by Jim the Realtor | Dec 6, 2023 | 2024, Forecasts, Jim's Take on the Market |

We’re in the forecasting time of year!

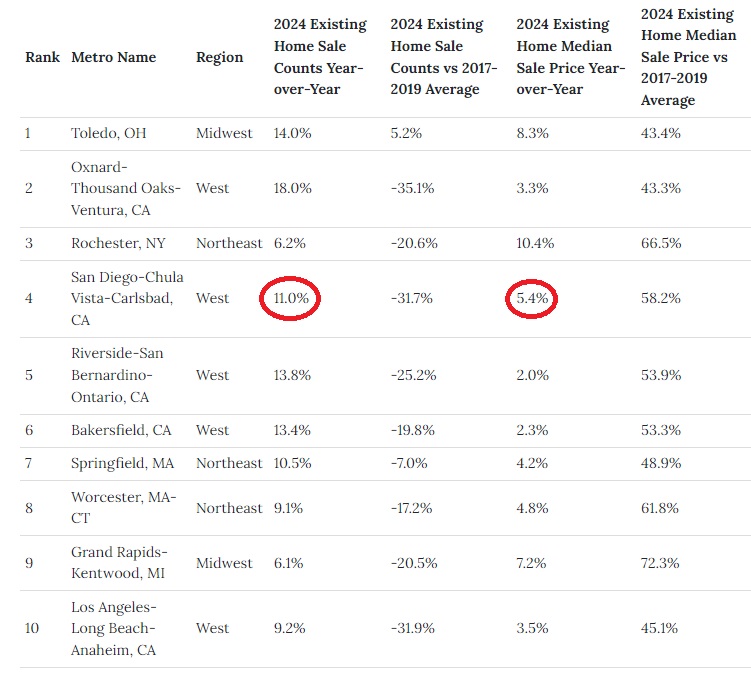

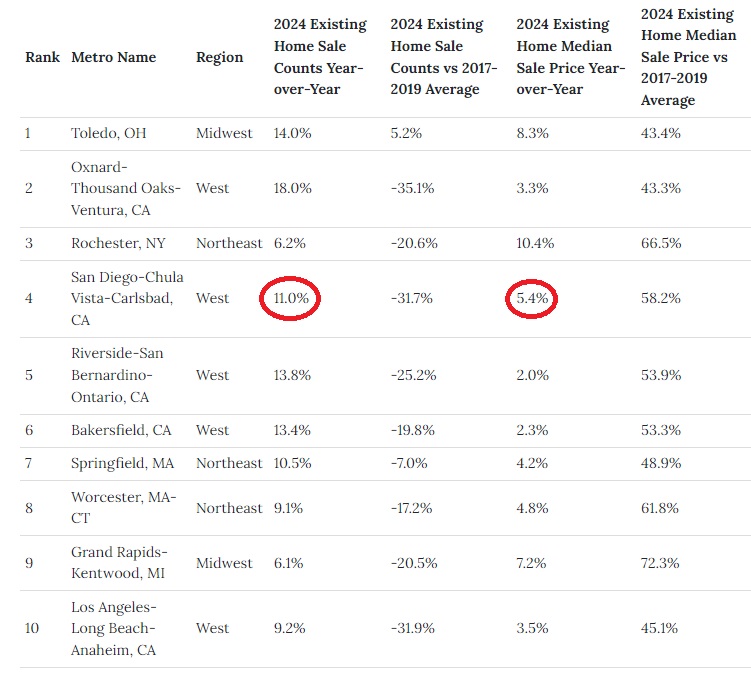

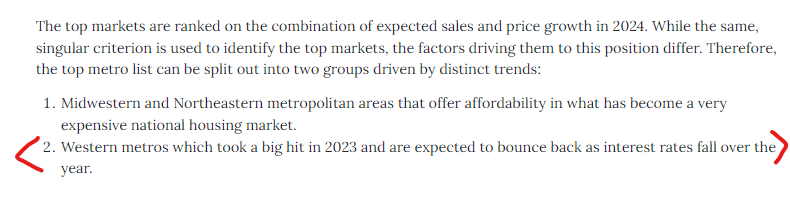

The chart above is from Realtor.com. We are used to the ivory-tower types who don’t bother to get out of their office or even pick up a phone. They just shine up their previous guess with some current events, like lower mortgage rates, and tell everyone we’re going to be fine.

But their guess that sales will be up 11% in San Diego is preposterious, and giving credit to lower rates doesn’t address the ultra-low inventory that is so likely to persist:

For sales to increase by 11% means that inventory will have to increase by the same or higher amount. While an 11% to 20% increase in the number of homes for sale would be fantastic for the market, there is virtually no evidence to support that idea – other than I have three listings booked already.

https://www.realtor.com/research/top-housing-markets-2024/

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

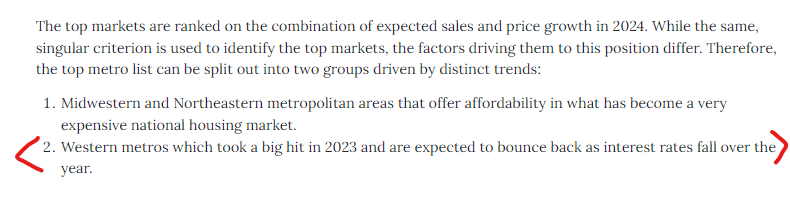

If you’d like to make your own predictions, here is some local data (La Jolla to Carlsbad):

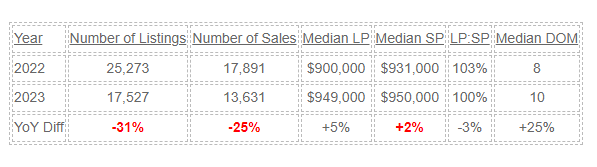

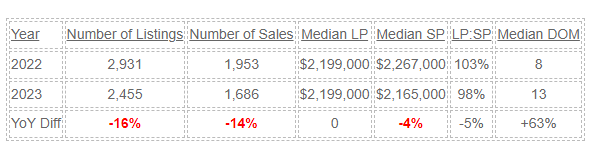

NSDCC Detached-Home Listings & Sales, Jan 1 to Nov 30

I’m guessing that sales will be flat/same in 2024, and the median sales price will be +4%.

Why? Because I think we’ll see mortgage rates in the sixes, which will help to energize the demand. The number of listings may grow slightly but not up by more than +10% and many will be wronger on price, which will cause the number of sales to be about the same as they were in 2023.

We know it will be hot during the selling season, it’s what happens in the second half of the year that will drag down the median sales price.

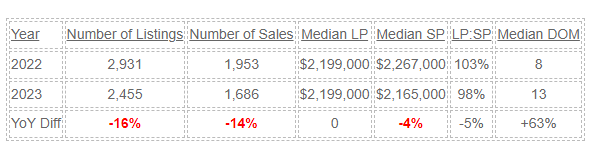

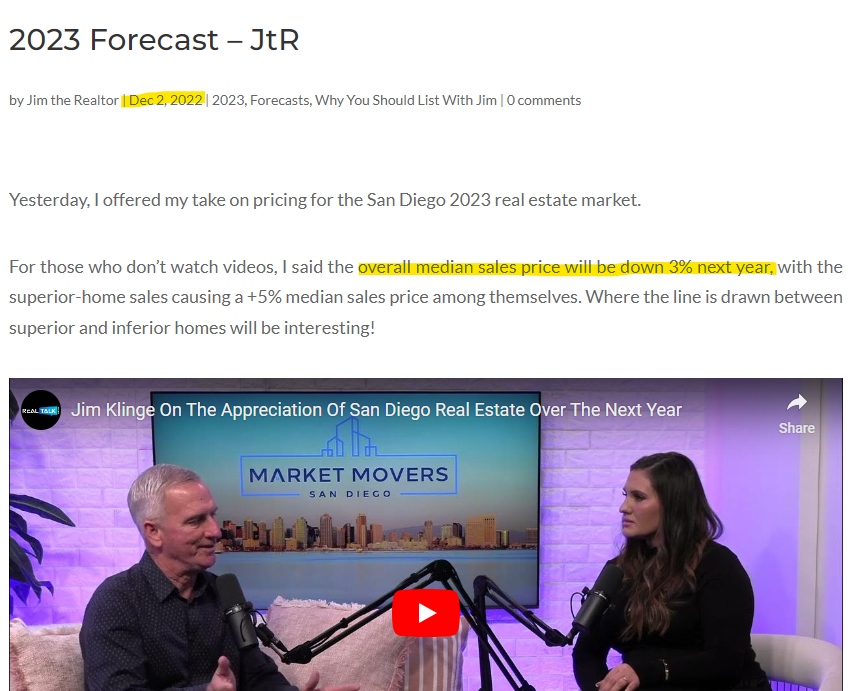

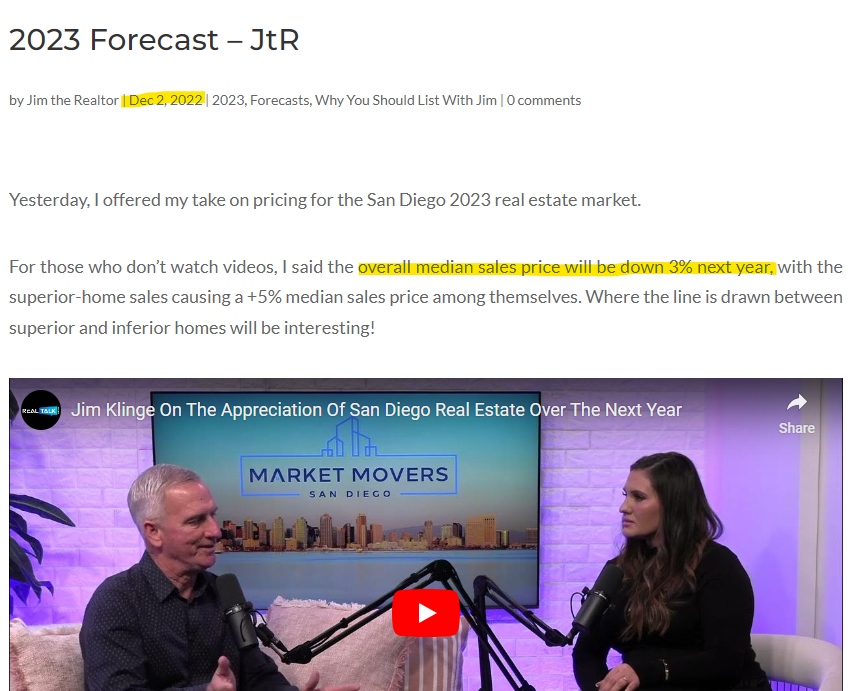

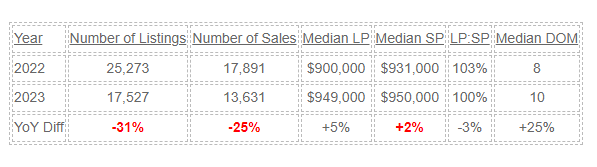

Here’s what I thought last December:

San Diego County Detached-Home Listings & Sales, Jan 1 to Nov 30:

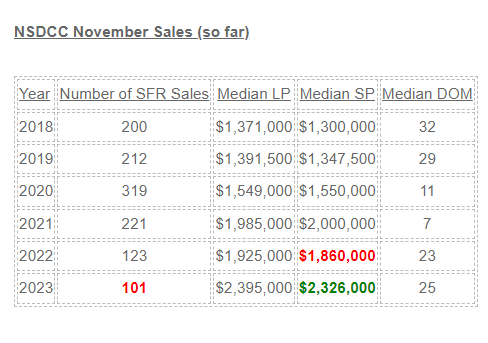

by Jim the Realtor | Nov 30, 2023 | Jim's Take on the Market, Sales and Price Check |

The market is so much different now than it used to be that we should jettison all previous assumptions (paraphrased from a Rob Dawg comment years ago).

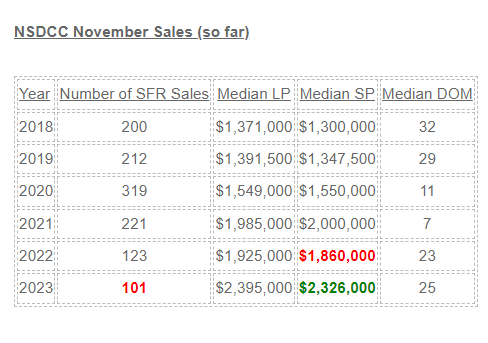

In the old days, prices would be coming down by now because the demand would have been severely impacted by higher prices and rates – but not today:

Is it just early? Maybe, but are sellers going to dump on price when there’s always next year? With virtually no foreclosures and unemployment, there aren’t the usual pressures on sellers, and most will wait it out, rather than lower their price in a panic.

The real impact will be on the number of sales. We’ve already experienced – and survived – around 100 sales per month in the off season, and if that happened every month of the year, we’d find a way to live with that too.

Sellers need to choose – do more to spruce up the house for sale, or be willing to take less. If the house is already dated and needing a full renovation, the discount will probably be getting larger, because buyers are putting up a fight.

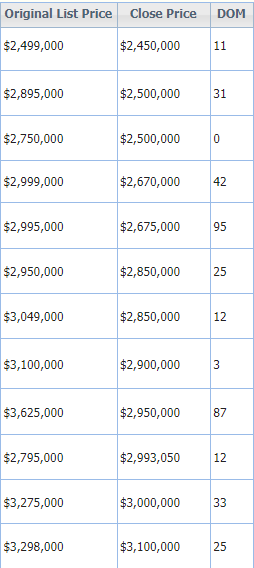

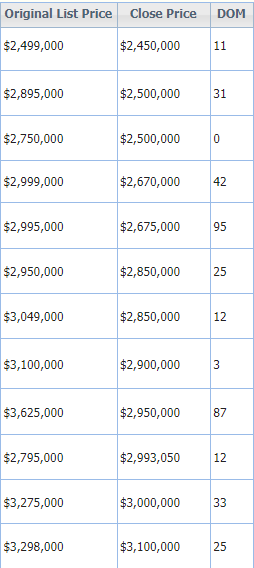

Here are examples of the November discounts – only one sold over list:

The median sales price could levitate, or even rise, while more discounts off the aspirational list prices keep happening!

by Jim the Realtor | Nov 29, 2023 | Inventory, Jim's Take on the Market, Market Surge, North County Coastal |

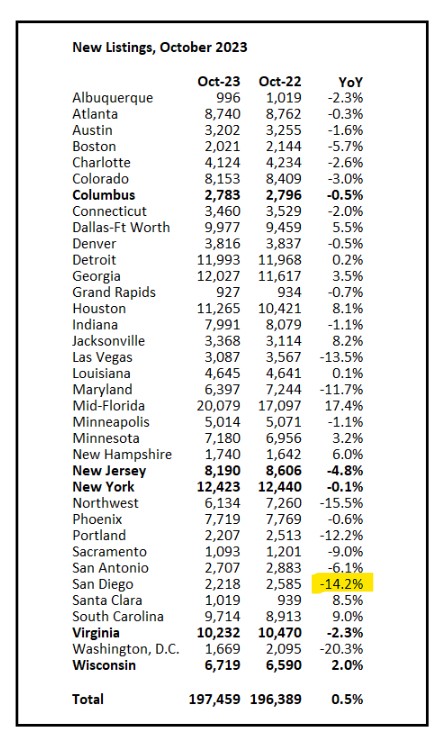

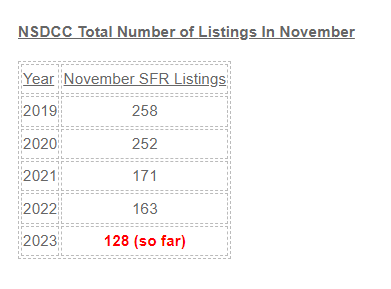

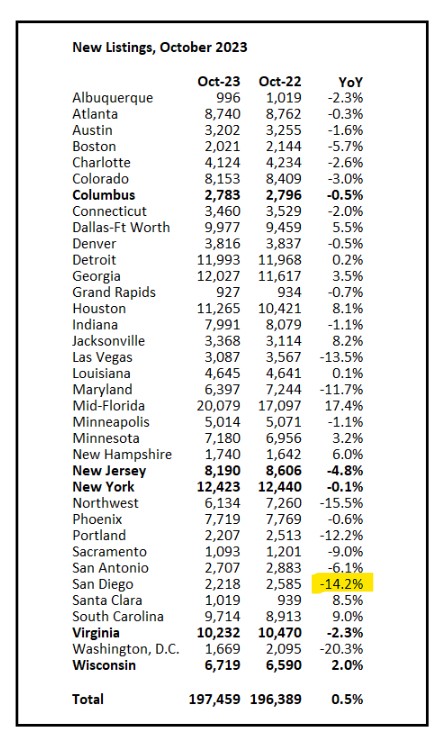

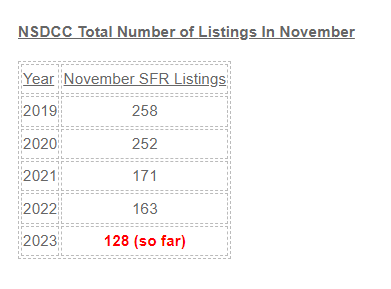

While a surge in inventory next year would help to change the market dynamics, there isn’t any hard evidence of it happening yet:

How many would be considered a surge? If the number of new listings rose 10% or even 20%, would anyone notice? Probably not.

Using these November numbers, and adding an extra 20% would only get us back to last year’s total – which we thought was bleak then. but now I’d take it!

It would take a real bump to get buyers to step back and say, ‘hold on, I’m going to wait and see where this goes for a month or two’.

Let’s guess that it would take at least a 25% increase in new listings for buyers to pause.

I was asking around yesterday, but nobody had anything definite to report about their new-listings flow for next year. One agent thought that we’re going to see a lot of short sales though (???).

by Jim the Realtor | Nov 28, 2023 | 2024, Forecasts, Jim's Take on the Market, Same-House Sales, Why You Should List With Jim |

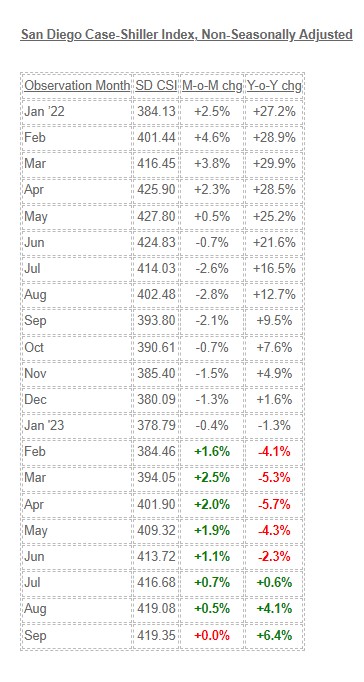

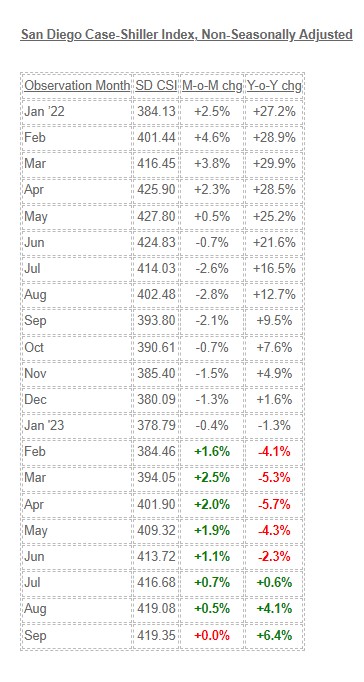

Ok, ok – yesterday I said that we’re at the highest pricing ever, but the San Diego non-seasonally-adjusted Case-Shiller Index isn’t quite there yet.

But it feels like record pricing around the north county coastal region, doesn’t it?

The index dropped eight months in a row last year, and it might track negatively over the next few readings of 2023 – big whoop. The index gave back 11% last year, and we’ve regained all but 2% of it this year. It is a seasonal event that will probably repeat in the coming years.

If the pricing keeps trending upward in 2024, at least it should be somewhat offset by lower mortgage rates this time. The quick rise in rates in the middle to late 2022 had to be reflected in the pricing, which it was. But this year, pricing held up nicely in spite of touching 8% rates recently.

I’m predicting an increase in listings next year, and it could amount to a full-blown surge. I already have three listings lined up for early-2024, which has never happened this early – there have been years where I get well into January without sniffing a new listing!

I’ll survey my fellow agents over the next couple of weeks to see what they say – two have already agreed!

by Jim the Realtor | Nov 21, 2023 | Jim's Take on the Market, Why You Should Hire Jim as your Buyer's Agent, Why You Should List With Jim |

What a great day! Delivering pies and talking real estate – what a privilege!

Talking points you might hear over Thanksgiving dinner.

– It’s too unaffordable. Prices have to adjust.

There will be the occasional seller who gets caught in a pinch and has to sell that day – and might take a 10% to 20% discount. All you have to do is be there on that day. It is why you have a realtor!

But will it be a superior home on a premium lot? Highly unlikely – those owners know what they got.

Buyers need to decide: Are you a lowballer, or are you trying to buy a high-quality property? It’s either/or.

Bottome line: Prices may adjust downward on the inferior properties. Take your chances.

– There seems to be more homes for sale – is it the big slowdown?

As time goes on and the market gets tighter, it will be natural for sellers to price too high and cause inventory to grow. It’s easier than ever to overprice and miss the market! What to do?

Spruce up the home and price attractively, which is about where the comps are….and not 5% to 10% higher.

Tip: Lately the local prices have been going up about 0.5% per month. But once a home is on the open market, the buyer expectations drop about 1% per week on price.

Once as home has been on the market for 2-3 weeks, there might be some negotiations on price!

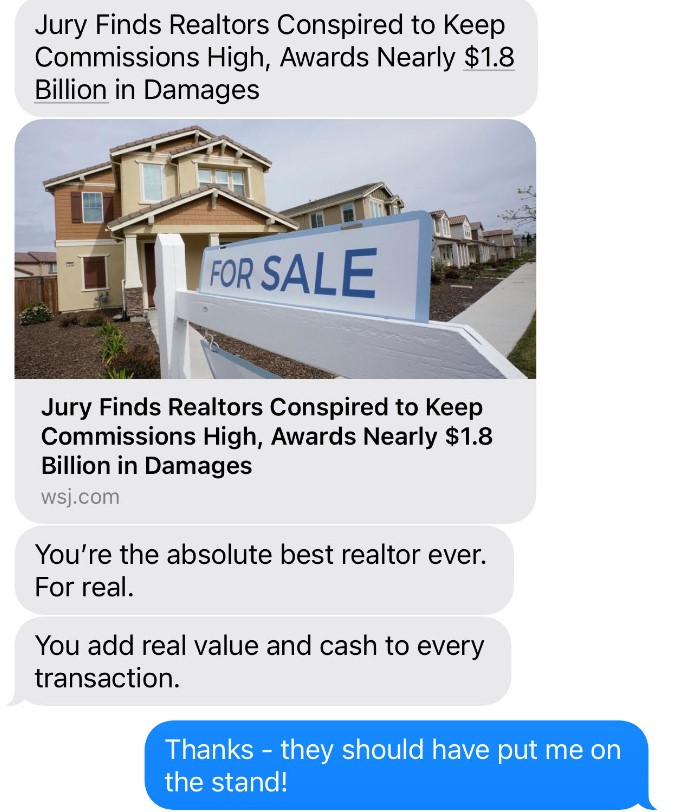

– Are commissions negotiable now?

Yes, absolutely and agents who are desperate and have no skills will be happy to represent you for 1% or less. It’s a ripoff. Find an agent who will produce beyond expectations. The best thing to come out of these lawsuits is that consumers will investigate agents more thoroughly!

Get Good Help!

If it gets hot, just call me. I’m happy to talk to people on the phone!

by Jim the Realtor | Nov 18, 2023 | 2024, Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

Zillow CEO Rich Barton weighed in on the bombshell cases in both an investor call and a shareholder letter. Barton’s key comment came early in the call when he said “We also believe complete disruption to the existence of buyer’s agents is improbable for a few reasons.”

Barton reaffirmed his support for buyer agents and the theme of buyers having their own representation. “We believe a well-lit game is cleaner and more equitable. People deserve and need independent representation,” Barton said. “We’ve seen double-siding in the industry, which is clearly a conflict and is at certain times more expensive to the transaction.”

Damien Eales, CEO of Realtor.com said, “I don’t think that from a consumer perspective, they are paying a great deal of attention to what is occurring more broadly in the industry. And as much as these court cases play out, I think it will be in some respects very much confined to the industry conversation as opposed to the consumer conversation.”

During his own investor call, Compass CEO Robert Reffkin pointed to the Seattle region, where sellers have not been required to offer buyers’ agent commissions for several years. Despite that change, Reffkin said, commissions in the area remain in line with the rest of the country — an outcome that suggests the bombshell lawsuits may not radically upend the status quo.

“I don’t think there’s any evidence to suggest that there will be pressure on commissions,” Reffkin said.

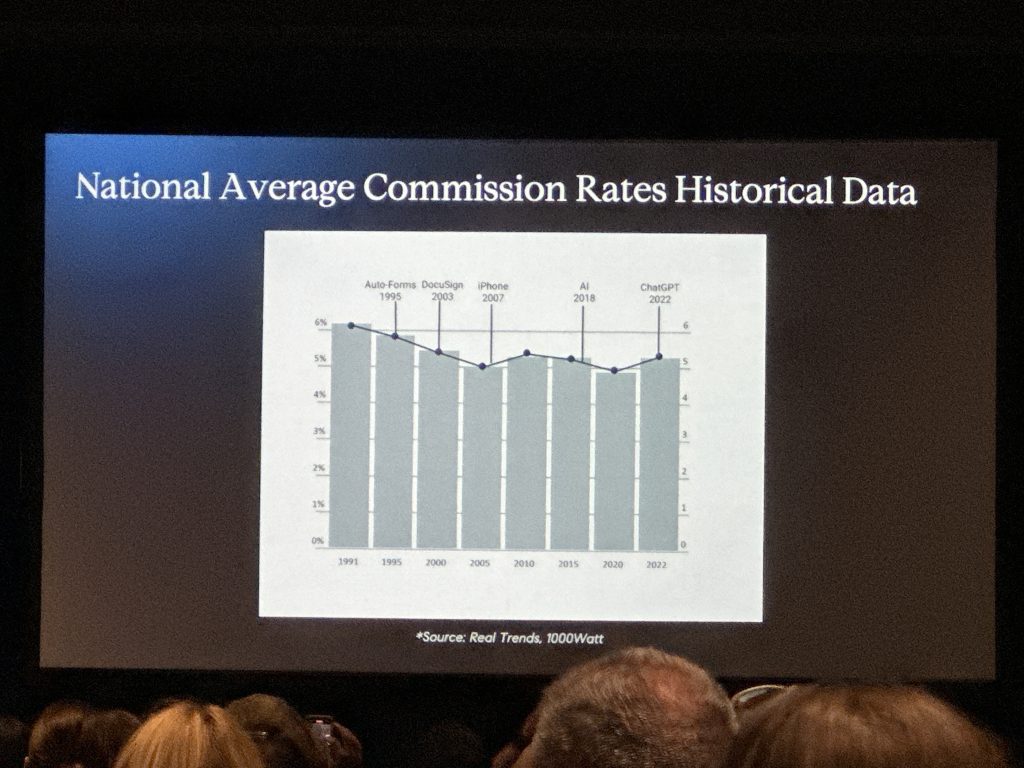

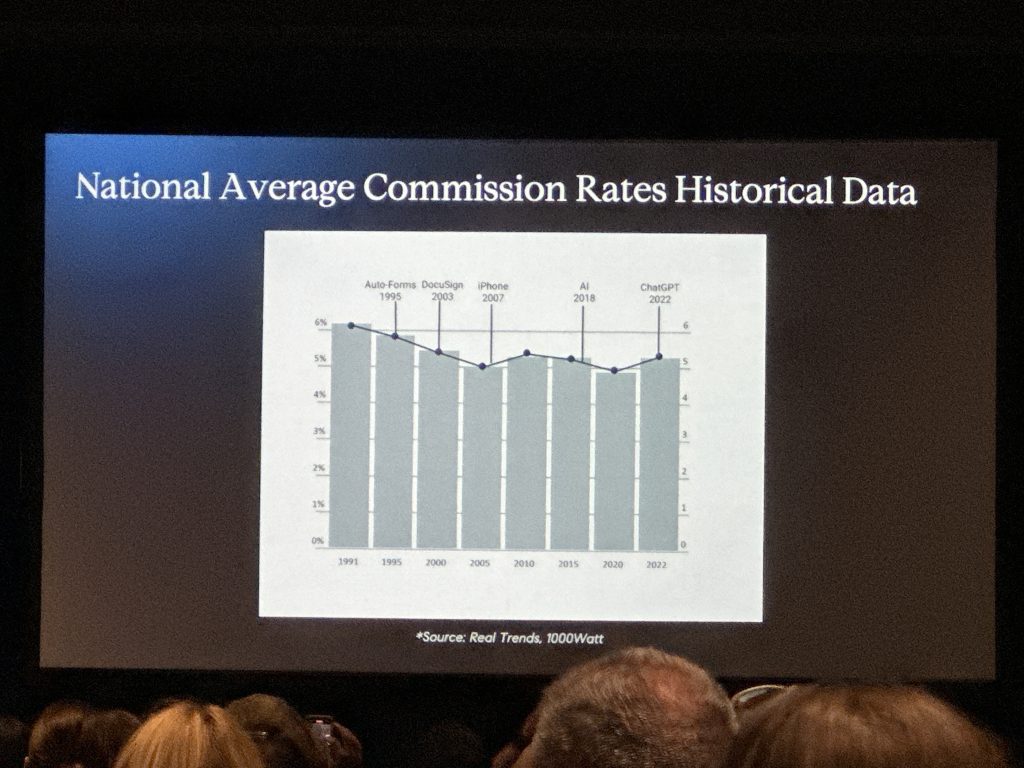

The history of steady commission rates will be mentioned in the lawsuit appeals.

Doesn’t the history suggest a conspiracy? Especially when combined with the ascent of home prices? Lawyers for the plaintiffs will note that the annual home appreciation gives the appearance of realtors getting a raise in income every year – including +40% since 2020.

There is no conspiracy on the street. It’s too competitive between agents!

Any pressure on commission rates will come from agents who are desperate to eat. The perfect storm of market conditions should push hundreds of thousands of agents out of the business. As they exit, they might give a seller a deal – if they can find a listing opportunity.

What do sellers and buyers want – the best rate, or the best agent? It’s one or the other.

Hopefully this mess will cause consumers to thoroughly investigate the choices. Otherwise, this will all blow over in a few months – unless the Department of Justice does something permanent.

Get Good Help!

by Jim the Realtor | Nov 6, 2023 | 2023, Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop, Why You Should Hire Jim as your Buyer's Agent, Why You Should List With Jim |

The first week after the realtor-lawsuit verdict went as expected – chaos, doom, and no sexy alternatives. It will take years to appeal, but it won’t matter how it turns out. Buyers are going to be paying their agents.

If sellers aren’t obligated to pay any commission to the buyer-agents, will they appreciate the benefit of incentivizing buyer-agents with a bounty, or reward? Probably not, unless their listing agent makes it very clear, and insists on it.

It is more likely that listing agents won’t push it, and because sellers naturally will want to pay less commission and not more, they will list for 2.5% or 3% and hope for the best. Both will shrug it off, and joke about how it’s about time commissions came down!

It will be a grave mistake.

Why? Because the buyer-broker agreement is a disaster:

- Buyers won’t like it.

- Agents won’t like it.

- The market won’t like it.

Today’s buyers are picky, and you can’t blame them. They’ve had to endure +40% on prices, +200% on interest rates, and -50% on inventory…..talk about challenging!

The buyer-broker agreement will be a disaster because both agents and buyers will sign a short-term arrangement and hope the seller might kick in some of the commission. But then everyone will go back to doing it the same way we always have – refreshing your feed every hour and praying!

The real opportunity will be for buyers to hire an aggressive buyer-agent who does more than just watch the MLS. When a seller hires a listing agent, they get a thorough marketing campaign to source every potential buyer in the market. Buyer-agents can do the same, in reverse!

The buyer-agents who offer a rifle-shot soliciting of specific homes that fit the needs perfectly of their buyers will eventually find one. If an aggressive buyer-agent brings the complete package to the seller’s table without having to mess with a full listing, they will likely get an audience. It could even take the place of listing agents!

Because auctions aren’t close yet, this could be what changes the world of residential resales!

It will mean more off-market sales, which means more fuzzy comps because not much if anything is known about the home’s condition. But if it catches fire and the MLS or a rogue search portal insists on buyer-agents reporting everything about their sales including photos, we could still have a database full of accurate market data. But if we don’t, we don’t – good luck everybody!

by Jim the Realtor | Nov 2, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

Are realtor commissions negotiable?

Sure….how high do you want to go? 😆

Commissions aren’t all the same, just like agents aren’t all the same. Different agents charge different rates because they do different things for the consumer. Commissions/fees range from $100 to 7%. Nice range!

So if all that matters is paying less for your agent, then shop around – there are plenty of discount agents. You might consider hiring the very best agent you can find – one who pays for themselves, and more.

This is the question that has never been answered by the industry:

“If agents employ different skill sets and services, why do they all get paid the same?

It was mentioned in the recent lawsuit, and they presented it as part of their case:

72. Additionally, because the Rule requires a blanket offer, the Rule compels home sellers to make this financial offer without regard to the experience of the buyer-broker or the services or value they are providing — in other words, the Rule treats all buying brokers and their services the same. The seller is required to offer the same fee to a buyer-broker with little or no experience as that offered to a buyer-broker with twenty years of valuable experience. Accordingly, there is a significant level of uniformity in the payments that sellers must pay to buyer-brokers.

73. As a result, there is little relationship between the commission and quality of the service. “Skilled, experienced agents and brokers charge about the same price as agents with little experience and limited knowledge of how to best serve the consumer clients.” In a price-competitive market, less experienced and less skilled brokers and salespersons would be offering consumers lower commission rates, but they have no incentive to do so because of the Rule.

74. The Rule creates tremendous pressure on sellers to offer the “standard” supra-competitive commission that has long been maintained in this industry. Seller-brokers know that if the published, blanket offer is less than the “standard” commission, many buyer-brokers will “steer” home buyers to the residential properties that provide the higher standard commission.

The changes or fines from the lawsuit(s) probably won’t matter much today. Offering no commissions to buyer-agents is a nice idea, and you’d think it would cause agents to publicize the full set of productive services they offer to their buyers to convince them to pay the fee. Don’t get your hopes up.

Ideally, the consumer would research the detailed resumes and work histories of each prospective agent and make an informed decision. The agent pages on Zillow do provide the basics, but based on results, consumers aren’t using them much.

It’s why realtors have a lousy reputation – consumers keep hiring the inexperienced/bad agents, and the industry doesn’t mind because they make more profit off them.

Get Good Help!

by Jim the Realtor | Nov 1, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

Now what?

The National Association of Realtors clearly underestimated the chances of losing this case – and the others to come. They must have thought that touting their 100-year old Code of Ethics was all that was needed to impress people, and instead they found out that it doesn’t.

What doesn’t get addressed is the common belief that realtors are overpaid.

It is a wide-spread belief. Even Joe Kernen, a guy who works 15 hours per week and gets paid between $3,000,000 and $22,000,000 per year (depending on the website), has to open his CNBC show today with the declaration that 6% commissions are too much, and 1% would be more like it.

This is what needs to be addressed. Can agents explain their value?

Listing agents are used to making a presentation to homeowners, but 80% of the time, the sellers have already decided on who they will hire so the presentation doesn’t have to be great. Buyer-agents rarely discuss what they do – they just have people jump in their car and go look at houses.

The judge and/or the Department of Justice will rule on future sellers paying the buyer-agent commission. If sellers are allowed to pay a commission to the buyer-agents, then their listing agent can counsel them properly on what rate to offer, and the status quo will endure. But it will be a game-changer if the sellers are no longer able to offer ANY commission to buyer-agents.

With the former, the listing agents will have to discuss the pros and cons in detail to the sellers, and agree to a comfortable amount. With the latter, the buyer-agents will have to create a presentation to convince their buyers to pay them directly. This will be a new practice, and they won’t be very good at it.

By the end of the day yesterday, I had already been notified of three different seminars being offered about using the Buyer-Broker Agreement. It sounds simple enough to the ivory-tower types – just get your buyers to pay you the commission! But they underestimate both sides.

Agents aren’t jumping at the chance to work with buyers in the current market.

It takes months or years for buyers to finally win the right home at the right price, and the abuse from the listing agents is mean and nasty along the way. Nobody plays by the same rules, and multiple offers are mishandled regularly, which delays the buyer finally getting a house.

The 2024 Selling Season will begin with buyer-agents pleading with their prospects to sign a contract to pay them a commission. It will only take a few months for this practice to get exposed. The buyers will be reluctant to sign, and those that do sign a contract will find out that it won’t change the outcome. It is still going to take months to find the right house, at the right price. There will still be the typical aggravations and shenanigans with the listing agents – most of whom now insist on buyers providing a bank statement and lender pre-approval letter just to see a house.

Because the local inventory is will be ultra-low, the desperation will cause buyers to blame their agent. It is a fact of life with both sellers and buyers – if they don’t get the outcome they want, it’s too easy to blame their agent (especially when it is true most of the time).

Will sellers and buyers be more diligent about who they hire?

They never have been – they just grab an agent and hope for the best. They don’t know the right questions to ask; they don’t want to waste time investigating thoroughly; and besides, the buyers just want a house, and the sellers just want their money.

This is where each agent and the industry at large could go a long way towards providing a solution.

If there was an outpouring of explanations on how the business works, what to expect, and why a consumer should pay the fee, it would help. Maybe write a blog or something!

Without a delberate attempt to educate everyone, the business will gravitate to the lowest common denominator – single agency, where buyers go direct to the listing agent, and the benefits of buyer-agency are slowly forgotten. Next year will be the phase-out stage.

It will be the next step towards auctions becoming the way to sell houses!

by Jim the Realtor | Oct 29, 2023 | 2023, Flips, Jim's Take on the Market, North County Coastal |

Could there be trouble brewing under the surface?

Are there home sellers scrambling to get out with whatever money they can? Maybe get just enough net proceeds for the family to have a steak dinner at closing? It was like that last time…..but it’s different now.

It’s a lot different now!

Let’s check the home sellers who purchased during the pandemic days. Those who bought their home before 2020 are having no problem selling for substantially more than they paid, so we only need to check the recent purchasers. Is anyone losing their shirt?

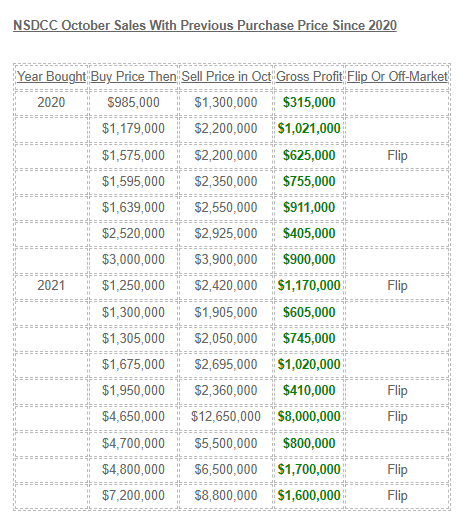

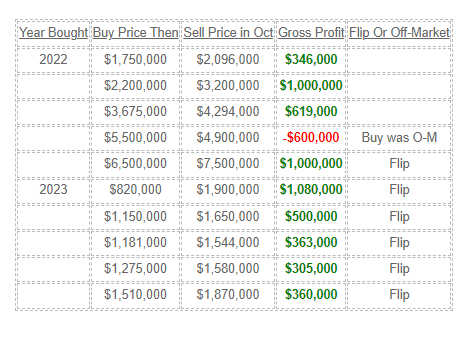

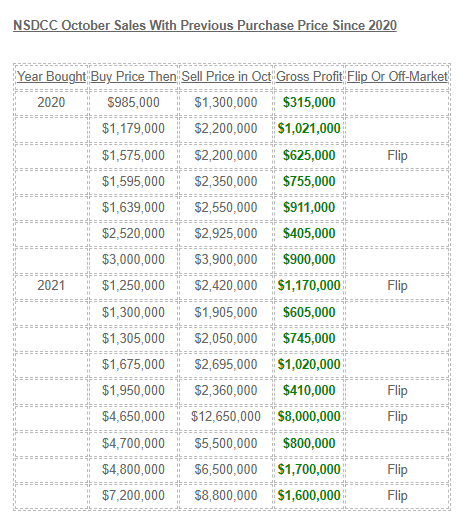

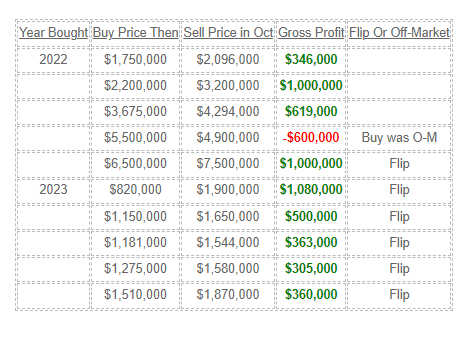

This month’s NSDCC sales are up to 117 – here are the ones that were purchased since 2020, and comparing what they paid then to their sales price this month:

Observations:

- Twenty-six of the 117 sales had purchased since 2020 (22%), but 12 of the 26 were corporations in the business of making money. They succeeded!

- The median gross profit was $750,000.

- Fourteen of the 117 sellers (12%) were regular buyers since 2020 who found a reason to sell this month.

- Even if they were in some sort of trouble, they still made out nicely – and for all we know, there were many who sold JUST BECAUSE they could hit the jackpot!

- The only seller who lost money had purchased 1,700sf for $5,500,000. Think twice about doing that!

- There are at least 100 sellers EVERY MONTH who are walking away with $1,000,000+ in their pocket!

Could there be trouble ahead for those who bought this year if prices declined substantially? Maybe, but rates have been rising for 18 months so they shouldn’t be surprised about future market shifts – if any.

For them to purchase a home in spite of market conditions must mean they are in it for the long haul.

P.S. The flip that made $8,000,000: Click here