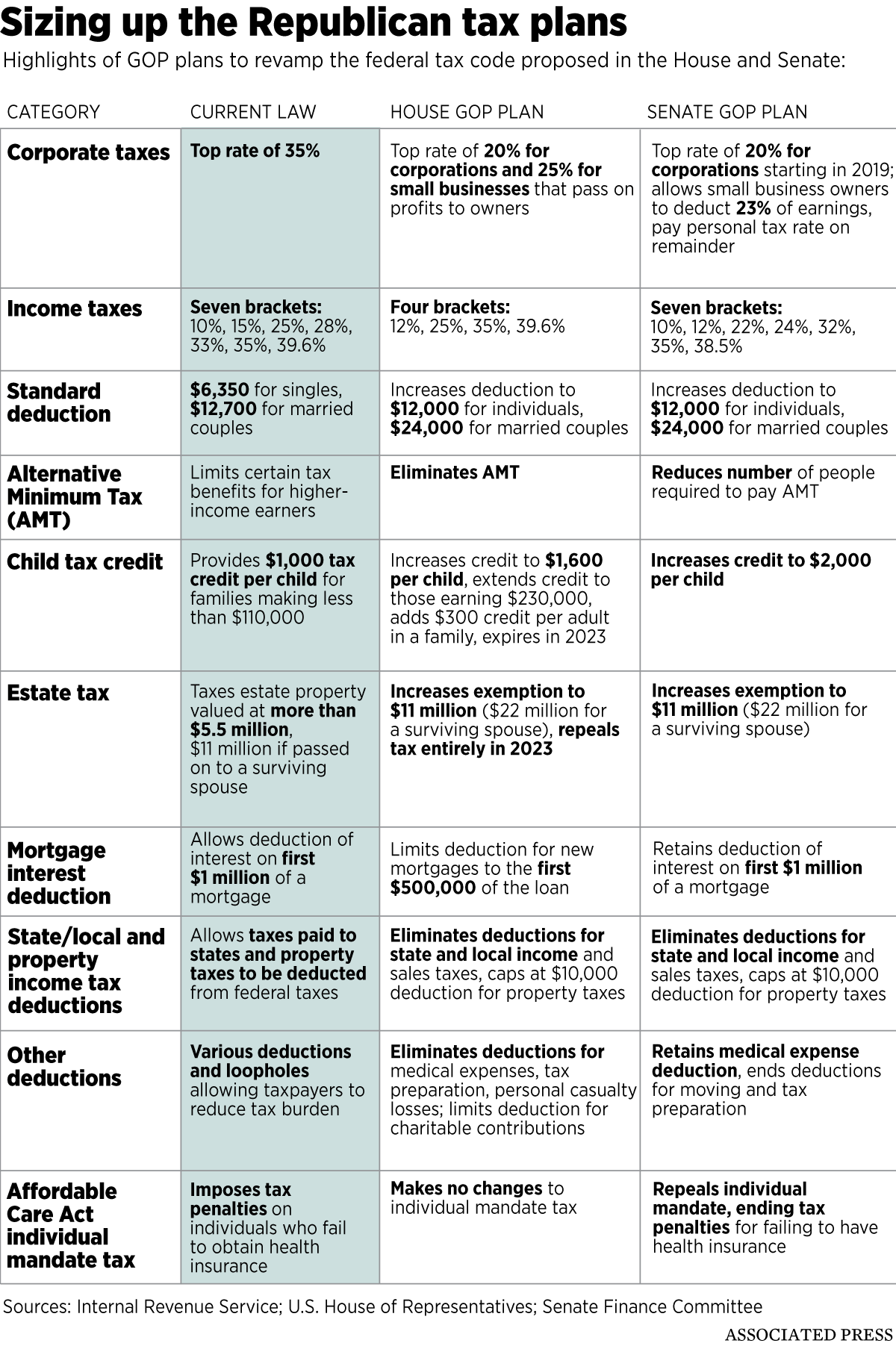

The Senate’s version of the tax reform bill didn’t include any changes to the mortgage-interest deduction, which keeps the limit at mortgages under $1,000,000. But the House limit was $500,000, and they still have to reconcile the two versions, so it’s not done yet.

The ability to deduct property taxes up to $10,000 was included at the last minute by the senators.

The 2-out-of-5 year residence requirement to avoid taxes on profits from selling your home will be changing to 5-out-of-8 years, but the effective date isn’t exactly clear yet. The Senate version included any sales contract signed in 2017 would qualify, even if they close in 2018, but we’ll see about the final reconciled version – which should come in the next couple of days.

The N.A.R. should declare victory, and assure us that our property values won’t be going down 10% to 15% now.

Received by email this morning – I’m not sure what he wants:

December 2, 2017

Dear Jim,

I want to give you an update on the tax reform bills that you have been helping C.A.R. and NAR oppose over the past several weeks through our Calls for Action.

Late last night, the Senate passed its tax reform bill against REALTORS®’ opposition to the provisions that adversely impact real estate. Similar to the House bill, the Senate version increases taxes on hundreds of thousands of California homeowners and makes it more difficult for Californians to attain the American dream.

We are disappointed that Congress has chosen to pay for tax reform on the backs of homeowners and the real estate industry.

The House and Senate will now appoint conferees to work out the differences between the two bills. Both chambers must vote on a final bill before it is sent to the president.

We thank California Sens. Dianne Feinstein and Kamala Harris for voting No on the Senate bill and for believing their constituents deserved better.

We also thank all C.A.R. members who made their voices heard by contacting their members of Congress asking them to vote No; HOWEVER, THE FIGHT IS NOT OVER!

C.A.R. and NAR will be launching new Calls for Action next week, and we’ll continue to update you.

Sincerely,

Steve White

2018 President

CALIFORNIA ASSOCIATION OF REALTORS®

I agree with the NAR in one aspect. It is unfair to mess with people’s multi-decade plans with neither phase ins or delays to implementation. I was planning on “2 of 5” being used three times over seven years to liquidate certain residential properties.

We all know the mortgage interest deduction is just a subsidy mostly to wealthy coastal areas. If you look at the numbers you see like 80% of homeowners across the US can’t use it. Canada got rid of it a long time ago. The only reasons it stays is the power of the NAR lobby. This is a direct example of how our congress (and country) are run by corporate lobbyists paying off congress and not for the people.

I think property prices falling 10-15% in SD would be a GOOD thing. The mortgage interest deduction and Prop 13 help artificially inflate house prices in coastal CA causing all kinds of dysfunction in the local economy and inability of families to buy homes close to their jobs they can afford. I would add NIMBY-ism to this too. Prop 13 and MID make absolutely no sense whatsoever. But entrenched interests will do anything possible to fight to keep the status quo.

As I commented and predicted on the Blog, the 10K property tax deduction is huge and now both bodies appear to be on board with the coming limitations on deductions

My prediction on the interest rate deductions amount will be that it will remain for the for the million UNLESS it does not apply the refinance of an existing mortgage. It is a bit unclear if the limitation would only apply to “new purchases” only or any time of loan on the property as no agreement has been reached yet, but look a atomic bomb on the refinance business if the 500K limit applies. So, I believe that there will be a limit, but it will be set at $750K in the spirit of compromise and not be applicable to refi unless more money is pulled out, again any limitation is going to effect loan brokerages.

2/5 rule is gone, so you had better sell prior to 2018, However, who is not to day its gonna be 4/7…another compromise..my guess

Final prediction: The market price will remain UNAFFECTED in overall sales which will be lower and inventory will be lower. However, in terms of new home construction, forget about the middle priced (here 750-900K) homes being built if the 500K limit , its gonna be either 620-650K or 1.5 mil and up…which means an additional shortage in that under mill over 625 price range.

Final prediction: The market price will remain UNAFFECTED in overall sales which will be lower and inventory will be lower.

Agreed – but mortgage rates at 5% would affect buyer mojo though.

I think property prices falling 10-15% in SD would be a GOOD thing.

10% to 15% less wouldn’t make them affordable though. You’d get a halfway-decent house in Carlsbad for $700,000, instead of a teardown.

But entrenched interests will do anything possible to fight to keep the status quo.

I was shocked to see the CAR president ripping off a letter for mass distribution in his jammies this morning. I don’t think he thought it though.

Congress is bound to pass something, and this version is way better for realtors than where they started. But I guess he feels that he has to constantly fight for the status quo no matter what the actual facts are?

I agree a 10-15% fall would not create affordability. But if you did the combination of getting rid of prop 13, MID, and reducing red tape enabling builders to add new supply much faster and cheaper….it might start to put a dent in home prices and rents. I know it will never happen but I can dream:)

Coastal CA is just so dysfunctional and distorted due to the cartoonish levels of lack of affordable housing – both to buy & rent.

Prop 13 help[s] artificially inflate house prices in coastal CA

The logic escapes me. Please explain how lower taxes makes houses less affordable.

One of my favorite things to do in CA, is watching rich elite liberals turn into these raging fiscal conservatives when their own wallets are threatened. Like getting rid of the MID, prop 13. Its really hilarious. The epitome of hypocrisy. It shows what they are REALLY about when push comes to shove. Their own self interests like we all are.

Reaist: time to get “real” here, Now that this state open to all persons legal or illegal with a lack of housing and if you think demand is going down..no way, if you think “red tape” is gonna disappear….the reality is more fees, more protests of Nims, we cannot fit everybody coming from Mexico, etc and place them in affordable housing in Encinitas. Living on the coast is not a right with 40 million people here, somebody is gonna have to live inland and the those who work hardest or smartest have the right to live in the best place. This is not “Looney Tunes” as you have suggested, we have to admit that we do not have unlimited resources when it comes to costal living.

The California coast is NOT dysfunctional, it reflects proper demand price principals of paying a premium for something that is limited.

“Prop 13 help[s] artificially inflate house prices in coastal CA

The logic escapes me. Please explain how lower taxes makes houses less affordable.”

Prop 13 keeps more inventory from hitting the market. If the $1m home you bought 30 yrs ago has $2,000 a year in property taxes. Why would you sell? But if it had $10k a year in property taxes you might think of selling and moving to a cheaper state.

Some who buys a house tomorrow, is going to pay market property taxes. They won’t be aided by the effects of prop 13 until they are in the house a long enough for the property to appreciate greatly but not have their property taxes rise. So in summary, prop 13 does nothing for the new home buyer today. Just for the person who bought a long time ago.

The California coast is NOT dysfunctional, it reflects proper demand price principals of paying a premium for something that is limited.

Agreed – the same frenzied market conditions are happening in many places outside of CA. (Seattle, Portland, Denver, etc)

“in summary, prop 13 does nothing for the new home buyer today. Just for the person who bought a long time ago.”

Prop 13 limits new buyer taxes to ~1% and add-ons. That is protection.

Explain instead how lower taxes make housing less affordable like I asked rather than reply to questions you wished I had asked.

I’m amazed such an unpopular bill which is opposed by NAR, CAR, NAHB, AMA, AHA, AARP … will become law nonetheless.

“They own you” George Carlin

“in summary, prop 13 does nothing for the new home buyer today. Just for the person who bought a long time ago.”

Prop 13 limits new buyer taxes to ~1% and add-ons. That is protection.

Explain instead how lower taxes make housing less affordable like I asked rather than reply to questions you wished I had asked.”

Appears you didn’t read my post. If people who bought 30 yrs ago had to pay market property taxes, like 1% of assessed value, more would be forced to sell and thus more inventory would hit the market. More inventory hitting the market equals lower prices, which equals more affordability.

Prop 13 also distorts the California economy where you have people who have owned their house for 30 years paying ridiculously low property taxes. So therefore CA has to have the highest state income taxes in the country to make up for that shortfall in property taxes. So people who bought their house a long time ago basically get “subsidized” by high income w-2 workers in CA (many of them renters) paying the highest state income tax in the nation.

Ohhhhh. Forcing people to sell is what keeps houses affordable.

We are done.

If Prop 13 had never been invented, coastal california would be a Blade Runner Sh*tshow. I keep telling the complainers, that is, the latecomer’s, that Prop 13 protects them TOO! Without it, they’d be out of luck. They would have to move, and the most elite EXCLUSIVELY would STILL be nursing their mimosa’s on the cliff’s of Dana Point, with coastal housing tighter than a new goose’s ass, and they would put any card carrying nazi to shame over protectorate legislation to keep it that way.

Google Rob Reiner and read about him leading the charge to keep one Walgreen from being built in Malibu, because he feared Wal Greener’s would mar the neighborhood. “Damn right, I’m a NIMBY!!” he exclaimed to hoots and hollers from the Malibu peanut gallery.

And another idea of yours begs the question, what right does the government have to assert itself with guns, to tell people when it’s time to move? Prop 13 took the perpetual guns out of their hands, and that’s a good thing in EVERY way, by my value system.

“What the heck are you talking about guns for?” you might ask. Raised taxes must be paid, regardless of the percentage rise. If you can’t or won’t, then you do what you’re told. The government will tell you to move, and you will, if you know what’s good for you.

If you don’t move from your home, and don’t pay every penny of demanded egregiously increase taxes, SWAT teams surround your house, and you’re either shot in the head, or otherwise carried out of your home forever, strapped to a stretcher. That’s not what homeownership is about in America, as far as I’m concerned, and as far as our founding father’s would ever have it.

An 80 year old guy, living in a beach cottage that he built in Malibu, and paying Prop 13 level taxes… is GOOD! It contributes to strong communities, rather than de facto temporary bus depots with “seats” auctioned off to the highest bidder, foreign or domestic.

You might advocate, owing to your apparent principals, “hey, old guy! quit taking up prime space! move to an old folks home in Hesperia. Why are you still in the way, old man? you’re not relevant. your days are past. come on, hi ho! hi ho! off to Hesperia you go!”

I think any rendition of that scenario is bad for communities, bad for people, bad as a collective agreed upon value system… just bad.

Many, many times, when it comes to government conceived social engineering, the outcomes are bad, despite their claims to the contrary. It probably owes to the kind of people who decide to go into government in the first place. Too many of them are qualifiable sociopaths, if not supremely neurotic, and I don’t think anyone would be making a big mistake of starting out with that premise, before accepting what they tell you. Especially when they advocate raising taxes. It’s not for you.

If people who bought 30 yrs ago had to pay market property taxes, like 1% of assessed value, more would be forced to sell and thus more inventory would hit the market.

You don’t know that. A reverse mortgage is all they need, and that’s a much better solution than having to pack up the farm and go somewhere else, just because of higher taxes.

Daytrip for president!!

Jim, true I don’t know for sure if they would sell if prop 13 went away. But, it may change the equation on a free & clear house if your property taxes are $15k a year vs. $3k a year. I do know lots of retired people in other expensive states that DO make a decision to move to another state based on their property taxes.

Prop 13 is basically just a welfare “subsidy” paid for by high income working professionals in CA paying the highest state income taxes in the USA. NO OTHER state in the U.S. has any weird “fixed for life” property tax set up like Prop 13. There are plenty of expensive places in the USA like NYC, Seattle, Boston, DC, Naples, etc…that adjust property taxes EVERY YEAR based on assessed values. And people who have owned properties for 30 years in those areas all pay current market property taxes and deal with it.

But CA creates this weird distortion where they have to make up the lost revenue from the Prop 13 “welfare subsidy” by having the #1 highest state income tax and the nation, and punish young working professionals.

Realist: The new home buyer today is not more important than the current wanna be homeowner, if fact the current owner of a coastal property should have the highest form of protection. Just because supply low, does not mean somebody’s propriety rights should be taken away or overcharged. Thank God for prop 13 otherwise the properties that become unaffordable go the rich as a second or third house, even they become more affordable.

Living on the coast means you gotta get it “UP” dollars wise, we cannot have 30+ plus million people all living on the coast.

Of course the reverse mortgage does mean the house will go on the market sooner or later, since it will be sold when the owner dies or goes into a nursing home. No children inheriting the prop 13 value.

“Living on the coast means you gotta get it “UP” dollars wise, we cannot have 30+ plus million people all living on the coast.”

Once again agreeing with Franklin. Since around 1959, we’ve DOUBLED the population of the United States. In half that time, we shall double it again. In half that time, we shall double it again. It’s happening in other important parts of the world also.

Conclusion: If I’m lucky enough to make it to my eighties, it will be a great time to be stepping off this mortal coil, and… to Generation Z… you’re gonna be the ringmasters of an historic worldwide riot. Your go-to emotions will be fear and surprise. Not even President Ivanka will be able to mitigate it. Good luck with that. I’m not being sarcastic.

And god bless Prop 13. It’s not a class war strategy. It’s a containment strategy to counteract bad government, and… it’s just the right thing to do.

Ponto:

“Daytrip for president!!”

Ha! I saw what you did there!”

“But CA creates this weird distortion where they have to make up the lost revenue from the Prop 13 “welfare subsidy” …”

FYI for those keeping score. After Prop 13 state revenues went up.

Rob Dawg:

“FYI for those keeping score. After Prop 13 state revenues went up.”

And fear of life went waaaay down! It’s hard to enjoy the day when you know a hammer is going to drop on you by the caprice of historically illiterate “leaders” with no significant accountability for their long-term actions based on what they “feel” is “best” for “you” at the moment. Especially those politicians who honestly believe California is just a part of Europe. And China. And Somalia. And the Ukraine.

That’s why “realist” can’t form a cohesive argument on Prop 13. His economic value system is stuck in the ’80’s, where it might deserve at least a nanosecond of consideration.

2017 California… doesn’t care.