Welcome Michele!

Michele has received her license, and has joined the Klinge Realty group as an agent!

Michele has received her license, and has joined the Klinge Realty group as an agent!

Ringo talking about playing the drums! BTW, you’ll hear him properly call it a drum kit, not a drum set.

If you wanted proof that the tight-inventory era will persist – and possibly get worse – over the next few years…..well, here you go. As prices have risen sharply, so has home equity – which means the long-time owners can be looking at a six-figure tax hit, even after the 2-out-of-5-year tax exemption.

While you can make the case that the capital-gains tax gets paid with the same-and-seemingly free money created by the recent home-price appreciation, Americans have a real aversion to paying taxes. Especially in six-figure amounts!

The long-timers who might consider selling their home are smart to calculate the potential capital-gains tax first. For most, it will probably be the last straw!

Buyer fatigue has hit San Diego’s real estate market as some people are taking a break after making offers on several homes to no avail, according to several real estate agents.

“In my opinion, I feel the buyers are feeling beat up and a little tired,” said Dawn Suprenant, with Windermere Homes & Estates. “It’s still crazy. It’s not as crazy as the spring. I think they feel like, ‘I’ve tried everything. I’m going to take a break,’” Suprenant said. “There’s only so many times you can make an offer and be rejected and want to come back.”

Julia Maxwell of Berkshire Hathaway HomeServices California Properties said that for most buyers, “it’s a very frustrating and emotionally draining market.”

“Currently we’re seeing a very subtle, I can’t emphasize how subtle, softening in the upper range prices where we were seeing market times of two days, three days or less, we’re seeing slightly longer market times,” Maxwell said.

Even so, the market remains hot, with multiple offers still commonplace as prices continue to rise, interest rates remain near record lows and buyers far outnumber sellers with no letup seen anytime soon. Suprenant said she recently sold a Rancho Penasquitos home for $101,000 over the asking price. She said it’s become more common for buyers to pay more than list price.

Carlos Gutierrez of eXp Realty of California said the market is shifting ever-so-slightly, but that it remains very much a seller’s market. “We’re starting to see inventory creep up, longer days on market,” Gutierrez said, adding that there are fewer “hyper bidding wars happening.”

“We still have bidding wars but I don’t see them happening as much,” Gutierrez said.

Nancy Layne, president of North San Diego County Realtors, said she’s noticed a letup in the market, like Suprenant, attributing it to buyer fatigue. “We’re finally seeing more stuff come on the market. It’s getting a little more competitive, Layne said. “I think it’s flattening out.”

Dina Brannan, vice president of operations for Century21 Award, said the market “has kind of lost its panic mode.” “Things are not flying off like hotcakes. They’re still going fast, but they’re not this crazy where things are selling before they even hit the market,” Brannan said.

Melissa Goldstein Tucci of Coldwell Banker West said that the overall market is “the strongest it’s ever been,” although she said the number of offers being made on a particular house has dropped a little since mid-June. “The values are still skyrocketing and it’s still a great time to buy because I don’t personally see anything changing anytime soon,” Tucci said. “I see the market remaining strong.”

Wendy Purvey, chief operating officer of Pacific Sotheby’s International Realty, said it would be wrong to say the market was softening. “The frenzy has tailed off. I would not say it has died down. We still have frustrated buyers that can’t get what they want,” Purvey said. “There’s no way that there’s a softening in the market. What’s happening is a tiny correction and that correction is way, way needed in a healthy market. The price and values can’t keep going up at this rate.”

Sean Caddell of Pacific Sotheby’s International Realty, said he’s seen more people paying cash instead of having a mortgage, and they’re willing to pay more than the seller’s asking and they’re eliminating contingencies, “buyer investigations, everything.”

“We’ve had almost every property we sold recently, the buyers have removed their appraisal contingency, whether it’s financed or cash,” Caddell said. “I have not seen it like this before where people are so anxious and excited to get a property.”

According to Reports on Housing, an agency that tracks housing in San Diego and Orange counties, the inventory of homes on the San Diego County market was up by 11% in mid-July, to 3,059 listings but that still was a near record low and compared to 4,577 homes on the market at the same time last year.

The inventory in 2006 – a year before the Great Recession – was 18,000 homes on the market, reaching 20,000 in 2008. Meanwhile, housing prices appreciated at a rate of 14.6%, the highest rate of appreciation since 1988, according to Reports on Housing.

Read full article with more realtor quotes here:

https://www.sdbj.com/news/2021/jul/27/san-diego-seeing-tightest-housing-market-years/

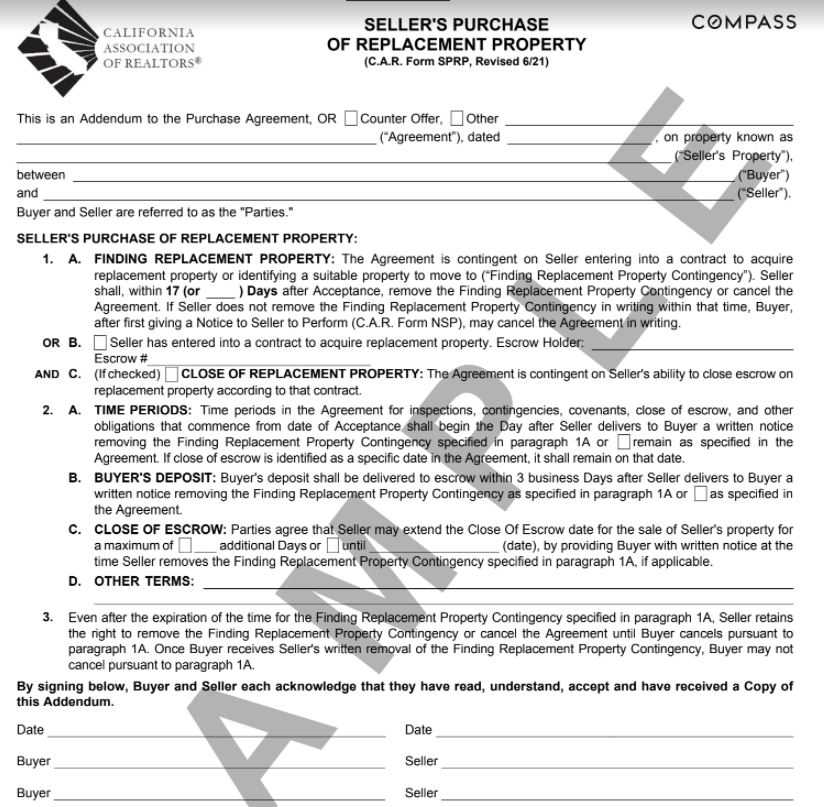

Do sellers buy first, or sell first?

Most want to use the equity in their current home to buy the next one.

But if you sell first and can’t find a replacement, you could end up homeless, and/or having to move twice – once into a (very expensive) rental, and then move again once you finally find the replacement home.

The C.A.R. has revised the form above and it’s a reasonable solution for sellers.

It enables them to put their home on the open market, find a buyer, and come to an agreement to sell the home – with adequate protection that if the sellers can’t find a replacement, they aren’t obligated to sell.

Let’s offer this idea to potential sellers in order to get more listings and increase the inventory. Buyers have had to endure much worse, so if they can tie up a home and just need to be patient while the sellers find a new home, then they should be happy.

We need to expand the possibilities because there will come a day when bidding wars don’t break out on every listing. Without creative solutions, the market could hit a post-frenzy flat spot!

I made sure our kids earned it…..

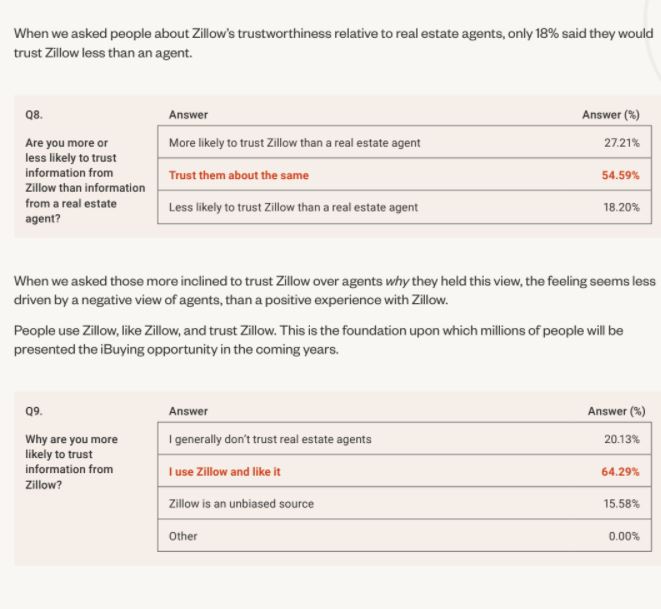

It’s probably no surprise that a well-branded company that spends $100 million per year on advertising has made an impression on the consumer. On the other hand, agents are independent contractors running around hoping to sell a house. The impression that leaves on consumers isn’t always great.

But Zillow has been built upon lies and deceit from the beginning, and they are doubling down now when they say they are going to pay the amount of the zestimate for your home in cash.

A part-time blogger guy like me isn’t going to change anything, but for those who find this page and want the truth about Zillow and how they do their business, here are several examples below:

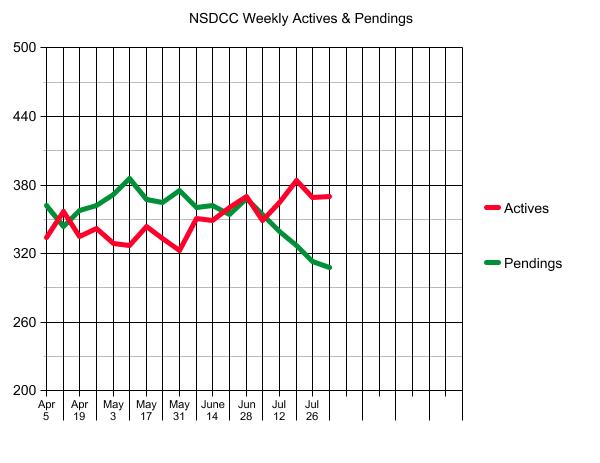

The 308 NSDCC pendings is the lowest count since February 1st and typical for this time of year.

Both actives and pendings should taper off for the rest of 2021, as we get ready for Spring, 2022!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Here’s the tour of the property that had 100 visitors during the first hour of open house. Listed for $1,650,000, it got bid up to $1,811,000, or $873/sf for a 27-year old tract house! Closed on 7/29/21.