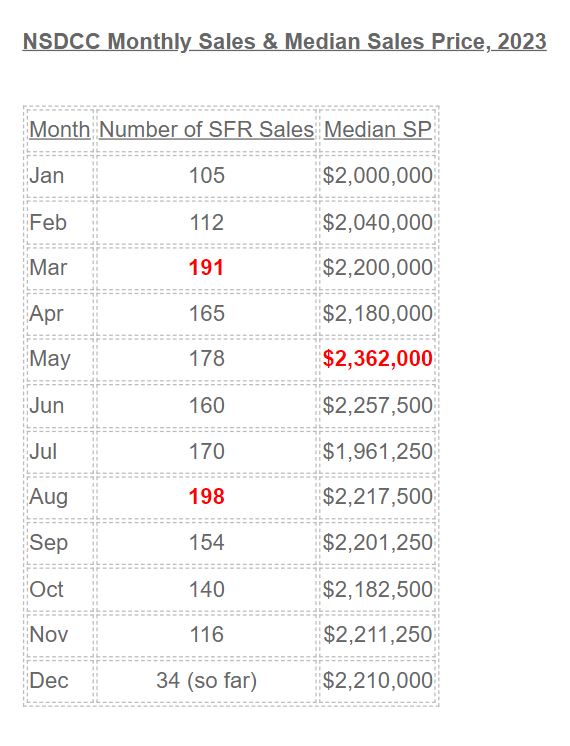

Let’s consider how 2023 played out:

In June, I mentioned that 2023 got off to a very fast start, and that March would have the highest sales count of the year – which means buyers and sellers were active in January and February!

We had a mid-summer surge too, and the August sales beat out those in March by a nose.

Because the price points are so much higher these days, every property is a luxury home that appeals to the affluent. It means the homes for sale need to be spruced up more than ever, which takes planning and preparation for weeks and months.

We already know that our team will be listing homes for sale on January 18th and 25th, and there should be many more others doing the same. With the 2023 inventory being so bleak, the pent-up buyers will be noting the lower mortgage rates and be on the prowl early.

We will do our annual January inventory contest to give everyone a feel for how the number of homes for sale is breaking early in 2024. Between the number of January listings and the results of our listings, you’ll have quality data on how the 2024 market is unfolding!

My guess is that there will be 10% more listings in January, and combining that with lower mortgage rates could set off a mini-frenzy!

Pricing was steady this year, and it should bump around by the same +/-5% in 2024. It’s probably not worth it to try to predict your purchase or sale by the price history – it will bounce around just because the metric is flawed.

From Goldman Sachs:

In light of the faster return to target, we now expect the FOMC to cut earlier and faster. We now forecast three consecutive 25bp cuts in March, May, and June to reset the policy rate from a level that the FOMC will likely soon come to see as far offside, followed by quarterly cuts to a terminal rate of 3.25-3.5%