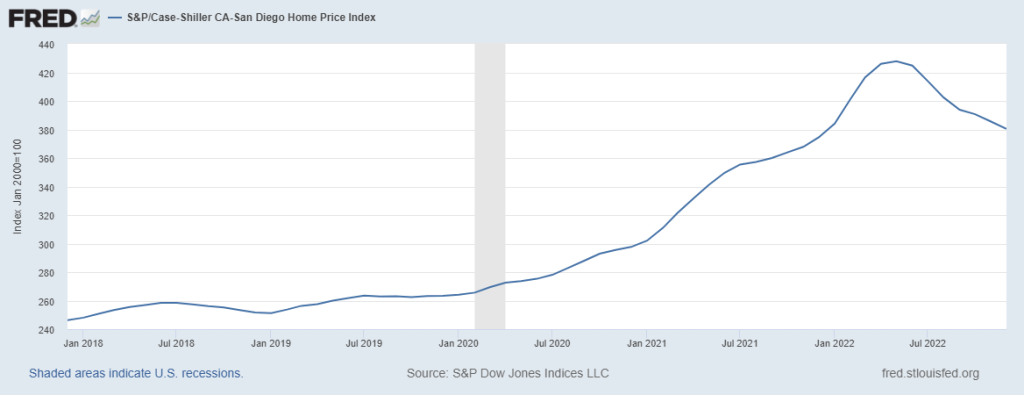

The local index is 11% lower than its peak in May.

The beauty about this market is that buyers don’t have to fight with the decision to buy now or wait. Because the inventory of quality homes is so thin, having to wait is baked in.

How often do buyers see a home for sale that interests them? Once a month, maybe?

The higher rates go, the more sellers will think it’s a bad time to sell – causing FEWER homes for sale.

It’s a big game of chicken, and you have to wonder if every buyer will get the memo to hold out. If renegade buyers keep paying retail for the premium properties, it spoils the whole idea of prices dropping.

Will higher rates cause better pricing on the homes you are willing to buy?

Don’t ask Jay Powell, because he doesn’t know. He said:

We are well aware that mortgage rates have moved up a lot. And you are seeing a changing housing market. We are watching it to see what will happen.

How much will it really affect residential investment? Not really sure.

How much will it affect housing prices? Not really sure.

Thanks Jay!

“Because the inventory of quality homes is so thin, having to wait is baked in.”

Buyers, don’t expect to see many creampuffs, because most current owners are not living in creampuffs! This is the true reality of homeownership. Unless the current owners bought >20 years ago, continued to work with increases in salary and other investments, it’s unlikely major updates have occurred at the residence. Mortgage, taxes, maintenance, landscaping, utilities, etc. eat up a large portion of the income.

Creampuffs are the exception, not the rule. And with most owners locking in very low interest rates for the past 5 years, expect a trickle of inventory in coastal real estate until other areas are a value to buy (which they’re not right now).

Thanks Joe, and I think you’ll agree that the trickle could change to an occasional drop here and there!

One thing is for sure – estate sales will dominate the field.