The Squeeze

It’s easy for sellers to miss these days!

Just because you have comps doesn’t mean you’re going to sell. Adjust on the fly!

It’s easy for sellers to miss these days!

Just because you have comps doesn’t mean you’re going to sell. Adjust on the fly!

Bob Seger and the Silver Bullet Band will be on tour later this year!

The NAR settlement went into effect on August 17th of last year.

How’s it working?

I heard this story from another agent – it didn’t happen to me.

A home has been on the market for a couple of weeks, listed for $1,200,000. An offer was received at $1,220,000, and it asked for the seller to credit the buyer 2.5% ($30,500) to compensate for the buyer-agent’s compensation. Minus the credit, the net offer would be $1,189,500, which is only $10,500 under list.

The buyer offered to pay $20,000 over list to help compensate for the credit.

But the seller only wanted to pay 1.5% to any buyer-agent.

The seller turned down the deal.

Here’s why I bring it up:

The solution?

Get Good Help!

Mother’s Day is this Sunday and it’s not too late to ensure the special women in your life feel celebrated! If you’re looking to celebrate in San Diego, there are plenty of Sunday brunch specials happening at various restaurants.

Take a look!

333 Pacific, Oceanside

Chandler’s, Carlsbad

Park Hyatt Aviara, Carlsbad – plus they have a Mommy & Me Wellness activity at 4:30pm!

Herb & Sea, Encinitas

Fairmont Grand Del Mar, Carmel Valley

The Marine Room, La Jolla

La Valencia, La Jolla

Cellar Hand, Hillcrest

El Prado, Balboa Park

Café Sevilla, Downtown – Special Flamenco show & champagne brunch!

Hotel Del, Coronado

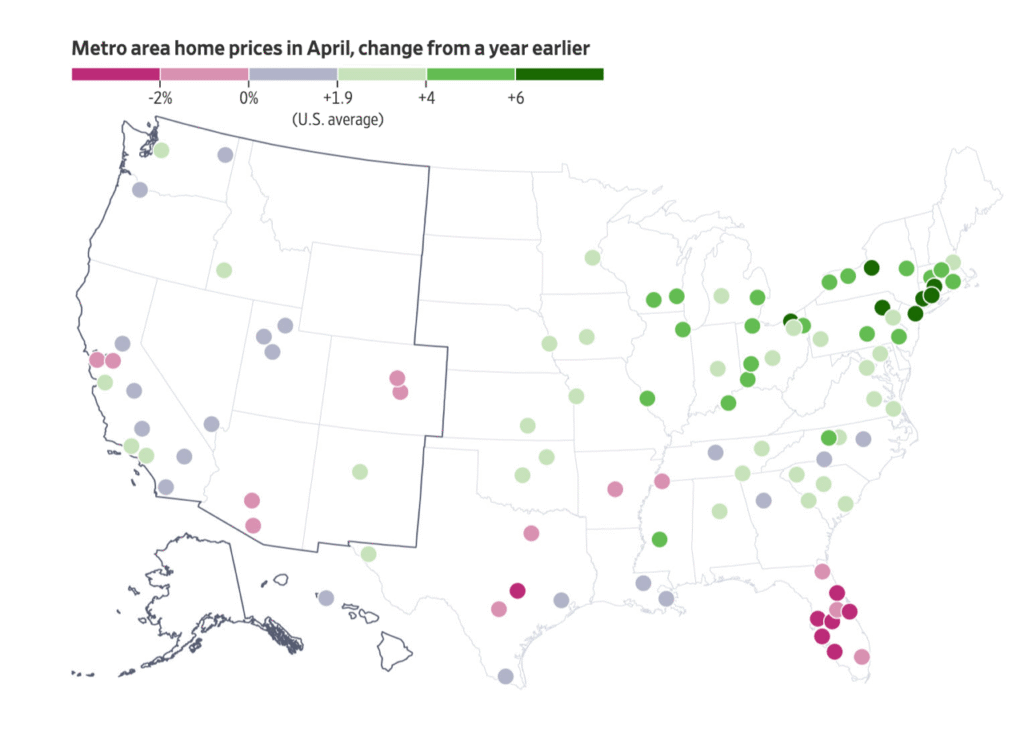

A reminder how all real estate is local….pricing in San Diego is holding up ok.

There are an amazing number of green dots, but for us, Flat City will do for now.

Link to free WSJ article

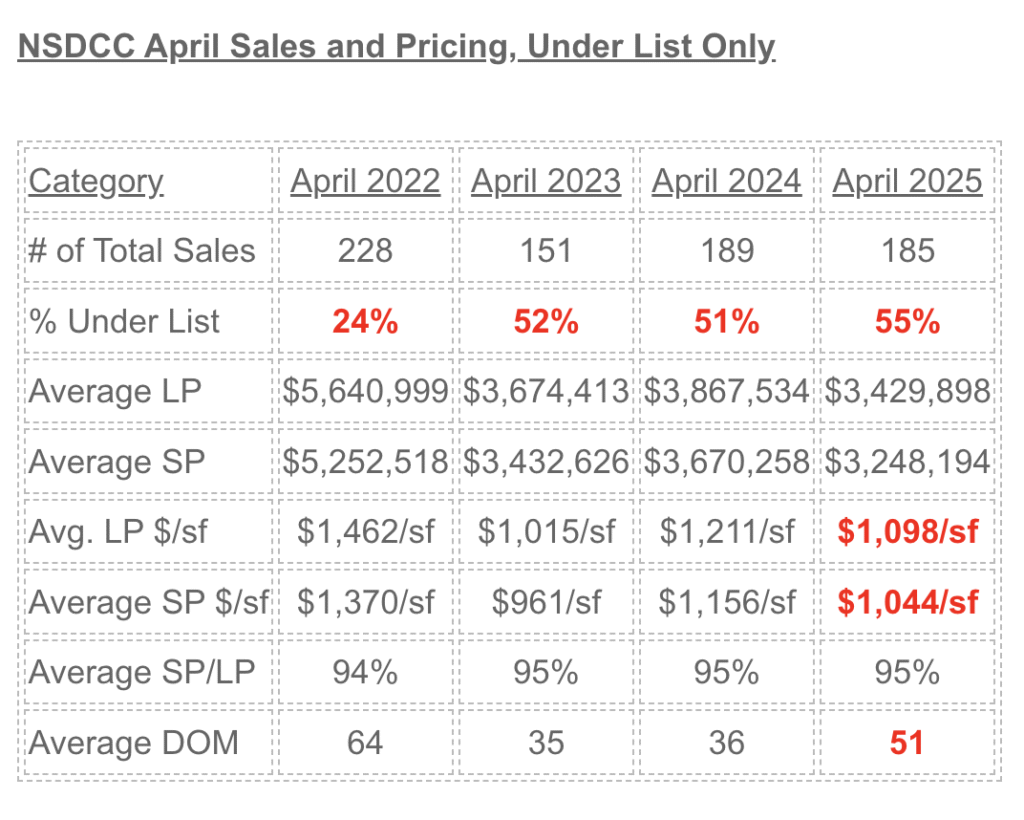

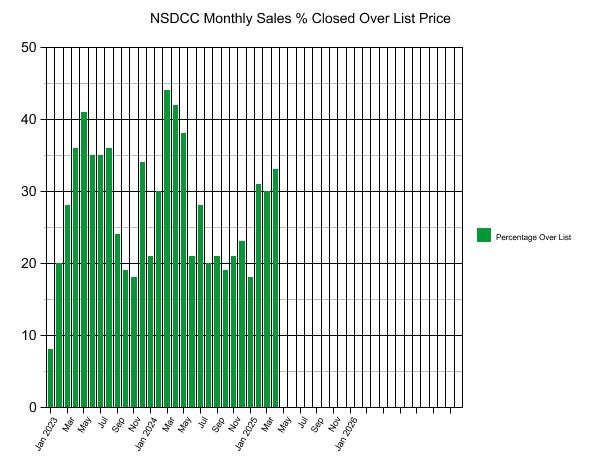

I give the Over-List sales plenty of attention.

How about the Under-Lists?

Most buyers today (55%) are paying under the original list price.

Back in the 2022 frenzy days, only 12 of 142, or 8% of the sales under $3,000,000 sold for less than their original list price – wow, remember those days? You can tell by the $3,248,194 average sales price last month that buyers are paying under list at all price points today.

Interestingly, the homes that needed to sell for less were priced 10% lower than they were last April, but they still sold for 5% under their list price.

Buyers are willing to pay over the list price if they see a spectacular home (great location and condition) which happens to about a third of the sales. However, the majority of homes aren’t flashy enough to impress the buyer pool, and both buyers and sellers are waiting longer (avg. 51 days) to commit to the inevitable discount.

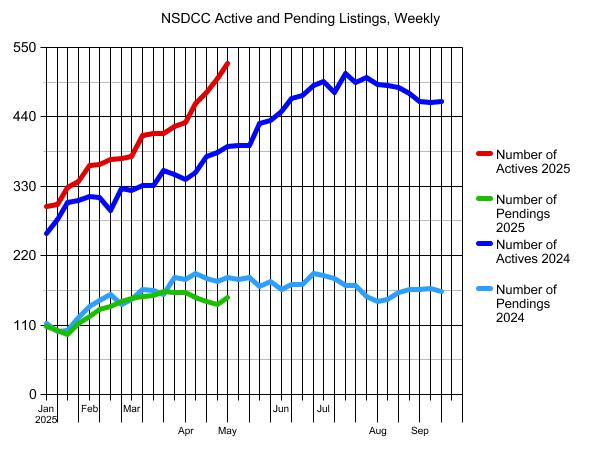

Another 82 new listings between La Jolla and Carlsbad hit over the last week.

It’s the highest weekly total since July, 2021.

Today there are 524 NSDCC active listings – the most in 5+ years!

The flow has been fairly orderly though. The number of pendings increased for the first time since mid-March, and all this is happening while there has been a steady stream of closings coming out the other end:

First four months of the year:

2024: 570 sales closed

2025: 598 sales closed

The buyers’ ability to ignore the unsolds stacking up is quite impressive.

The quartile pricing may dip a little under the 2024 levels, but probably not by much. This is why buyers have to dig out the deals. Most sellers are happy to wait.

After three weeks of uncertainty, buyers emerged at the end of April:

https://www.compass.com/listing/4949-san-jacinto-circle-west-fallbrook-ca-92028/1801067495862896353/

April is usually a contender for best statistical month of the year.

In 2023, April lost out to May for the highest percentage of sales that closed over the list price, and last year’s early start had March be the year’s winner in the category – with April in a close second.

This year, April has a great chance at being #1 for 2025!

The tariff tantrum should throttle the enthusiasm for the May and June sales, but we’ll see!

It’s amazing how pricing is holding up. Buyers are determined to get a house!

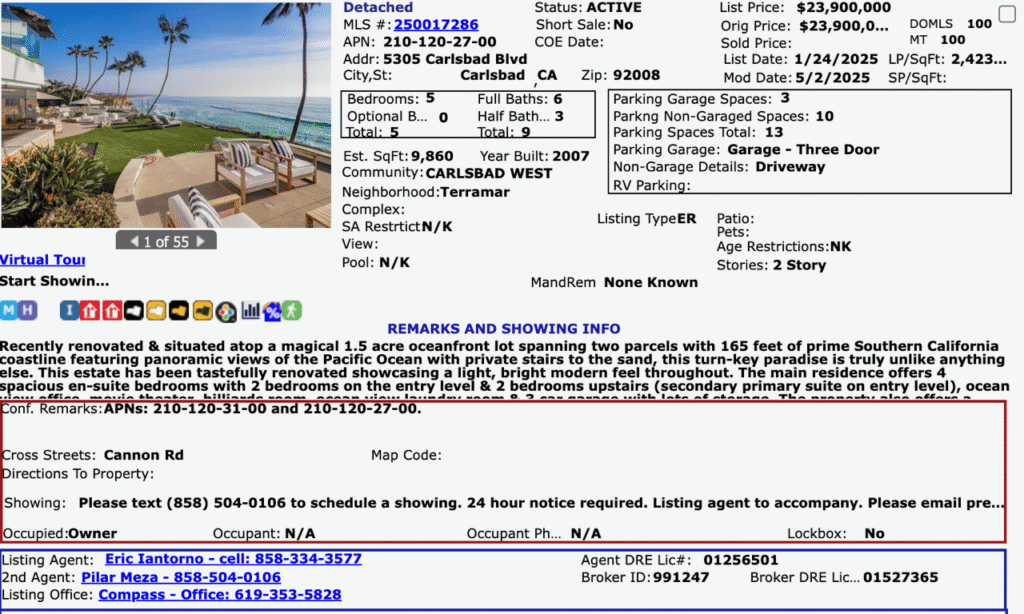

There were 12 sales of the 185 (0.6%) that showed zero days on market, the universal sign for an off-market sale. Of the twelve, TEN of them were sold to an agent from a different brokerage (one was a Compass-to-Compass, and one was CB-to-CB).

I hope we can move on from this off-market talk – less than 1% of the 185 sales? Come on – what is the threat? Every brokerage is doing it, yet it’s a dogpile on Compass. The real threat is the Compass recruiting teams continuing to poach the best agents from other brokerages that makes their executives so uncomfortable, and they hope that bad-mouthing Compass might help save their job.

Let’s also note that it’s not working. Welcome Eric and Pilar to Compass!

On Saturdays, I try to suggest suitable places to move, in case readers are wondering where to retire. But for those who want to work and get into the AI craze, Phoenix is a relative boom town.

The Taiwan Semiconductor Manufacturing Company (TSMC) took another major step in expanding its north Phoenix campus on Tuesday. The company broke ground on its third semiconductor manufacturing fab, or factory, near 43rd Avenue and Dove Valley Road.

TSMC said the third facility will create roughly 6,000 jobs and will manufacture chips using 2 nanometer or even more advanced process technology, with production starting by the end of the decade.

The milestone coincided with a visit from the U.S. Secretary of Commerce Howard Lutnick, who praised the groundbreaking and expansion of TSMC’s facilities. He said it was part of the Trump administration’s renewed commitment to strengthening the “golden age of American manufacturing.” “We are at TSMC Arizona to celebrate the return of American manufacturing. President Trump’s bold leadership and clear direction are driving companies and jobs back to this country at a record pace,” Lutnick said.

TSMC is the world’s biggest semiconductor manufacturer and produces chips for companies including Apple, Intel and Nvidia. “AI is revolutionizing every aspect of the technology stack, and Nvidia AI supercomputers are at the foundation. We’re proud to produce our technology in Arizona, bringing AI infrastructure manufacturing back to America. The administration’s support for U.S. manufacturing makes this possible—and vital—for the next industrial revolution,” said Jensen Huang, founder and CEO of Nvidia.

https://www.azfamily.com/2025/04/29/tsmc-breaks-ground-third-facility-north-phoenix/

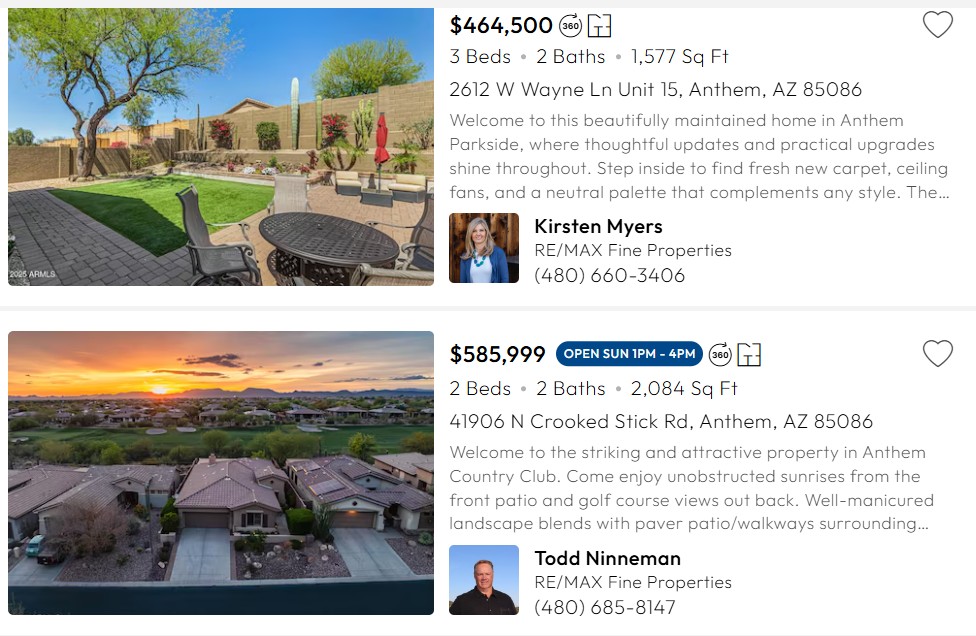

Check out Anthem, which is nearby:

https://www.homes.com/anthem-az/