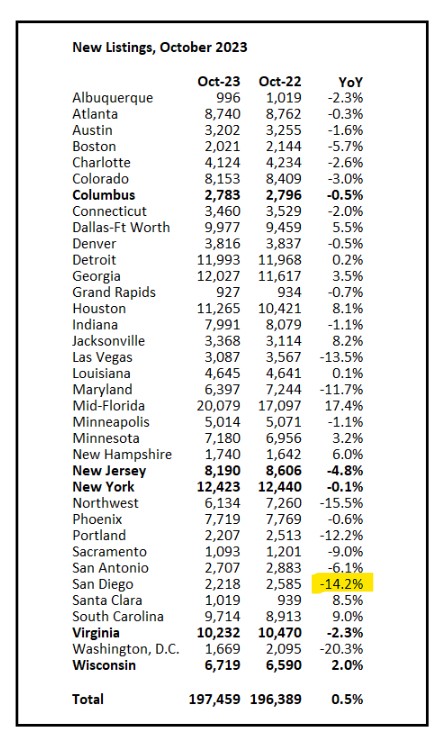

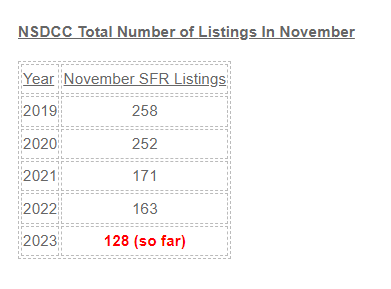

While a surge in inventory next year would help to change the market dynamics, there isn’t any hard evidence of it happening yet:

How many would be considered a surge? If the number of new listings rose 10% or even 20%, would anyone notice? Probably not.

Using these November numbers, and adding an extra 20% would only get us back to last year’s total – which we thought was bleak then. but now I’d take it!

It would take a real bump to get buyers to step back and say, ‘hold on, I’m going to wait and see where this goes for a month or two’.

Let’s guess that it would take at least a 25% increase in new listings for buyers to pause.

I was asking around yesterday, but nobody had anything definite to report about their new-listings flow for next year. One agent thought that we’re going to see a lot of short sales though (???).

Munger Musings:

Every now and then a really wise man speaks and we should all listen and learn. Here are some words of wisdom/opinions from Charlie Munger, mega-investor and partner to Warren Buffet – and Pasadena, California resident – who passed away yesterday:

“We all start out stupid and we all have a hard time staying sensible, and you have to keep working at it,”

“I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than when they got up and boy does that help — particularly when you have a long run ahead of you.”

“Know your circle of competence.”

“What we’re getting is wretched excess and danger for the country. A lot of people like a drunken brawl, and so far those are the people that are winning, and a lot of people are making money out of our brawl.”

“There is so much money now in the hands of so many smart people all trying to outsmart one another. It’s a radically different world from the world we started in.”

“If I can be optimistic when I’m nearly dead, surely the rest of you can handle a little inflation”

“If you’re going to invest in stocks for the long term or real estate, of course there are going to be periods when there’s a lot of agony and other periods when there’s a boom. And I think you just have to learn to live through them. As Kipling said, treat those two imposters just the same. You have to deal with daylight and night. Does that bother you very much? No. Sometimes it’s night and sometimes it’s daylight. Sometimes it’s a boom. Sometimes it’s a bust. I believe in doing as well as you can and keep going as long as they let you.”

“Mimicking the herd invites regression to the mean (merely average performance).”

“You don’t have a lot of envy, you don’t have a lot of resentment, you don’t overspend your income, you stay cheerful in spite of your troubles. You deal with reliable people and you do what you’re supposed to do. And all these simple rules work so well to make your life better. And they’re so trite. And staying cheerful … because it’s a wise thing to do. Is that so hard? And can you be cheerful when you’re absolutely mired in deep hatred and resentment? Of course you can’t. So why would you take it on?”

“I know I’ll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.”

“A cryptocurrency is not a currency, not a commodity, and not a security. Instead, it’s a gambling contract with a nearly 100% edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity.”

“Another thing, of course, is life will have terrible blows, horrible blows, unfair blows. Doesn’t matter. And some people recover and others don’t. And there I think the attitude of Epictetus is the best. He thought that every mischance in life was an opportunity to behave well. Every mischance in life was an opportunity to learn something and your duty was not to be submerged in self-pity, but to utilize the terrible blow in a constructive fashion. That is a very good idea.”

> “I know I’ll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.”

The duo eventually came round after missing the first few thousand percent rise in Apple. They owned that error and fixed it. By the time they were at the top of the pile they “created their own weather.” Accumulate a position and when it was revealed follow on investors made their buys automatic winners.

The only thing negative I recall was his proposal for student housing at UCSB.

https://dailynexus.com/2022-11-03/nexus-explained-munger-hall/

Best advice IMO? “In Munger’s view, to make good decisions, you need to be able to draw on mental models developed from different disciplines. He knew how a lawyer approached an issue would differ from how an engineer or artist would approach it, so it made sense to develop mental models that span different specialties.”

With Mr. Munger practically broke, his daughter Molly complained to him about his beat-up yellow Pontiac. “Daddy, this car is just awful, a mess,” she said. “Why do you drive it?”

As recounted in Ms. Lowe’s biography, he replied, “To discourage gold diggers.”

Henry Kissinger passed away yesterday at the ripe old age of 100 and politics aside, no-one can deny his brilliant mind. Here are some quotes of his worth repeating:

“There cannot be a crisis next week. My schedule is already full.”

“If you don’t know where you are going, every road will get you nowhere.”

“The absence of alternatives clears the mind marvelously.”

“A leader does not deserve the name unless he is willing occasionally to stand alone.”

“If it’s going to come out eventually, better have it come out immediately.”

Since we’re talking Buffett adjacent quotes here’s my favorite quote attributed to Buffett himself.

“You never know who’s swimming naked until the tide goes out.”

Warren Buffett

Applied to real estate it means that there’s many people holding on by their fingernails to buy/finance property purchases. These are the ones swimming naked and once the tide goes out (real estate market goes down for whatever reason) they’re to one’s who are going to get caught naked.

Unfortunately once government deemed banks “too big to fail” everything has turned upside down.

As the late Charlie Munger put it, “Show me the incentive and I will show you the outcome.”