Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

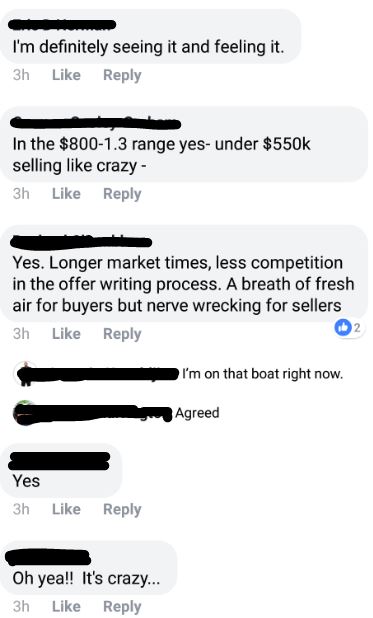

Slowdown is definitely here, besides for price reductions…I am seeing rentals pop about 6-10% on monthly rates.

Jim can you explain the comment from the person in the post with a “point of view on the lending side”? I don’t understand what he is saying. Just curious.

Thanks,

BAM

Would you buy a house in this market? Assuming you didn’t have equity from a prior sale.

So, when I was a kid, a friend of mine got popped in the nose by another kid. He came to my house to complain about it, and my dad was listening in.

Me: Why’d he punch you in the nose?

Friend: For nothing! Nothing!!

Me: Must have been something…

Friend: I didn’t say anything! He just punched me in the nose!

Me: And his reason was?

Friend: He said he didn’t like me looking at him! That’s a reason to punch me?!

My Dad: Kid… if someone doesn’t like you, one reason is as good as another.

Conclusion: When you hit the resistance level of a well established chart, one reason is as good as another.

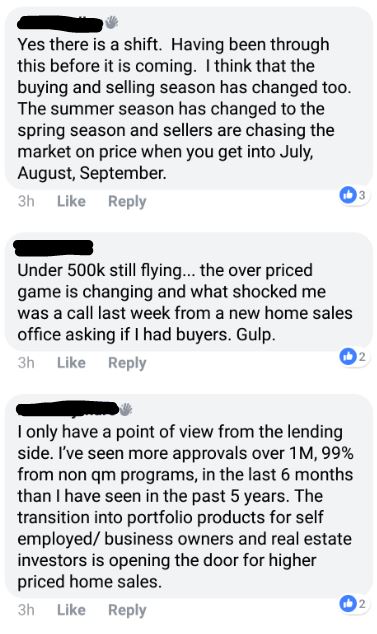

Jim can you explain the comment from the person in the post with a “point of view on the lending side”?

He said:

QM = qualified mortgage, meaning they fit the normal underwriting standards and could prove their income using tax returns – and the lender has made a good-faith effort to determine that you have the ability to repay your mortgage before you take it out.

He means that alternative documentation is back, and they are using 24 months of bank statements to qualify, instead of tax returns. It is an alternative that was made famous by First Franklin back in the day, and you can see here how it turned out for them. They did so well that Merrill Lynch bought them in 2006 for $1.3 billion:

https://en.wikipedia.org/wiki/First_Franklin_Financial_Corp.

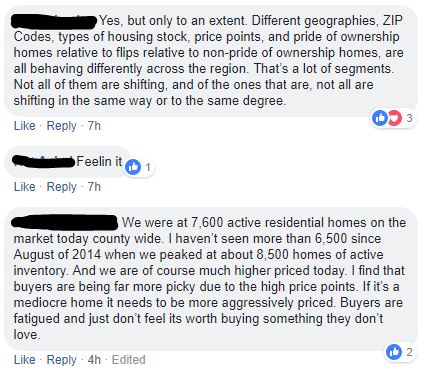

Here is another comment left at FB since:

I can feel the sarcasm, but it is seriously Great News for us that we have the Non QM loans and the Renovation loans as well as the conventional loans as they are making our paychecks. Our clients are competing with cash buyers because of these loans, buying cheap and renovating just like buyers on HGTV. I just closed a bank statement loan – if they used their taxes they would qualify for a home for $350K – with a bank statement loan they qualified for 800K. Great for buyers that write off a lot on their taxes. I am building home buyers. I am doing these loans with top rated conventional lenders that also saw the shift coming and brought these products on. Good to be on the leading edge.