The data keeps pointing to a slowdown, and like a Yu Darvish hanging curveball, once it’s in flight, there’s not much you can do. Few sellers need to sell bad enough that a substantial price reduction will be considered – and there isn’t enough competition to cause any fear. For buyers who keep reading about the threat of rising rates, it can be very frustrating.

Here’s how the C.A.R. describes it:

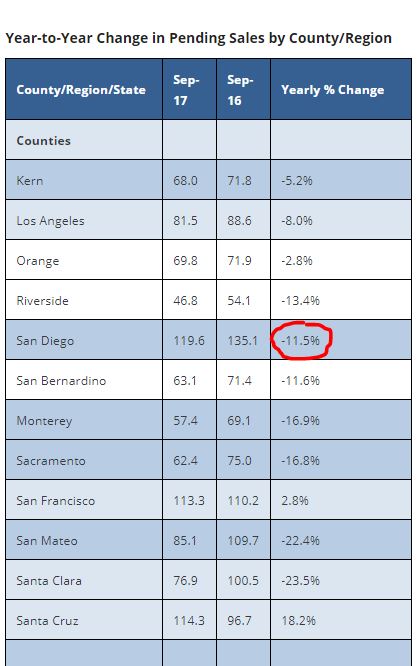

• Pending home sales have declined on an annual basis for eight of the last nine months so far this year. After a solid run-up of closed sales in May, June, and August, continued housing inventory issues and affordability constraints may have pushed the market to a tipping point, suggesting the pace of growth will begin to slow in the fall.

• C.A.R.’s Market Velocity Index – home sales relative to the number of new listings coming on line each month to replenish that sold inventory, or market indicator of future price appreciation – suggests that there continues to be upward pressure on home prices through the fall. Home sales continue to outstrip new listings coming online to restock sold units.

• The Market Velocity Index dipped from 53 to 52, implying that there were 52 percent more homes sold than new listings, meaning the supply of homes available for sale continued to drop.

However, fewer homes are coming to market, in spite of record pricing:

NSDCC # of Houses Listed Between August 1 – September 30th:

2016: 848

2017: 738

Diff: -13%

All SD County # of Houses Listed Between August 1 – September 30th:

2016: 6,006

2017: 5,346

Diff: -11%

NSDCC # of Houses Listed In September Only:

2016: 413

2017: 337

Diff: -18%

All SD County # of Houses Listed In September Only:

2016: 2,836

2017: 2,473

Diff: -13%

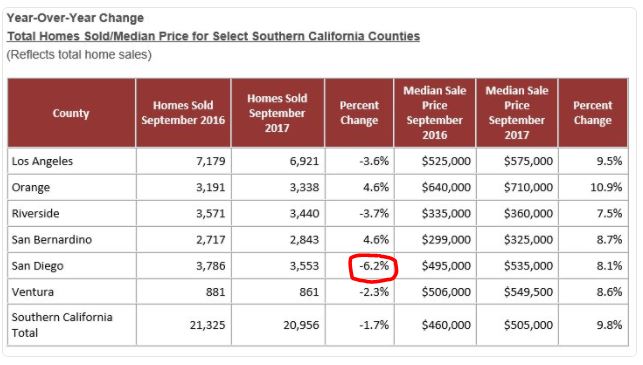

With fewer homes to sell, the percentages of pending and closed sales have nowhere to go but down – and we’re doing fine, considering the inventory. The declines in the pending and closed sales are in line with, or better than the decline in new listings.

Higher interest rates, higher property taxes, sometimes outrageous HOA and mello roos, and possibly less of a tax deduction on housing is not a good sign. I have equity and would like to get into a bigger home, but home prices are way more than I want to spend. So I’m part of the statistic that is staying put until prices come down. Yes, I’ll lose some equity but I’m not about to overpay to what is starting to look like a flipper dominant market.

So I’m part of the statistic that is staying put until prices come down.

Thanks Rob for checking in again!

I’ll ask an obvious question – have you considered moving further out?

On flippers – if it weren’t for them, buyers would only have the older-looking resales to mull over. Because local governments have been slow to re-purpose old properties and vacant land, new-home building has dropped off the map, especially in the sub-million market. Flippers are picking up the slack, and offering the newer-look product, though at retail, or retail-plus pricing.

I moved to Carlsbad 12 years ago and love everything about the city. Since moving, my wife and I both have a good job in Carlsbad and our child will soon be attending one the high rated schools. Yes I’ve considered moving further out, but it doesn’t make sense at this point just to have more square footage. Every so often I look at what’s available and the flips are obvious by the photos with a 100-250k+ markup. I guess the majority of shoppers don’t want to lift a hammer or paint brush. If there was a home for sale that needs a little elbow grease and meets my criteria at a decent price I’m sure my bid couldn’t compete with an investor. So in the meantime I’ll continue window shopping and enjoy reading your blog.

ROB, always love your comments,BUT if the republican tax plan passes the 500K deduction limit on mortgages which I corrected predicted in earlier posts will apply to NEW mortgages, which means a “run” on all properties here above a price point of 600K or there abouts when you include closing costs to the mix. My earlier prediction was that existing mortgages would be grandfathered in.

Most say 2 million and up sales will not effected, they already have a 1 million limit, but if you are going to move AND get a loan over 500K mark, this is a no brainer time to make, yes high prices but very low costs of funds, going from 4% to 5% is a minimum 20% interest increase over the life of the loan, which would cover any price swings you are waiting for. I do not see the issue of the 250/500K sale deduction mentioned here, but that could possibly be limited in the future.

I would make the move if the above situation fits you, and you pay taxs. Jim as a “super” realtor you had better get prepared for a busy time coming up in the mid price range, especially on the coast.

Good Luck

Hmmmm….maybe it’s time to refinance and pull all the equity out while I can still deduct the interest. My guess is mortgage brokers are going to be REALLY busy until the last refi closes December 29th.