The economists like the housing market, but they are known to play it safe.

How about the consumers?

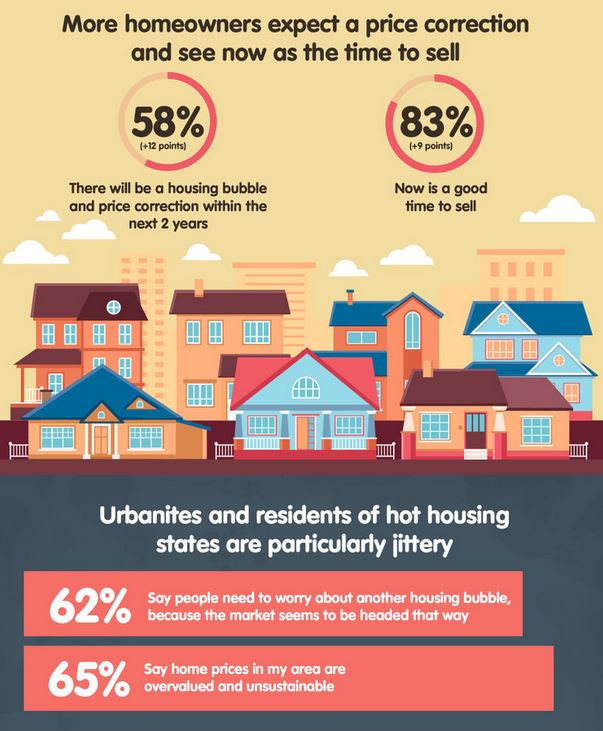

I’d prefer to survey the active home buyers and sellers in our area to get the best reading on our future. But here are the sentiments of 1,079 American adults over the age of 18 who were surveyed last month:

Fifty-eight percent of homeowners say that they expect there will be a “housing bubble and a price correction” in the next two years – up 12 percentage points since April.

Looking across the country, residents in hot housing states are particularly jittery. The top five states where residents believe the market is approaching a “housing bubble” include:

- Washington (71 percent)

- New York (68 percent)

- Florida (63 percent)

- California (59 percent)

- Texas (58 percent)

While experts have long suggested living in a home for more than seven years could lower a homebuyer’s exposure to market fluctuations, only 37 percent of millennials in the survey plan to live in next home they buy for more than six years, making the so-called “rule of seven” less relevant to the next generation of serial homebuyers.

“Beyond the jitters, I see in our survey an increasingly informed nation of homebuyers, who understand the risk of the market,” said Melendez. “To those concerned about a price correction, or waiting to time the market, I recommend a proactive approach. Have an exit plan, then anytime you find a home you love is a good time to buy.”

Read full article here:

How do you feel? Leave your thoughts in the comment section!

If millennials want to have a 5 or 6 year time horizon, then yes, they take a risk. But market forces probably won’t bend to their wants.

The main question should be “If I were to buy a home today, am I confident it would be worth more in 10 years”. Haven’t done the math, but I would think you would be hard pressed to find a 10 year span in California where 10 years isn’t enough to smooth out a correction. The only likely culprits might be 1999-2009; 2000-2010; 2001-2011; 2002-2012, but I doubt it. For the most part, people that bought in 2007-08 are fine now, unless they simply bought a house they couldn’t afford (separate issue) or were forced to sell due to death, divorce, job loss or relocation.

For the most part, people that bought in 2007-08 are fine now, unless they simply bought a house they couldn’t afford (separate issue) or were forced to sell due to death, divorce, job loss or relocation.

Think of those who got a neg-am loan. They saw a much-higher payment ‘option’ a couple of months into it, and freaked out. The same loan agents who gave them the neg-am had jumped into the short-sale/credit repair business – and they scared the crap out of homeowner that they will be broke forever unless they dump their house.

The homebuyers’ credit got hammered, and the scars lingered – and they didn’t buy another house.

It’s too late for them now. If they would have just hung in there, they would have been fine too.

Absolutely, it was never a good idea to have used car salesmen hawking mortgages and neg-am loans were borderline criminal.

I learned the long-game lesson courtesy of the first of our high school buddies (the one that didn’t go to college) to buy in Orange County, circa 1988. By ’90 he was hating life. He stuck it out. Was it easy? Nope. He had to really grind for awhile. Sold around 2002 and was fine and traded up to the family house he still has today. He got in at the worst possible time, but since he was able to stick it out, he’s now living in his well-funded retirement plan (or his kids path to being able to somehow live in California some day).

Have an exit plan… Right, easier said than done though.

An exit plan is fine in theory but real estate markets can turn quicker than you can list and sell, and that’s before family and work considerations

An exit plan is fine in theory but real estate markets can turn quicker than you can list and sell, and that’s before family and work considerations

Agreed – the market change as fast as you can say ‘nuclear bomb’.

Agree with everyone, so much for “anytime you find a home you love is a good time to buy”.