We’ve had 208 closed SFR sales between La Jolla and Carlsbad this year.

How crazy is it?

Eighty homes sold over the list price, which is 38% of the total number of sales. Of those, most were just $10,000 to $50,000 over list, but there were some big bombers:

Most % Over List Price

| List Price | ||

| $1,150,000 | ||

| $1,500,000 | ||

| $1,850,000 | ||

| $1,500,000 | ||

| $650,000 | ||

| $2,199,000 | ||

| $2,395,000 | ||

| $2,250,000 | ||

| $2,995,000 | ||

| $1,449,000 |

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

It’s not just paying more than the list price. The listing agents will test your mettle too.

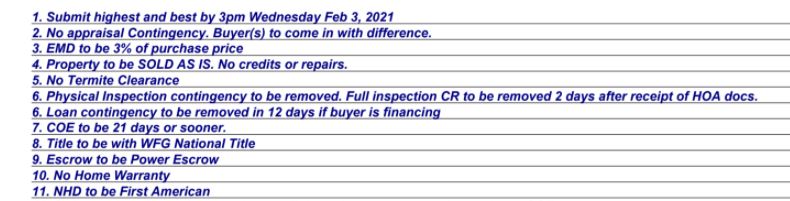

Here’s a seller counter-offer on a million-dollar home with nine offers on it:

The house was built in the 1980s, and you expect the buyer to take it as-is without a home-inspection contingency? And you’re going to get 5% to 10% over list price, but you can’t throw in a home warranty?

There will be buyers who would have paid more money but who drop out when they see the extra demands.

Listing agents believe that this is how you get rid of the buyers who ‘aren’t serious’, but in reality it just limits the remaining buyer pool to the emotionally-charged-and-will-sign-anything buyers. They are the ones that are less likely to close escrow.

Is a no appraisal contingency even legal?

Seriously. That would put the buying agent in the crosshairs of a due diligence suit. Certainly violates most consumer protection laws.

Oh, and #8 “Title to be with” is beyond illegal.

This is the Wild Wild West – nobody cares about the stinking laws!

I thought that during the REO days they decided that the title-insurance company was to be selected by the buyer. But this from the CA insurance commissioner:

Who Pays the Premium for the Title Policy?

In California, settlement practices vary from locality to locality.

The party that pays the title premium is a matter of local custom and practice and not set by law. Depending upon the region, the premium for a title insurance policy can be paid by the buyer or the seller or split between both parties. In Southern California, the seller customarily pays the premium for title insurance.

It has been the practice in Northern California that the buyer customarily pays the premium for title insurance, or occasionally the premium is split between buyer and seller. In almost every county, the buyer pays the lender’s policy premium. The parties are free to negotiate a different allocation of fees. Your title company or escrow company can advise you as to who normally pays the premium in your area.

http://www.insurance.ca.gov/01-consumers/105-type/95-guides/03-res/Title-Insurance.cfm

As a seller, what could make me choose something other than the highest offer?

21 vs 30 days escrow really doesn’t make a difference to me. All-cash vs Financed still shows up the same in my bank account.

If a buyer writes up an offer exactly as asked for above, they can still drop out before the last contingency is due and leave me hanging. What does an offer written this way prove?

As a seller, what could make me choose something other than the highest offer?

The extra terms were all cooked up by the agent – the seller rarely cares about anything except the highest price.

They intend to put the buyer’s feet to the fire, but if it causes you to lose legitimate buyers in the beginning (who won’t tolerate them) and then the one you select blows out because you demand they release all contingencies whether they are ready or not – did you do your seller any favors?