by Jim the Realtor | Nov 6, 2023 | 2023, Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop, Why You Should Hire Jim as your Buyer's Agent, Why You Should List With Jim |

The first week after the realtor-lawsuit verdict went as expected – chaos, doom, and no sexy alternatives. It will take years to appeal, but it won’t matter how it turns out. Buyers are going to be paying their agents.

If sellers aren’t obligated to pay any commission to the buyer-agents, will they appreciate the benefit of incentivizing buyer-agents with a bounty, or reward? Probably not, unless their listing agent makes it very clear, and insists on it.

It is more likely that listing agents won’t push it, and because sellers naturally will want to pay less commission and not more, they will list for 2.5% or 3% and hope for the best. Both will shrug it off, and joke about how it’s about time commissions came down!

It will be a grave mistake.

Why? Because the buyer-broker agreement is a disaster:

- Buyers won’t like it.

- Agents won’t like it.

- The market won’t like it.

Today’s buyers are picky, and you can’t blame them. They’ve had to endure +40% on prices, +200% on interest rates, and -50% on inventory…..talk about challenging!

The buyer-broker agreement will be a disaster because both agents and buyers will sign a short-term arrangement and hope the seller might kick in some of the commission. But then everyone will go back to doing it the same way we always have – refreshing your feed every hour and praying!

The real opportunity will be for buyers to hire an aggressive buyer-agent who does more than just watch the MLS. When a seller hires a listing agent, they get a thorough marketing campaign to source every potential buyer in the market. Buyer-agents can do the same, in reverse!

The buyer-agents who offer a rifle-shot soliciting of specific homes that fit the needs perfectly of their buyers will eventually find one. If an aggressive buyer-agent brings the complete package to the seller’s table without having to mess with a full listing, they will likely get an audience. It could even take the place of listing agents!

Because auctions aren’t close yet, this could be what changes the world of residential resales!

It will mean more off-market sales, which means more fuzzy comps because not much if anything is known about the home’s condition. But if it catches fire and the MLS or a rogue search portal insists on buyer-agents reporting everything about their sales including photos, we could still have a database full of accurate market data. But if we don’t, we don’t – good luck everybody!

by Jim the Realtor | Nov 3, 2023 | Realtor, Realtor Training |

The latest lawsuit will cause people to consider different pay structures for realtors.

If realtors were paid less, could they at least get some of it up front? Yes, if approved by the commissioner:

Before a broker may solicit, advertise for and agree to receive an advance fee, the paperwork material is to be submitted to the Commissioner of the California Department of Real Estate (DRE) for approval at least 10 calendar days prior to use.

If the Commissioner, within 10 calendar days of receipt, determines the material might mislead clients, the Commissioner may order the broker to refrain from using the material.

To be approved, the advance fee agreement and any materials to be used with the agreement will:

- Contain the total amount of the advance fee and the date or event the fees will become due and payable;

- List a specific and complete description of the services to be rendered to earn the advance fee;

- Give a definite date for full performance of the services described in the advance fee agreement; and

- Contain no false, misleading or deceptive representations.

Further, the advance fee agreement may not contain a provision relieving the broker from an obligation to perform verbal agreements made by their employees or agents; or a guarantee the transaction involved will be completed.

It sounds like slipping a few thousand under the table won’t be tolerated! The paperwork involved will probably make the big brokerages shy away from the idea, but we should consider alternative ideas.

by Jim the Realtor | Nov 2, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

Are realtor commissions negotiable?

Sure….how high do you want to go? 😆

Commissions aren’t all the same, just like agents aren’t all the same. Different agents charge different rates because they do different things for the consumer. Commissions/fees range from $100 to 7%. Nice range!

So if all that matters is paying less for your agent, then shop around – there are plenty of discount agents. You might consider hiring the very best agent you can find – one who pays for themselves, and more.

This is the question that has never been answered by the industry:

“If agents employ different skill sets and services, why do they all get paid the same?

It was mentioned in the recent lawsuit, and they presented it as part of their case:

72. Additionally, because the Rule requires a blanket offer, the Rule compels home sellers to make this financial offer without regard to the experience of the buyer-broker or the services or value they are providing — in other words, the Rule treats all buying brokers and their services the same. The seller is required to offer the same fee to a buyer-broker with little or no experience as that offered to a buyer-broker with twenty years of valuable experience. Accordingly, there is a significant level of uniformity in the payments that sellers must pay to buyer-brokers.

73. As a result, there is little relationship between the commission and quality of the service. “Skilled, experienced agents and brokers charge about the same price as agents with little experience and limited knowledge of how to best serve the consumer clients.” In a price-competitive market, less experienced and less skilled brokers and salespersons would be offering consumers lower commission rates, but they have no incentive to do so because of the Rule.

74. The Rule creates tremendous pressure on sellers to offer the “standard” supra-competitive commission that has long been maintained in this industry. Seller-brokers know that if the published, blanket offer is less than the “standard” commission, many buyer-brokers will “steer” home buyers to the residential properties that provide the higher standard commission.

The changes or fines from the lawsuit(s) probably won’t matter much today. Offering no commissions to buyer-agents is a nice idea, and you’d think it would cause agents to publicize the full set of productive services they offer to their buyers to convince them to pay the fee. Don’t get your hopes up.

Ideally, the consumer would research the detailed resumes and work histories of each prospective agent and make an informed decision. The agent pages on Zillow do provide the basics, but based on results, consumers aren’t using them much.

It’s why realtors have a lousy reputation – consumers keep hiring the inexperienced/bad agents, and the industry doesn’t mind because they make more profit off them.

Get Good Help!

by Jim the Realtor | Nov 1, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

Now what?

The National Association of Realtors clearly underestimated the chances of losing this case – and the others to come. They must have thought that touting their 100-year old Code of Ethics was all that was needed to impress people, and instead they found out that it doesn’t.

What doesn’t get addressed is the common belief that realtors are overpaid.

It is a wide-spread belief. Even Joe Kernen, a guy who works 15 hours per week and gets paid between $3,000,000 and $22,000,000 per year (depending on the website), has to open his CNBC show today with the declaration that 6% commissions are too much, and 1% would be more like it.

This is what needs to be addressed. Can agents explain their value?

Listing agents are used to making a presentation to homeowners, but 80% of the time, the sellers have already decided on who they will hire so the presentation doesn’t have to be great. Buyer-agents rarely discuss what they do – they just have people jump in their car and go look at houses.

The judge and/or the Department of Justice will rule on future sellers paying the buyer-agent commission. If sellers are allowed to pay a commission to the buyer-agents, then their listing agent can counsel them properly on what rate to offer, and the status quo will endure. But it will be a game-changer if the sellers are no longer able to offer ANY commission to buyer-agents.

With the former, the listing agents will have to discuss the pros and cons in detail to the sellers, and agree to a comfortable amount. With the latter, the buyer-agents will have to create a presentation to convince their buyers to pay them directly. This will be a new practice, and they won’t be very good at it.

By the end of the day yesterday, I had already been notified of three different seminars being offered about using the Buyer-Broker Agreement. It sounds simple enough to the ivory-tower types – just get your buyers to pay you the commission! But they underestimate both sides.

Agents aren’t jumping at the chance to work with buyers in the current market.

It takes months or years for buyers to finally win the right home at the right price, and the abuse from the listing agents is mean and nasty along the way. Nobody plays by the same rules, and multiple offers are mishandled regularly, which delays the buyer finally getting a house.

The 2024 Selling Season will begin with buyer-agents pleading with their prospects to sign a contract to pay them a commission. It will only take a few months for this practice to get exposed. The buyers will be reluctant to sign, and those that do sign a contract will find out that it won’t change the outcome. It is still going to take months to find the right house, at the right price. There will still be the typical aggravations and shenanigans with the listing agents – most of whom now insist on buyers providing a bank statement and lender pre-approval letter just to see a house.

Because the local inventory is will be ultra-low, the desperation will cause buyers to blame their agent. It is a fact of life with both sellers and buyers – if they don’t get the outcome they want, it’s too easy to blame their agent (especially when it is true most of the time).

Will sellers and buyers be more diligent about who they hire?

They never have been – they just grab an agent and hope for the best. They don’t know the right questions to ask; they don’t want to waste time investigating thoroughly; and besides, the buyers just want a house, and the sellers just want their money.

This is where each agent and the industry at large could go a long way towards providing a solution.

If there was an outpouring of explanations on how the business works, what to expect, and why a consumer should pay the fee, it would help. Maybe write a blog or something!

Without a delberate attempt to educate everyone, the business will gravitate to the lowest common denominator – single agency, where buyers go direct to the listing agent, and the benefits of buyer-agency are slowly forgotten. Next year will be the phase-out stage.

It will be the next step towards auctions becoming the way to sell houses!

by Jim the Realtor | Oct 31, 2023 | Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

A federal jury today agreed with the plaintiffs that organizations such as Keller Williams, Berkshire Hathaway HomeServices of America, and the National Association of Realtors had violated the law by conspiring to inflate commission rates.

Their attorney then filed an additional lawsuit against the other large brokerages, including Compass.

There’s enough for several blog posts here! Let’s begin with the first problem:

In this trial, the defense was pathetic, and the realtors will likely lose in appeals court too.

The defense attorneys rode in cocky and notched it up on the first day when they said the plaintiffs have the burden of proving their case…..and the defense may not even call a witness! Then when they did call a witness, it just had to be the CEO of NAR, Bob Goldberg, whose arrogance may be unrivaled.

He offered the following:

The CEO returned to the stand on Tuesday to face cross-examination from plaintiff party’s attorney Michael Ketchmark. During the cross, Ketchmark tried making an analogy — not for the first time — between the allegations facing NAR and the hypothetical of chicken producers inflating prices.

Goldberg argued the analogy was “apples and oranges” because real estate agents offer a service, not a product. When Ketchmark continued his analogy and pressed Goldberg on whether he needs an explanation of antitrust law, the CEO responded, “No. I need you to explain to me the chicken law.”

What the defense never considered was that the jury came into the courthouse with the same biases/prejudices that every American has considered – realtors are overpaid, and it’s a racket. The industry never bothers to educate the public, so you can’t blame the jurors or anyone else for thinking that we need to be taken down a notch…or two.

When Bob made his crack about chicken law it had to make every juror hate him even more. Sure, it was kinda funny but this is no time for wisecracks when billions of your members’ money is on the line!

Gary Keller is a nice guy but his soft-spoken testimony didn’t sway the jury – and you can blame his defense attorneys for asking questions that were too lame and indifferent:

Keller’s was the final testimony in the defense’s bid to argue that broker commissions vary and are not set by real estate companies.

Keller denied in his testimony that a “standard commission” existed, saying agents are responsible for setting their own commissions. He said the company had no say in the commissions charged by agents.

While it is true that realtors are independent contractors and each sets their own commission rates, having a gazillionaire state it towards the end of the trial isn’t going to persuade anyone.

The two most important facts of the case were never brought up:

- The sellers should have the right to pay a reward, or bounty, to persuade agents to sell their house.

- Every seller pays the listing brokerage the full commission, and it’s the LISTING AGENT who decides how much commission the buyer-agent gets.

For the defense to not bring up these points just shows how arrogant and unprepared they were for this trial. The NAR president didn’t exactly give us a reason to think it might be different next time:

This matter is not close to being final. We will appeal the liability finding because we stand by the fact that NAR rules serve the best interests of consumers, support market-driven pricing and advance business competition. We remain optimistic we will ultimately prevail. In the interim, we will ask the court to reduce the damages awarded by the jury.

In court, NAR presented evidence that consumers are better off and business competition is able to thrive because of our rules and how well local MLS broker marketplaces function. In fact, the NAR cooperative compensation rule for local MLS broker marketplaces ensures efficient, transparent and equitable marketplaces where sellers can sell their home for more and have their home seen by more buyers while buyers have more choices of homes and can afford representation. NAR also presented that REALTORS® are everyday working Americans who are experts at helping consumers navigate the complexities of home purchases and advocates for fair housing and wealth building for all.

Is that all you got? With leaders like this, any future trials will be decided in the same 2.5 hours that it took the jury to decide this one. The only hope is that Compass will hire our own attorneys, and they call on a part-time blogger from San Diego to testify!

by Jim the Realtor | Oct 31, 2023 | Realtor, Realtor Training |

Many think this won’t change much about commissions. They might have to go higher to pay for the damages!

A jury in Kansas City, Missouri, sided with a group of homeseller-plaintiffs Tuesday, ruling that real estate’s biggest names participated in a conspiracy that helped keep agent commissions inflated.

The jury found that all of the defendants, which include the National Association of Realtors as well as franchisors such as Keller Williams and Berkshire Hathaway participated in the conspiracy.

The jury awarded $1,785,310,872 in damages, which will be automatically trebled to $5.356 billion.

Just minutes after jurors sided with the homeseller-plaintiffs in the Sitzer | Burnett trial Tuesday, their attorney Michael Ketchmark filed a new class action lawsuit against another group of big-name real estate industry entites.

Ketchmark filed the suit on behalf of three new homesellers, who like those in Sitzer | Burnett claim to have suffered from a real estate industry conspiracy that inflated agent commissions. In this case, however, the suit names as defendants Compass, eXp World Holdings, Redfin, Weichert Realtors, United Real Estate, Howard Hanna, and Douglas Elliman. The suit also names the National Association of Realtors as a defendant.

Ketchmark said, “Our hope and goal is to free the grip they have on homesellers across the United States. It’s time that the free market and the internet is allowed to do its work and to bring the savings to homeowners that they’re so entitled to when they sell their homes.”

“This is an earthquake,” said Jason Haber, a real estate agent with Compass who has been one of the most outspoken critics of N.A.R. in recent months. “I’m disappointed in today’s verdict and I’m even more disappointed in N.A.R. This was their Super Bowl and World Series rolled up into one and not even Taylor Swift could have saved them.”

Mr. Haber, who created a grass-roots organization demanding the resignation of N.A.R.’s top leadership after the sexual harassment allegations came to light this summer, said he believed that there was no conspiracy when it comes to agent commissions, and that N.A.R. had let down its members by failing to present a stronger defense in court.

by Jim the Realtor | Oct 27, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Scams, Zillow |

Paying referral fees is a standard practice in the realtor business.

Are you thinking of moving to a new town and need an introduction to a realtor there? Your agent here will track one down for you, and that agent will pay them a referral fee, which used to be 20% to 25% of the gross commission. The challenge? Getting good help!

Great agents don’t need any assistance with procuring new clients, and they might reluctantly pay a 20% or 25% referral fee only if the new client is motivated and in the upper regions, price-wise.

Less-experienced agents are willing to pay out higher referral fees, which doesn’t do the client any favors.

What we do is tough work, and fewer and fewer people want to do it.

It’s so hard to hire, train, and retain good/great agents now that many real estate companies are just resorting to referring clients, and taking a substantial referral fee instead.

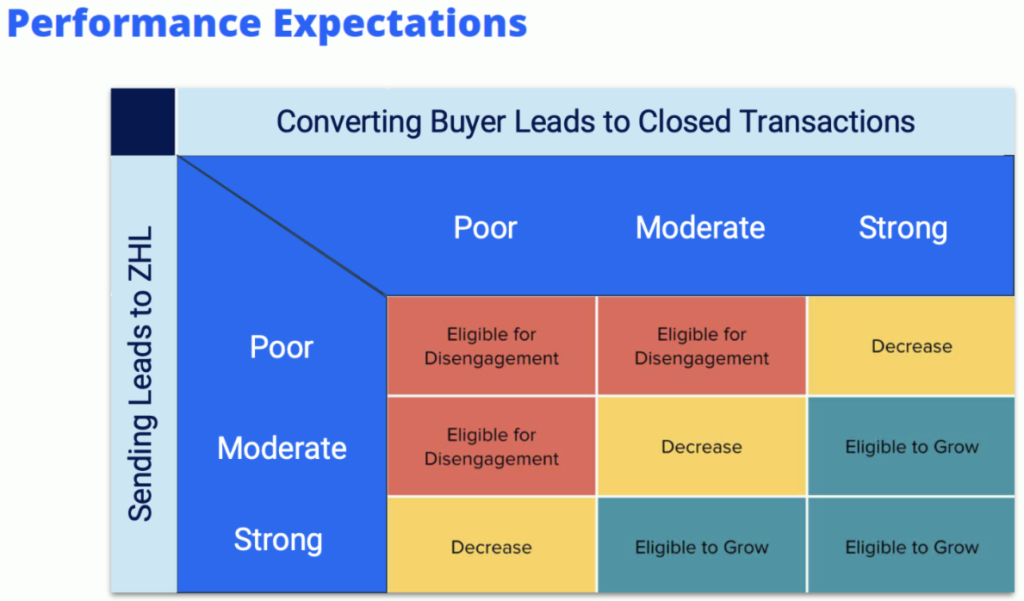

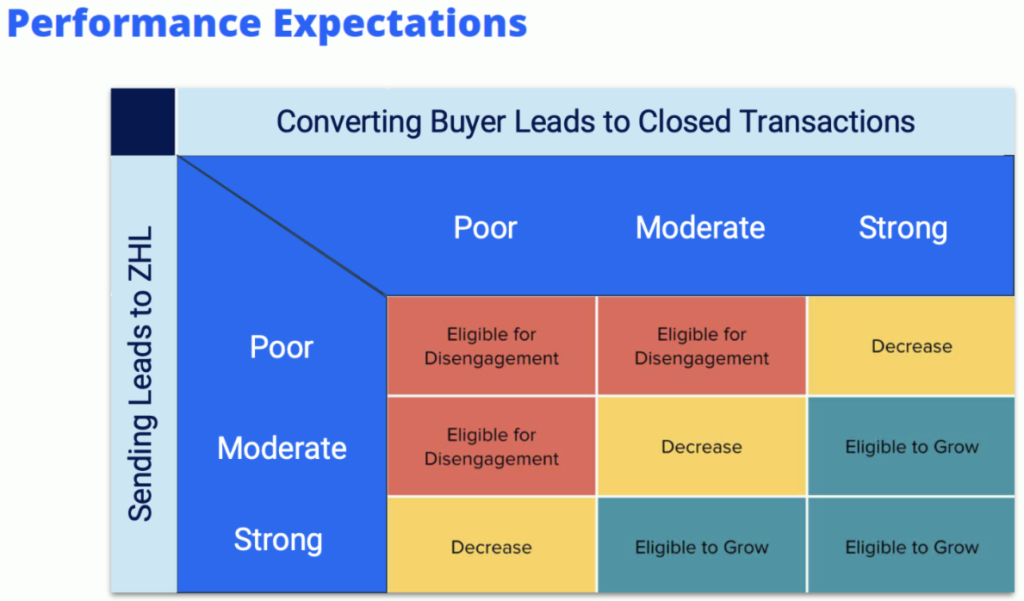

Zillow has staff taking the incoming calls, and qualifying the leads before sending them to their Flex agents. Their referral fee is now 40% of the gross commission, AND they want buyers to use Zillow Home Loans too. Their Flex agents who send their buyers to ZHL will be rewarded with more leads, and vice versa:

Less than five percent of the U.S. real estate agent population works with Zillow (with far fewer Flex agents), and Zillow only touches around three percent of U.S. real estate transactions. They are running a small, exclusive ecosystem of agents that are willing to play by their rules, which now includes tight integration with Zillow Home Loans.

You’ve probably seen the TV ads by Homelight? The ones that pitch teaming you up with the best agents in town? Well, at least with the best agents who are willing to pay them a 30% cut of the gross commission.

Now Redfin is giving up on their agent-employee program, and they are testing the idea of hiring agents on commission splits, instead of salary and paying them “up to 75%”. It’s doubtful they will pay many of their agents the full 75% split. It’s just another way for them to get referral fees of 30% to 50%.

None of the referral fees are disclosed to the client, and it’s never discussed of how the size of the fee will impact the quality of the agent service you receive.

But most of all, any thought of commissions dropping will be fleeting at best. Commissions need to stay high in order to pay the larger referral fees!

by Jim the Realtor | Oct 22, 2023 | Realtor, Why You Should List With Jim |

This topic came up in my 45 hours of continuing education, and Donna agreed that rarely do listing agents comment on their seller’s disclosures – do they even read them? A focal point as we transition into single agency:

To complete the disclosure process, the seller’s agent filters property information provided by the seller before it is provided to the prospective buyer.

Accordingly, all property information received from the seller is reviewed by the seller’s agent for inaccuracies or untruthful statements known or suspected to exist by the seller’s agent. Corrections or contrary statements by the seller’s agent necessary to set the information straight are entered on the disclosure forms before the information is used to market the property and induce prospective buyers to purchase, collectively referred to as fair and honest dealings.

The extent to which disclosures about the physical condition of the property are to be made is best demonstrated by what the seller’s agent is not obligated to provide. Everything else adversely affecting value and known to the seller’s agent – material facts – are to be brought to the attention of prospective buyers as a matter of law.

As a minimum effort to be made before handing a prospective buyer information received from the seller, the seller’s agent is to:

- review the information received from the seller;

- include comments about the agent’s actual knowledge and observations made during their visual inspection of the property which expose the inaccuracies or omissions in the seller’s statements; and

- identify the source of the information as the seller.

by Jim the Realtor | Oct 20, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, The Future, Why You Should List With Jim |

Currently, every listing agent is required to offer some sort of buyer-agent compensation on the MLS. Zillow and Redfin publish those commission amounts on every listing now, so they are all out in the open.

Today, there are 79 homes for sale between La Jolla and Carlsbad in the $2,000,000-$3,000,000 price range. Thirty percent of those listing agents are offering less than 2.5% commissions to the buyer-agents.

Outsiders who see that will assume that commissions are finally starting to drop, after all these years.

But the vast majority of those listing agents are probably still taking 5% to 6% commissions, and offering 2% or less to the buyer-agent (and more for themselves).

If the listing agent is supremely talented and brings special skills to the transaction, then it would be understandable. But I’ve been a buyer-agent on listings that are offering less than 2.5%, and they’re not different. Virtually every listing agent still practices the Three-P marketing plan: Put a sign out front, Put it in the MLS, and Pray.

There are hundreds of multiple listing services in America. So far, only a few have removed the requirement of offering a buyer-agent commission. But the NAR lawsuits are going to change that, and soon every MLS will permit 0% commissions to be offered to the buyer-agents (hoping buyers will pay their own agent).

The listing agents who have little or no repsect for the buyer-agents will keep offering them lower and lower commissions. Eventually, their rate will get down to zero or close.

Will sellers figure it out?

Sellers focus on the total commission. They don’t do enough transactions to know that the amount the listing agent pays to the buyer-agent will impact the sale. It is a bounty offered to encourage the sale of the house, and when market conditions are soggy, it is better to pay buyer-agents more commission, not less.

In the lawsuits, they will discuss agents steering their buyers to homes that pay higher commissions. It’s why the search portals publish the commission rates now so buyers can track whether their agent shows any bias based on the commission rate being offered.

It’s why the industry will be racing towards 0% commissions offered to the buyer-agents.

Eventually, the DOJ will probably step in and insist that ALL sellers pay 0% commission to the buyer-agents to insure there is no chance of steering. Instead, listing agents will just offer them spiffs under the table in a softer market or when the house is ‘unique’.

Until then, the listing-agent teams are going to keep offering lower and lower commissions (if any) to the buyer-agents – who will then try to get their buyers to pay them something….anything!

At the same time, the listing agents will be encouraging buyers to avoid paying a buyer-agent commission altogether by coming direct to the listing agent instead. Their in-house assistant-agents will attempt a faux representation of the buyer but it will just be a novice clerk who processes their paperwork.

Boom! The seller didn’t have to pay a buyer-agent commission – making these lawsuits worth it – and instead the listing agent keeps the whole commission. If buyer-agents can somehow wedge themselves into the deal, then great, but will the buyer pay them too, when it doesn’t seem necessary?

Mark my words – this will be standard fare in the next year or two.

by Jim the Realtor | Oct 19, 2023 | Realtor, Realtors Talking Shop, The Future, Thinking of Buying?, Thinking of Selling?, Why You Should List With Jim |

People are asking about the NAR lawsuits – hat tip to Susie, Gerry, and Carl!

The lawsuit that began this week contends that realtors force sellers to pay a commission to the buyer’s agent. Two defendants, ReMax and Anywhere (Coldwell Banker, Sotheby’s, etc.) have already come to settlement agreements, though they haven’t been approved by the judge yet. The other two brokerages, Keller Williams and Berkshire Hathaway, plus the National Association of Realtors are the remaining defendants. Their attorney started the proceedings by declaring that the plaintiffs have the burden of proof, and the defense may not call a witness. It is that type of arrogance that got them into this mess!

A summary:

In their trial brief, the plaintiffs in the suit allege that NAR’s Participation Rule, which they refer to as the Mandatory Offer of Compensation Rule, is “a market-shaping and distorting rule” that stifles innovation and competition.

“The Rule requires every home seller to offer payment to the broker representing their adversary, the buyer, even though the buyer’s broker is retained by and owes a fiduciary obligation to the buyer (who may be told, falsely, that the services of the buyer broker are “free”),” the brief said.

They argue that the current practice of the seller’s agent splitting their commission with the buyer’s agent, who typically negotiates for a lower selling price for their client, works against the seller’s interest and only exists due to the alleged anticompetitive rules. The plaintiffs also note that the NAR rule in question requires a blanket offer of compensation for the buyer’s broker regardless of their experience or the level of service they provide the buyers with, and that the compensation offer was only visible to the buyer’s agent and not their clients, until very recently.

“This artificial and severed market structure created by Defendants’ conduct deters price-cutting competition and innovation, resulting in inflated commissions,” the brief states. “The Mandatory NAR Rules impede the ability of a free market to function in the residential real estate industry, and the plain purpose and/or effect of the Rules is to raise, inflate, or stabilize commission rates.”

In the brief, the plaintiffs claim that the other defendants in the suit colluded with NAR to enforce this and other NAR and MLS policies.

“The Corporate Defendants compel compliance in multiple ways, including by requiring their franchisees, subsidiaries, brokers, and agents become members of NAR; writing the NAR Rules into their own corporate documents; and requiring that their franchisees, subsidiaries, brokers, and agents become members of and participants in the Subject MLSs — entities that compel NAR membership and adopt the mandatory NAR Rules,” the brief reads.

The brief notes that Craig Schulman, the director of Berkeley Research Group and professor of economic data analytics at Texas A&M University, will be an expert witness for the plaintiffs at trial. In studying transaction data from NAR and other parties, the brief states the Schulman has concluded that “(a) the NAR Rules have anticompetitive effects; (b) the NAR Rules caused a seller to pay his adversary (buyer broker) and that, but for the conspiracy, a seller would not pay the buyer broker; and (c) all class members were impacted.”

The brief also notes that Schulman will testify that NAR’s rules have stabilized commission rates at an “anticompetitive level,” noting that commissions have remained at 6% for several years.

Unfortunately, none of the reality of what happens on the street will get introduced during the trial. Instead, it will be ivory-tower guys hoping to persuade the judge and jury (one of which has to breast-feed her infant every 1.5 hours) that the whole commission thing is out of control and someone is to blame.

But the defendants have a good point:

NAR also argued that the plaintiffs do not have the ability to sue for damages —which some believe could reach as much as $4 billion in this case — because under federal and Missouri antitrust law, only “direct purchasers” can be allowed to sue and the plaintiffs have not bought anything directly from NAR or the other defendants.

“And, according to those same Model Rules and listing agreements, Plaintiffs did not directly pay cooperating agents, NAR, or the other Defendants; sellers only directly pay their listing agents and only directly receive services from their own agents,” the brief states. “Therefore, at best, Plaintiffs might claim that they paid their listing agents (who are not parties to this case) who, only then, paid Defendants. But such an indirect claim is prohibited by Supreme Court case law.”

Home sellers pay the full commission to the listing brokerage. It is the listing agent who declares in the original listing agreement of how much of the full commission they are willing to pay the buyer’s agent. None of this will be discussed during this trial, but it’s the most important part!

The plaintiffs should be suing the individual listing agents – good luck with that!

In the end, the defendants might be found guilty, and they will appeal for years – the American way! Or it’s more likely that they will settle in the next couple of weeks because the ReMax and Anywhere settlements were only $55 million and $85 million, which is pennies.

Part of the settlement package will be that the MLS will no longer be obligated to display ANY commission to be paid to the buyer’s agent. It will cause two things to happen:

- MORE steering by the buyer-agents to the homes that are paying a healthy commission (bounty).

- Buyer-agents trying to convince their buyers to pay them the buyer-side commission.

Kayla is faced with this dilemma in New York City. Did you know that 2/3’s of the population in Manhattan are renters? It’s a big business! But the listing agents don’t offer a tenant-agent commission, which means Kayla has to get paid by her tenants upon finding them new home to rent.

The results:

- She has had the landlord’s listing agent pull aside her potential tenant and tell her to ditch Kayla and save the money, and go through him directly. Apparently they aren’t concerned with their reputations!

- She has also had her potential tenants be reluctant to sign an tenant-agent agreement because they see apartments being advertised by the listing agents. They want to reserve the right to go direct to the listing agent, and usually they do. As a result, Kayla only works with those who appreciate her advice.

The idea that home buyers will hire and pay their own buyer-agents is a great idea…..in theory.

The reality is that buyers will go direct to the listing agents when they see an interesting new home for sale. Those listing agents will be advertising to those buyers directly, and flat-out encourage them to get a better deal by going through them.

The buyer-agent is a dead man walking.