We have known Jim & Donna Klinge for over a dozen years, having met them in Carlsbad where our children went to the same school. As long time North County residents, it was a no- brainer for us to have the Klinges be our eyes and ears for San Diego real estate in general and North County in particular. As my military career caused our family to move all over the country and overseas to Asia, Europe and the Pacific, we trusted Jim and Donna to help keep our house in Carlsbad rented with reliable and respectful tenants for over 10 years.

Naturally, when the time came to sell our beloved Carlsbad home to pursue a rural lifestyle in retirement out of California, we could think of no better team to represent us than Jim and Donna. They immediately went to work to update our house built in 2004 to current-day standards and trends — in 2 short months they transformed it into a literal modern-day masterpiece. We trusted their judgement implicitly and followed 100% of their recommended changes. When our house finally came on the market, there was a blizzard of serious interest, we had multiple offers by the third day and it sold in just 5 days after a frenzied bidding war for 20% above our asking price! The investment we made in upgrades recommended by Jim and Donna yielded a 4-fold return, in the process setting a new high water mark for a house sold in our community.

In our view, there are no better real estate professionals in all of San Diego than Jim and Donna Klinge. Buying or selling, you must run and beg Jim and Donna Klinge to represent you! Our family will never forget Jim, Donna, and their whole team at Compass — we are forever grateful to them.

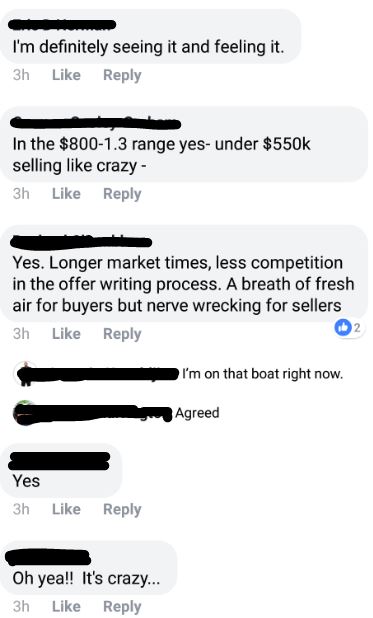

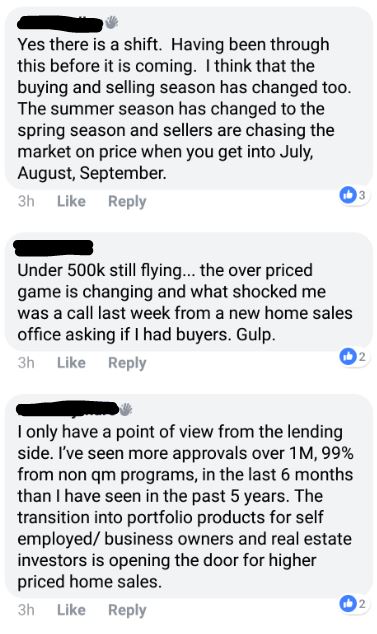

Slowdown is definitely here, besides for price reductions…I am seeing rentals pop about 6-10% on monthly rates.

Jim can you explain the comment from the person in the post with a “point of view on the lending side”? I don’t understand what he is saying. Just curious.

Thanks,

BAM

Would you buy a house in this market? Assuming you didn’t have equity from a prior sale.

So, when I was a kid, a friend of mine got popped in the nose by another kid. He came to my house to complain about it, and my dad was listening in.

Me: Why’d he punch you in the nose?

Friend: For nothing! Nothing!!

Me: Must have been something…

Friend: I didn’t say anything! He just punched me in the nose!

Me: And his reason was?

Friend: He said he didn’t like me looking at him! That’s a reason to punch me?!

My Dad: Kid… if someone doesn’t like you, one reason is as good as another.

Conclusion: When you hit the resistance level of a well established chart, one reason is as good as another.

Jim can you explain the comment from the person in the post with a “point of view on the lending side”?

He said:

QM = qualified mortgage, meaning they fit the normal underwriting standards and could prove their income using tax returns – and the lender has made a good-faith effort to determine that you have the ability to repay your mortgage before you take it out.

He means that alternative documentation is back, and they are using 24 months of bank statements to qualify, instead of tax returns. It is an alternative that was made famous by First Franklin back in the day, and you can see here how it turned out for them. They did so well that Merrill Lynch bought them in 2006 for $1.3 billion:

https://en.wikipedia.org/wiki/First_Franklin_Financial_Corp.

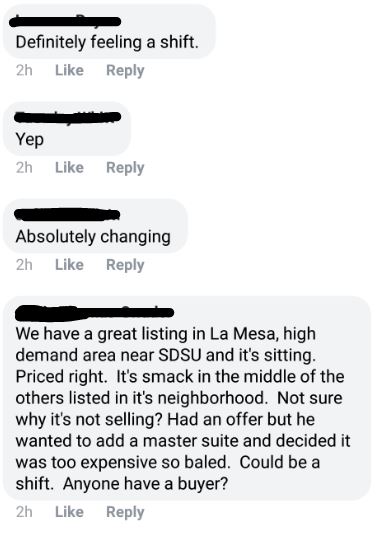

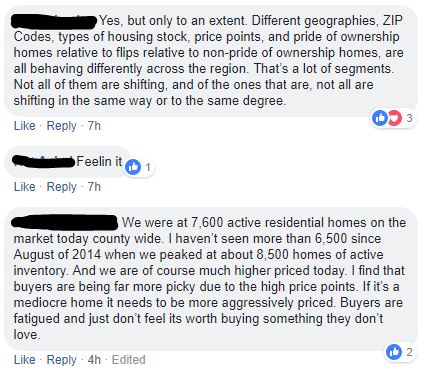

Here is another comment left at FB since:

I can feel the sarcasm, but it is seriously Great News for us that we have the Non QM loans and the Renovation loans as well as the conventional loans as they are making our paychecks. Our clients are competing with cash buyers because of these loans, buying cheap and renovating just like buyers on HGTV. I just closed a bank statement loan – if they used their taxes they would qualify for a home for $350K – with a bank statement loan they qualified for 800K. Great for buyers that write off a lot on their taxes. I am building home buyers. I am doing these loans with top rated conventional lenders that also saw the shift coming and brought these products on. Good to be on the leading edge.