We knew these were coming:

The legislation preserves the deductions for mortgage interest and charitable giving, though it lowers the cap on the mortgage deduction from $1 million to $750,000.

Seeking to win over House Republicans from high-tax states, the conference committee legislation caps the state and local tax deduction at $10,000, with filers allowed to deduct property taxes and state and local income and sales taxes.

Those aren’t quite as generous as before, but a happy compromise.

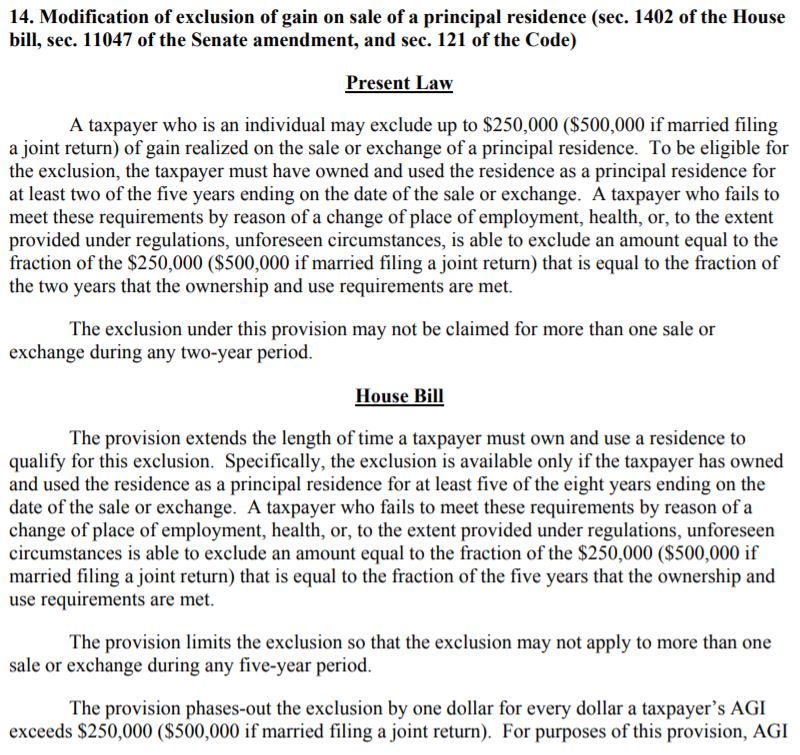

What about the change from owning your home for two out of the last five years to get up to $500,000 tax-free profits? Both the House and the Senate wanted to change the time period to owning five out of the last eight years.

I found this on page 663 of 1101 here:

http://docs.house.gov/billsthisweek/20171218/CRPT-115HRPT-%20466.pdf

I’m not a lawyer, and could be a little woozy after scrolling 600+ pages, but I think they threw it out altogether! Before I get too excited, can an attorney tell us that ‘No provision’ means nothing was included in the final bill?

If the two-out-of-five-years is still the law, then the realtor spokespeople better be running to the microphone to declare total victory, and assuring everyone that property values won’t be going down 5% to 15% now!

Looks to me to be five of eight Jan 1, 2018.

Dang, no phase in/out.

The presidents still better say something about their claim of property values dropping if this passes.

From the 12152017 NY Times article about the final tax bill:

“The bill also includes changes large and small to appease business lobbyists and their congressional champions, such as additional tax relief for the owners of engineering and architectural firms and the elimination of a change in capital gains treatment of homes sales — a key priority for the real estate industry.”

“In a pre-emptive move against accounting maneuvers in high-tax states such as New York and California, the bill prohibits taxpayers from prepaying next year’s state and local income or property taxes, in order to deduct them from 2018 taxes. That form of tax planning would have allowed taxpayers to benefit more from the full state and local deduction this year before it is capped next year.”

My understanding is that the mortgage limitation apples only to “new” purchases after 12/31/2017..so existing loan still carry the 1 million limit and of course that is done to protect the banks on their existing loans. Am I correct?

I see less resales coming to the market after the 5 year limit hits which mean further reduced inventory in the next few years.

My understanding is that the mortgage limitation apples only to “new” purchases after 12/31/2017..so existing loan still carry the 1 million limit and of course that is done to protect the banks on their existing loans. Am I correct?

That’s how I read it too.

the elimination of a change in capital gains treatment of homes sales — a key priority for the real estate industry.

They eliminated the change?

This guy can’t send letters fast enough – so I guess he’s sticking with the 10% to 15% price drops in California?

December 15, 2017

Dear Jim,

Steve White

As this year is quickly winding down, Congress is trying to pass a tax reform bill before the year ends. Here’s an update on the tax reform bills that you have been helping C.A.R. oppose over the past several weeks through our Calls for Action.

The final compromise tax plan was released just this afternoon. We’re still reviewing the exact details of the 500-page bill, but we do know that the limit for the mortgage interest deduction (MID) will be reduced from the current $1 million to $750,000 on mortgages for a first or second home and the deduction of state and local tax deductions, including property, sales, and income tax, are capped at $10,000.

The lower mortgage interest deduction cap punishes homebuyers in high cost states such as California and maintains provisions that weaken homeownership tax incentives. As a result, C.A.R. WILL CONTINUE TO OPPOSE THE BILL and will call on California REALTORS® to join in the effort, even if NAR chooses a different course. California members should anticipate a Call for Action over the weekend.

The final Congressional “Tax Reform” bill will be voted on early next week by both Houses of Congress. C.A.R. opposes the proposal because it dramatically weakens the tax incentives for homeownership and increases taxes on hundreds of thousands of California homeowners and makes it more difficult for Californians to attain the American dream.

Speaking of boosting homeownership in California, C.A.R. is embarking on an historic effort to increase homeownership opportunities that REALTORS® can feel good about supporting.

C.A.R. is going to qualify an initiative for the November 2018 ballot to allow disabled and senior homeowners (over 55 years of age) to keep all or most of their Proposition 13 property tax savings when they move.

This measure is important because seniors, who are often on a fixed income, fear they will not be able to afford a big property tax increase if they sell their existing home and buy another one, discouraging them from ever moving. As a result of this “moving penalty,” nearly three-quarters of homeowners 55 and older haven’t moved since 2000.

C.A.R. needs your help to qualify this ballot initiative. We’ve mailed you a petition and we need your signature and that of four more voters registered in your county.

We noticed some of the petitions have been returned with errors. Some have been returned with only the signature page (THE ENTIRE PETITION MUST BE RETURNED INTACT) and others have been returned without the Certification of Circulator fully completed. Please see this video for clear instructions on how to fill out your petition.

Many of you have also asked for a script or talking points that you can use to talk to family, friends and clients about the initiative. Please see our new “Portability Walking Piece” that includes both a script for talking about the measure and instructions for completing the petition.

While it would be helpful to have all signed petitions returned by the end of the year, we know you’re busy. We will be able to accept petitions until the end of February.

I hope you have a joyous holiday season and prosperous new year.

Sincerely,

Steve White

2018 President

CALIFORNIA ASSOCIATION OF REALTORS®

C.A.R. Should just focus on an omnibus consolidation of 13, 60 & 90 and add the disabled exemption and mandate it statewide. If they were truly serious they would include raising the annual increase on commercial properties from 2% to 3 or 4%.

Concerning the 3/4ths not moving since 2000. Well duh. Besides being a self selecting statistic it brackets the Great Recession. It also only applies to instate moves so it appears self serving rather than consumer friendly.

California is a high cost high tax low service state. Address those rather than carving out more exemptions.

Was anything done about the death tax? I’d like Trump to take it all.

I’m very concerned about these people acquiring any fiscal power whatsoever:

https://youtu.be/SaJMiKQx27U

Most outrageous element: “carried interest” still exists. Fully 20% of the debt increase in this bill comes from retaining this ongoing travesty.

The changes to the CA real estate market is minimal..the higher income required to buy a house coupled with the holdback on the capital gains resales until 5 years will cancel each other out. Further, the more expensive it is gonna be to buy will again prevent people from moving up and getting rid of their existing home.

Going from 1 mil to 750K is no big deal, look at all the 2 million sales, however look for an increase in LLC or other types of ownership in the 1.5 range or higher

I don’t see building fees by the state going down, I think the cost of building materials and labor is gonna increase, and I don’t think you will see a decrease in the litigation from the NIMBY”s either….

I think the buying strategy forward, in this uncertain time is a fundamental value structure approach. That is , is the value property you are looking EQUAL or greater than the current replacement cost. Then up or down market who cares if you are gonna live there. There are a lot properties out there that equal or exceed replacement cost when factoring in Government fees, land cost, and labor and material costs, as well job time and carring costs. Inflation is coming..big time, and that is where not buying hype but solid value will pay off, when building materials go up 10% or more per year.

Again, a great time to buy and lock in the interest rate for 15/30 years fixed everybody is saying rates are going up…and people forget..that 6% was a normal rate that 50% more interest paid over the life of loan if you wait.

Comment, according to the WSJ the limitation on 750K appiles 12-15-2017..on any transaction closed before that date the 1 million applies..go to tax coverage and click and then hit mortgage deduction for more details….

Sorry for late reply, Jim. Yes, that’s what the NY Times article said (in quotes). Out of the loop today. Many friends/family in Santa Barbara County in mandatory evac areas due to Thomas Fire

Susie. My BiL is in the voluntary zone. I doubt the fire will burn the Polo Grounds and then cross the 101 to threaten the beach houses. Tell your family our thoughts are with them.

Rob Dwag. My nephew is in the Riviera area in the SB hills. It’s their first home! Mandatory evac area. He put sprinklers on his roof right before roads closed.

Latest update: No homes have been lost today. The firemen have been absolutely heroic.

There is new fire in N. Santa Barbara County in Los Alamos.

Great coverage on KEYT3 on their FB page. Had it on all morning.Be well.

“750K appiles 12-15-2017..on any transaction closed before that date the 1 million applies..go to tax coverage and click and then hit mortgage deduction for more details….”

Does that include refinances?

Can a wife and husband file separately – taking all itemized deductions? That is, the wife deducts property taxes at $10k cap and husband income taxes at $10k cap?

The limitation using the words “purchase” implies originating a new loan on a new purchase. However, the limit is $750,000 after 12-14 on deductibility and there is no provision for an exception over the $750,000 period.

Another issue would be the deductibility of points on a $750,000 K loan if you max it out…interesting new year coming up, but if they limit re-fi look for people to keep in their present property longer.

I saw this on Forbes article from last night.

Exclusion Of Gain From Sale Of Your Home.

Under current law, you can exclude up to $250,000 ($500,000 for married taxpayers) in capital gains from the sale of your home so long as you have owned and resided in the house for at least two of the last five years.

Under the conference bill, there will be no change from current law.

Both House and Senate bills would have changed the “two of five” rule to “five of eight.” Additionally, the proposals would limit the use of the exclusion to one sale every five years (instead of one sale every two years) with one key difference: Under the House bill, the exemption would have been subject to phaseout based on income.

The sausage factory is working overtime.

Under the conference bill, there will be no change from current law.

Ok, that’s how it looked to me, a guy using google to lawyer. I trust Rob Dawg more than most lawyers though, so I’ll believe it when I hear the NAR president singing it from the mountaintops!

Ohhhh trusted more than a lawyer. Thanks. I think. ?

Thomas fire threatening Santa Barbara

http://www.keyt.com/news/live-wall-to-wall-coverage-of-the-thomas-fire-continues/670698437

So two out of five? Just when I was thinking of selling my home after two years (sometimes life changes miraculously) in April, the tax bill shows up this month. *Sigh*

As soon as you know, Jim, please post. I trust you!

I’m sticking with my wingman, Rob Dawg.

He’s never been wrong….well, except for the Coffee Bet…..

Not wrong. Early. 😉

If it helps I am lightening my stock market exposure into the Christmas rally. Probably early there too. Something about nickels and steamrollers.

Aren’t we about ready to review the housing predictions we made last year for this year? I give everyone a huge margin of error given the antics in DC.

Yes, right after we get to the bottom of this – I think I might have been right? Although she could have been a nobody like me:

From the wsj.com, and re-tweeted by Nick Timiraos which means something:

LOAD NEWER POSTS

Dec 15, 2017 at 7:23 pm ET

Home Sellers Get a Reprieve in Tax Bill

The conference committee did not adopt a provision that would have tightened an exemption for home sellers.

Under current law, the seller of a primary home can exclude $250,000 of profit on the home ($500,000 for married couples) if the seller has lived there for two of the previous five years.

Both the House and the Senate bills would have required sellers to have lived in the house for at least five of the previous eight years. In addition, the House bill would have phased out the exemption for higher earners.

Laura Saunders

NY Times and Forbes said two out of five. And did Rob Dwag say two out of last five? I’ve been watching fire coverage all day, and my nephew’s home is still threatened. My brain cells are dead…

Give me some good news today, Jim! 🙂 I have to text “Mystery Man”.

Does that include refinances?

Technically it was supposed to be for your purchase mortgages only, but I think they let up on that if you didn’t take cash out.

Can a wife and husband file separately – taking all itemized deductions? That is, the wife deducts property taxes at $10k cap and husband income taxes at $10k cap?

Also from the wsj.com:

New State and Local Tax Deduction Rules Hit Married Couples Harder Than Individual Filers

The Republicans’ new limit on state and local tax deductions will be gentler on individual filers than married couples.

The cap is $10,000 for both individuals and for married filers. Individuals will find it much easier to use because it’s an itemized deduction. That means they take it if their total deductions are over $12,000, the new higher standard deduction.

So a single person with the maximum $10,000 of income and property taxes and $3,000 of charitable contributions would be able to itemize deductions.

A married couple at the cap of $10,000 of income and property taxes would need another $14,000 in mortgage interest, charity and other deductions to get to the $24,000 standard deduction.

There’s a catch: According to the conference agreement, individuals can’t prepay their 2018 income taxes in 2017 to take advantage of the last year of the unlimited deduction.

Richard Rubin

Latest update: No homes have been lost today. The firemen have been absolutely heroic.

10,000 homes have been lost in wild fires this year in California, and 40 people killed. Something needs to be done – organize volunteer fire groups! I’d man a shovel for a couple of days!

No. I read both Senate and house as being 5 of 8 and went with that until the reconciliation/conference news that the entire mod was struck off. That prompted my “sausage making” comment. I’ve seen it. Heck I‘ve used it. Conference is where patrons collect. Maybe the NAR “invested” well?

For the record I never go on the record when Congress is in session. Samuel Clemens was right.

Give me some good news today, Jim! ? I have to text “Mystery Man”.

If you sell your house because the rule is still two-out-of-five and you move in with the “Mystery Man”, then we want full details! It kinda looks like it went that way!

I thought this was odd – time your divorce accordingly:

Dec 15, 2017 at 6:12 pm ET

Tax Bill Eliminates Alimony Deductions

Alimony deductions will be going away, but not as fast as many feared, if Congress passes the tax bill.

Under current law, alimony payments are deductible by the payer and count as income to the recipient.

The House bill included a provision repealing the current treatment for agreements signed after 2017. Thus alimony would no longer be deductible or taxable. The Senate bill had no alimony provision.

The conference agreement follows the House bill, but it pushes the effective date back by a year. The provision would take effect for divorce and separation agreements signed after Dec. 31, 2018.

Laura Saunders

Maybe the NAR “invested” well?

Just $32 million this year!

So at 750K mortgage with 20% down the price point for 100% deductibility after 12-14-17 is gonna be 900K…that price bodes well for lower end encinitas and carlsbad entry houses. The resale home market I predict will be unaffected on the lower end. Even under the current law with 20% down the most you can buy was $1,250,000. So it lowers that level only…the houses over 1,250,000 are not effected anyway.

Where the effect is gonna happen long term is the middle new home, look for builders to go either at the 900K market, which you video below showed or hit 1.5 or above, the entry level 1.1 mill house are gonna have less people qualify with the reduced tax deduction, which means less housing built and supply again reduced.

“There’s a catch: According to the conference agreement, individuals can’t prepay their 2018 income taxes in 2017 to take advantage of the last year of the unlimited deduction.”

What does this mean? I’ve already paid both installments in Nov. I wouldn’t call that “prepaid” as they sent both bills together. Are they saying I shouldn’t have done that?

Are they saying I shouldn’t have done that?

All of this is subject to your tax-preparer’s interpretation, and whether you get audited.

prepayment of “income taxs” is not property taxs, you should be able pay your property tax bill in one shot, you have the option to wait also, but prepayment of income taxs is another thing.

I agree with Franklin Jones. The conference bill clearly states that income tax (not property tax) can’t be prepaid and then claimed in 2017. I’ve asked my loan servicer to prepay my Feb 2018 property tax this month.

“The conference agreement also provides that, in the case of an amount paid in a taxable year beginning before January 1, 2018, with respect to a State or local income tax imposed for a taxable year beginning after December 31, 2017, the payment shall be treated as paid on the last day of the taxable year for which such tax is so imposed for purposes of applying the provision limiting the dollar amount of the deduction. Thus, under the provision, an individual may not claim an itemized deduction in 2017 on a pre-payment of income tax for a future taxable year in order to avoid the dollar limitation applicable for taxable years beginning after 2017”