We received three offers on our new listing, and all were around $2,000,000….well under the list price.

Once you get over $2,000,000, the buyers are putting up some fight.

If the only strategy is to take the best offer – by far the most popular realtor strategy – what do you do? Just select your favorite $2,000,000 agent with biggest down payment and shortest escrow? Or wait another week (or more) and hope there are two in the bush?

Those are the only two choices being employed all around the county. Home sellers have no idea how much money they are leaving on the table – and neither do the agents. It doesn’t occur to anybody that there is any other way to transact.

Spruce them up the best you can. Do the open-house extravaganza. Then counter ALL offerors for their highest-and-best…..and then tell everyone the current high price, and ask them to beat it. When faced with losing the house, buyers are much more likely to keep bidding.

I haven’t found any other agent who does it this way, but I hope they are out there.

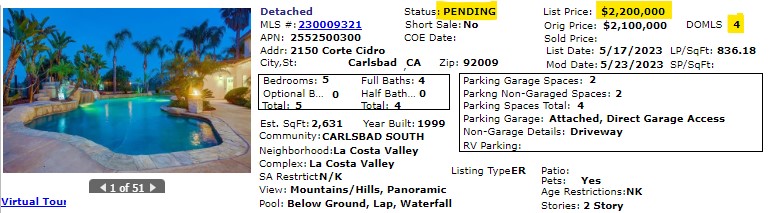

I had the sellers agree to raise our list price to the agreed-upon sales price in order to send a message to the rest of the marketplace. I don’t want any of the other listings nearby to drop their price, and I want to be supportive to other buyers in general that the market is fine. Three of the La Costa Valley Six listings have gone pending in the last week!

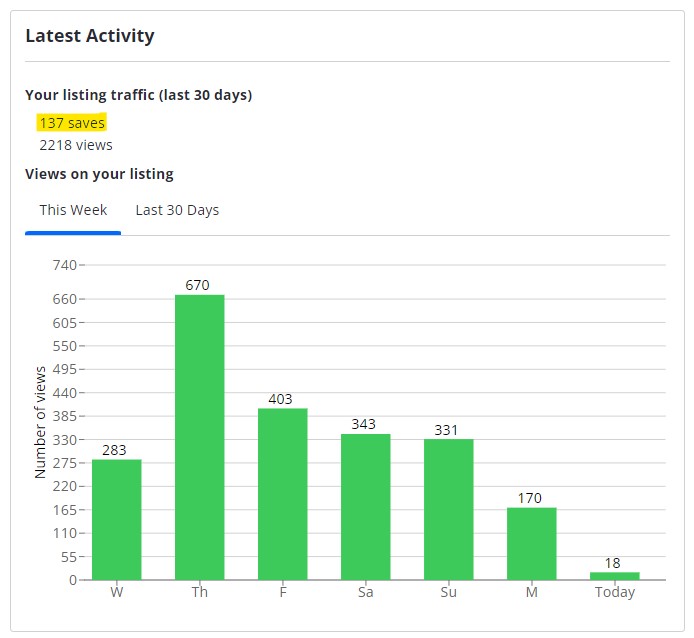

One more note. When possible, I want to pick the winner on Day Four – it is the peak of the buyer urgency, and interest drops off quickly. Once a listing is more than a month old, buyers are going to lowball – why would you want to be in that predictament? Look how the views taper off:

When the saves are running around 5% of the total views, the online presentation is being well-received. Buyers must like the location, the photos, and the price to want to save another Zillow listing!

I LOVE THIS METHOD!!!!!!!! However, I think most realtors want to “turn and burn” and just list for the lowest their dumb (I mean naive) seller will allow and take the quickest and easiest offer and move on to the next.

In sports gambling specifically basketball theres over/under. This is where books say that the total score of both teams will equal X. Gamblers can bet that the final outcome will be over or under the amout the book said it would be.

Heres where above can apply to the way you’re selling homes. Theres also a bet you can make called a “lighting” that says if you bet the over +10 every point over the over +10 pays out like 10 to 1.

What’s happening is the the gambler is being incentivized to bet more than just the minimum. The book knows that this will rarely occur but it’s fun for the gambler when it does.

Sellers need to somehow structure realtor comissision so that theres incentive to push for “best and highest” over first come first serve. Maybe 3% for offers accepted in the 1st round 4% in the 2nd round and 5% in the 3rd round. (As long as each round ups the price by Y%)

Klinge Realty hits another one out of the park! Great work Jim and team!

Thank you everyone!

Sellers need to somehow structure realtor comissision so that theres incentive to push for “best and highest” over first come first serve. Maybe 3% for offers accepted in the 1st round 4% in the 2nd round and 5% in the 3rd round. (As long as each round ups the price by Y%)

If we did incentivize, then every agent would catch on and do it too. But there is so little incentive for agents to push harder that I can’t even get anyone to consider it. When I talk to other realtors about them doing it too, their eyes glaze over and their voice trails off as they get back to their phone.

Sellers know when their realtor sucks AFTER the sale or no sale at all. Those realtors rarely get repeat customers and referrals. How many repeat customers and referrals does JTR get? Lots I am willing to bet because he works hard for his clients.

Thanks Old School for your support!

I ran into an old friend today. I sold his house about 15 years ago and he had settled in like most folks into a comfortable Carlsbad lifestyle.

He owns one of only two liquor stores in the village, and I asked him how much he’s been offered lately for the property. He said, “$6 million, but what would I do with it?”

I’m calling it the anti-inventory, because the owners will do anything but sell!

Your old carlsbad friend seems to be stuck with a Wells Fargo checking account yielding 0.001% interest.

You can easy place $6million at 5% interest which is a cool $300k per year doing nothing. I doubt he makes more working at the liquor store.

You would be wrong about that.

Some people just don’t understand the booze industry. The cash flow is huge.

Back to SD RE. A few weeks ago we were walking La Jolla. Hard to comprehend the the amount of money all but dribbling out of residents. I don’t see how it holds.