Typical

The homeowners paid $4,700,000 in March, 2023 (less than a year ago) and put in a pool and now they are asking $6,495,000.

The homeowners paid $4,700,000 in March, 2023 (less than a year ago) and put in a pool and now they are asking $6,495,000.

Four homes that have sold for more than $20,000,000 in the Ranch. The highest was $22,995,000 in 2021!

Brand new single story in the heart of the village – this property used to be part of the Inn. This sold for $4,250,000 after 450 days on the market (with no price reductions). The listing agent ‘refreshed’ the listing after 421 days and then it sold right away.

San Diego Magazine did a nice story on Chino Farm in Rancho Santa Fe, and called it the most important farm in America! It prompted me to include some video I did there a couple of months ago:

It is inevitable that homes will be built here some day, isn’t it?

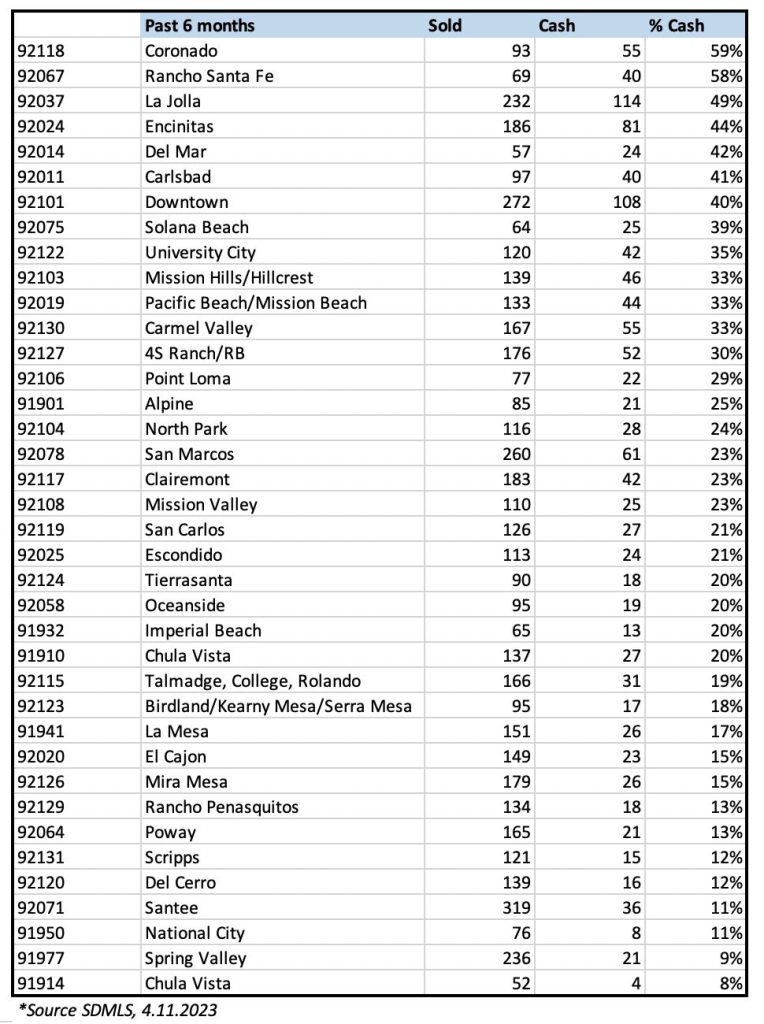

Wondering how the local market can survive higher mortgage rates? It starts with the cash buyers laying the foundation of comparable sales, and financed buyers deciding if they can keep up.

Thanks to Julie Chang for posting this data – her thread of comments here:

One of my favorite Compass agents went all out today to promote her new $15,000,000 listing – the MLS remarks:

If these walls could talk, they would speak of the fact that this estate was built by a US ambassador to Italy as a summer home for he and his family with many materials imported from Italy. They’d mention the famous houseguests, upscale fundraisers and political gatherings that have taken place here. Upon driving down the private road to the estate’s gate, you’ll be transported to Tuscany from the moment you pull in. Unlike anything else in the upscale town of Rancho Santa Fe, this home’s historic architecture is met with modern features from a head-to-toe renovation over the last two years.

A good value in a sweet spot next to Fairbanks Ranch:

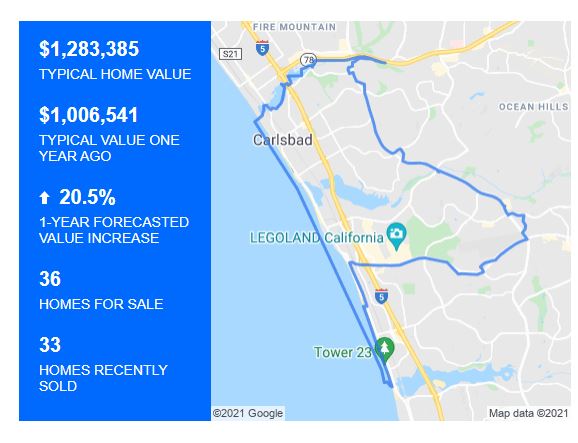

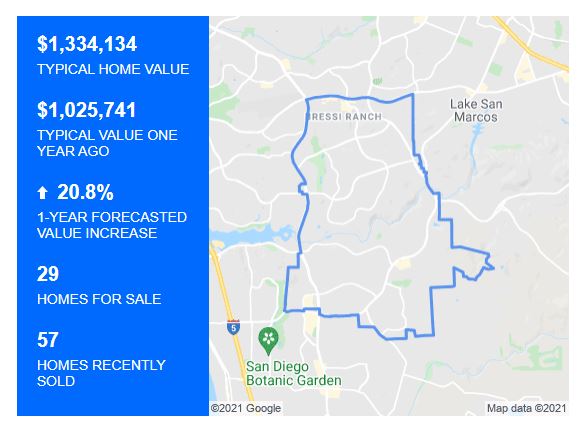

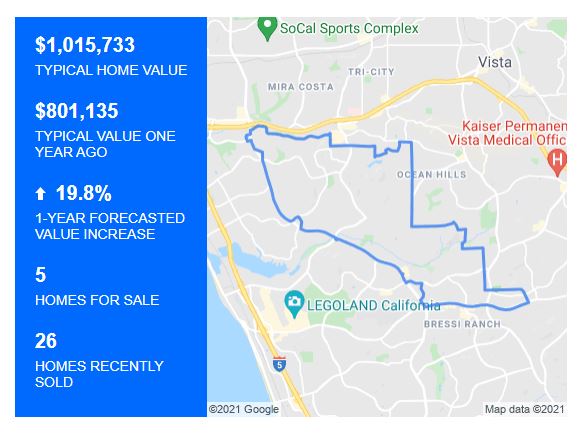

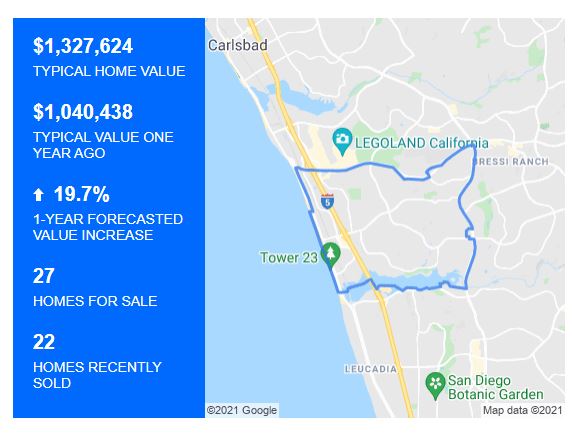

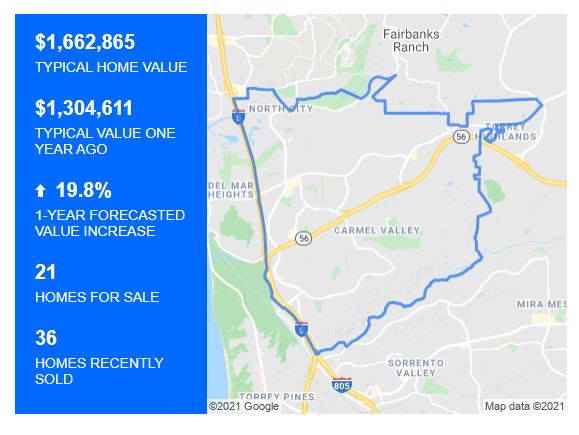

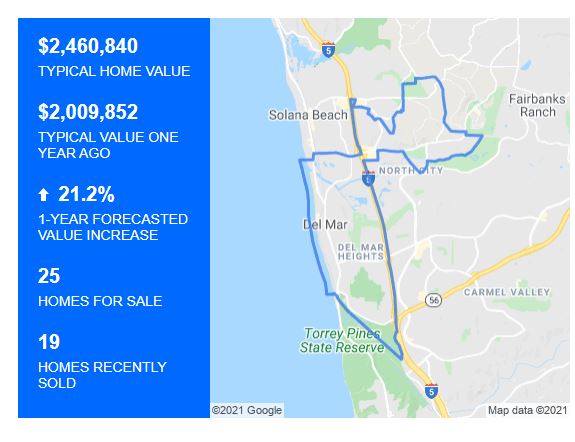

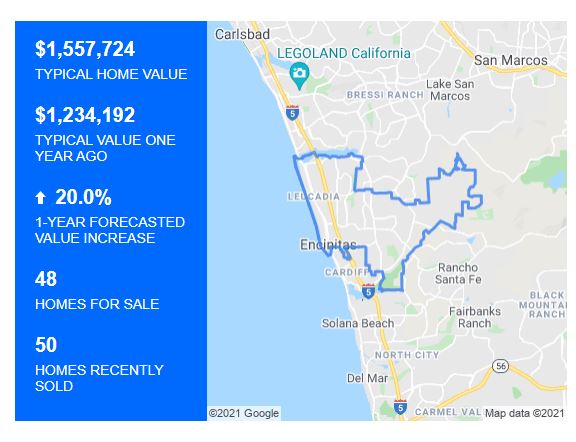

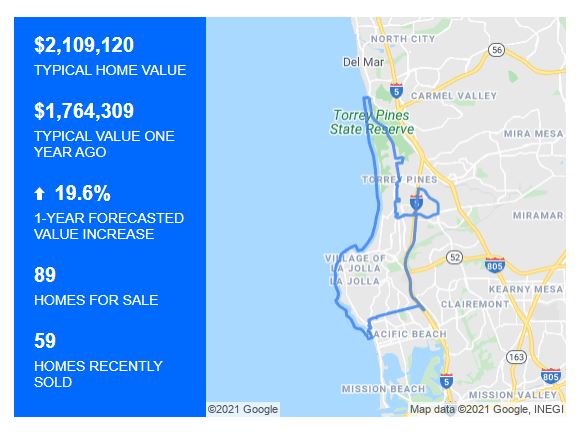

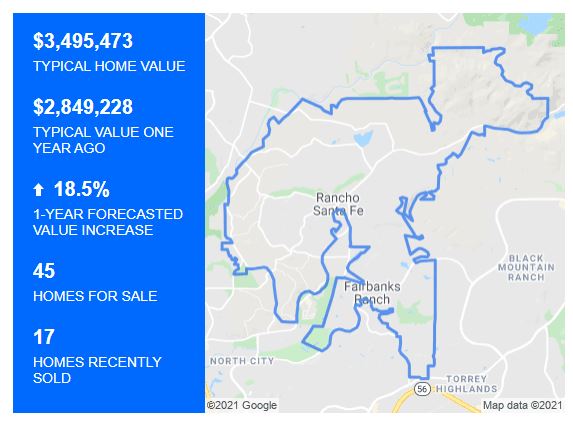

The Zillow 1-Year Forecasted Values are down 1-2 points from their previous guesses last month, but still very strong. This is their third consecutive month with similar forecasts:

For those who are steeped in real estate history, it’s hard to comprehend how prices could increase 25% to 30% this year – to think pricing could go up ANOTHER 20% next year is straining the brain!

I think it will happen, and be accomplished by mid-summer.

This Compass listing just closed escrow this week for $5,400,000:

Over 10,000 square feet of indoor and heated outdoor entertainment spaces, covered/heated loggias. Gated Estate with exceptional manicured grounds and rare dual bay motor coach villa/guest house. Renovated over the past 10 years, this thoughtful residence is designed with an Anglo Caribbean architectural style set on a cul-de-sac.

The main home features both a gourmet and full prep kitchen appointed with all high grade appliances and detail, perfect for servicing large events. Upgraded elevator, multiple ensuite bedrooms and a generous master bedroom/bathroom suite with large balcony w/spa, dual walk in closets, crystal chandeliers, and steam shower. Full outdoor kitchen set under the covered loggia with views of the grounds and living pond, Well prepared for indoor and outdoor events, the spectacular single level guest house with full kitchen and wine storage also includes two generous en-suite bedrooms. A gated motor court with limo-depth 4 car garage and room for boats/trailers.

For the car or RV enthusiast the motor coach villa could be an indoor sports court as well, home has large solar system and pool solar system with plenty of storage. A rare compound set on a flat 1.51 acre lot, a mature botanical garden of specimen palms, citrus, fruit and other rare tropical plants.

$19,900,000

15,435 square foot Main Residence; Plus: “The Lillian” Tennis Cottage; Recreation/Two Bedroom Guest House; and the Two Bedroom Staff House on 8.13 acres