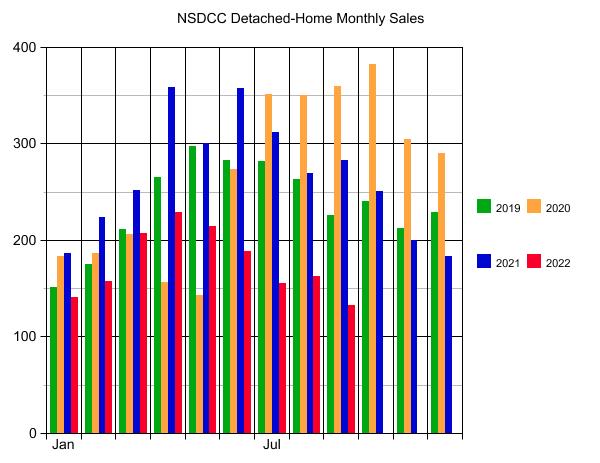

The number of NSDCC detached-home sales in September is up to 133 today, which is pretty good. There are only 138 pendings currently, but 34 sales have already closed in October so there is a decent chance that we’ll have 100+ sales this month too!

The drastically-lower YoY sales will give participants the idea that the market conditions keep deteriorating, but to me, it is a sign that sellers are holding out on price.

If we can just average 100 sales per month in the fourth quarter, I’d consider it a successful end to 2022!

It’s natural for most buyers to want to see what happens in springtime, and I think we can all predict what’s coming. The 2023 home sellers aren’t going to believe that the old comps don’t matter any more – and they will price their home within 5% of the peak pricing.

The way things are going I would say brace for impact and 10% mortgage rates. When lay-offs start, we will see who has been swimming naked. The whining and lamenting will get very loud in the media in the form “the end of the world is near” if we dont give more free money to casino players.

But its time for the housing to become affordable again if the youth can have a chance at starting a family. Housing shouldnt be a speculative asset.

But its time for the housing to become affordable again if the youth can have a chance at starting a family. Housing shouldn’t be a speculative asset.

It’s too late.

The cheapest NSDCC house for sale is $1,049,999, and there are only three for sale under $1,200,000. For normal people to be able to buy a home close to the coast, the prices would have to get down to $250,000 again, and at 7% interest the payments would be around $2,000 per month.

The affluent buyers will jump in long before that happens, and rent the houses to the normal people instead.

Judging by the decline in the median sales price (a terrible measuring stick) since June, these are the worst markets in America:

1. Austin -10.3%

2. Phoenix

3. Palm Bay

4. Charleston

5. Ogden

6. Denver

7. Las Vegas

8. Stockton

9. Durham

10. Spokane

https://nypost.com/2022/10/10/home-prices-are-falling-fastest-in-these-10-us-cities-data-shows/

House prices in the US are not market determined but a policy choice.

Keep mortgage rates high and prices will come down to what Joe the plumber can afford. People buy a monthly payment not a house.

Fed owns 25% of the mortgage market, they have no business doing that, but if they decide to make housing affordable they can, its a policy choice, start selling MBS they have in their balance sheet and you will see mortgage rates go over 10% instantly.

As for investors, that is easy fix, and many countries have fixed it, tax second residence , and tax more if you don’t live in the community, it can be done. Housing is one of those basic needs of life that we might find out was best not to speculate with. I wont be surprised to find a strong correlation between house prices and new births, which is appalling long term policy.

College graduates right out of college can easily make $75k/year starting in San Diego. A dual-income family has more buying power than most oldies think. And that’s STARTING salary. This isn’t your parents SD (I grew up here, so I understand how some old timers can’t figure out what’s happened).

And I’m one of those waiting on the sidelines to start scooping up, but I don’t think it’ll get close to where people are hoping. Maybe 10-15% short term decline. Maybe. But that’ll be in rear view mirror soon enough.

If minimum wage at McDonalds is $22/hr next year ($50k a year) and dual incomes earning $100k at McDonalds, what do you think is happening to nominal prices?