Graph-O-Rama

I may have featured this one before but this has several photos of his house on the shores of Coronado looking across the water at downtown San Diego:

https://homesofcelebs.com/san-diego-padres-star-manny-machados-10-million-coronado-mansion/

I love that Robert Reffkin is becoming the industry spokesman – what he says is mostly accurate and informative. For the record, yesterday we had Natalie film my next video before I saw the boss talking about 2025 inventory:

Finally there is an article that exposes their inaccuracy, but it doesn’t mention the negative effect on buyers due to the zestimates being adjusted to within a couple of bucks of the list price once a home goes on the market.

But the author does highlight that the zestimates are more than 10% wrong for about a third of all homes!

An excerpt:

By definition, half of homes sell within the median error rate, e.g., within 2.4% of the Zestimate in either direction for on-market homes. But the other half don’t, and Zillow doesn’t offer many details on how bad those misses are. And while the Zestimate is appealing because it attempts to measure what a house is worth even when it’s not for sale, it becomes much more accurate when a house actually hits the market. That’s because it’s leaning on actual humans, not computers, to do a lot of the grunt work.

When somebody lists their house for sale, the Zestimate will adjust to include all the new seller-provided info: new photos, details on recent renovations, and, most importantly, the list price.

The Zestimate keeps adjusting until the house actually sells. At that point, the difference between the sale price and the latest Zestimate is used to calculate the on-market error rate, which, again, is pretty good: In Austin, for instance, a little more than 94% of on-market homes end up selling for within 10% of the last Zestimate before the deal goes through.

But Zillow also keeps a second Zestimate humming in the background, one that never sees the light of day. This version doesn’t factor in the list price — it’s carrying on as if the house never went up for sale at all. Instead, it’s used to calculate the “off-market” error rate. When the house sells, the difference between the final price and this shadow algorithm reveals an error rate that’s much less satisfactory: In Austin, only about 66% of these “off-market Zestimates” come within 10% of the actual sale price. In Atlanta, it’s 65%; Chicago, 58%; Nashville, 63%; Seattle, 69%. At today’s median home price of $420,000, a 10% error would mean a difference of more than $40,000.

Read full article here:

I guess if we’re doing billboards it’s not much of a secret any more.

Selling Compass listings off-market to buyers of other Compass agents is legal and within the rules of the Clear Cooperation Policy. The CCP doesn’t allow public advertising of individual homes, but advertising the PE program is fine.

It is inevitable that residential real estate will go the way that the commercial brokers do it – selling properties without any organized effort to cooperate between agents.

The Compass Private Exclusives is merely the next step in the evolution.

Our current program isn’t that effective yet – I don’t think many homes are being sold off-market within the Compass network, but it’s coming. I think the more-public advertising of it is because we’re trying to bust up the CCP, and when it doesn’t happen then Compass will have a great reason the leave NAR/MLS and go it alone. The PE program will already be well-known by then, and it will be what we use to attract more clients, especially sellers.

The Big Change is underway!

I don’t think it is a concerted effort, but it will look like it in the end:

It allows for the brokerages to make a good living too.

Mortgage rates rose today by about as much as the Fed lowered – just like last time!

If anyone needed any further convincing that a Fed rate cut is no guarantee of lower mortgage rates, today is a great piece of evidence. Perhaps “great” is the wrong word. There was nothing great about the mortgage rate movement following today’s Fed rate cut.

The average lender is at least 0.20% higher than earlier this morning. Lenders are still in the process of adjusting their rate sheets, so the total damage could vary slightly by the time we’re able to run the full numbers.

Either way, the top tier conventional 30yr fixed rate will easily be back over 7% for the average lender.

What gives?

Read full article here:

https://www.mortgagenewsdaily.com/markets/mortgage-rates-12182024

The top 10 ‘housing hot spots’

“2025 is expected to be a year of more opportunities” for both homebuyers and sellers, said Nadia Evangelou, senior economist and director of research at the NAR.

Four out of the NAR’s 10 “hot spots” are located in the South — although unlike those on other lists, none are in Florida. Three of the list’s hot spots are in the Midwest.

Here’s the full NAR list:

https://www.cnbc.com/2024/12/18/the-top-10-hot-housing-markets-for-2025-according-to-nar.html

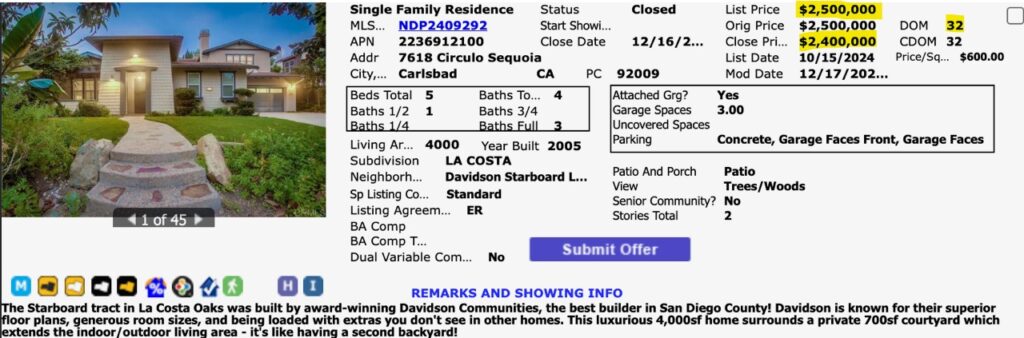

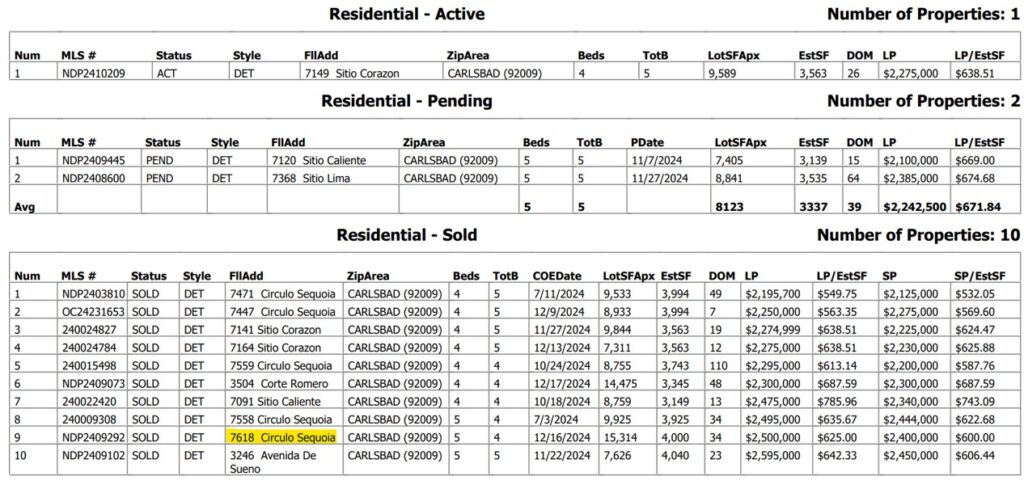

Here’s an example of how additional inventory causes commotion in the marketplace.

Over the last couple of years, you could put a home up for sale and not have any competing listings around you – and few, if any, recent closed sales either. Buyers and their agents had a tough time trying to mount a case about value!

Those days have passed.

Now there are guideposts for everyone to enjoy. It is imperative that sellers and their agents pay attention to the recent sales, AND what’s happening during their time on the open market.

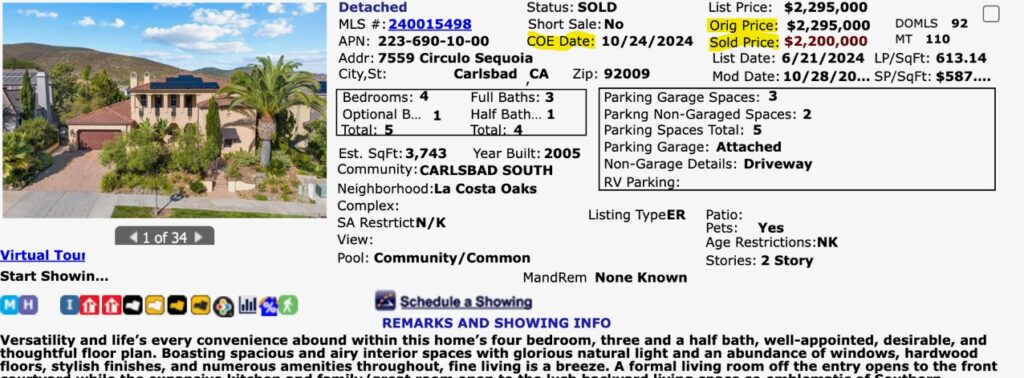

When we listed the home above on October 17th, this home (below) was the only one in the same Davidson tract and it was in escrow. The RSF agent said he got close to his list price, but in the Ranch that means within $95,000:

One week into my listing and I’m already facing a $300,000 difference in value between mine that’s listed for $2,500,000, and the slightly smaller home with a view just up the street. Great.

I wouldn’t mind that so much if my listing was spectacular, but ours had a couple of things. Not only did mine NOT have a view, but the backyard was on the north side of the street and this time of year it gets no sun. Plus, this tree on the west side of our backyard assured buyers that any sunshine would be limited:

Backyard view from the balcony off the primary suite:

We did our usual new carpet and paint plus staging, but our sellers didn’t do everything.

You’ve heard my rule-of-thumb: Buyers being asked to pay $2,500,000 should get a built-in fridge. But we opted to go with the alternative, which is what happens when you are thinking about selling your home and your built-in fridge goes out. Do you spend the $18,000 to replace it, or just $1,800 to get by:

The kitchen was already looking somewhat dated, and a fridge that stuck out an extra foot didn’t help.

They did agree to this paint upgrade, which made a big difference. Here is the BEFORE version:

Here is the AFTER, with staging:

We’ve made the home presentable, and now it’s up to me to get it sold.

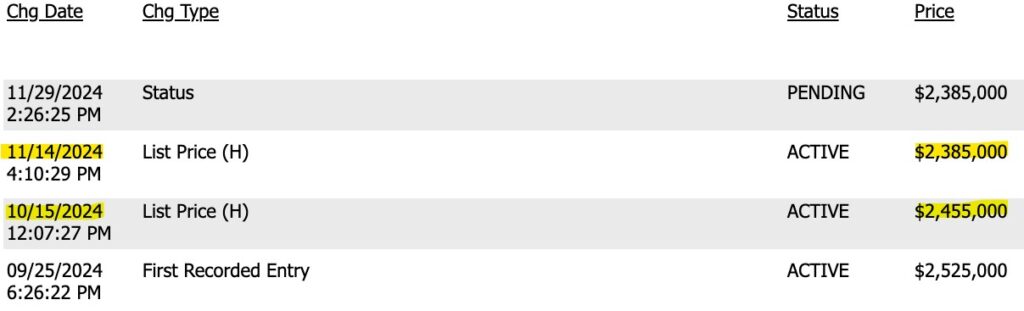

This was the active listing that I thought would help the most (because buyers are comparing the actives to decide which one to buy). It was smaller but had two bedrooms down, a pool, and visual openess even though you could see power lines in the distance. It was not a Davidson home, and it was priced at $2,525,000 – hey, thanks!

But the agent did a great job on pricing – they dropped their price right as we hit the open market:

On November 7th we get an offer of $2,350,000 from a Redfin agent from Orange County. She was in Rome, of course, and her buyers saw the property when I was doing open house so I was familiar with them.

I thought this might take a few days of negotiation before we can settle up, and I knew we had to scramble.

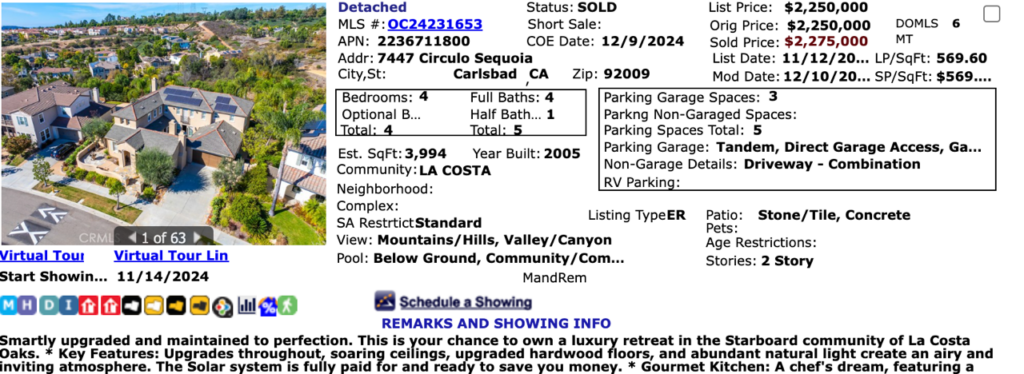

I had received a call from a different Orange County agent who had never been to Carlsbad, and knew nothing. He had a new listing on the same street as ours but in the Centex tract, which is way different than Davidson. He was fishing around for pricing information, so I told him he should definitely list high.

We countered our buyers at $2,450,000 on November 8th.

Three days later, they countered at their same offer price of $2,350,000, and their agent says that’s all.

But I know them, and I think they have more gas left in the tank.

We countered $2,400,000 on November 13th, and they took it.

On the same day, this hits the market – the OC guy:

At the time, my list price was still $2,500,000 so he undercuts me by 10% to quick sell, which is a very common tactic by listing agents who don’t care about their reputation and see the end of the year approaching fast. He saw me mention Davidson’s Starboard tract, and he didn’t know that he’s not in it. But at his price, it didn’t matter.

Thankfully, our buyers were also from Orange County, and their agent was still in Rome so I dodged that bullet.

Donna carefully managed them through closing and my $2,400,000 stuck!

There was a lot of other action going on in the second half of 2024 which could have complicated our chances so I feel great about our result.

Agents get hammered by solicitors – I get at least 10 calls per day. If I had been casual about the incoming call from the the Orange County agent which led me to discover he’s listing a home that could undercut me, we could have missed the opportunity to tie up our buyers when we did.

Here’s the rest of the action nearby from 2H24:

Just about everyone can find a way to live in 3,000sf to 3,500sf, so homes bigger than that have diminishing value per square foot. Looking at that list, I think we did well!

I think we are in for several monumental changes in the market conditions next year.

Some will be quick to label it a simple change from a seller’s market to a buyer’s market and leave you hanging. But it is a description that needs more definition – specifically, what does that mean for the participants? Do buyers get a better price? Do sellers have to take less?

You better rely on a great agent to help you with those questions!

One change that will be more evident will be doom from the casual observers. The commentary from the cheap seats is already ramping up, and buyers and sellers need to decipher whether it has any relevance to their own situation.

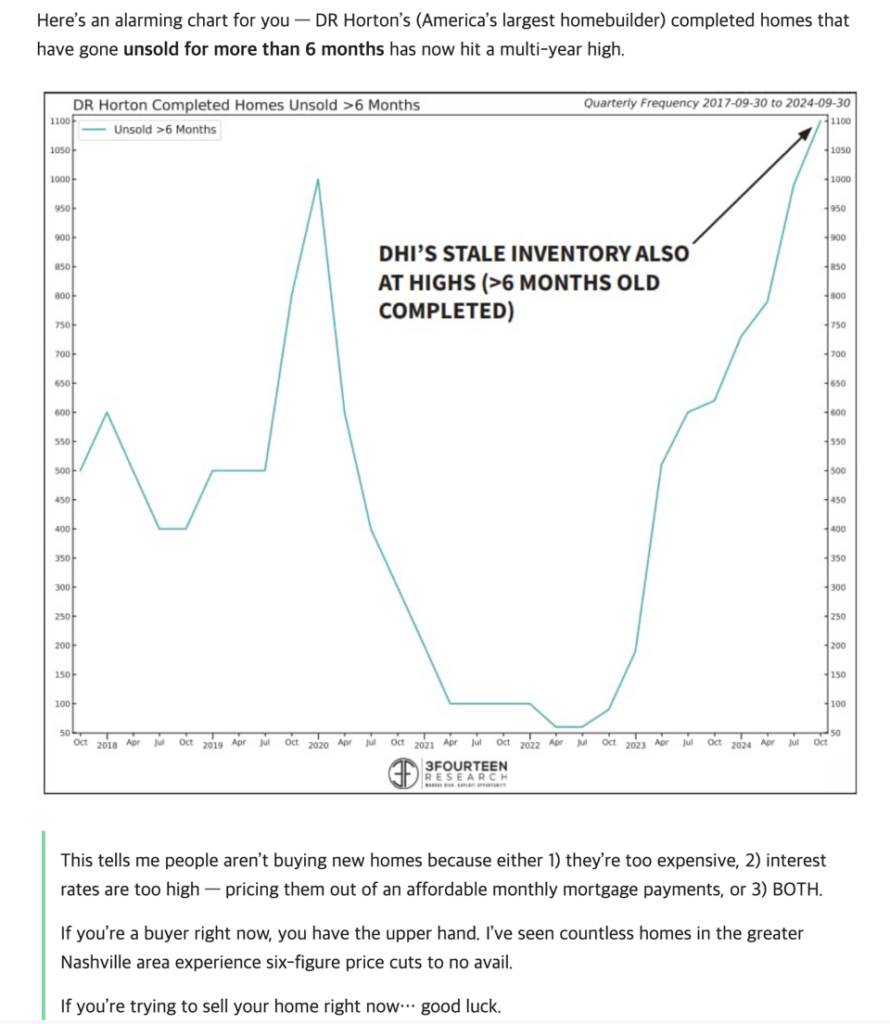

This may be an accurate assessment….but it’s about Nashville, not here:

My prediction? The doomers will be back with a vengance in 2025, especially on social media.

They were vicious in the 2008-2012 era, and I’m sure it delayed home purchases for many potential buyers. Much of it was due to the unprecedented market conditions – foreclosures and short-sales everywhere, and the ez-qual/no-doc financing had been eliminated.

Because it’s been such a strong seller’s market since the pandemic, the basic inexperience with a surge in inventory will tempt buyers (and agents) to pause. The stronger the surge, the more likely the pause.

If you’re selling, get ‘er done early in 2025.

Get Good Help!

In the last couple of years, we’ve followed how many new listings come to market in January. It’s been a good indicator of what to expect for the Spring Selling Season!

In past Januarys, the guesses spanned a reasonable range and usually the winner was somewhere in the middle of the pack. These were the guesses from last January:

Contest to Guess the Total Number of NSDCC January 2024 Listings

142 Anne M

157 Skip

160 doughboy

170 Dale

174 SurfRider

176 LifeIsRadInCbad

180 Kingside

188 Stephanie R.

189 Chris

190 Tom

192 Sara G.

196 Derek

200 Curtis

208 Rob Dawg

210 Bode

213 Shadash

217 Nick

222 Majeed

223 Joe

The final count was 255 listings in January, 2024, which was 14% over the highest guess!

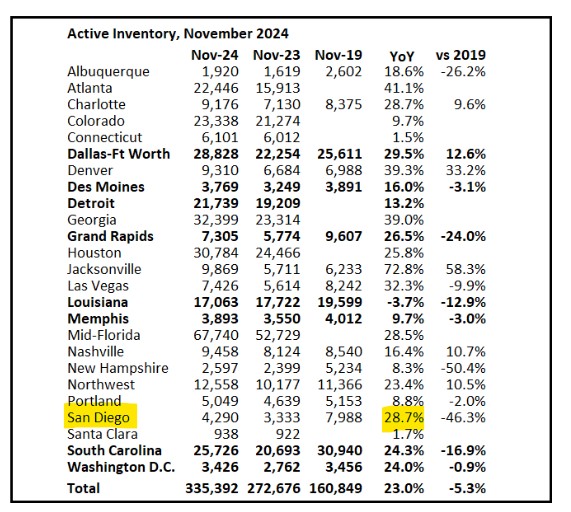

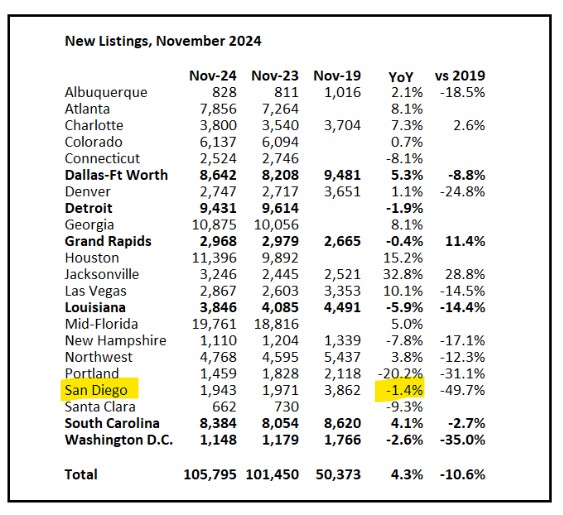

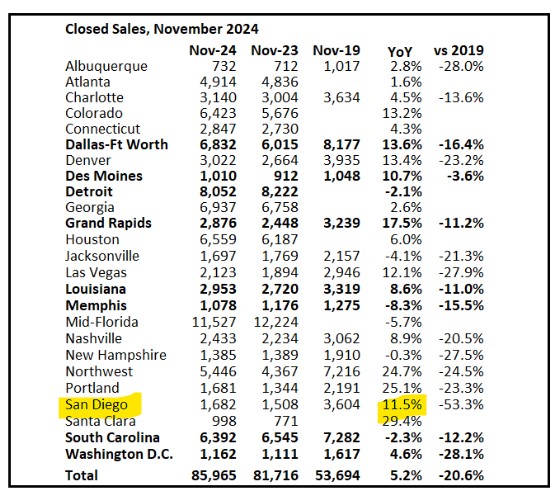

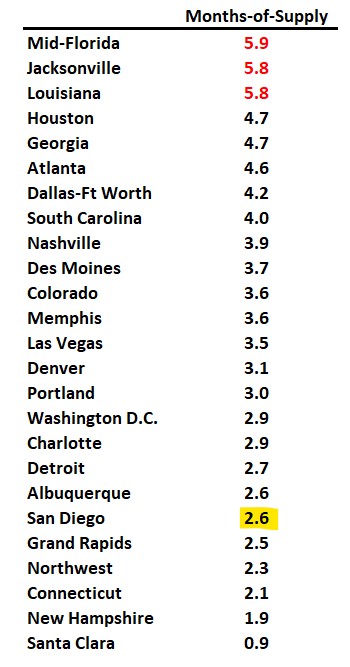

After January, the inventory continued to rise, and there were around +15% more NSDCC homes for sale this year, than there were in 2023.

I mentioned last January:

My theory is that 10% more inventory is easily absorbed and really won’t be that noticeable. It’s when the inventory is growing at 20% or more that buyers may wonder what’s going on – and be tempted to pause, and/or get more picky, if that is possible.

The way it’s going, the 2024 Selling Season should be as hot, or hotter than it was last year!

The +15% was about the ideal increase in inventory because sales were higher too. Will 2025 be the year that we find out how much is too much?

It’s going to be a wild and crazy season – and not just for the Padres!

Leave your guess any time, and officially this contest will begin the first week of the year.

More historical data:

NSDCC January Listings

2018: 427

2019: 420

2020: 355

2021: 302

2022: 233

2023: 207

2024: 255

2025: ?