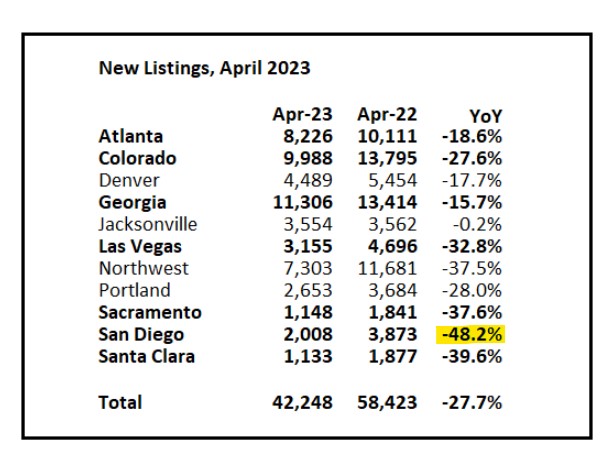

Last April was peak frenzy, and a main contributor was the lack of inventory….and there were 48.2% fewer listings last month? Holy Cow! This is primetime selling season and if there aren’t homes for sale now, how much worse will it be the rest of the year?

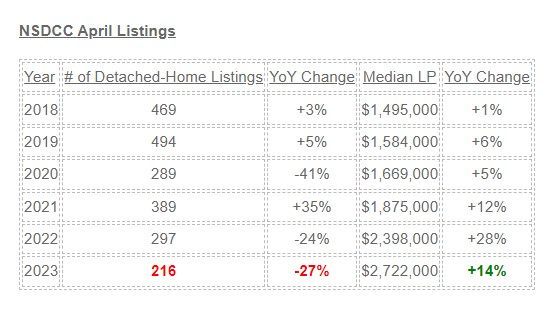

Here’s how it looks between La Jolla and Carlsbad:

Remember when inventory plunged in April, 2020 because nobody wanted to let anyone in their house?

I’d love to go back to those days!

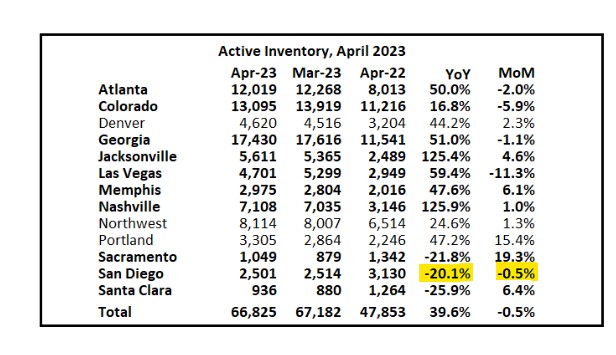

While other metro areas have YoY inventory exploding, we still have enough demand to cause the active-inventory count to decline year-over-year:

How hot is the rental market?

This seems like a good way to live somewhere cheaper + have someone else pay your mortgage off. Especially if you’re in a low mortgage or none at all.

I really have no idea what the rental market is like right now.

RE agents might have to start scrounging for the scraps of arranging rental contracts.

As you pointed out recently, there are way too many agents for the amount of inventory. Many times too many. And Technology/Connectivity is going to flatten the pyramid even more.

RE agents might have to start scrounging for the scraps of arranging rental contracts.

As you pointed out recently, there are way too many agents for the amount of inventory. Many times too many. And Technology/Connectivity is going to flatten the pyramid even more.

There have to be so many – and probably more than half – of agents in full panic mode. Our coach said today that every agent across the country is asking what else they can do to generate more business,

Those excess RE agents can go pickup bagels and doughnuts for JTR’s open houses or put out his open house signs on Saturday and Sunday for $16.30 an hour. Just a thought.

LOL 😆

I’ll chime in on the rental situation in North County Coastal. I’m leasing a few both as short term and long term.

Short term has evaporated along with Covid. I think alot of investors were buying homes based on the short term rental model. This market collapse has brought many short term over into long term rentals increasing supply.

As a result I’d say rents are lower by +10%.

However, prices are still elevated from 2 years ago and it is common to receive multiple applicants. I think rentals are fairly strong because both the widely held sentiment that it’s a bad time to buy and fear/hope that prices may go down further. Seems like higher interest rates make it more expensive to own than rent and those with mortgages in the 3’s can make it pencil still.

My perception as a landlord with North County rentals to this point is there is some pressure on the high end rentals, but on the low end, say 2 bedrooms 2 baths, demand is still hot and rents are holding up, if not continuing to increase.