For those looking for our jumping-the-shark moment, this might be it.

Inventory is growing, and there is only one reason: More prices are wrong.

But when you sell your best asset down the river and let amateurs run it who are out of touch with reality, you get explanations like this:

The number of homes for sale in the country is starting to flatten, which realtor.com® researchers say is signaling a “crucial inflection point for the inventory crisis.” Inventory has decreased slightly by 0.2 percent from a year ago, but is poised for an increase in the months ahead due to an 8 percent increase in new listings. This marks the largest annual jump since 2013, according to a new report from realtor.com®.

“After years of record-breaking inventory declines, September’s almost-flat inventory signals a big change in the real estate market,” says Danielle Hale, chief economist for realtor.com®. “Would-be buyers who had been waiting for a bigger selection of homes for sale may finally see more listings materialize. But don’t expect the level to jump dramatically. Plenty of buyers in the market are scooping up homes as soon as they’re listed, which will keep national increases relatively small for the time being.”

She gives the impression that more homes for sale will be satisfied by pent-up demand – that we shouldn’t “expect the level to jump dramatically”, because the new inventory will get scooped up.

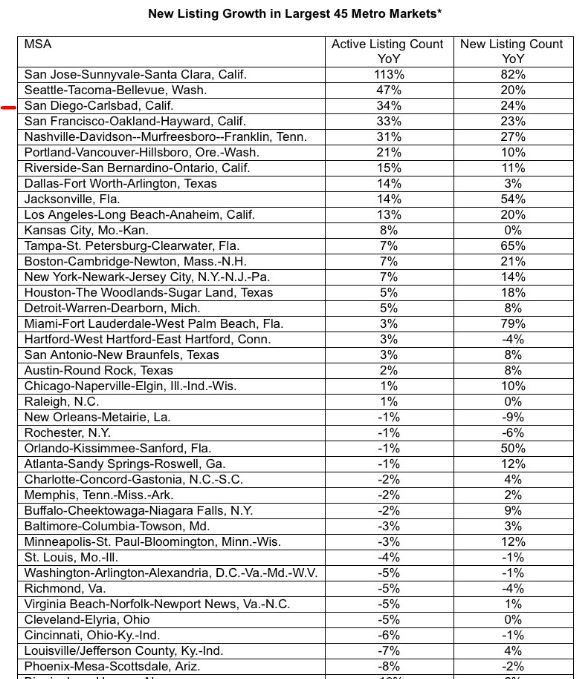

If you ask me, +34% and +24% is dramatic!

Inventory is up because buyers are waiting for a bigger selection of affordable and better-priced homes for sale. Any time the inventory grows, it is due to overly-optimistic pricing.

IMO we have to wait til next spring before we can say we whether or not we jumped the shark.

Could be just a lull (prices hitting resistance before breaking out to new highs)

Time will tell I guess.

Could you give the link to the full list? Thx!

https://magazine.realtor/daily-news/2018/10/04/real-estate-market-prepares-for-burst-of-new-listings

Interest rates too. Vs a year ago, payments on a 30 year mortgage are 13% higher. A lot of brokers aren’t adjusting prices or sellers’ (or their own) expectations for that.

The one spot where I think you could see a (small) flood of inventory is in rental properties as Mom and Pop LL try to get out before any rent control hits.

I think Rent control would really see a fast drop in available rental units as most the small players will just say no thinks, I am out.

Sometimes inflection points are just from rapidly rising to moderately rising/plateau.

Don’t discount rising gas prices in supressing longer commute communities.

Sometimes inflection points are just from rapidly rising to moderately rising/plateau.

Yes, and wrong-priced listings benefit greatly from rising prices – eventually the market catches up. It is a listing strategy for many!

The market time may just be stretching out due to the shift to moderately rising/plateau. Hope sellers don’t mind waiting!

Interest rates too. Vs a year ago, payments on a 30 year mortgage are 13% higher. A lot of brokers aren’t adjusting prices or sellers’ (or their own) expectations for that.

No adjusting yet – still hoping that is someone else’s problem.

IMO we have to wait til next spring before we can say we whether or not we jumped the shark.

Agree, and I think I was referring more to the advice coming from expert knuckleheads has become completely unhinged from reality.

My theory on the 2019 selling season:

Sellers ignore more-recent comps and instead value their home based on slightly-higher Spring-2018 prices.

> “My theory on the 2019 selling season:”

Woah, I haven’t even won this years’ prediction contest. There are conceivably two more rate hikes in the near future.

And let us not forget SALT caps.

More theory on 2019: SALT caps aren’t playing much of a role in the buyers’ decision-making process because the actual impact isn’t right in your face…it’s down the road and off in the future somewhere when taxes come around.

Higher mortgage rates? Right in your face.

Especially for those long-time lookers who thought they were going to get a mortgage-rate in the 3s.

Plus buyers feel like they’ve been robbed, and want retribution, i.e. sellers need to pay.

Most homes are locked with ultra low rates. Why do they have to sell?

Disagree. Middle class people doing their taxes Feb-Mar-Apr suddenly discover their house is costing $600 more per month are going to profoundly affect the housing market. And not all of them will be able to adsorb that kind of take-home paycut. And then they amend their W-2 for more deductions and the one-two-three has them Zillowing tech jobs in Austin.

Middle class people doing their taxes Feb-Mar-Apr suddenly discover their house is costing $600 more per month are going to profoundly affect the housing market.

Middle class? The SoCal coastal markets ain’t for them. Unless you’re suggesting that current SoCal homeowners are going to sell their home over $600 per month.

For the affluent, eliminating the SALT deductions is merely a flesh wound. 🙂

Most homes are locked with ultra low rates. Why do they have to sell?

They don’t – the frivolous, less-motivated sellers need not apply. This isn’t a market for them.

We’re down to those who have a good reason to sell. They need one, for moving to make sense.

No impact on the GOOD ones that you want to buy. They would still be “out-of-reach”.

All the impact on the NOT NICE ones … the ones you don’t want to buy anyway.

For NSDCC …Minimal or zero impact on or near the coast. Farther away you are from the coast … the more you could be “impacted”.

“The one spot where I think you could see a (small) flood of inventory is in rental properties as Mom and Pop LL try to get out before any rent control hits.”

Seeing nothing of the kind in the areas I keep track of, and realtors are spewing offers to be my new friend like confetti. A few have hand-written expensive little cards telling me how great we’d be together. They took time on me. There’s a hell of a lot less mom ‘n pop rental operations than a decade ago. All over the place in areas I pay attention to, especially in ripe areas of LA, it’s corpoations and REITs handling things.

Ain’t many want to be selling, especially in areas being “re-whited.”

Cough cough Inglewood cough.

No impact on the GOOD ones that you want to buy. They would still be “out-of-reach”.

All the impact on the NOT NICE ones … the ones you don’t want to buy anyway.

For NSDCC …Minimal or zero impact on or near the coast. Farther away you are from the coast … the more you could be “impacted”.

This is the price gap returning to normal spreads between superior and inferior homes. The lousy ones have had it good in the frenzy – buyers weren’t paying close-enough attention, and paid too much for the dogs. Not any more.

Middle class people doing their taxes Feb-Mar-Apr suddenly discover their house is costing $600 more per month are going to profoundly affect the housing market.

Still thinking about this one.

Long-time owners have lower property-tax bases, so hopefully the SALT $10,000 limit still leaves some room to write off state and local income taxes. They also can still write-off mortgage interest on loans up to $1M.

New owners this year? It’s too late for them; by the time they run their tax returns it will be too late to change anything. They might feel like selling, but not at a discount.

Could astute potential buyers calculate the impact before they purchase? Let’s hope so, but unlikely if the lease is coming due and they have no write-offs currently.

Let’s go back to the first point. What is middle class now? $100K+ income per year?

The SALT limit isn’t done yet:

https://www.forbes.com/sites/kellyphillipserb/2018/07/17/states-sue-irs-treasury-to-strike-down-salt-cap-under-new-tax-law/#737463d05303

And let us not forget SALT caps.

I’m still thinking about this one.

We could have a general malaise descend upon the market, and not know the exact cause.

It reminds me of the mechanic at the Mercedes dealership when I asked him about them having transmission problems. He said he was the wrong guy to ask. Why? He only sees the ones that do have transmission problems.

I wouldn’t know the cause of a slowdown, because I only talk to people who are in the game, or are thinking about getting in.

I don’t think anyone would know, unless you went door-to-door and interviewed everyone to reach those who were interested, but have now opted out due to some cause.