by Jim the Realtor | Apr 29, 2016 | Jim's Take on the Market, Real Estate Investing, Shadow Inventory

Hat tip to GM for pointing this out – did you know that the Obama Administration has been trying to modify the 1031 exchange rules?

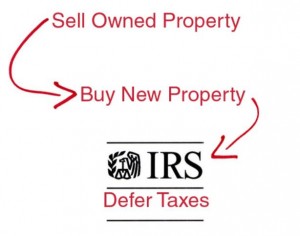

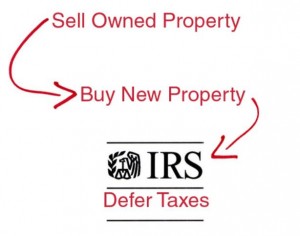

Potential sellers of investment properties are already paralyzed by the thought of the excessive taxation by federal and state governments. The 1031 exchange allows properties to be sold and the excessive taxation be deferred – any limiting of the 1031 rules will cause fewer transactions.

If this change is implemented, it will apply to 1031-exchanges that are completed after this year. If you want to upgrade your investment portfolio, let’s move!

More here:

http://www.1031taxreform.com/legislation/treasury/

Excerpt:

The proposal would limit the amount of capital gain deferred under section 1031 to $1 million (indexed for inflation) per taxpayer per taxable year. The proposal limits the amount of capital gain that qualifies for deferral while preserving the ability of small businesses to generally continue current practices and maintain their investment in capital. In addition, art and collectibles would no longer be eligible for like-kind exchanges. Treasury would be granted regulatory authority necessary to implement the provision, including rules for aggregating multiple properties exchanged by related parties.

The provision would be effective for like-kind exchanges completed after December 31, 2016.

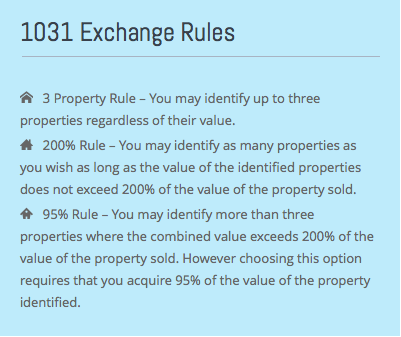

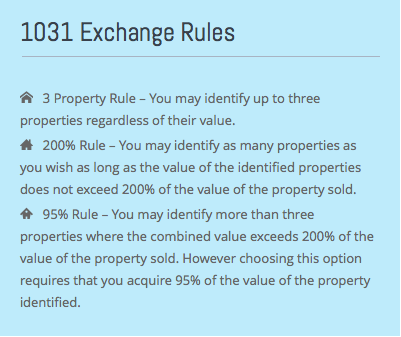

Other existing rules:

by Jim the Realtor | Aug 25, 2014 | Market Conditions, Shadow Inventory, Why You Should List With Jim |

The other day, I used the term ‘die correctly’, which refers to those who hold properties until death, allowing those who inherit to step up the tax basis.

From wiki:

Under IRC § 1014(a) the general rule applied to property a beneficiary receives from a benefactor is that the beneficiary’s tax basis equals the fair market value of the property at the time the decedent dies. For example, Decedent owns a home they originally purchased for $35,000. Their tax basis in the home is equal to its cost, $35,000, assuming no adjustments under IRC § 1016. On the day Decedent dies, the fair market value of the home is $200,000. If Decedent bequeaths the home to Beneficiary, Beneficiary’s basis in the home will be the fair market value, $200,000.

In contrast, had Decedent given the home to Beneficiary before their death, Beneficiary would receive a carryover basis, which would be equal to the decedent’s adjusted basis in the home, $35,000.

Because of this provision, any appreciation of the affected property that occurred during the decedent’s lifetime will never be taxed. Thus, this provision provides an incentive for taxpayers to retain appreciated property until death.

As the baby boomer generation begins to expire, we should see more inventory – especially rental properties. Any houses within a few miles of the coast are already in record territory, price-wise, and the beneficiaries would be smart to liquidate at least some of the properties while they can get top dollar.

The ones to sell would be the older homes needing more work, and/or those in inferior locations. Keep the best, and sell the rest!

If you are thinking of selling, give me a call!

by Jim the Realtor | Mar 5, 2014 | Foreclosures/REOs, REO Inventory, Shadow Inventory, Short Sales, Short Selling

After seeing Bernanke holding the smoking gun on Monday (where he said that he told banks to not disrupt the economy with their REOs), did you give up hope getting a deal on a distressed sale?

After seeing Bernanke holding the smoking gun on Monday (where he said that he told banks to not disrupt the economy with their REOs), did you give up hope getting a deal on a distressed sale?

If not, this might push you closer to believing.

Here is the mix of NSDCC detached listings this year:

REOs: 1

Short-sales: 10

Non-distressed: 825

REO listing agents, flippers, and short-sale scammers have to be scrambling. Keep your head down!

by Jim the Realtor | Dec 17, 2013 | Sellers Waiting For Comeback, Shadow Inventory, Strategic Defaults, Walkaways

In the San Diego-Carlsbad area, 11.4 percent, or 66,899, of all residential properties with a mortgage were in negative equity as of the third quarter 2013, according to CoreLogic. It was a slight improvement from 2Q13, when 13.6% of all mortgaged properties were in negative equity.

In the San Diego-Carlsbad area, 11.4 percent, or 66,899, of all residential properties with a mortgage were in negative equity as of the third quarter 2013, according to CoreLogic. It was a slight improvement from 2Q13, when 13.6% of all mortgaged properties were in negative equity.

San Diego-Carlsbad

More than 20% equity: 73.3%

0 – 20% equity: 15.3%

Negative Equity: 11.4%

Near Negative Equity (95%-100%): 2.4%

Near Positive Equity: (100%-105%): 2.0%

Mortgaged Properties: 585,000

Average Loan-to-Value ratio: 56.9%

http://www.corelogic.com/about-us/researchtrends/equity-report.aspx

Click on image:

by Jim the Realtor | Nov 29, 2013 | Shadow Inventory, Short Sales, Short Selling |

From NMD:

RealtyTrac reports that the nature of distressed property sales is evolving. In its most recent report on market and distressed sales, the company noted that changing economics are increasing the reliance on more traditional third party purchases at foreclosure auctions rather than the lender/borrower negotiated sale at less than the outstanding loan balance.

“After a surge in short sales in late 2011 and early 2012, the favored disposition method for distressed properties is shifting back toward the more traditional foreclosure auction sales and bank-owned sales,” said Daren Blomquist, vice president at RealtyTrac.

“The combination of rapidly rising home prices – along with strong demand from institutional investors and other cash buyers able to buy at the public foreclosure auction or an as-is REO home – means short sales are becoming less favorable for lenders.”

Read entire article here:

http://www.mortgagenewsdaily.com/11252013_realtytrac_home_sales.asp

by Jim the Realtor | Sep 14, 2013 | Foreclosure Count, Jim's Take on the Market, North County Coastal, Shadow Inventory, Short Sales, Short Selling |

Distressed sales have dwindled down to a fraction of the NSDCC market, though they were never a large contributor.

Here are the detached-home sales from the June 1-to-August 31 period:

| Year |

REOs |

SS |

Non-Distressed |

% Distressed |

| 2009 |

48 |

35 |

572 |

13% |

| 2010 |

46 |

69 |

575 |

17% |

| 2011 |

41 |

71 |

610 |

16% |

| 2012 |

45 |

102 |

748 |

16% |

| 2013 |

14 |

42 |

890 |

6% |

There are only 9 active listings of short sales (out of 1,030 total active listings), 29 are marked as contingent currently, plus 4 active listings of REOs.

Should the feds decide to not extend the relief from debt tax past 12/31/13, it should be the final straw and end short sales altogether around here.

For buyers, the hope of getting a deal should be fully extinguished, and just trying to find something suitable for a decent price is a major challenge.

by Jim the Realtor | Sep 6, 2013 | Foreclosures/REOs, No-Foreclosure as Banking Policy, Shadow Inventory |

From DSNews.com:

As home prices improve and headlines spell out recovery, those on the ground in housing markets across the country are encountering a new threat: “zombies.”

These so-called “zombie” foreclosures take place when a bank initiates foreclosure on a property but then abandons the process, leaving the property in a sort-of no-man’s land—vacant but not for sale.

According to RealtyTrac, there are about 167,000 properties nationwide that fall into this category. In addition, the company says there are hundreds of thousands of unlisted REOs and even more properties winding through lengthy judicial foreclosure procedures.

According to RealtyTrac, there are about 167,000 properties nationwide that fall into this category. In addition, the company says there are hundreds of thousands of unlisted REOs and even more properties winding through lengthy judicial foreclosure procedures.

“Unlisted foreclosures and bank walkaways used to be extremely rare, but they have mushroomed recently, ballooning into a large number of homes stuck in foreclosure limbo, sometimes for years,” RealtyTrac stated in its most recent issue of Foreclosure Report News.

JtR: Click on the link above to read about some smug REO brokers.

Bank of America has 23,966 foreclosure “zombies,” the most held by any bank, according to RealtyTrac.

Wells Fargo is not far behind with 22,968, and JPMorgan Chase holds the third-highest inventory of foreclosure “zombies”-16,054 by RealtyTrac’s count.

With 55,503, Florida is home to the highest number of unoccupied “zombie” properties.

In total, RealtyTrac estimates there are about 1 million vacant homes that need to be sold but are currently out of reach for most real estate agents.

Meanwhile, real estate markets across the country are dealing with inventory shortages.

The shortages, combined with high investor activity, have caused price surges in several markets. In fact, some real estate professionals worry that investors have crowded out traditional buyers and artificially inflated property values in some areas.

“It’s not rocket science to predict what will happen next,” said Steve Hawks of Platinum Real Estate Professionals in Henderson, Nevada.

He says Las Vegas “will see another 20 percent appreciation in prices over the next nine months. Vacant homes and delinquent loans will be converted to available inventory in the second half of 2014. And the second bubble pop in less than a decade will begin.”

“Only stupid money is buying now,” Hawks said.

JtR: If prices are going up 20% over the next nine months, why stupid now???

A full 8 percent of single-family homes in the Las Vegas metro-about 40,000 properties-are vacant, according to data from the Lied Institute at the University of Las Vegas.

RealtyTrac says agents hoping to survive in today’s zombie-land must form relationships with banks, private lenders, the GSEs, and distressed borrowers to dig into the shadow inventory and zombie population in order to bring markets back to life.

http://www.dsnews.com/articles/real-estate-professionals-must-battle-foreclosure-zombies-to-survive-2013-09-04

by Jim the Realtor | Jun 1, 2013 | REO Inventory, Scams, Shadow Inventory |

Remember this from September?

The use of third parties to help Fannie Mae sell its REO properties is coming to an end.

Fannie Mae notified remaining vendors that the government-sponsored enterprise will transition all REO sales work completely to Fannie Mae’s in-house teams over the course of the next several months.

In the past, Fannie Mae used in-house sales teams and external vendors to dispose of REO properties.

“We have reduced our REO inventory from 162,489 properties at the start of 2011 to 109,266 as of June 30, 2012,” said an email from Fannie Mae to HousingWire. “With a reduced inventory of properties, Fannie Mae’s in-house teams now have sufficient capacity to manage our REO properties without the assistance of third party asset management providers.”

Fannie Mae said the third party vendors, firms such as Vendor Resource Management and 24 Asset Management were notified of the move with enough time to make any necessary adjustments.

Some aspects of REO sales will remain the same.

“We will continue to engage local real estate professionals to market our properties,” Fannie Mae said. “Fannie Mae’s goal is to help neighborhoods recover by selling as many properties as possible to owner occupants at competitive prices.”

They deliberately brought the REO operation in-house because of “reduced inventory”. But now it’s revealed that in the same month, September, 2012, they had 8x that number which were 90 days late?

Keeping their current staff busy with a limited supply of REOs allows the defaulters to skate longer – how can Fannie keep processing the defaulters if they scaled back their REO operation?

This smells bad.

Letting deadbeats skate for months and years erodes what is left of the moral fiber of this country.

by Jim the Realtor | May 31, 2013 | Shadow Inventory |

From NMD:

As the housing crisis unrolled the Department of Housing and Urban Development (HUD) and the two government sponsored enterprises (GSEs) Freddie Mae and Fannie Mae came into possession of more and more properties thorugh foreclosure. As of September 30, 2012, HUD held 37,445 foreclosed properties (REO) while the GSEs held 158,138.

In addition, the “shadow inventory” (residential loans at least 90 days delinquent) totaled 1,708,033 properties, roughly 8.7 times the size of the HUD and GSE REO inventories combined. Even a fraction of the shadow inventory falling into foreclosure could considerably swell HUD and GSE inventories of REO properties.

Because of the volume of this current and potential REO the Offices of Inspector General (OIG) for both HUD and the Federal Housing Finance Agency (FHFA) (conservator of the GSEs) recently produced a report on how HUD and the GSEs are managing and disposing of it.

(more…)

by Jim the Realtor | Apr 24, 2013 | Foreclosures/REOs, Shadow Inventory, Strategic Defaults |

An excerpt from an article in the MND:

While great efforts must be taken to avoid a future crisis and bailout the SIGTARP says, we cannot lose sight of the current TARP bailout. Wall Street may have recovered but Main Street has not. TARP was always intended as a bailout of the financial system to protect American families. Business and homeowners are still feeling the effect of the crisis and still need help from TARP.

“In its March 2013 TARP report, Treasury writes, ‘Thanks to TARP…struggling homeowners have seen relief, and credit is more available to consumers and small businesses. ‘” SIGTARP says of this, “Lost in this statement is the unfortunate reality that this improvement is only a fraction of what TARP could and should have done, and in many ways still can do.”

As of March 31, Treasury had spent less than 2 percent ($7.3 billion) of TARP funds on homeowner relief programs including HAMP and the Hardest Hit Funds while spending 75 percent to rescue financial institutions. “Treasury pulled out all the stops for the largest financial institutions, and it must do the same for homeowners.”

Treasury also has a responsibility to insure the help it does provide is sustainable.

In order to avoid foreclosure through HAMP a homeowner must remain active in a permanent mortgage modification and only 862,279 homeowners are in one, about half of which were funded with TARP money.

Now many homeowners are defaulting on these modifications, more than 312,000 to date. SIGTARP is concerned that these defaults are increasing at an alarming rate. As of March 31 the oldest modifications, done in Q3 and 4 of 2009, are defaulting at respective rates of 46.1 and 39.1 percent.

The report says Treasury should work to curb redefaults, which often inflict great harm on already struggling homeowners when any amounts previously modified suddenly come due. SIGTARP recommended this month that Treasury conduct research to better understand the causes of redefaults and work with servicers to develop an early warning system so they can intervene before problems occur.

As regards Wall Street, the report says too big to fail is not just about size, it is about the interconnections the largest financial firms have to each other and to American households.

Regulators were shocked, in 2008, to find how these large institutions were tied to each other and to counterparties so that if one went down it pulled other down with it. Even the institutions themselves did not realize the extent to which they were linked. Nor did they realize their exposures to short-term funding counterparties which, as Treasury Secretary Geithner said, “can flee in a heartbeat”, bringing the system down. While the financial system is more stable now, ending too big to fail is critical to its safety.

http://www.mortgagenewsdaily.com/04242013_tarp_hamp.asp