Well, now what?

Will there be a flood of new inventory from those who leave the country?

No way – the mega-rich celebrities might hit the road, but normal people will stay put. We have it too good here, and moving to another country is everything its cracked up to be:

http://www.cnbc.com/2016/10/31/heading-to-canada-post-election-is-a-bad-money-move.html

Without a flood of inventory, our market conditions should stay the same – the demand for buying houses far out-stripping the supply, with the only thing in the way of sellers selling is their own price reluctance.

The demand could get stronger too. We had hundreds of open-house visitors to the listing on Bluff Ct., and 16 offers – the weekend before the election! There had to be a segment of buyers who have been on hold until the election concluded. If they get back in, the demand could grow further.

If Trump gets the same chance that Obama got to prove himself, and Trump gets off to a decent start, we could see the housing frenzy fire up again early next year around North San Diego County’s coastal region.

http://www.inman.com/2016/11/09/president-trump-mean-housing-market/

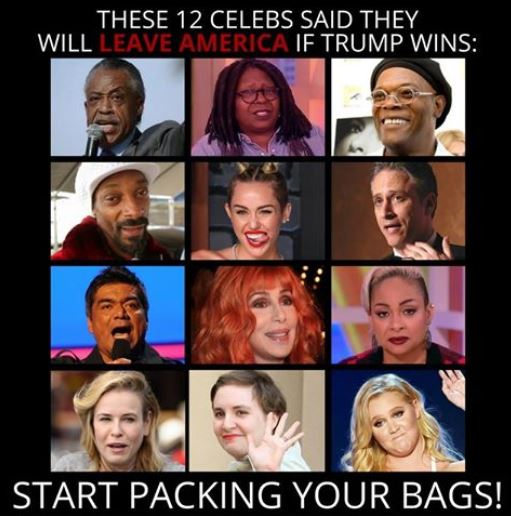

i will gladly help them pack. except for Samuel L Jackson…..he can stay.

Some big money in Silicon Valley is freaking out and will be looking to get California to become its own country.

http://mashable.com/2016/11/08/silicon-valley-election-freakout/#zu8lwZGqz8qw

Snoop Dogg isn’t going anywhere, Prop 64 just puff, puff, passed!!

Conforming rates up to 3.75% no points:

http://www.mortgagenewsdaily.com/consumer_rates/677466.aspx

Mortgage Rates skyrocketed today, relative to their average range of movement. It was the single biggest move higher since the days of the taper tantrum in mid-2013. Virtually all lenders are quoting conventional 30yr fixed rates that are at least an eighth of a point higher versus yesterday. Over the past decade, you can count single-day eighth-point moves without using any toes. Some lenders were a quarter point higher, which has only happened a few times, ever.

The source of the drama is the market’s paradoxical reaction to Trump’s victory. Before the election, news that benefited Trump generally benefited rates. This was logical because Trump connoted uncertainty and rates tend to benefit when investors seek shelter from uncertainty by buying bonds. Indeed, bonds’ first move was tremendously positive when Trump pulled ahead overnight. Everything was going according to plan, and those of us burning the midnight oil expected decent improvements in rates this morning.

But the positive narrative unraveled before sunrise. According to the negative narrative, Trump’s claimed policy goals stood a greater chance to hurt bond markets and push rates higher in the long-run. That negative narrative wasn’t a new concept, but very few market participants expected it to steal the show so quickly. Once traders find themselves on their heels in the face of unexpected momentum, the only course of action is to turn around and run with that momentum indefinitely.

Bottom line, this is what financial media often refers to as a capitulation trade. “OK, so we’re going to go with higher rates on the Trump Victory? OK, I’ll sell some bonds too then!” When tension and market volumes are running high, and when every trader wants to sell bonds, things tend to move quickly.

The natural question: was that it? Is it over?

Rates were long overdue for a 50-100 basis point move higher. This just means more people staying put near the coast and smaller 1099s for mortgage brokers. If equity markets remain elevated, then we should have stable house prices and fewer move up buyers. Cash buyers should be an even larger chunk of the market. Buyers in general will be pickier.

Trump made his money from real estate. Now he has control of government. It’s going to be interesting to see how Trump and the bankers get along.

Before being elected he talked about raising interest rates. We’ll have to see if he follows through.