by Jim the Realtor | Oct 29, 2024 | 2025, Forecasts, Inventory, Jim's Take on the Market |

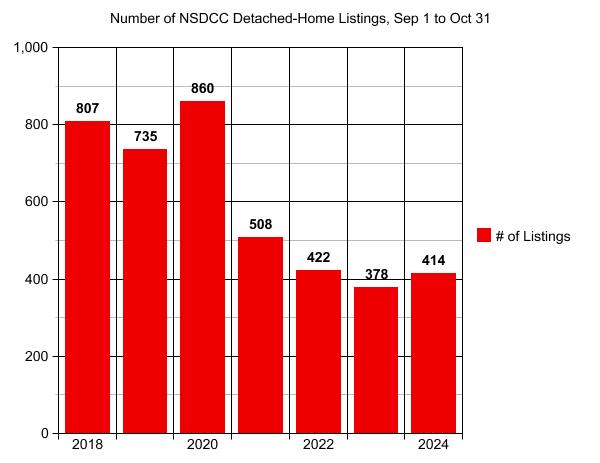

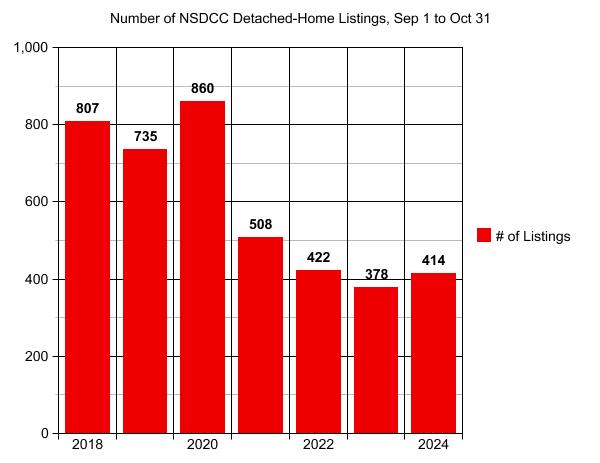

I thought the run-up to the election would cause potential home sellers to wait it out.

Wouldn’t it make sense to NOT list your home in the month or two before the most contentous election in history? Certainly home sellers would have foresight and believe that buyers would be distracted. Everyone would be doing the wait-and-see!

Nope – and we’re not done with new listings this month. There will probably be another 10-20 homes go on the market before Friday (plus late-reporters).

It means that a surge of listings is in the works.

Our stager told Donna yesterday that she is already getting booked up for January. Our regular contractors have been voicing the same thing – they are very busy, and getting busier.

How about this as an indicator:

I already have three listings signed for January/February, and another 2-3 in the works. Never before have we had a January listing signed in October!

It means the first quarter of 2025 is going to be insane – a frenzy of inventory!

Get Good Help!

by Jim the Realtor | Oct 29, 2024 | Jim's Take on the Market

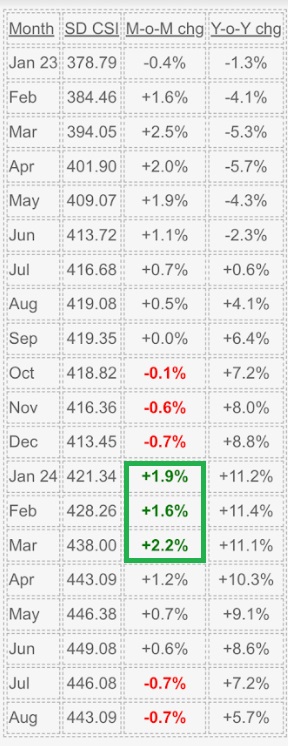

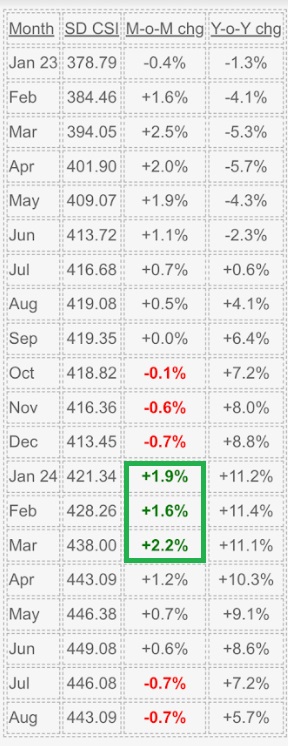

San Diego Case-Shiller Index, August 2024

It is typical for pricing to be softer towards the end of the year.

In 2023, the decline was limited to the last three months, but this year it started much earlier and the drop has already matched last year’s total decline with four readings to go!

The monthly declines will probably be similar (-0.7%) so the index may drop another 3% to 4% in 2024 – which we won’t know for sure until the end of February.

Let’s note in the green box above how this year got off to a very fast start, and that literally in 2024, the FIRST QUARTER WAS THE BEST TIME TO SELL YOUR HOME!

It will be similar in 2025!

For the January reading to be +1.9%, it means buyers were active in December – wow!

by Jim the Realtor | Oct 28, 2024 | 2025, Jim's Take on the Market

He’s not just passing through – Mark Wahlberg is setting up shop in South O:

by Jim the Realtor | Oct 28, 2024 | Boomer Liquidations, Boomers, Where to Move

Approximately 79% of homes in the US are owned by people aged 65 and older. Aging in place is fine, but many of the more-affluent seniors are opting for luxury accommodations and paying a hefty price – and there is no shortage of demand. The better units at La Costa Glen have a three-year wait list – plan ahead! From the WSJ:

In the heart of Silicon Valley, well-off baby boomers enjoy meals of porchetta and cheesy polenta, prepared with herbs plucked from the community garden. Thirty-foot-tall windows offer a view on a quiet creek winding along manicured grounds.

Spending later years at this community, Vi at Palo Alto, comes with a price tag that starts with an upfront payment that can range from $1.17 million for a one-bedroom apartment and up to $7.3 million for a three-bedroom unit. Ongoing monthly fees up to $13,800 cover services such as housekeeping and valet parking, and amenities. Residents can attend lectures by professors of nearby Stanford University or a performance by opera singers.

For wealthier Americans, greater options exist for how to spend their later years. A growing crop of high-end communities, called life plan communities, allow residents to start in an apartment and then move to more nursing-like care as they age. Occupancy rates are rising, with the rate in the independent living units above 80% today, according to NIC MAP Vision, a data source for senior housing research.

Resident contracts typically work like a membership and, depending on terms, lock in rates so that costs don’t escalate when higher levels of care are needed. Inclusive care contracts come with higher upfront fees, but allow customers to sidestep having to find, and pay for, different levels of care as they age.

Many baby boomers who watched parents or friends struggle to age in their homes—and scramble to find nursing or home healthcare—say they are determined to do things differently, for their own peace of mind and that of their children.

“It’s a gift to our kids,” says Virginia Pollard, who lives with her husband, David, at Vi at Palo Alto.

Finding the right life plan or continuing care retirement community is like looking at colleges, say residents. The ideal is a place that feels personally comfortable, whether in the city or country, and where they can be among others with similar accomplishments and interests.

Kendal Corp. has life care communities near Oberlin College in Ohio and Cornell University in Ithaca, N.Y. The Forest at Duke neighbors Duke University. Like colleges, they often have wait lists.

Ron Litvak, 66, a retired lawyer in Denver, says he and his wife are on two wait lists, one for a premier life planning community in Denver and another for La Costa Glen in Carlsbad, Calif., and plans to get units in each.

(more…)

by Jim the Realtor | Oct 28, 2024 | Inventory

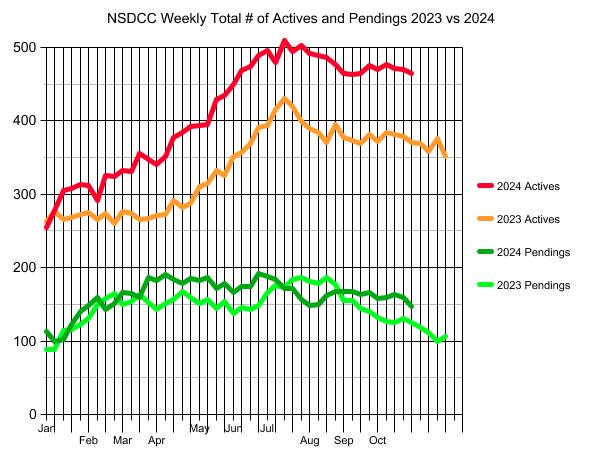

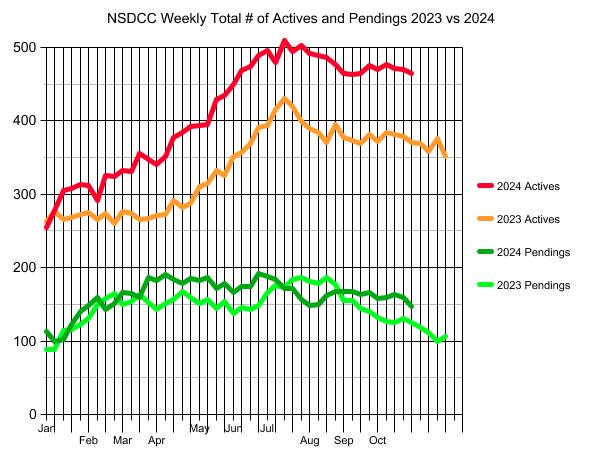

The number of pendings is catching up with last year’s counts, and, with this being the end of October, there should be another 20+ that close escrow this week. The pendings’ count is going to get down to around 100 in the next couple of weeks, which probably means sales in November and December will be under 100 – unless we get a good pop after the election, which is feasible.

The hangover carryover of actives going into 2025 will be substantial.

We started 2024 with 255 actives, and by the end of the month it had grown by 23%. Pendings grew +24%!

We’re going to start 2025 with at least 350 actives though, and with a surge of new listings it could get back to 400-450 actives by February. It will be the first time we have that much to consider since pre-covid February, 2020.

(more…)

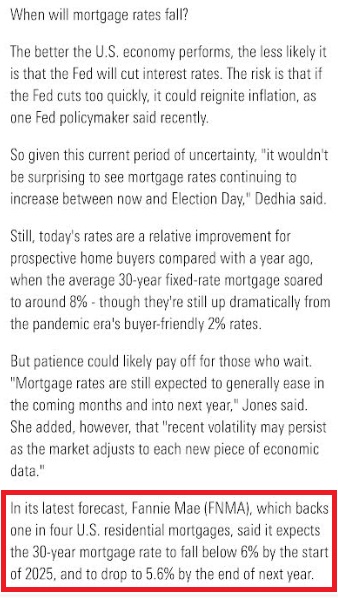

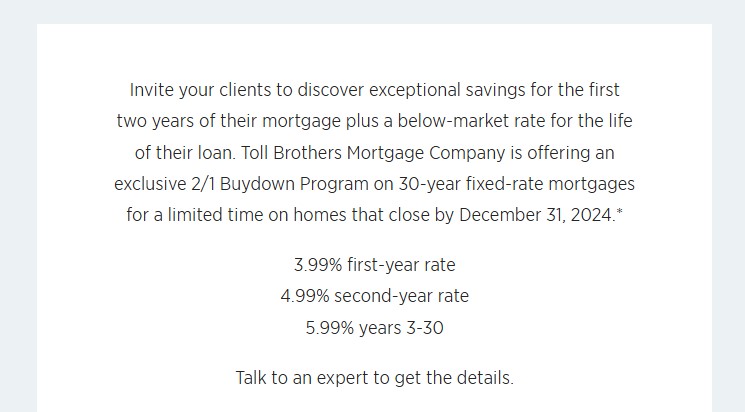

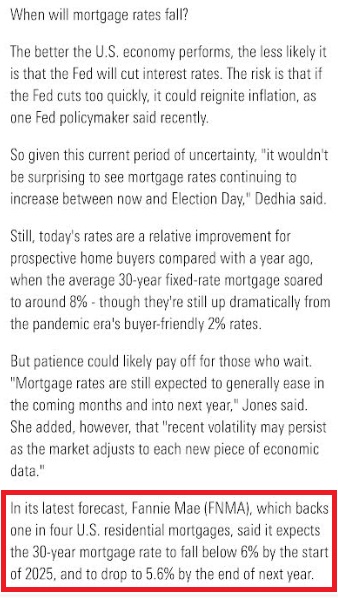

by Jim the Realtor | Oct 27, 2024 | Interest Rates/Loan Limits, Mortgage News, Mortgage Qualifying

Mortgage rates are going to be sticky. A good solution for buyers is to do a 2/1 buydown on their rate today. They get the benefit of lower-than-market rates for the next year or two while waiting to refinance once rates drop – and if they don’t drop, at least you get the 5.99% in this example:

A recent example: the buyer negotiated a $100,000 discount on a house priced in the $2 millions. Then he took a $60,000 discount on the price, and had the seller apply $40,000 towards a rate buydown to get a program similar to the one above!

by Jim the Realtor | Oct 27, 2024 | Local Flavor

by Jim the Realtor | Oct 26, 2024 | Where to Move |

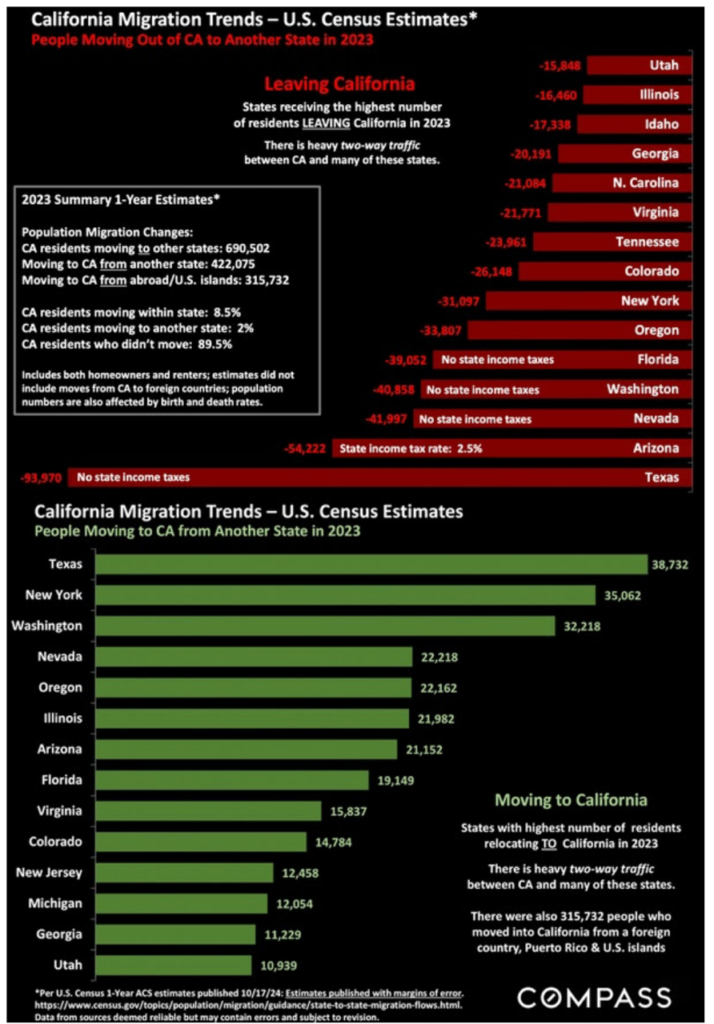

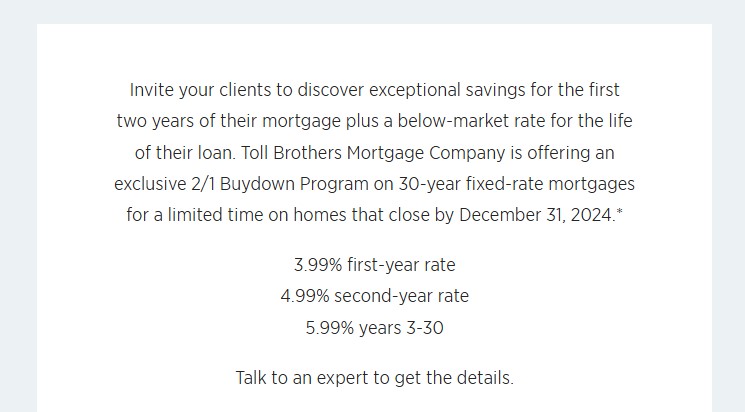

One-year estimates show more homeowners and renters are moving to California vs. the number of people leaving, though they didn’t count those moving to a foreign country.

Interesting that Texas is #1 on both lists!

by Jim the Realtor | Oct 25, 2024 | Zillow |

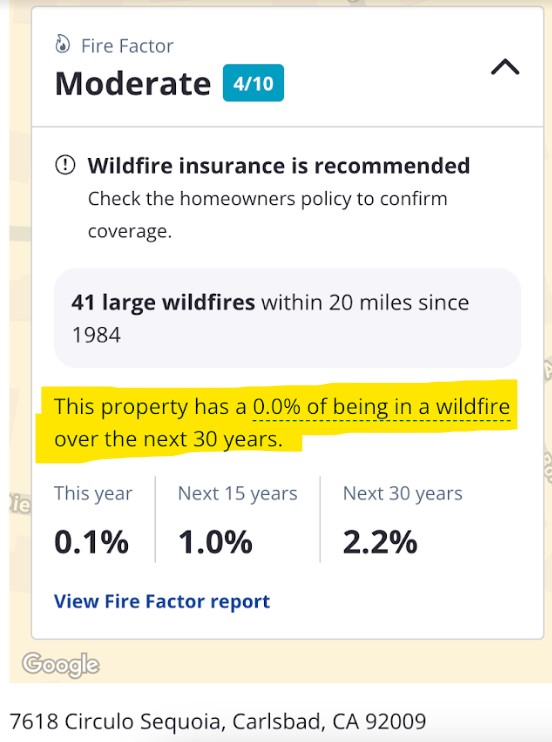

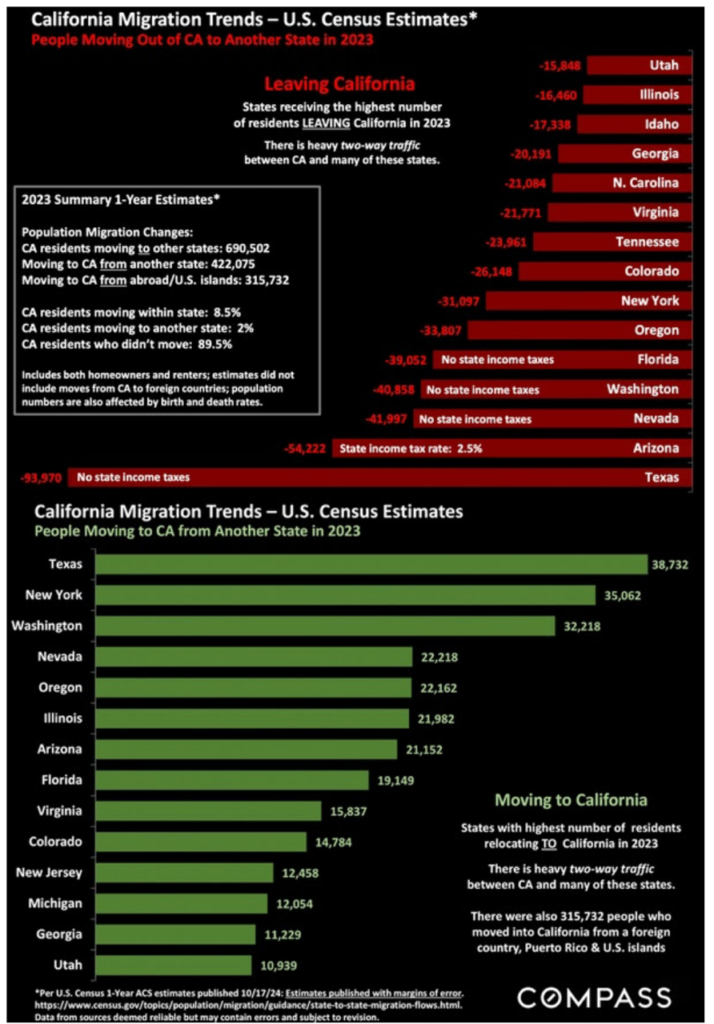

There has been a lot of discussion recently about the outrageous cost of fire insurance, and how the FHSZ has been expanded to include major portions of regular suburban towns like Carlsbad.

The buyer of our Circulo Sequoia listing will be forced to pay a premium for fire insurance now, even though the house is in the middle of the tract and doesn’t back to open space – just because the FHSZ box is checked ‘yes’ (above).

Hat tip to ‘just some guy’ for noting that Zillow now has climate-risk factors on some of their for-sale listings. Here is their report on my current listing in Carlsbad:

If the chances are between zero and 2.2% over the next 30 years, wouldn’t you think the insurance industry could find a way to take a little less? (new premiums are roughly double what they were).

The 41 large wildfires within 20 miles since 1984? I’d like to dispute that number (maybe 10?) and fires that are 20 miles away shouldn’t matter to a suburban tract house owner and their insurance company!

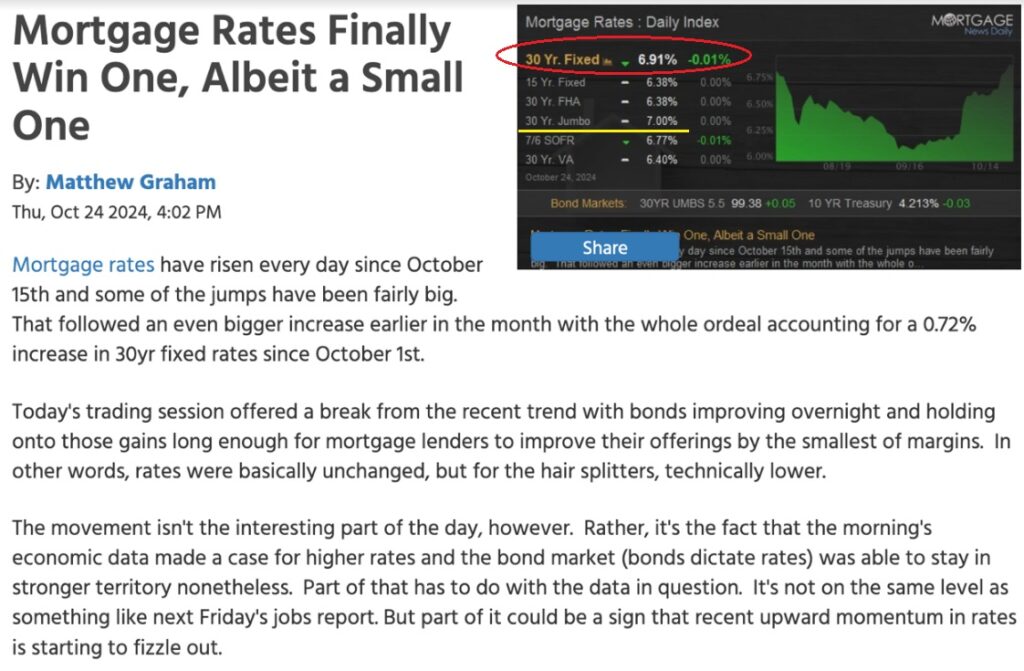

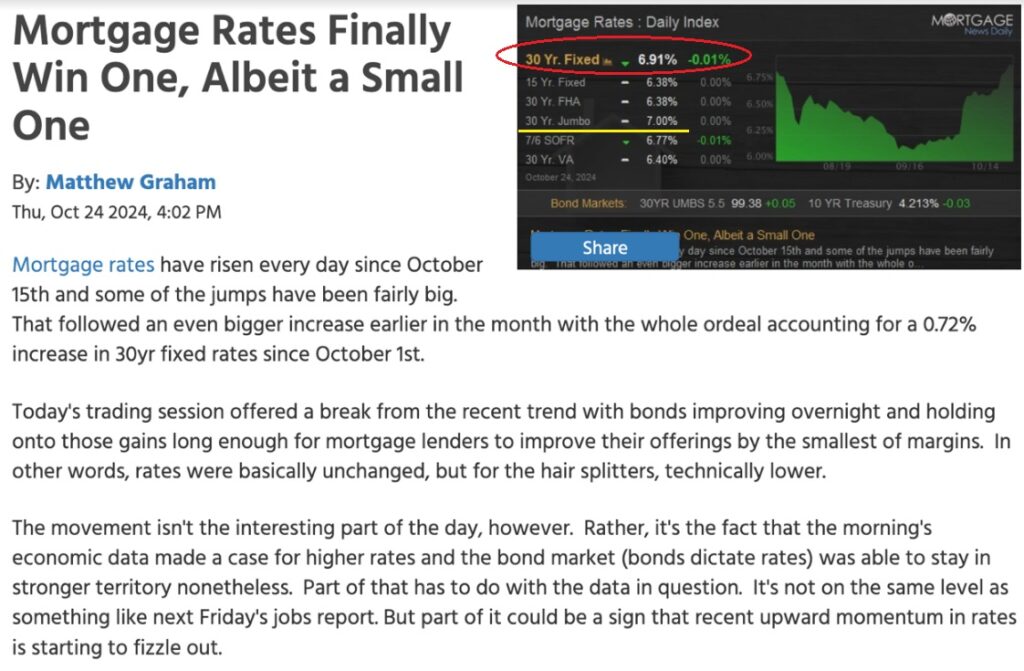

by Jim the Realtor | Oct 24, 2024 | Interest Rates/Loan Limits |