by Jim the Realtor | Nov 2, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

Are realtor commissions negotiable?

Sure….how high do you want to go? 😆

Commissions aren’t all the same, just like agents aren’t all the same. Different agents charge different rates because they do different things for the consumer. Commissions/fees range from $100 to 7%. Nice range!

So if all that matters is paying less for your agent, then shop around – there are plenty of discount agents. You might consider hiring the very best agent you can find – one who pays for themselves, and more.

This is the question that has never been answered by the industry:

“If agents employ different skill sets and services, why do they all get paid the same?

It was mentioned in the recent lawsuit, and they presented it as part of their case:

72. Additionally, because the Rule requires a blanket offer, the Rule compels home sellers to make this financial offer without regard to the experience of the buyer-broker or the services or value they are providing — in other words, the Rule treats all buying brokers and their services the same. The seller is required to offer the same fee to a buyer-broker with little or no experience as that offered to a buyer-broker with twenty years of valuable experience. Accordingly, there is a significant level of uniformity in the payments that sellers must pay to buyer-brokers.

73. As a result, there is little relationship between the commission and quality of the service. “Skilled, experienced agents and brokers charge about the same price as agents with little experience and limited knowledge of how to best serve the consumer clients.” In a price-competitive market, less experienced and less skilled brokers and salespersons would be offering consumers lower commission rates, but they have no incentive to do so because of the Rule.

74. The Rule creates tremendous pressure on sellers to offer the “standard” supra-competitive commission that has long been maintained in this industry. Seller-brokers know that if the published, blanket offer is less than the “standard” commission, many buyer-brokers will “steer” home buyers to the residential properties that provide the higher standard commission.

The changes or fines from the lawsuit(s) probably won’t matter much today. Offering no commissions to buyer-agents is a nice idea, and you’d think it would cause agents to publicize the full set of productive services they offer to their buyers to convince them to pay the fee. Don’t get your hopes up.

Ideally, the consumer would research the detailed resumes and work histories of each prospective agent and make an informed decision. The agent pages on Zillow do provide the basics, but based on results, consumers aren’t using them much.

It’s why realtors have a lousy reputation – consumers keep hiring the inexperienced/bad agents, and the industry doesn’t mind because they make more profit off them.

Get Good Help!

by Jim the Realtor | Nov 1, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

Now what?

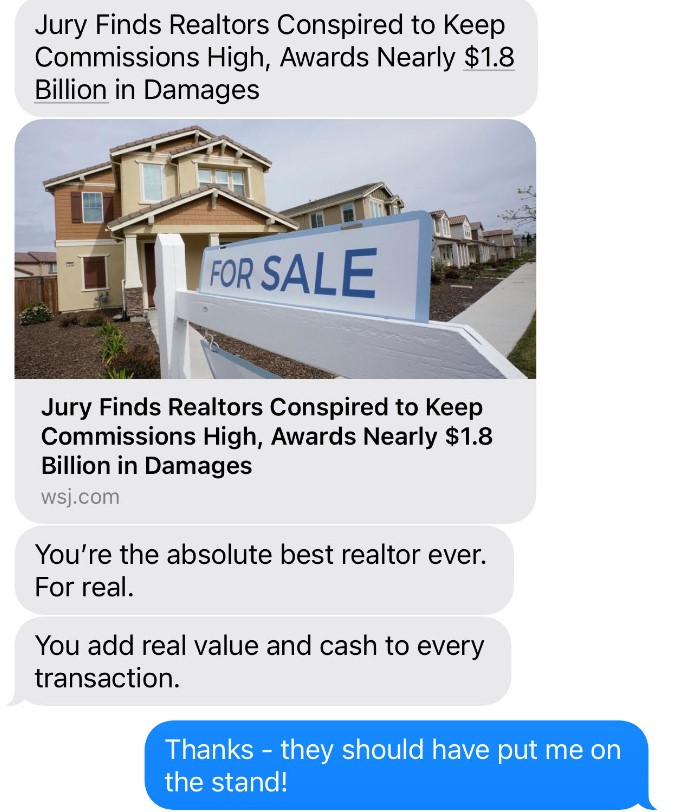

The National Association of Realtors clearly underestimated the chances of losing this case – and the others to come. They must have thought that touting their 100-year old Code of Ethics was all that was needed to impress people, and instead they found out that it doesn’t.

What doesn’t get addressed is the common belief that realtors are overpaid.

It is a wide-spread belief. Even Joe Kernen, a guy who works 15 hours per week and gets paid between $3,000,000 and $22,000,000 per year (depending on the website), has to open his CNBC show today with the declaration that 6% commissions are too much, and 1% would be more like it.

This is what needs to be addressed. Can agents explain their value?

Listing agents are used to making a presentation to homeowners, but 80% of the time, the sellers have already decided on who they will hire so the presentation doesn’t have to be great. Buyer-agents rarely discuss what they do – they just have people jump in their car and go look at houses.

The judge and/or the Department of Justice will rule on future sellers paying the buyer-agent commission. If sellers are allowed to pay a commission to the buyer-agents, then their listing agent can counsel them properly on what rate to offer, and the status quo will endure. But it will be a game-changer if the sellers are no longer able to offer ANY commission to buyer-agents.

With the former, the listing agents will have to discuss the pros and cons in detail to the sellers, and agree to a comfortable amount. With the latter, the buyer-agents will have to create a presentation to convince their buyers to pay them directly. This will be a new practice, and they won’t be very good at it.

By the end of the day yesterday, I had already been notified of three different seminars being offered about using the Buyer-Broker Agreement. It sounds simple enough to the ivory-tower types – just get your buyers to pay you the commission! But they underestimate both sides.

Agents aren’t jumping at the chance to work with buyers in the current market.

It takes months or years for buyers to finally win the right home at the right price, and the abuse from the listing agents is mean and nasty along the way. Nobody plays by the same rules, and multiple offers are mishandled regularly, which delays the buyer finally getting a house.

The 2024 Selling Season will begin with buyer-agents pleading with their prospects to sign a contract to pay them a commission. It will only take a few months for this practice to get exposed. The buyers will be reluctant to sign, and those that do sign a contract will find out that it won’t change the outcome. It is still going to take months to find the right house, at the right price. There will still be the typical aggravations and shenanigans with the listing agents – most of whom now insist on buyers providing a bank statement and lender pre-approval letter just to see a house.

Because the local inventory is will be ultra-low, the desperation will cause buyers to blame their agent. It is a fact of life with both sellers and buyers – if they don’t get the outcome they want, it’s too easy to blame their agent (especially when it is true most of the time).

Will sellers and buyers be more diligent about who they hire?

They never have been – they just grab an agent and hope for the best. They don’t know the right questions to ask; they don’t want to waste time investigating thoroughly; and besides, the buyers just want a house, and the sellers just want their money.

This is where each agent and the industry at large could go a long way towards providing a solution.

If there was an outpouring of explanations on how the business works, what to expect, and why a consumer should pay the fee, it would help. Maybe write a blog or something!

Without a delberate attempt to educate everyone, the business will gravitate to the lowest common denominator – single agency, where buyers go direct to the listing agent, and the benefits of buyer-agency are slowly forgotten. Next year will be the phase-out stage.

It will be the next step towards auctions becoming the way to sell houses!

by Jim the Realtor | Oct 29, 2023 | 2023, Flips, Jim's Take on the Market, North County Coastal |

Could there be trouble brewing under the surface?

Are there home sellers scrambling to get out with whatever money they can? Maybe get just enough net proceeds for the family to have a steak dinner at closing? It was like that last time…..but it’s different now.

It’s a lot different now!

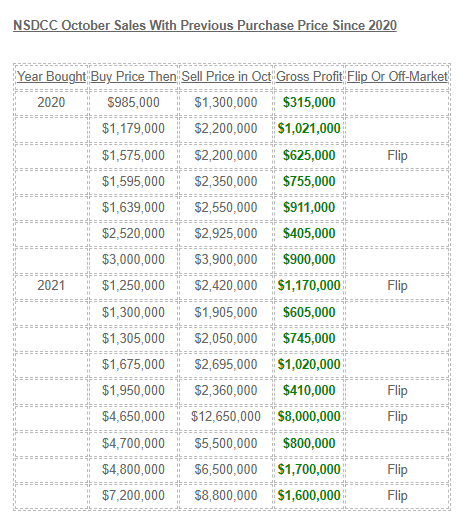

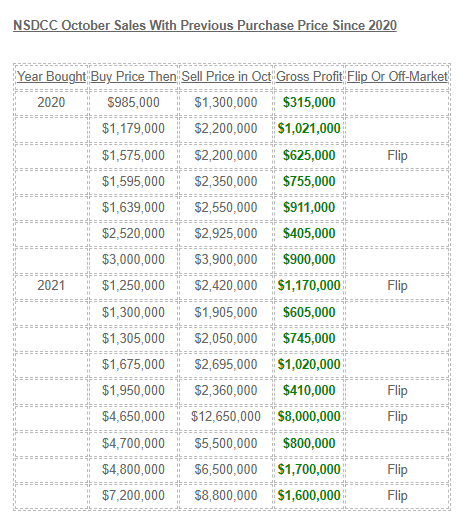

Let’s check the home sellers who purchased during the pandemic days. Those who bought their home before 2020 are having no problem selling for substantially more than they paid, so we only need to check the recent purchasers. Is anyone losing their shirt?

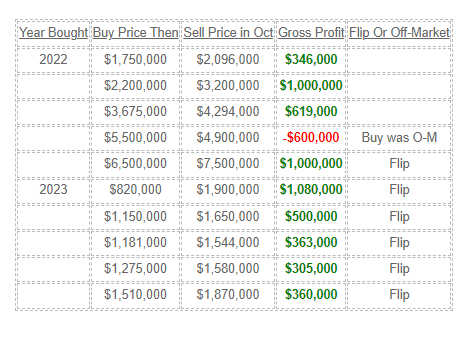

This month’s NSDCC sales are up to 117 – here are the ones that were purchased since 2020, and comparing what they paid then to their sales price this month:

Observations:

- Twenty-six of the 117 sales had purchased since 2020 (22%), but 12 of the 26 were corporations in the business of making money. They succeeded!

- The median gross profit was $750,000.

- Fourteen of the 117 sellers (12%) were regular buyers since 2020 who found a reason to sell this month.

- Even if they were in some sort of trouble, they still made out nicely – and for all we know, there were many who sold JUST BECAUSE they could hit the jackpot!

- The only seller who lost money had purchased 1,700sf for $5,500,000. Think twice about doing that!

- There are at least 100 sellers EVERY MONTH who are walking away with $1,000,000+ in their pocket!

Could there be trouble ahead for those who bought this year if prices declined substantially? Maybe, but rates have been rising for 18 months so they shouldn’t be surprised about future market shifts – if any.

For them to purchase a home in spite of market conditions must mean they are in it for the long haul.

P.S. The flip that made $8,000,000: Click here

by Jim the Realtor | Oct 27, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Scams, Zillow |

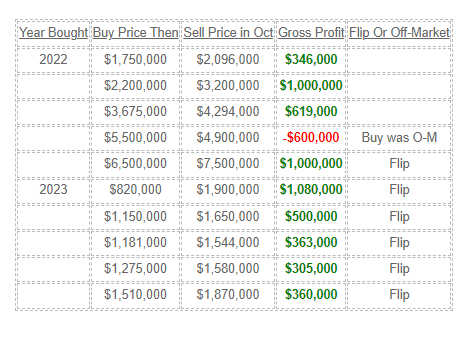

Paying referral fees is a standard practice in the realtor business.

Are you thinking of moving to a new town and need an introduction to a realtor there? Your agent here will track one down for you, and that agent will pay them a referral fee, which used to be 20% to 25% of the gross commission. The challenge? Getting good help!

Great agents don’t need any assistance with procuring new clients, and they might reluctantly pay a 20% or 25% referral fee only if the new client is motivated and in the upper regions, price-wise.

Less-experienced agents are willing to pay out higher referral fees, which doesn’t do the client any favors.

What we do is tough work, and fewer and fewer people want to do it.

It’s so hard to hire, train, and retain good/great agents now that many real estate companies are just resorting to referring clients, and taking a substantial referral fee instead.

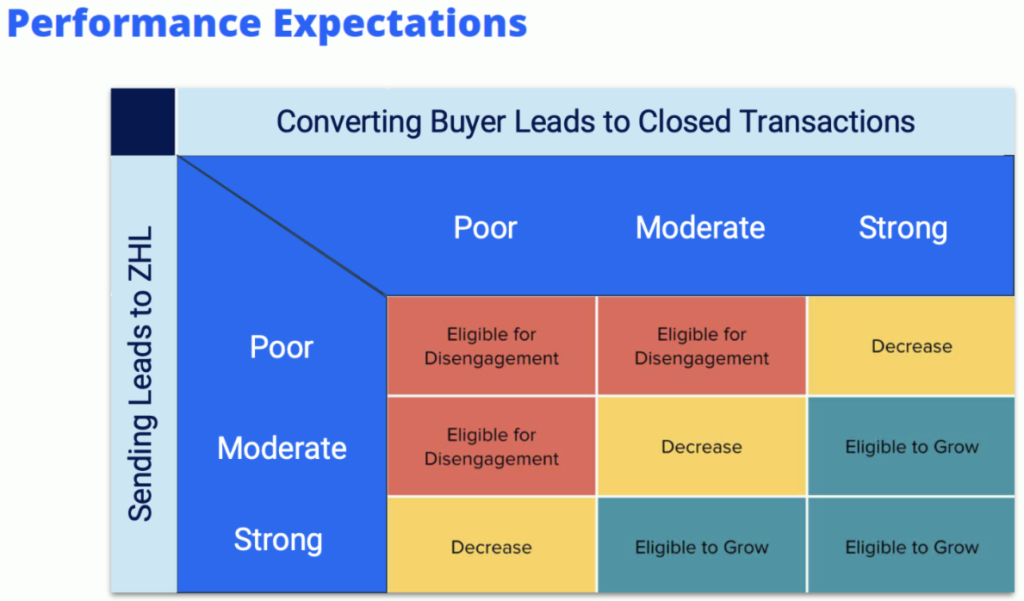

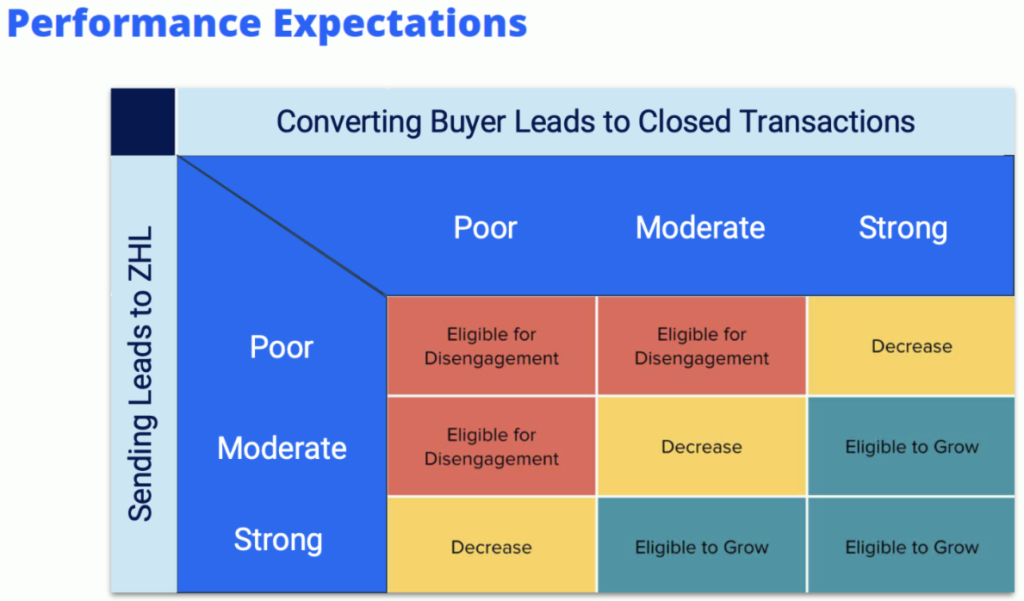

Zillow has staff taking the incoming calls, and qualifying the leads before sending them to their Flex agents. Their referral fee is now 40% of the gross commission, AND they want buyers to use Zillow Home Loans too. Their Flex agents who send their buyers to ZHL will be rewarded with more leads, and vice versa:

Less than five percent of the U.S. real estate agent population works with Zillow (with far fewer Flex agents), and Zillow only touches around three percent of U.S. real estate transactions. They are running a small, exclusive ecosystem of agents that are willing to play by their rules, which now includes tight integration with Zillow Home Loans.

You’ve probably seen the TV ads by Homelight? The ones that pitch teaming you up with the best agents in town? Well, at least with the best agents who are willing to pay them a 30% cut of the gross commission.

Now Redfin is giving up on their agent-employee program, and they are testing the idea of hiring agents on commission splits, instead of salary and paying them “up to 75%”. It’s doubtful they will pay many of their agents the full 75% split. It’s just another way for them to get referral fees of 30% to 50%.

None of the referral fees are disclosed to the client, and it’s never discussed of how the size of the fee will impact the quality of the agent service you receive.

But most of all, any thought of commissions dropping will be fleeting at best. Commissions need to stay high in order to pay the larger referral fees!

by Jim the Realtor | Oct 26, 2023 | Jim's Take on the Market |

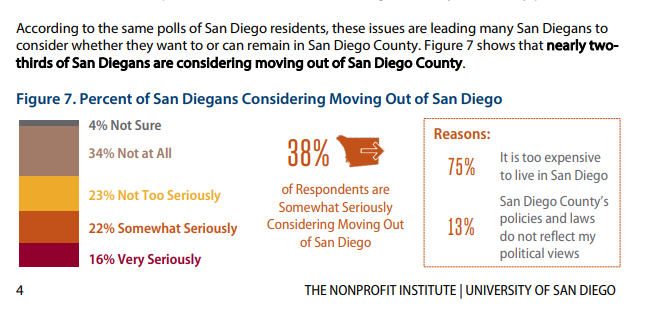

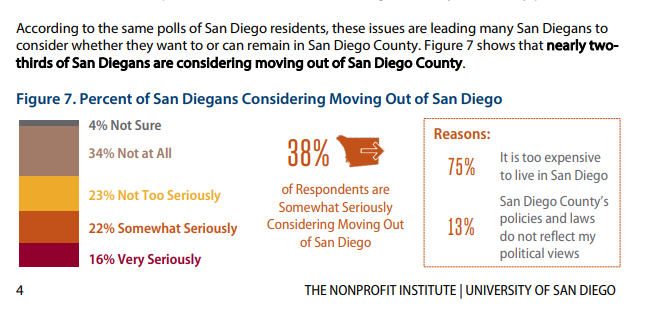

Below is a graphic from a USD publication that shows how many people might do something about high cost of housing here. Unfortunately, the majority of people polled probably weren’t the long-time homeowners who find it quite comfortable here and wouldn’t consider moving even if you gave them a couple of million dollars:

Many San Diegans are questioning if they can remain in San Diego County due to the lack affordable housing, inflation, and the related high cost of living. The housing crisis is forcing residents – including those who work in the nonprofit sector – to rethink staying in San Diego. Likewise, the high cost of living is increasing demand for nonprofit services as the need for basic support services grows. Inflation is driving upward pressure on wages while depressing the value of charitable gifts and assets, threatening the financial stability and strength of the nonprofit workforce.

https://digital.sandiego.edu/cgi/viewcontent.cgi?article=1019&context=npi-stateofnp

by Jim the Realtor | Oct 25, 2023 | Jim's Take on the Market, North County Coastal

There have already been 101 detached-home sales close this month between La Jolla and Carlsbad!

With five business days left in the month, plus the late-reporters, it means we should match last October’s count of 133, and maybe even approach last month’s 153 sales.

Of this month’s 101 sales, 45 were all-cash.

The 8% mortgages won’t kill the market – especially for the superior homes for sale, which are hot. They may be the only ones selling, unless sellers of the inferior homes will accept an appropriate discount – a gap which is probably 10% to 20%.

by Jim the Realtor | Oct 21, 2023 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage Qualifying |

People might think that 8% mortgage rates will kill the real estate market, but they are one more thing that can be fixed with money.

Two popular strategies to lower the mortgage rate:

30-year fixed rate buydown: Paying one point, or 1% of the loan amount will lower the rate by 1/4%. It would take a few points paid to make a significant difference, and the home seller can contribute too. On a $2,000,000 purchase with 25% down and a loan amount of $1,500,000, the monthly payment is $11,006 at the 8% rate. But the payment can be permanently reduced to $9,358 per month (6.375%) by paying six points, for a savings of $1,648 per month! Hopefully the seller will contribute some or all of the fee.

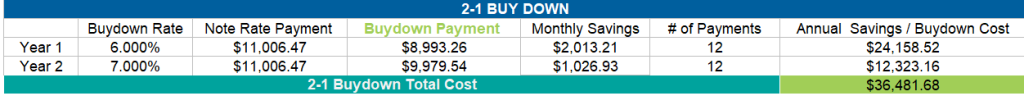

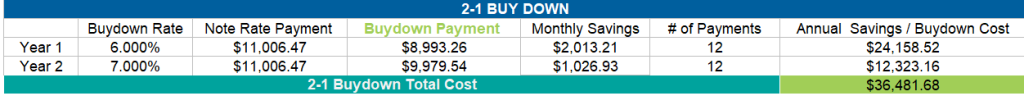

2-1 temporary rate buydown: Paying 2.4 points will lower the mortgage rate by 2% in the first year, and then by 1% in the second year. With the same $1,500,000 loan, here’s how the 2-1 buydown looks:

In both of those examples, you have a fixed-rate 30-year mortgage. If you are more of a gambler and don’t want to pay any points, the other alternative is to get the 3/1 ARM that has a fixed rate of 6.25% for three years, and then the rate adjusts annually for the remaining 27 years.

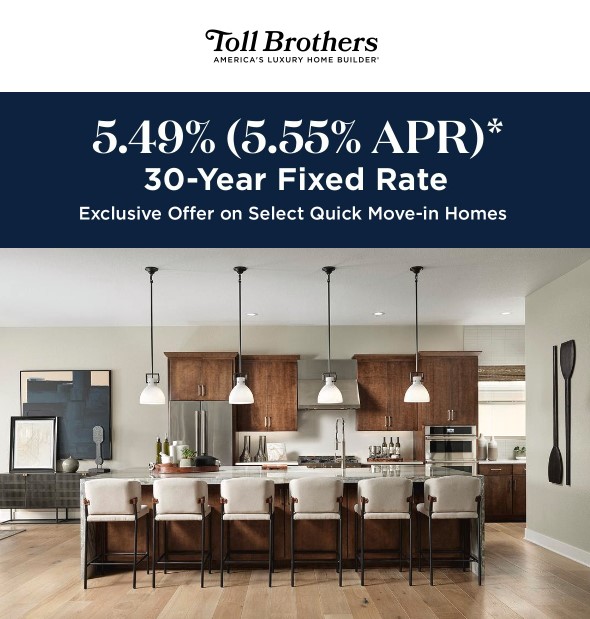

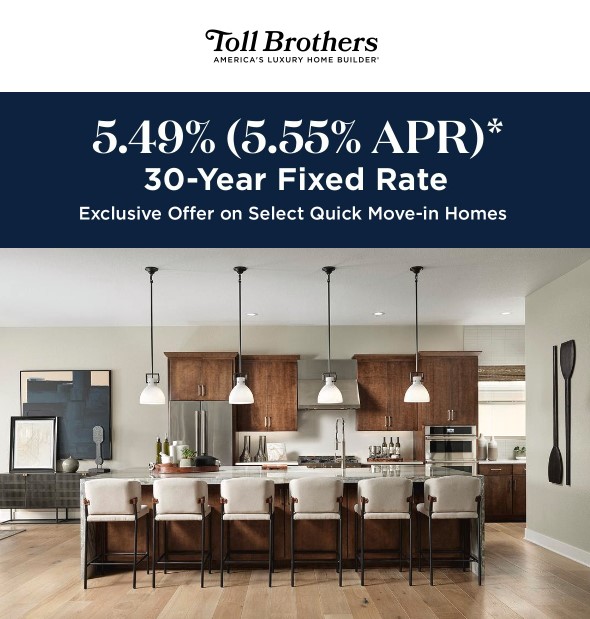

Or you can buy a Toll Brothers home:

A side note on Toll Brothers. Their Del Mar Mesa tract where construction was getting underway? They did sell all of those homes.

by Jim the Realtor | Oct 20, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, The Future, Why You Should List With Jim |

Currently, every listing agent is required to offer some sort of buyer-agent compensation on the MLS. Zillow and Redfin publish those commission amounts on every listing now, so they are all out in the open.

Today, there are 79 homes for sale between La Jolla and Carlsbad in the $2,000,000-$3,000,000 price range. Thirty percent of those listing agents are offering less than 2.5% commissions to the buyer-agents.

Outsiders who see that will assume that commissions are finally starting to drop, after all these years.

But the vast majority of those listing agents are probably still taking 5% to 6% commissions, and offering 2% or less to the buyer-agent (and more for themselves).

If the listing agent is supremely talented and brings special skills to the transaction, then it would be understandable. But I’ve been a buyer-agent on listings that are offering less than 2.5%, and they’re not different. Virtually every listing agent still practices the Three-P marketing plan: Put a sign out front, Put it in the MLS, and Pray.

There are hundreds of multiple listing services in America. So far, only a few have removed the requirement of offering a buyer-agent commission. But the NAR lawsuits are going to change that, and soon every MLS will permit 0% commissions to be offered to the buyer-agents (hoping buyers will pay their own agent).

The listing agents who have little or no repsect for the buyer-agents will keep offering them lower and lower commissions. Eventually, their rate will get down to zero or close.

Will sellers figure it out?

Sellers focus on the total commission. They don’t do enough transactions to know that the amount the listing agent pays to the buyer-agent will impact the sale. It is a bounty offered to encourage the sale of the house, and when market conditions are soggy, it is better to pay buyer-agents more commission, not less.

In the lawsuits, they will discuss agents steering their buyers to homes that pay higher commissions. It’s why the search portals publish the commission rates now so buyers can track whether their agent shows any bias based on the commission rate being offered.

It’s why the industry will be racing towards 0% commissions offered to the buyer-agents.

Eventually, the DOJ will probably step in and insist that ALL sellers pay 0% commission to the buyer-agents to insure there is no chance of steering. Instead, listing agents will just offer them spiffs under the table in a softer market or when the house is ‘unique’.

Until then, the listing-agent teams are going to keep offering lower and lower commissions (if any) to the buyer-agents – who will then try to get their buyers to pay them something….anything!

At the same time, the listing agents will be encouraging buyers to avoid paying a buyer-agent commission altogether by coming direct to the listing agent instead. Their in-house assistant-agents will attempt a faux representation of the buyer but it will just be a novice clerk who processes their paperwork.

Boom! The seller didn’t have to pay a buyer-agent commission – making these lawsuits worth it – and instead the listing agent keeps the whole commission. If buyer-agents can somehow wedge themselves into the deal, then great, but will the buyer pay them too, when it doesn’t seem necessary?

Mark my words – this will be standard fare in the next year or two.

by Jim the Realtor | Oct 16, 2023 | Forecasts, Inventory, Jim's Take on the Market |

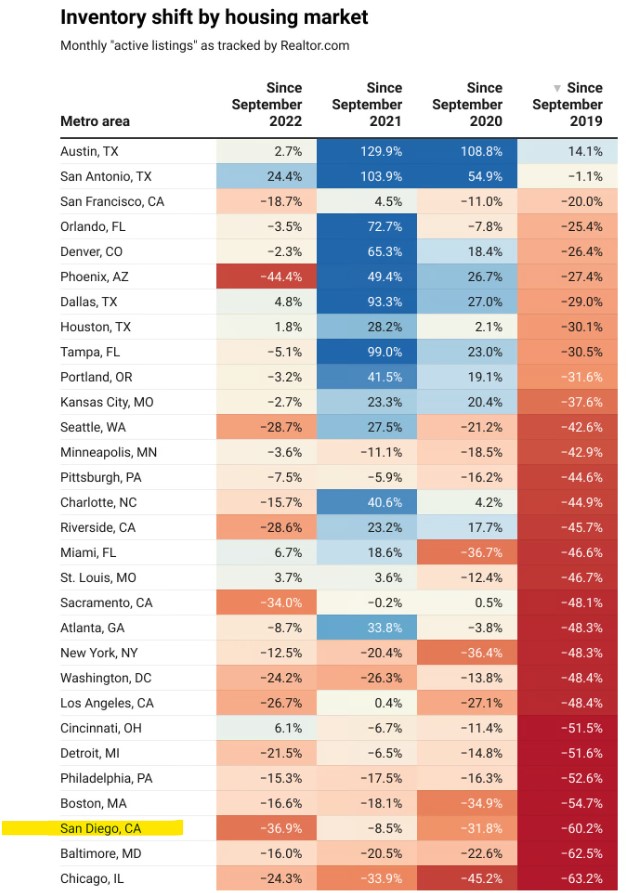

Recently the president of the local association of realtors was asked what the real estate market will do in the future. His response: “Nobody knows what the market is going to do in the future”. Of course, immediately after that comment he said, “Interest rates have to drop to 5.5%. Then you’ll see everyone get excited and say, ‘Hey, let’s sell our house and get another one.'”

Even if mortgage rates to go back to 5.5%, people are living in their forever home. The difficulty of finding a better home for a decent price will overwhelm any minor inconvenience at their existing home.

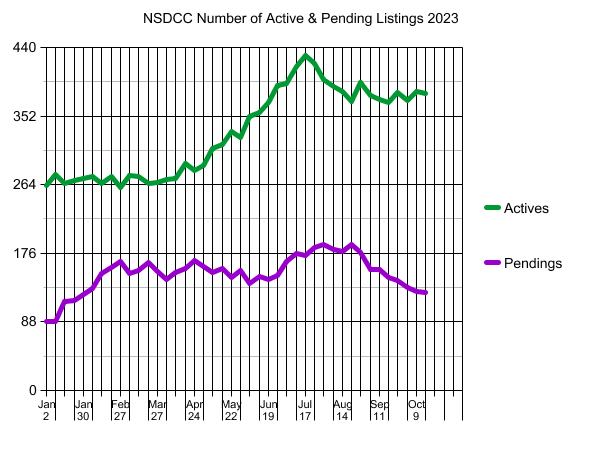

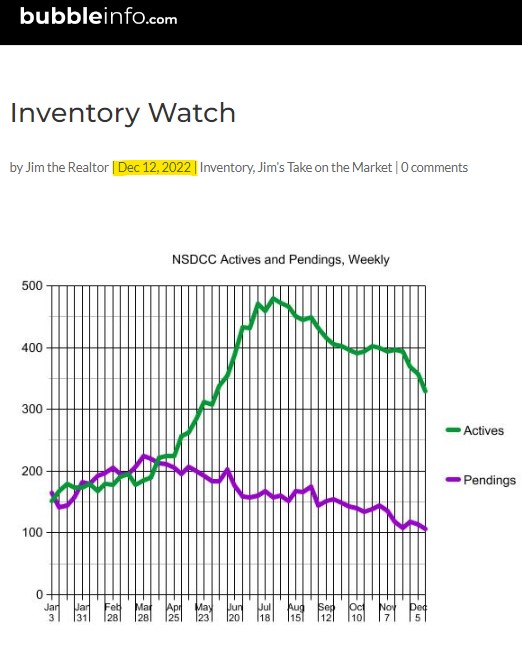

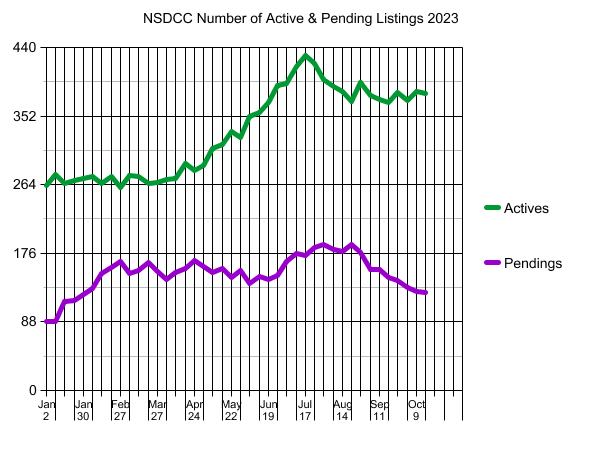

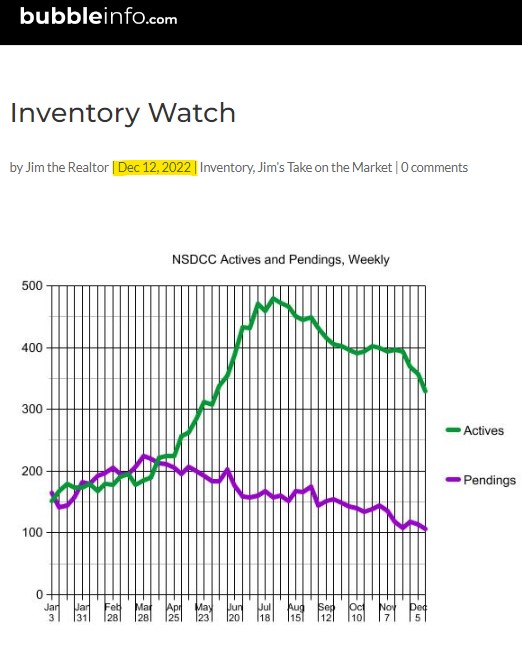

I don’t mind predicting the future. The rest of 2023 is going to look a lot like it did last year:

Next year, the inventory should grow quickly in the April-July time frame. Price will fix everything else!

(more…)

by Jim the Realtor | Oct 13, 2023 | Inventory, Jim's Take on the Market, Why You Should List With Jim

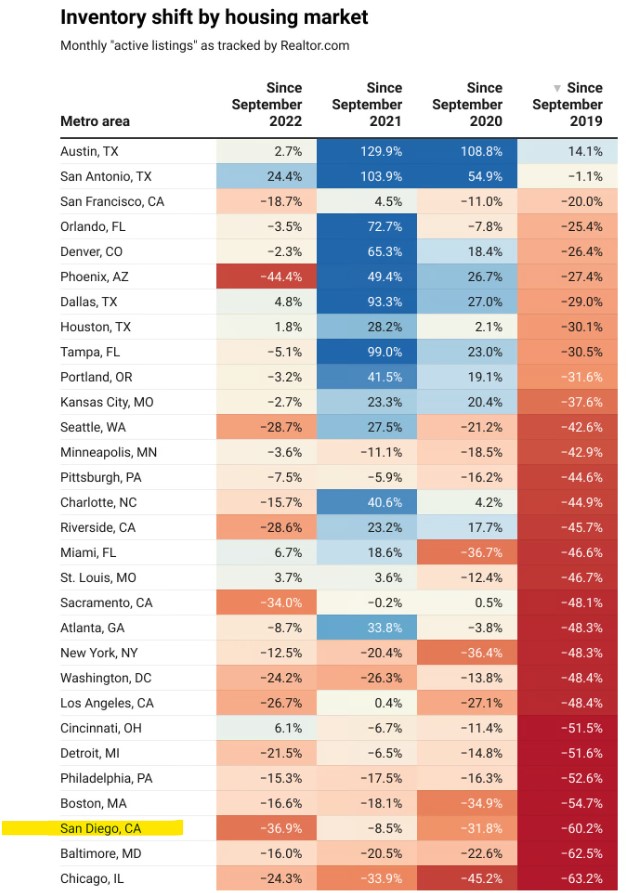

We have plunging sales mostly due to plunging inventory!

The supply and demand has plunged at the same time, and there is no way to know that if the inventory were to grow, would there be enough buyers to soak it up? Today’s inventory is full of the leftovers that didn’t sell during summer (today’s average DOM among NSDCC active listings is 77 days), so we can’t really judge it correctly now. But if you see homes that look good and are priced attractively but aren’t selling, then you know the tide might be turning.