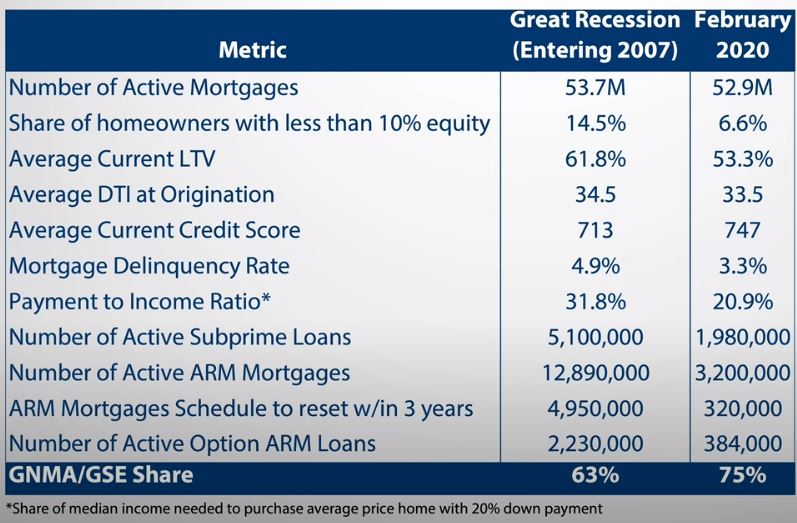

Matthew does a statistical comparison of today vs. 2008 in this video below. Important to note how his stats show how comfortable sellers are today, and I’ll add that even if homeowners lose their job and stop making payments, it would take a year or two before you’d see foreclosures:

Could the coronnavirus get so bad that it triggers the boomer liquidations? Maybe, and if so, the boomer sales would still be spread out over time because homeowners – especially the long-timers – will resist leaving the comforts of home for as long as possible, and they will hope that waiting out the virus will lead to a better market.

Might as well title this post why its different this time

Agree – I have heard this comparison several times in the last seven weeks from various real estate types but I thought this one at least had the stats clearly identified and his reasoning was fairly neutral (others have laughed off any repeat of 2008).

While the underlying fundamentals of our real estate market today is much better than last time (everyone has had to qualify for their loan this time, for example), nobody wants to touch on the new facts that could disrupt the real estate market further.

I’m looking for them though!

People don’t default if they have skin in the game. Without defaults, prices don’t drop in a big way. Especially in high end CA.

Exactly. We had a crisis in 2008 because buyers financed 100%, not just because of the neg-am.

Sellers will wait forever, rather than walk with nothing.

There was a Bressi Ranch victim who kept paying about $5000 per month to save his credit, even though he had no equity from the beginning (he financed 100% of $1.3M).