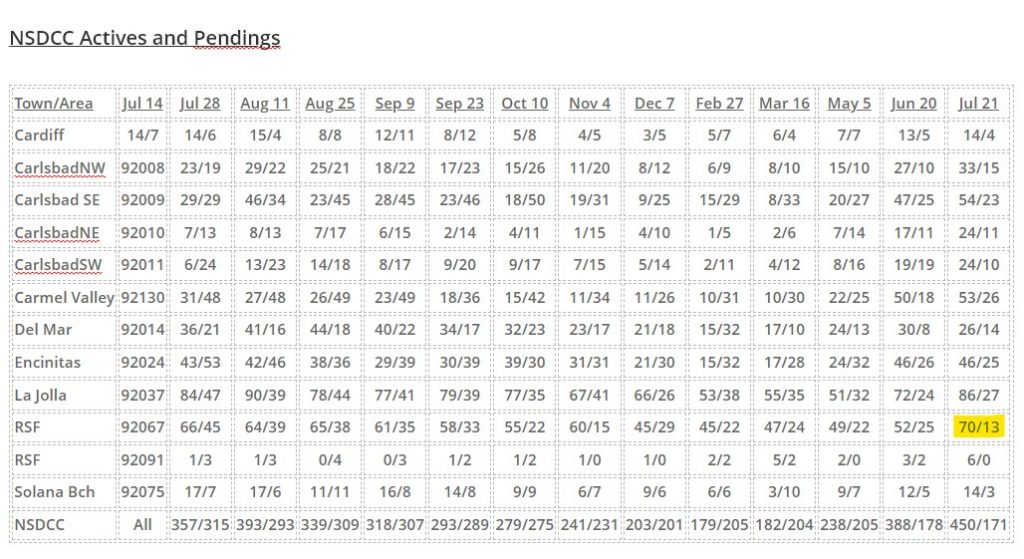

The reason for breaking down the active and pending listings by zip code is to give the readers a closer look at their neighborhood stats.

In the recent years prior to the pandemic, the actives/pendings in Rancho Santa Fe ran at a 10:1 pace. Nobody is in a hurry there, they don’t have to sell, and they’re not going to give it away. Those days appear to be coming back.

The median list price of those RSF actives is $5,995,000 – is anyone going to feel sorry for them? Probably not. Does it reflect what is going on in the rest of the area? Not really – the other areas are mostly around a 2:1 ratio (except La Jolla) which has been our standard for a healthy market and pretty good, all considered.

In 2020, we had 400+ pendings from June 22nd to November 30th – with a peak of 491 pendings on September 7, 2020.

Rates are at 2-week lows:

https://www.mortgagenewsdaily.com/markets/mortgage-rates-07212022

NOTE: rate quotes are all over the map right now, and one key reason is the outsized value of discount points in the current market. For example, during more normal times, you might see two equivalent loan quotes (2 options from the same lender) where one option has one discount point in exchange for a 0.25% lower rate. At present, however, that discount point can buy 0.5% to 0.625% in rate.

None of the above is intended to offer any commentary on whether paying points is wise. Certainly, if we knew that rates would be quite a bit lower in 6 months, you wouldn’t break even on the extra upfront expense of discount points (assuming you refinance in roughly 6 months). The only reason I share the information is to explain why some rate quotes are so seemingly different. In many cases, they’re not very different at all. One lender is just quoting a scenario with additional upfront costs (i.e. points) that bring the rate down.

For most scenarios with most lenders, borrowers should be able to choose between paying lower upfront costs with a higher rate or higher upfront costs with a lower rate. When presented with both options, one simple way to evaluate them is to calculate the number of months it will take to recoup the additional upfront cost (feel free to adjust for investment opportunity cost if you like) and ask yourself if you’re likely to be selling or refinancing before the “break-even” month.