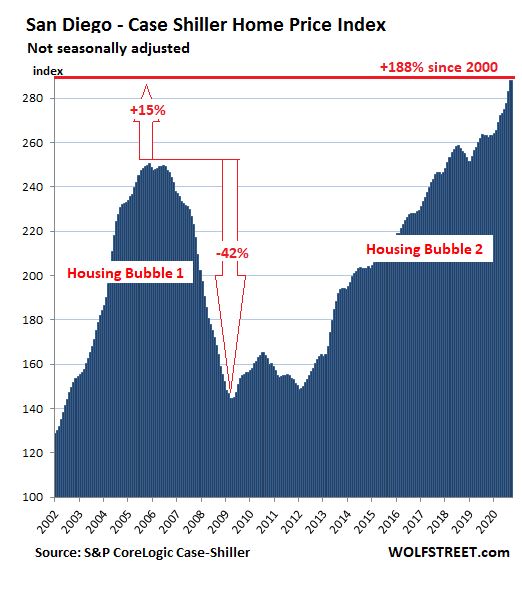

The 15% increase from the last peak 15 years ago doesn’t seem bad, though both were bubblelicious thanks to stimulus (exotic financing then and ultra-low rates today).

https://wolfstreet.com/2020/11/24/the-most-splendid-housing-bubbles-in-america-november-update/

The big difference is that the last bubble was built on the backs of the the under-qualified borrowers who took exotic mortgages from unscrupulous loan brokers. The bad loans were funneled to Wall Street, where the same thing happened – the Tan Man took advantage of greedy but unknowing financiers and the combined effect exposed the house of cards. Without the end users making their payments, the machine came to a grinding halt.

Could it happen again?

Because mortgage underwriting has been strict over the last ten years, it’s hard to imagine that a wave of homeowners loaded with equity would get foreclosed – and then the banks would give them away too.

But it is possible that we could have mild swings of 5% to 10%. But if there were a couple of low sales, wouldn’t the lower-motivated sellers just wait it out? Probably.

Here’s a recent example we can follow – I think we can call this a low sale:

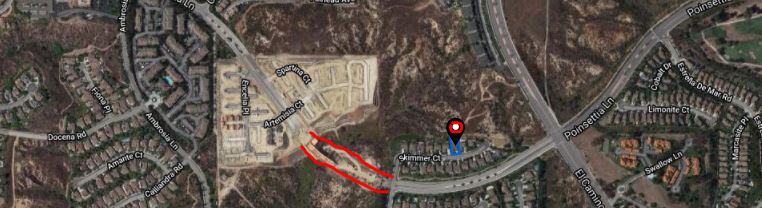

1756 Skimmer Ct., Carlsbad, CA 92011

4 br/2.5 ba, 2,409sf one-story with 3-car garage on a 10,041sf lot.

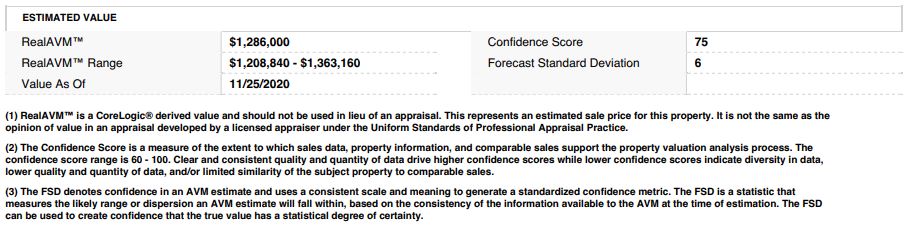

LP = $1,328,000 on September 10, 2020

SP = $1,000,000 on November 17, 2020.

The home had been on the market for a couple of months and it was time – the seller was ready to move! My buyers offered the right price, on the right day, and the seller signed it.

It’s a classic example of finding a long-time owner who could sell for less and still walk away with a bucketful of money. The seller paid $430,000 when the home was new in 2001. They didn’t put in any upgrades then or now – it was the original carpet and paint, etc., they made no attempt to improve the property for sale:

https://www.compass.com/listing/1756-skimmer-court-carlsbad-ca-92011/603767865654710185/

The thing to appreciate about this home is that it backs to dedicated open space, where the other side of the street backs to Poinsettia, a four-laner which will soon be connected to the I-5 off-ramp about a mile away. My buyers benefit from easier access but no noticeable road noise!

The last two sales of this model were $910,000 and $935,000 in 2017 (does anybody want to pay within 10% of 2017 prices today – yeah!). The last sale on this street was a newly-built 3,380sf home at the end of the street that sold for $1,380,000 in August. It was in the shadow of the power lines, and backed to El Camino Real/Poinsettia intersection with substantial road noise:

Here are the one-story homes sold in the last six months – they average $533/sf, and we closed at $415/sf:

Yes, I’m tooting my own horn for being the agent who recognized that this home was languishing on the market, had an original owner and would be a candidate to sell for less.

But will I be the villian who started the Big Downturn in the 92011? No, every other one-story-home seller nearby will shrug this off and list for at least $500/sf in the foreseeable future.

I am sure the memory of the fire that ripped through that area some years ago likely motivated the seller to get out when a good deal was on the table.

I doubt it.