Could there be trouble brewing under the surface?

Are there home sellers scrambling to get out with whatever money they can? Maybe get just enough net proceeds for the family to have a steak dinner at closing? It was like that last time…..but it’s different now.

It’s a lot different now!

Let’s check the home sellers who purchased during the pandemic days. Those who bought their home before 2020 are having no problem selling for substantially more than they paid, so we only need to check the recent purchasers. Is anyone losing their shirt?

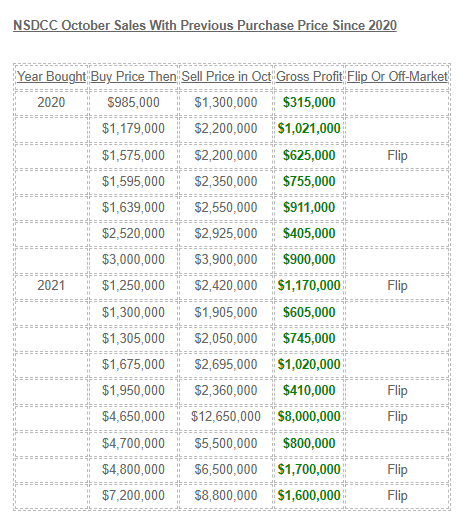

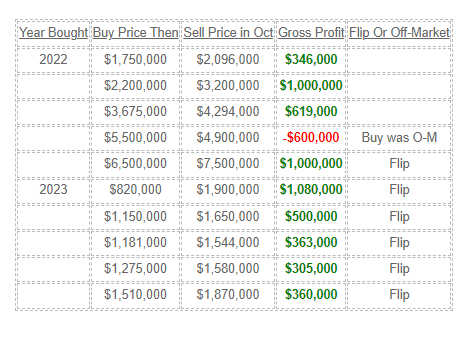

This month’s NSDCC sales are up to 117 – here are the ones that were purchased since 2020, and comparing what they paid then to their sales price this month:

Observations:

- Twenty-six of the 117 sales had purchased since 2020 (22%), but 12 of the 26 were corporations in the business of making money. They succeeded!

- The median gross profit was $750,000.

- Fourteen of the 117 sellers (12%) were regular buyers since 2020 who found a reason to sell this month.

- Even if they were in some sort of trouble, they still made out nicely – and for all we know, there were many who sold JUST BECAUSE they could hit the jackpot!

- The only seller who lost money had purchased 1,700sf for $5,500,000. Think twice about doing that!

- There are at least 100 sellers EVERY MONTH who are walking away with $1,000,000+ in their pocket!

Could there be trouble ahead for those who bought this year if prices declined substantially? Maybe, but rates have been rising for 18 months so they shouldn’t be surprised about future market shifts – if any.

For them to purchase a home in spite of market conditions must mean they are in it for the long haul.

P.S. The flip that made $8,000,000: Click here

Sounds like a lot of musical chairs going on at the high end.

Problem is there’s not enough 1st time buyers because the can’t make a new home + 8% mortgages work with current salaries.

Can the higher end keep the market afloat? In America traditionally there’s always been a large middle class. However in other countries 10% of the people have 90% of the money. Maybe we’re moving more in this direction.

Sellers are smart to appeal to the baby-boomer retirees making their last move.

Nearly 50% of post-2020 buyers who sold in October were corporations (12 out of 26) — how many of those sales were to other corporations?

None

So how often has it ever NOT been a bad idea to buy a house when prices are booming and only hold onto it for a short time?