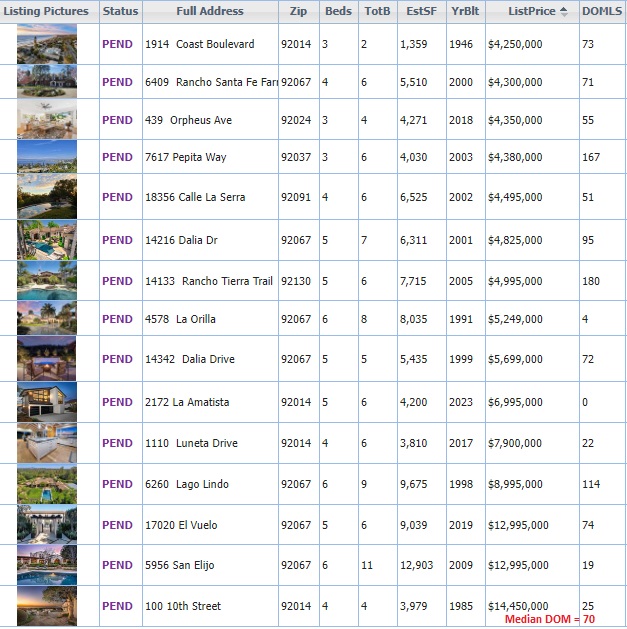

It’s impressive to see so many high-enders go into escrow this quickly – these are the NSDCC homes listed over $4,000,000 than have gone pending since the first of the year:

Not mentioned above is the listing that hit the MLS on January 3rd, went pending on the fifth, and closed on the 17th – and went back on the market the next day for $620,000 more:

https://www.compass.com/app/listing/4532-rancho-del-mar-trail-san-diego-ca-92130/1227253413756497393

It sold for $5,380,000 in 2019, $5,959,000 in 2014, and $5,650,000 in 2013.

Here are the historical counts:

| Year | ||

| 2018 | ||

| 2019 | ||

| 2020 | ||

| 2021 | ||

| 2022 |

I guess we will know the real story once these close.

On one hand seems to be defying logic here in the luxury market but on the other hand the amount of money that was made during the pandemic via stock gains and PPP fraud makes me think the buyers will eventually keep showing up.

Featured home of the day – just closed yesterday for $8,000,000 (and sold for $7,900,000 in Jan 2022):

https://www.compass.com/app/listing/6855-la-valle-plateada-rancho-santa-fe-ca-92067/1129027977484078473

makes me think the buyers will eventually keep showing up

Me too – and I’m guessing that most of the buyers are from out of the area. The winter should be our prime selling season – attracting the affluent snowbirds!

I believe what’s happening is that theres a group of people that value time over money.

The insiders / squatters / speculators are getting out of high end real estate and the people (likely 65+) with lots of $$$ are finally getting a chance to buy.

Theres only so many of those type of people + usually when they pass the family fights over the leftovers + the house gets sold. So while this is good for now if the economy doesnt get better in the next 5-10 years properties will get sold again at a loss or even.

It is good to see Sales happening though. It shows that sellers and buyers are finding a middle ground.