Move to Italy?

16,000sf on 7.4 acres!

16,000sf on 7.4 acres!

These ivory-tower guys have explored the topic of rising inventory and it’s relationship with declining home prices – and backed up their conclusions with math that every rocket scientist should love!

https://home-economics.us/when-should-we-worry-about-rising-inventory/

Their summary in layman’s terms:

We answer two questions:

Our conclusions, in brief:

We estimate the inventory threshold at 5.0 months. Below that level, inventory has only a weak relationship with year-over-year home price changes. But above it, the relationship becomes more clearly negative, signaling price declines 9 months in the future.

Importantly, this is not a vague association. The fit is unusually strong: our best-performing model—a 9-month lag with a 5.0-month threshold—yields an adjusted R² of 0.75, indicating that it explains a substantial share of the variation in home price growth.

Based on the model coefficients, we calculate that the predicted change in home prices turns negative at 5.81 months of inventory.

In other words, once inventory rises above 5.0 months, prices tend to soften. If inventory climbs above 5.81, the model implies that year-over-year price declines are likely to follow—with a lead time of about 9 months.

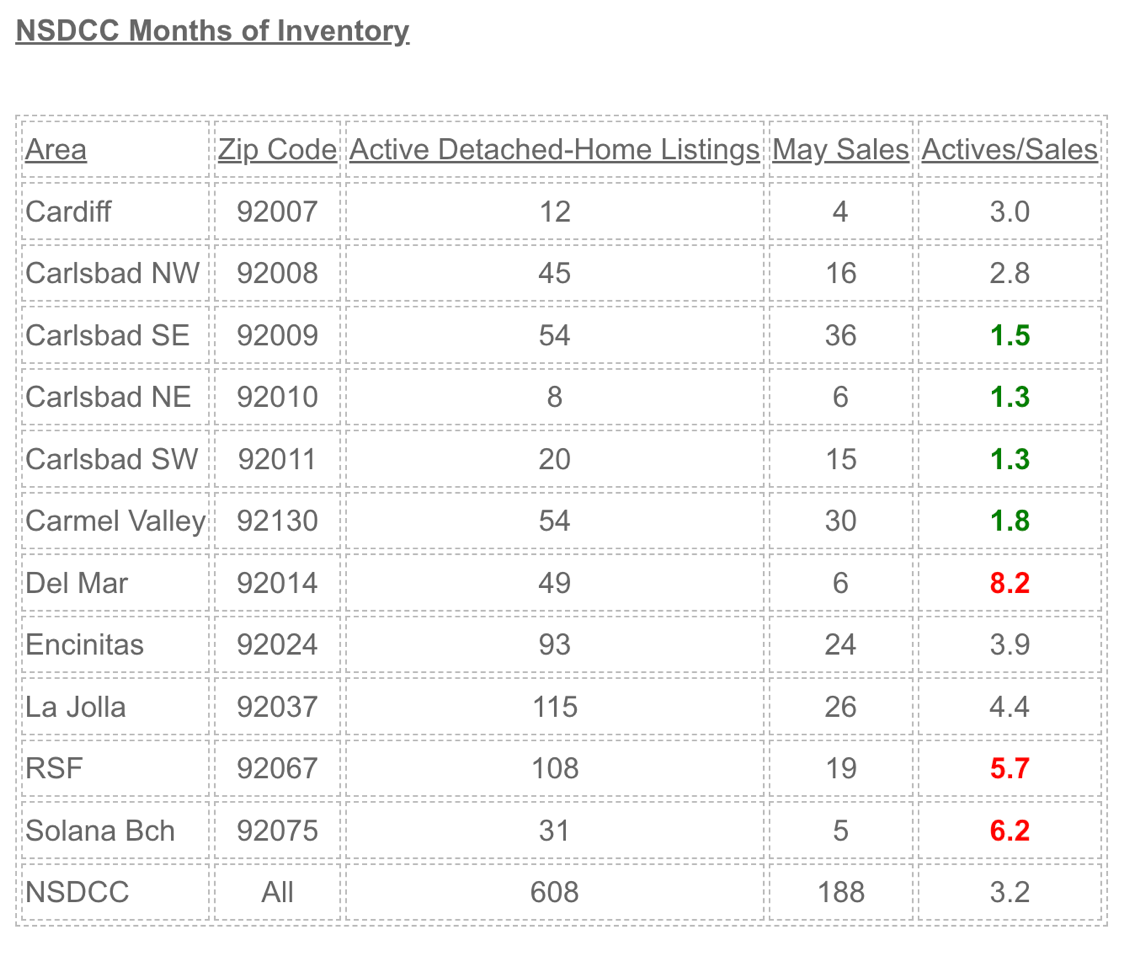

The months of inventory is measured by dividing the current inventory by last month’s sales. For the NSDCC, it means 608/188 = 3.23 months of inventory.

But the NSDCC sales in June are lagging way behind. There have only been 111 closings this month and Monday is the last day. If it gets up to 125-130 sales, then the 608/130 = 4.7 months of inventory!

Let’s break it down to the individual zip codes:

The areas under 2.0 should be fine, at least for now.

But I’ll add that the impatience of sellers who failed to sell this year will be intensifying in 2026. The researchers’ 9-month-window-before-price-declines could be shorter once longtime sellers see a flood of inventory in the new year.

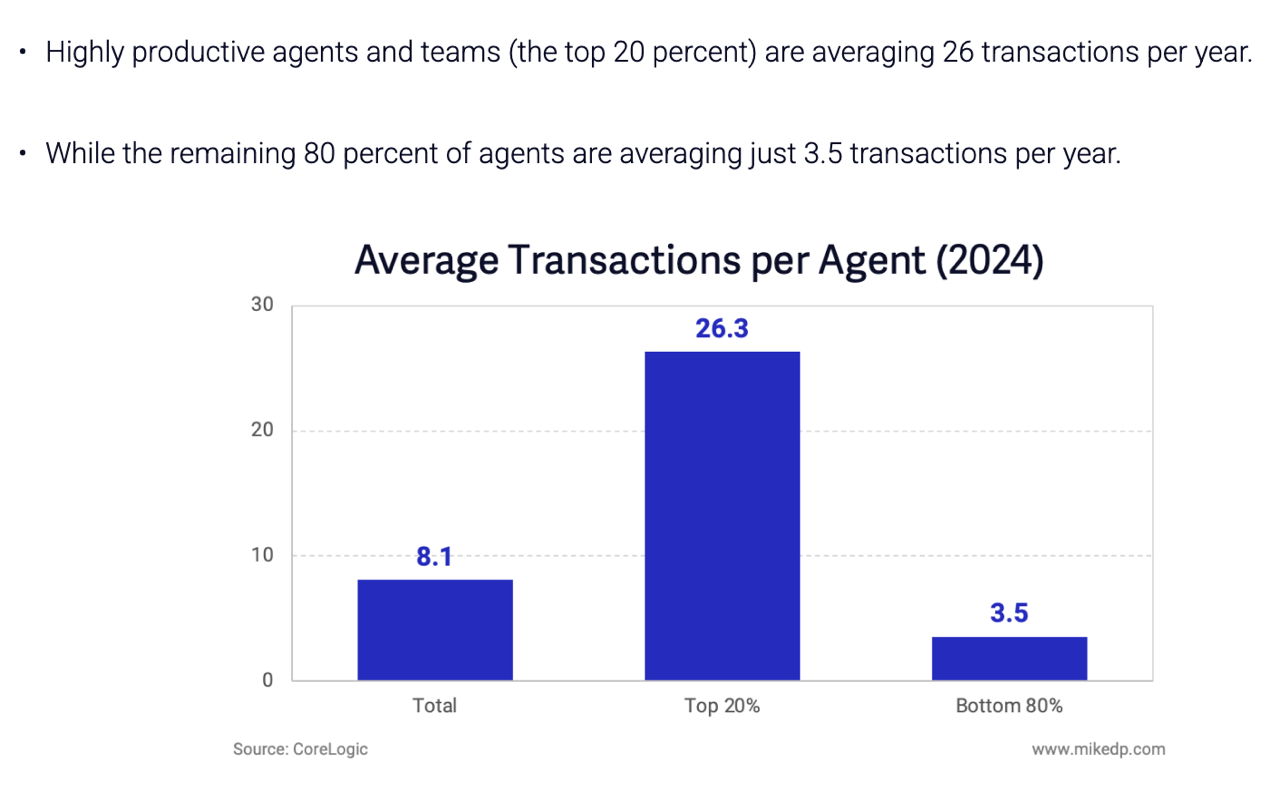

The importance of hiring an experienced agent during tough times can’t be overstated. Every agent can handle the easy deals in the absence of chaos and uncertainty. But the deals are going down harder than ever now.

Buyers are gaining more control of the market every day, so the agent’s ability to understand that and advise their clients properly is critical. The evidence of how well an agent is navigating these turbulent times is their number of sales – can they get people to the finish line? Check their number of closed sales at Zillow.

Get Good Help!

https://www.mikedp.com/articles/2025/5/12/the-top-20-of-agents-do-65-of-transactions

P.S. We’ve closed 20 sales this year. Hopefully we’ll get to 26.3 by December!

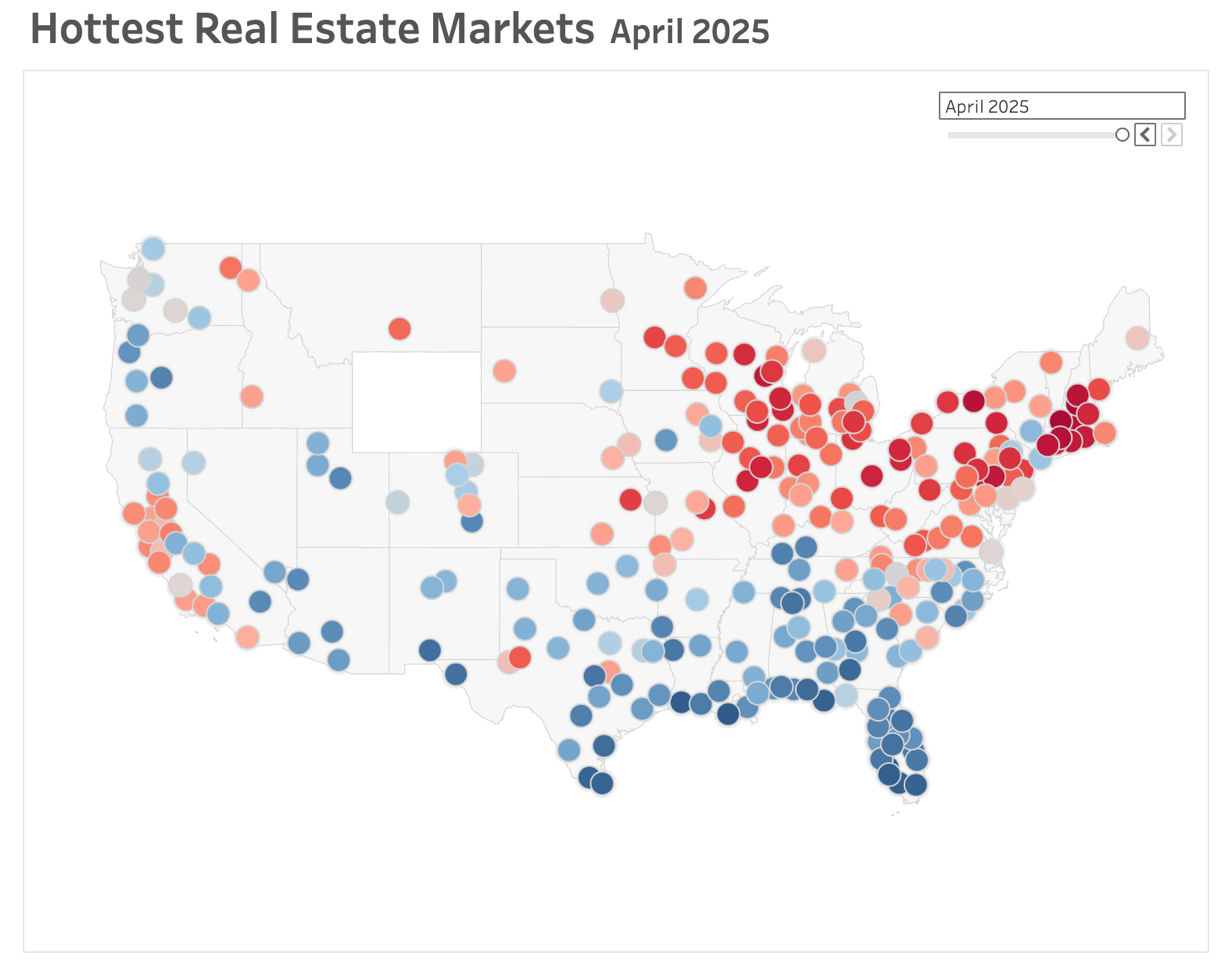

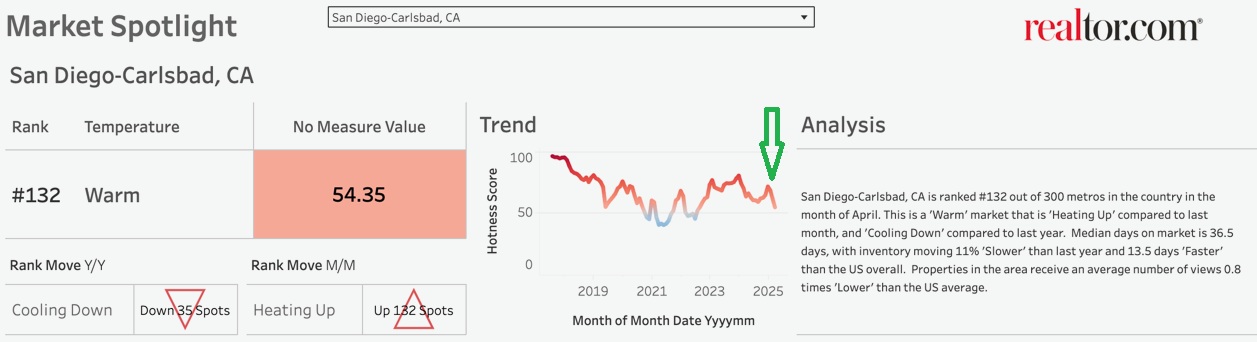

The San Diego metro area is considered ‘Warm’ by realtor.com, but only because of the fantastic start we had this year. Our ranking among other metros is plummeting:

Jan: #65

Feb: #72

Mar: #96

Apr: #132

My green arrow above points out how if it weren’t for the hot action in January and February, we would have been on a steady slide.

It looks obvious by now, doesn’t it?

We’re going to muddle through the rest of 2025 and then have a nice pop to start next year. Probably not more than two months of 2026 hotness though, and then back to the muddling as inventory grows faster and higher than it did this year.

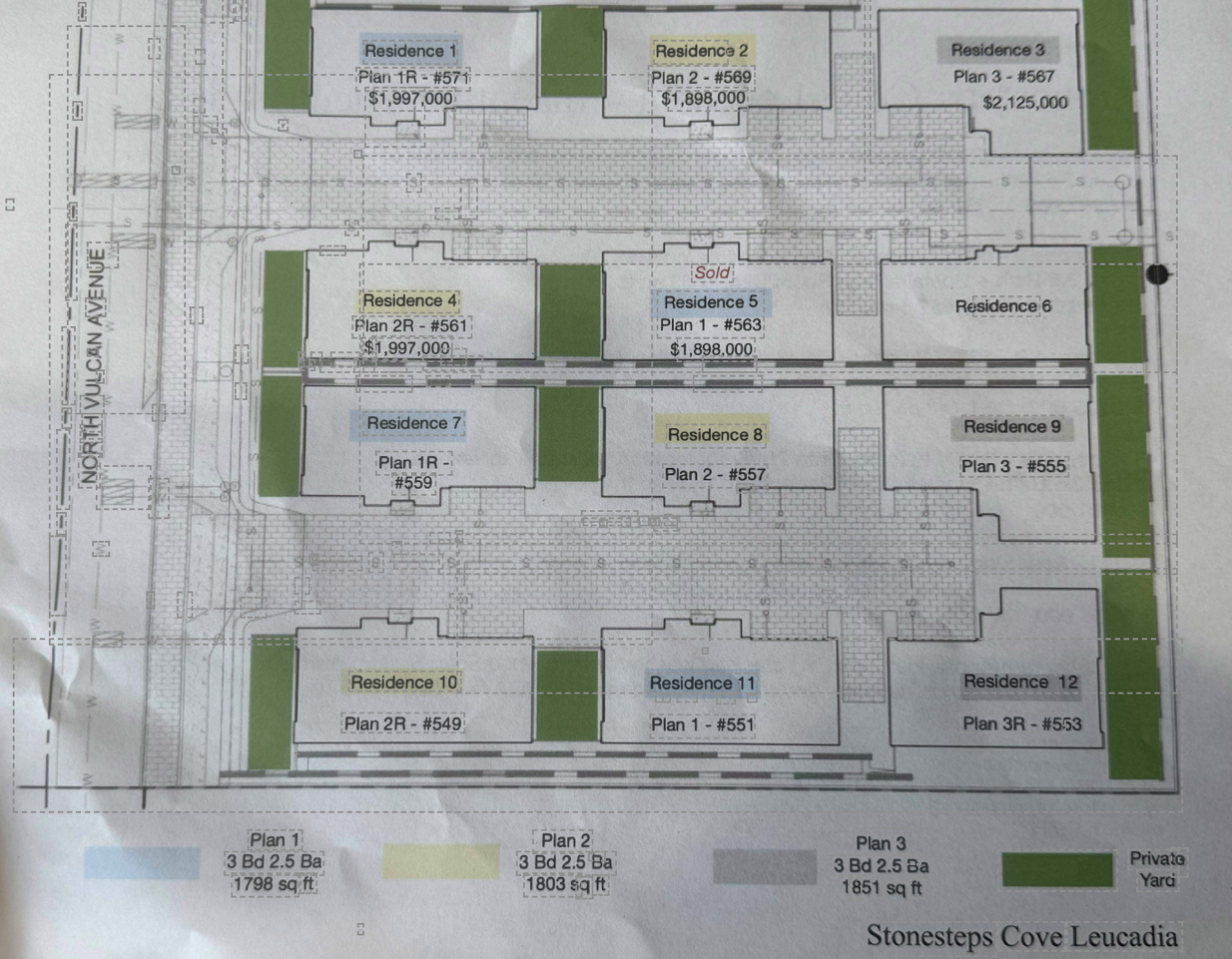

These are as good as anything else at the beach! Plus a peek at a $3.2M in La Costa Oaks.

Mick Ralphs, lead guitarist for Mott the Hoople and Bad Company, passed away this week. He’s on Paul’s left here. I agree with one of the readers – Bad Company deserves to be in the Rock and Roll Hall of Fame:

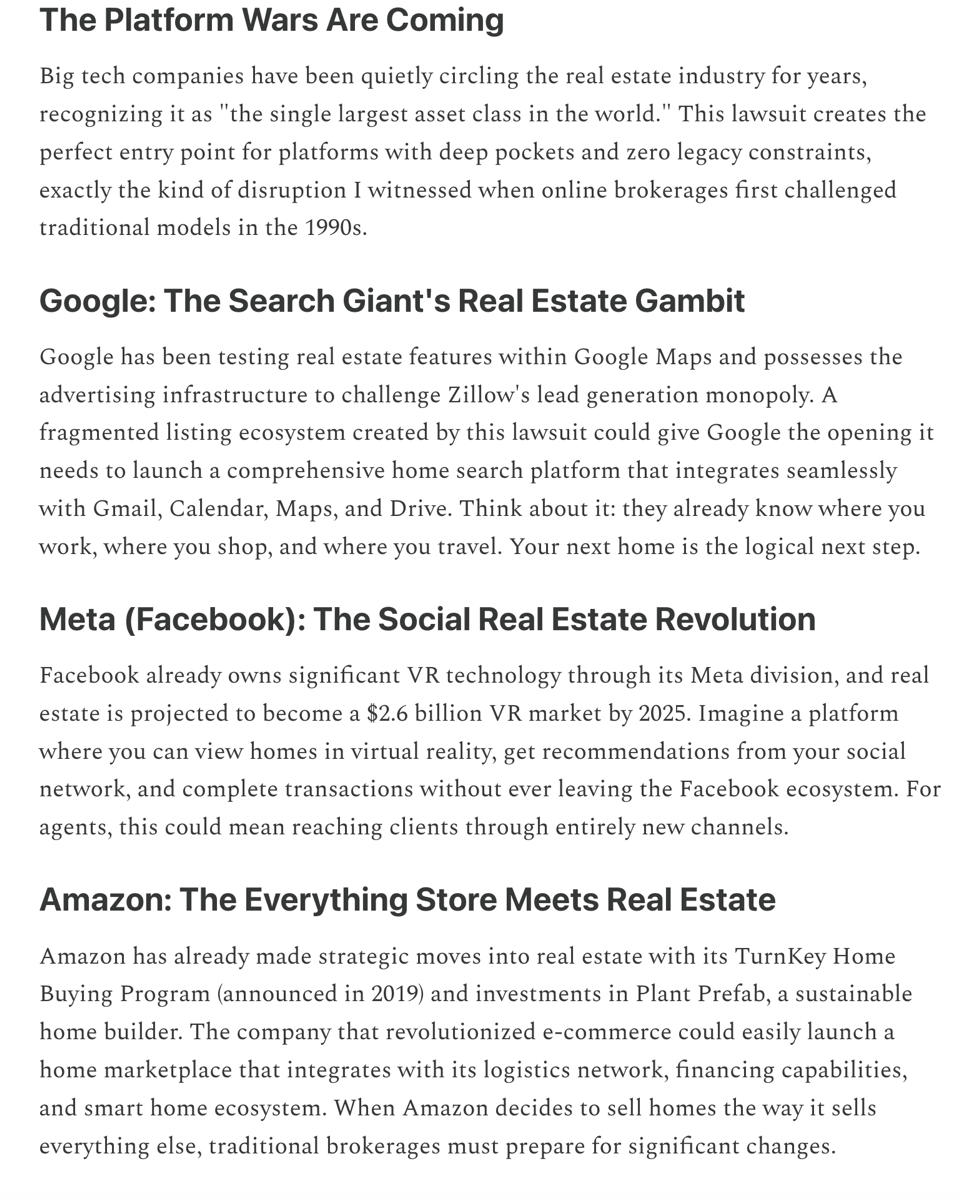

It looks like the Compass vs. Zillow lawsuit could change the world.

A long-time broker/attorney filed his response here, and he thinks Compass has a strong case – and Robert Reffkin added his thoughts in the comment section:

https://notoriousrob.substack.com/p/guest-compasss-antitrust-gamble-could

The author thinks it’s likely that Zillow settles the case, and ends their ban of listings that don’t comply with their rules. But more importantly, he thinks it will open up the home search to others:

If Zillow settles, it means there will be more private marketing of homes. It’s acceptable to keep listings in-house, and we’re going to be forced to deal with it. The public will be on the outside looking in, and because the market conditions are already tough, agents might resort to actions we haven’t imagined yet.

P.S. I checked – Compass Private Exclusives make up 0.8% of the total NSDCC sales this year (7 out of 884). We have just scratched the surface of the private marketing of homes!

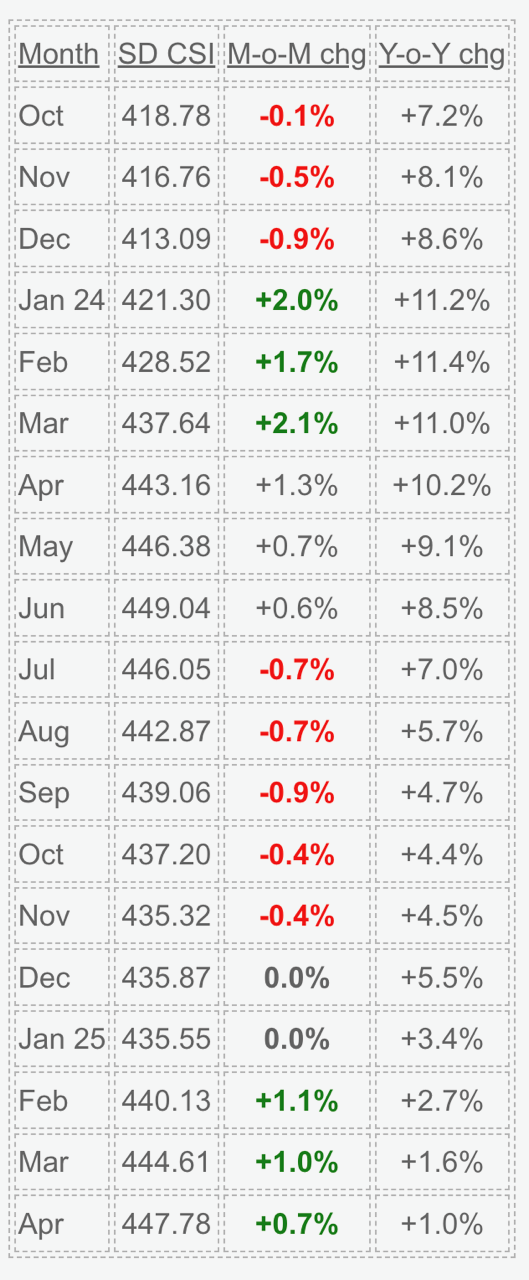

The first few months of 2025 are logging about half the gains as last year. It means next month will be flat at best, and hopefully the rest of the year is the same as last year?

“The housing market continued its gradual deceleration in April, with annual price gains slowing to their most modest pace in nearly two years,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “What’s particularly striking is how this cycle has reshuffled regional leadership—markets that were pandemic darlings are now lagging, while historically steady performers in the Midwest and Northeast are setting the pace. This rotation signals a maturing market that’s increasingly driven by fundamentals rather than speculative fervor.”

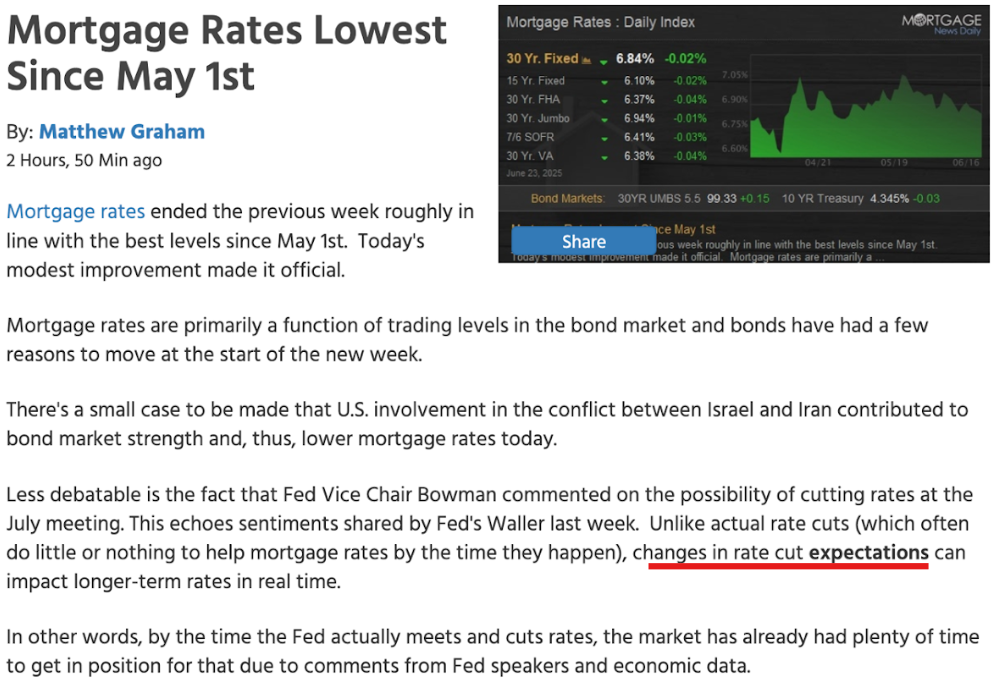

The mortgage rates usually drop before the Fed does their cut – then mortgage rates rise. Buy the rumor and sell the news!

If we could just get down to 6.5% it would be a relief.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-06232025

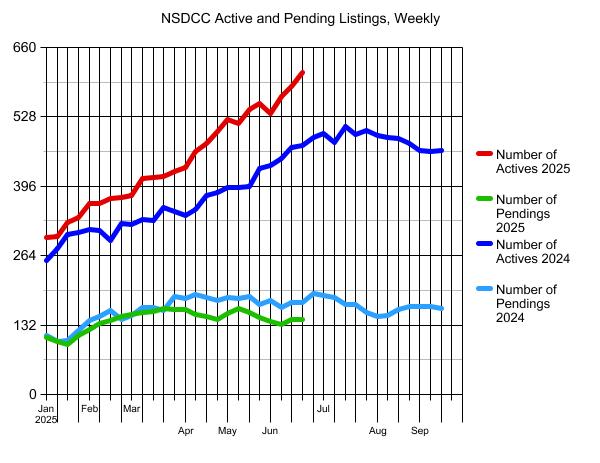

Wow – the stack of unsold listings keeps rising, and now up to 612!

Comparing to recent years:

2022: There were 15 weeks when the number of actives was between 400-500.

2023: Only three weeks when the standing inventory was just over 400.

2024: There were 28 weeks with more than 400 actives, and the highest was 509.

Of the 65 new listings in the last week, 22 of them were on the market previously this year with the same or different agent. Those refreshed listings don’t add to the count either – they just replace the one that was cancelled.

It shows how tired the inventory is – it’s hard for buyers to keep their eyes open!

This is why sellers should have the option to sell their home off-market. Going on the open market doesn’t look that fruitful to many – especially to the sellers who are attached to an aspirational price.