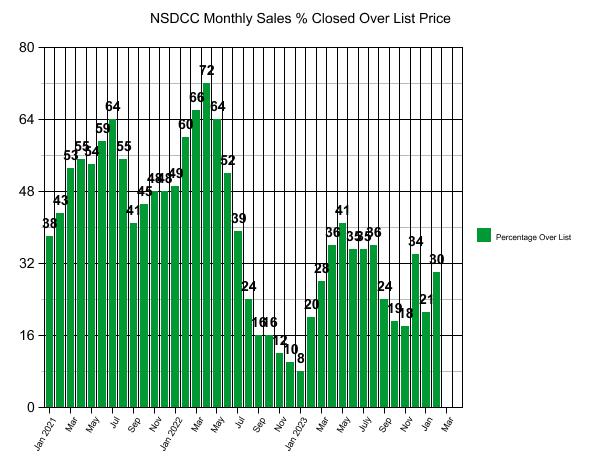

Over List, February

The Over-List buys jumped up to 30% in February as the selling season got an early start in 2024.

The 156 sales in February is the real proof, and the pricing is the highest since the peak in early 2022:

The market is already in full-tilt boogie mode!

Property Auction – Pro Style

I mention how tough it is to find anyone who has a bidding-war strategy, but it’s because our expectations rose dramatically in 2010 after witnessing one of the best of all-time.

They were auctioning off a vacant lot owned by the City of Del Mar.

This video starts at the beginning of the auction, and the bidder at the bottom of the screen was a proxy for Carson Palmer – who eventually got the last laugh when he built a 6,580sf house on this lot and then sold it for $18,000,000 in 2020.

The auction starts at $1,000,000 – but watch how fast it climbs, particularly from $3,000,000 to $4,000,000. Did he have to pay that much? How about the guys in suits running around, the cameraman, and the auctioneer’s chant all contributing to the excitement. It was over before anyone could think!

Carson also paid a 10% buyer’s premium on top, so his final purchase price was $4,400,000:

The Buy of a Life Time!

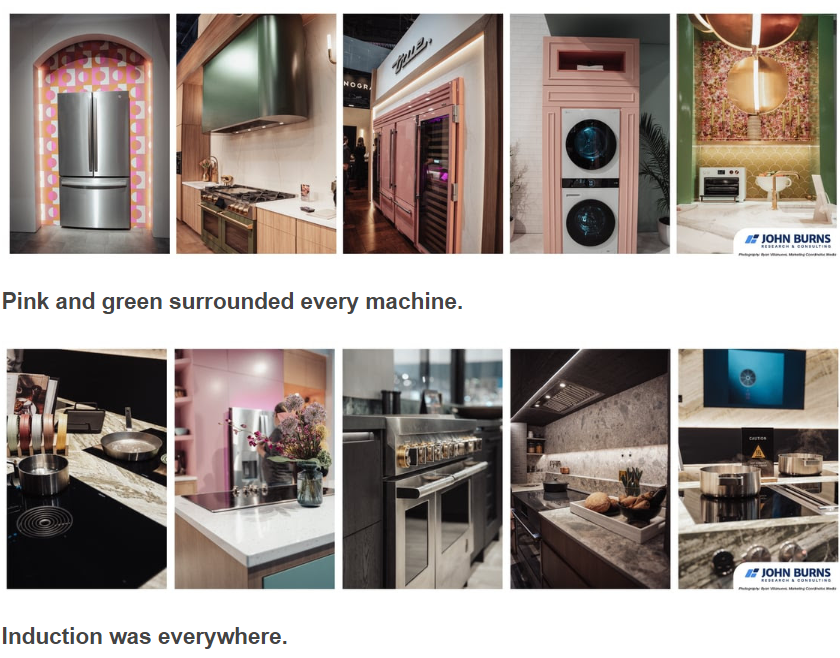

New Design Trends

Last week was the International Builder Show | Kitchen & Bath Industry Show 2024 in Las Vegas.

John Burns was there and in his newsletter today he featured the following gizmos:

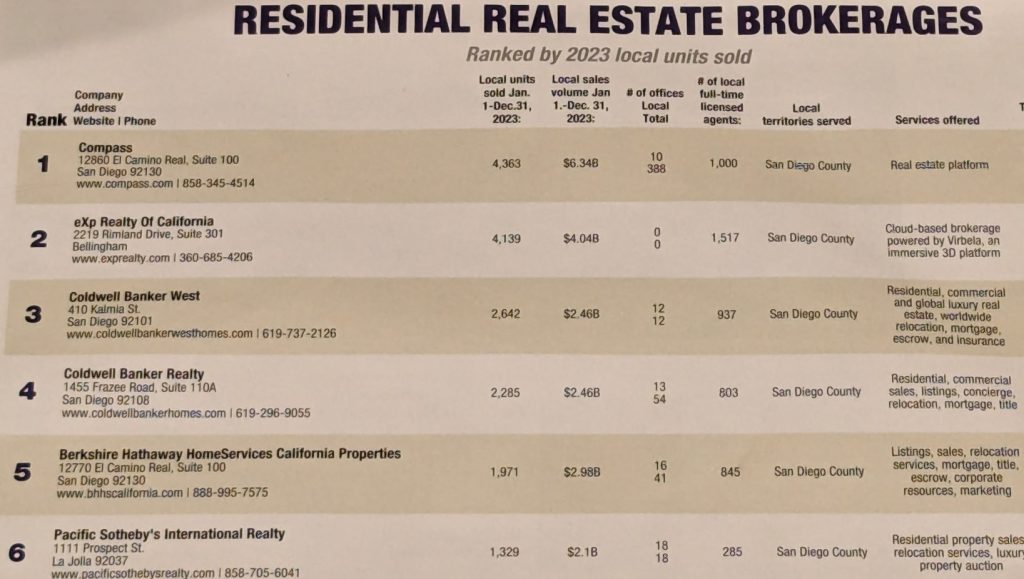

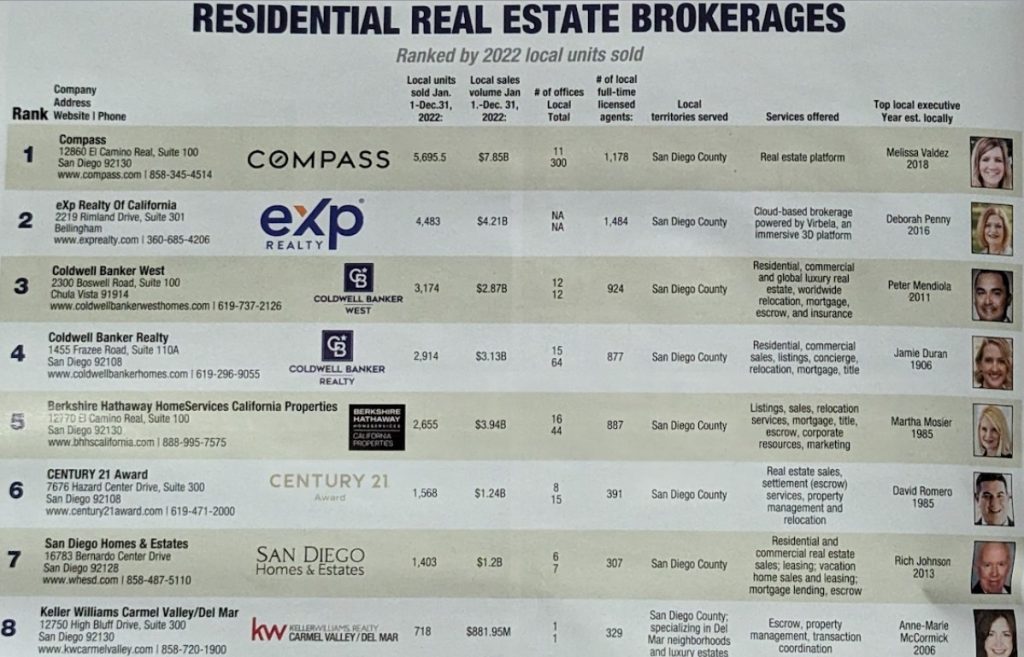

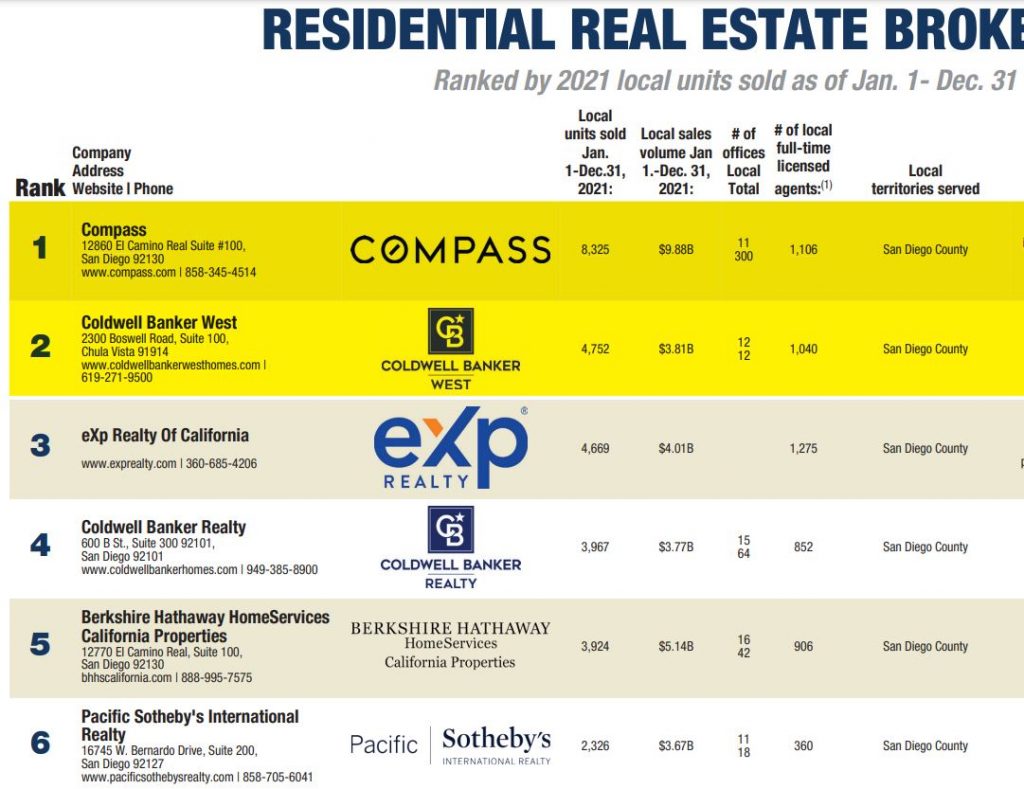

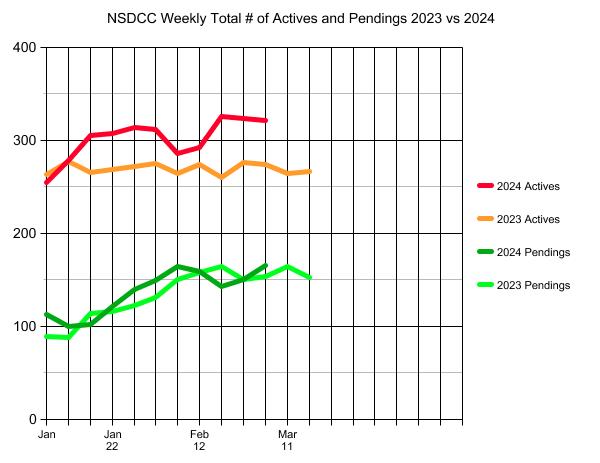

Local Brokerages, Sales & Volume

The general market conditions have appeared relatively healthy over the last few years, but the above demonstrate why brokerages – especially those operating on thin margins – have been feeling the pain.

Volume has dropped considerably between 2021 and 2023:

Top Five Brokerages

The 2-year stats for the whole county were even worse. Sales were down 44%, and volume was off 36%. Even the 2019 county stats were better than in 2023. Sales last year were 37% lower than in 2019, and volume was 3% lower.

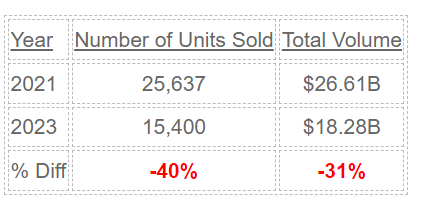

Inventory Watch

There have been 12% more listings YoY in the first two months of 2024, and buyers are responding!

Closed SFR sales between La Jolla and Carlsbad are +20% YoY in the first two months of the year!

It’s why the number of active listings (red line above) isn’t exploding, AND there have been 88 new pendings in the last two weeks – which is about twice the pace we had in January. The median LP of those 88 pendings is $2.5 million, which means pricing will be at least +10% higher than last year. Wow!

Los Altos Price Explanation

There had to be skeptics to my Los Altos Adventure last weekend.

Did you mis-price the house by more than a million dollars on purpose – or just by accident? Come on – you were 440 miles out of your normal market area….dude….you got lucky!!

I like to pay close attention to the market activity in the days before inputting a new listing. This was the latest listing by the guy who has just captured nationwide attention of his lowball $10,000-commission offer to the buyer-agents. As of Wednesday night, this was still active, and I told my sister that I didn’t want to compete directly because mine would help to sell his. If it was still an active listing when I woke up on Thursday, then I’m not coming up and we will postpone the listing for at least two weeks due to weather:

https://www.compass.com/app/listing/764-parma-way-los-altos-ca-94024/1510956913476773969

Miraculously, when I woke up the listing was marked pending – so I left for Los Altos.

All I had to be was the most attractive new listing in a very exclusive area (Nvidia is based in San Jose). There had to be losers from the Parma bidding war who were motivated to buy the next one, and there was nothing else for sale at this price point.

I was talking it up with every agent who came to my open house, and eventually I found an agent who was in the same office as the buyer-agent of Parma – and they confirmed that it sold for $4,150,000! Do you think I told that to every person I met over the next 48 hours….yes!

Let’s note my options: Either price attractively and have buyers bid it up, or price at retail and wait.

Here’s an example. The size of house and lot are pretty similar to mine, and it’s a busy street too. How are they doing? They listed for $3,998,000, and 30 days later they are still unsold:

https://www.zillow.com/homedetails/1107-Covington-Rd-Los-Altos-CA-94024/19533609_zpid/

There is an easy guide for pricing:

The more obstacles that need to be overcome, the more attractive the price needs to be.

I’ve been showing houses to buyers the last couple of days, and this theory has never been more clear. As we walk into a house that appears to be priced at the top of the range (or higher), the skepticism builds with every step – and we’re looking for any reason NOT to buy.

But when you walk into an attractively-priced home and see defects, they just confirm why the price is attractive – buyers don’t expect perfection when the price is attractive!

What happens once a home hits the open market depends on the listing agent. Yesterday, one was blaring his Jesus music, and another was chatting with the sellers who were still hanging around even though the open house started 15 minutes earier. Most listing agents aren’t implementing any bidding-war strategy – heck, yesterday there was one agent who didn’t even know the price of the home!

In reviewing the Los Altos comps, about half of them had closed over the list price, so I knew it was going to be hot. I knew that I was selling a house that looked all original, and was on a busy street. So we priced it attractively and I aggressively implemented my tried-and-true bidding war strategy that works!

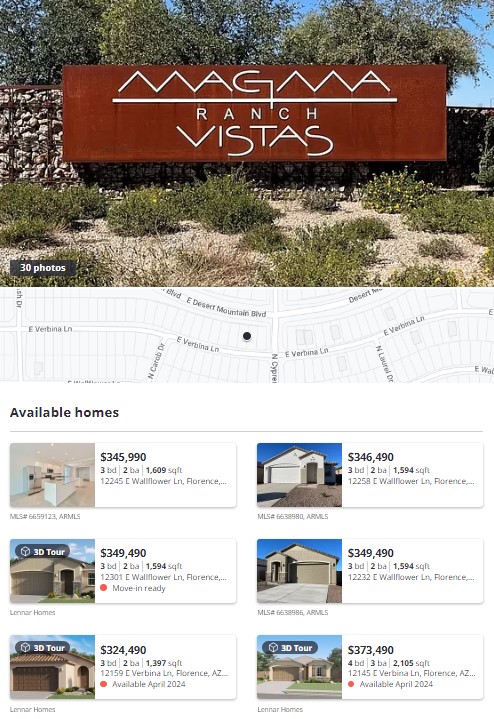

Florence, AZ

Look at these prices for new homes – just an easy one-day cruise across the desert!

https://www.zillow.com/community/magma-ranch-vistas-premier/29997323_plid/

Rest of 2024

We can expect that the election season will be like no other in the history of the USA!

Prepare accordingly!

Can you imagine how this will play out? If Biden wins, there will be a civil war. If Trump wins, he’s promised that there will be full chaos on Day One. We can write off the 4Q24, and maybe more!

CV, Encinitas, & Carlsbad Sales and Pricing

Happy March!

These are updated on the first of the month and are interactive:

No real concerns there. The low volume causes the bumpy appearance, but for the most part, the pricing is fairly steady. If there were a downward trend for a few months, it would be different.