This year will be over in hours!

How did we do?

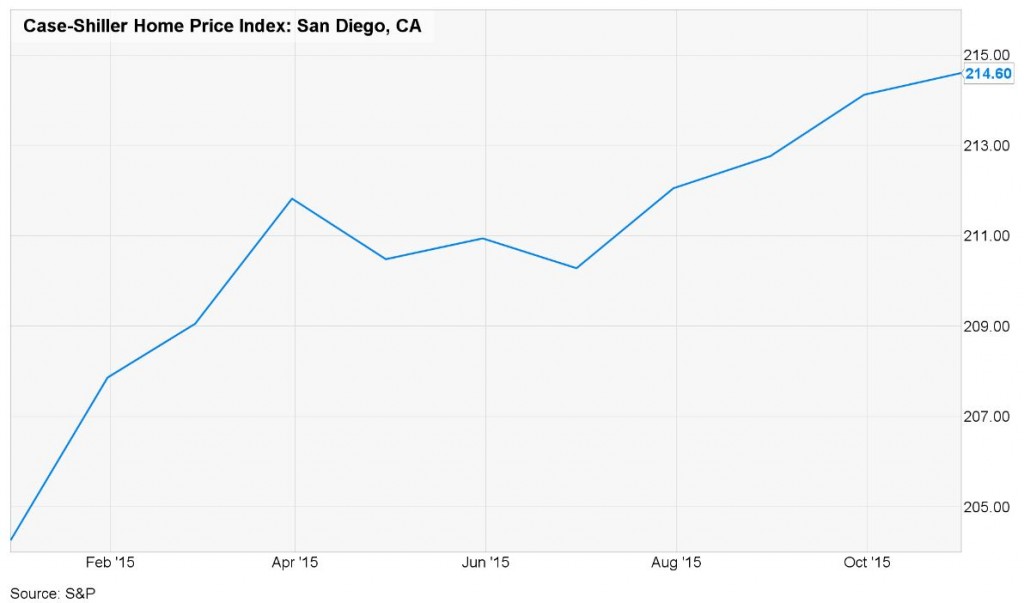

The San Diego Case-Shiller Index is 6.2% higher than it was 12 months ago (October to October readings), which beats just about everyone’s expectations.

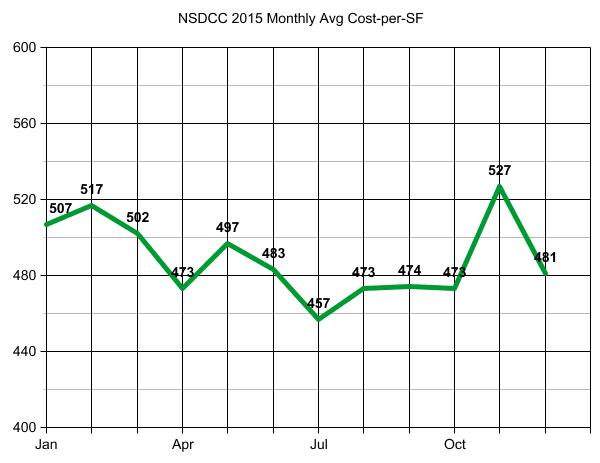

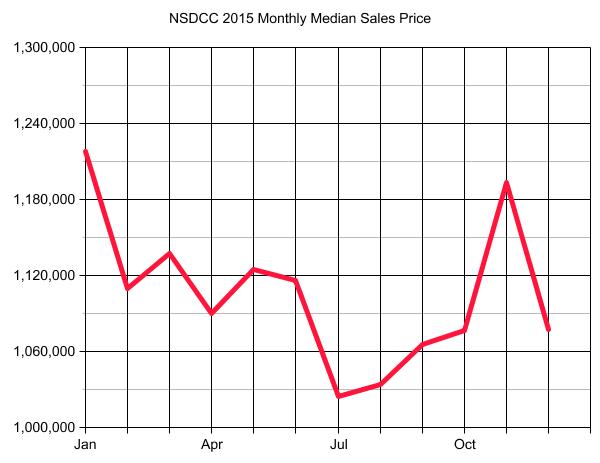

But the tony north-coastal region (La Jolla to Carlsbad) had already experienced healthy price gains since 2012. At the beginning of 2015, lower mortgage rates (3.5% to 3.75%) fueled a surge of sales at higher pricing, but then things mellowed out the rest of the year – just like Rob Dawg predicted!

If it weren’t for the blip in November, it would be clear that the first quarter of 2015 was the best time to sell, price-wise. If we do get more inventory this year, the same will probably be true – more houses for sale combined with higher mortgage rates = more of a buyer’s market.

A snapshot of how 2015 pricing compared to 2014:

Jun 2014 $482/sf, $1,077,850

Dec 2014 $481/sf, $1,052,075

Jun 2015 $483/sf, $1,116,000

Dec 2015 $481/sf, $1,077,500

Flatsville!

We should see a tight +/- 3% range in 2016.

Happy New Year Jim! Thanks for the shout out. I’m still piecing together my thoughts for 2016 but in a possible shocker they most likely will be more upbeat than yours. Some will be plain old running out of affordable homes which isn’t really a good thing and part of why my crystal ball is cloudier than usual.

Prices could take off statistically.

If buyers get a hold of themselves and lay off the inferior properties. then only the best properties would sell for deserved premium prices.

It’s because buyers keep paying too-high prices for inferior properties that pricing in general goes up.

If that stopped, the market would need to re-adjust, meaning the inferior properties wouldn’t sell for a year or two before their sellers were convinced.

Then general pricing would properly reflect the condition of homes, and gains would be balanced – and muted.

Bam! Right on the money.

And perhaps with nominally higher interest rates and stocks/bonds/etc taking huge hits, the “easy money” could force buyers to stop doing stuff like this.