Oh geez, did Jim say something about prices going down?

Yes, and isn’t it inevitable in areas where there is more supply than demand?

Sure, we can always reflect on Rancho Santa Fe where having your home languish on the market every year is a rite of passage. Somebody will come along some day, won’t they?

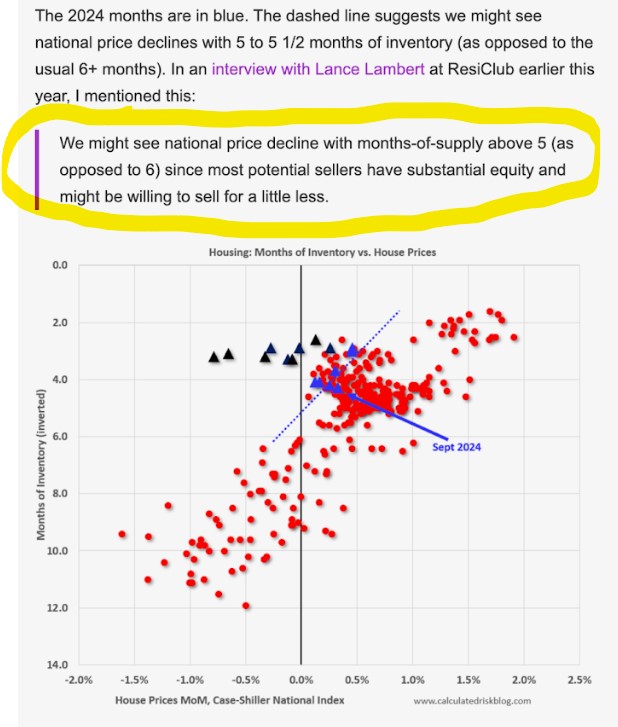

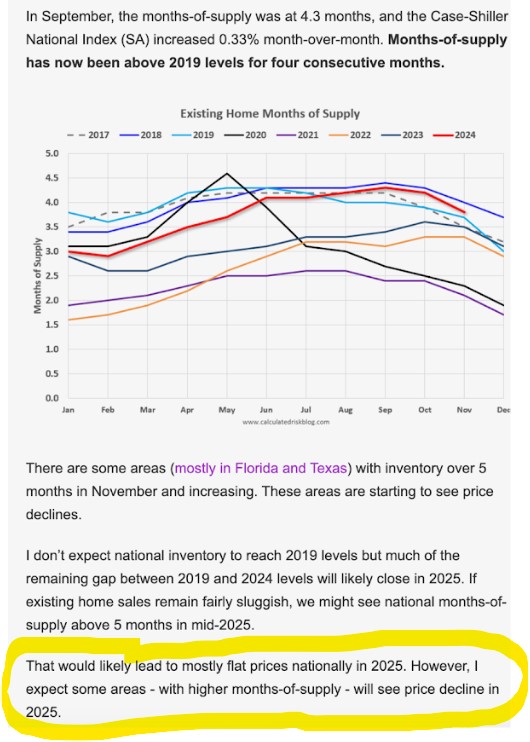

Bill is one of the OGs from 2005 and he is more analytical than me. He is giving us a formula; when the months’ supply gets over 5, prices might decline:

The NSDCC is safely around a 3-month supply currently. We’ll see where it is in February and March!

https://open.substack.com/pub/calculatedrisk/p/question-9-for-2025-what-will-happen

Supply doesn’t matter if banks aren’t foreclosing. Without foreclosures there’s nothing pressuring sellers to ask banks to do short sales.

Sellers can just sit back making a payment now and then sitting on a crazy price waiting for their lottery ticket buyer.

I agree, and without any influence/pressure from other market forces, it will likely become the #1 strategy – Priced to Sit.

Would a few lower-priced sales nearby cause that seller to rush to get out?

No, it is too easy to blame “the market” and cancel instead. They will try it again next year!