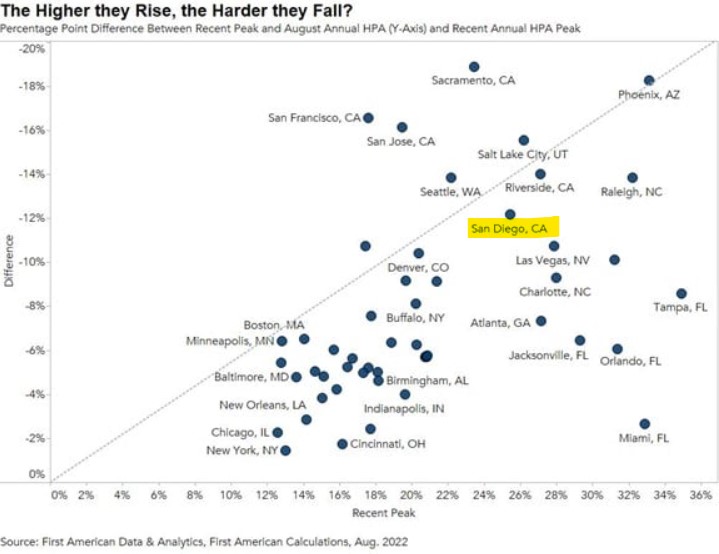

The local Case-Shiller index is due tomorrow, and expectations are for a 2% drop from June. First American has their own repeat-sales index which is already showing a 12% decline in San Diego pricing (above).

https://blog.firstam.com/economics/pandemic-boom-markets-cooling-the-fastest

While the -12% over six months is probably a surprise to people who think pricing is downward sticky, it’s different this time. In the past, the home-equity positions were much smaller, and many sellers had hold out just to have enough for a steak dinner at closing.

None of today’s sellers need to hold out. All of them could sell today for what the market will bear, if they could just get out of their own way. Yes, it’s true that they may have plans for all the money and need to sell for their price, and those sellers should just wait it out.

This could be over before you know it.

Is there a specific marker for home buyers to know when it’s time to buy? Or is it just when prices go down?

Is the -12% enough to get the attention of the highly-motivated buyers – those who don’t own a house yet?

Or will they just look up in March/April and say, “Close enough!”

“While the -12% over six months is probably a surprise to people who think pricing is downward sticky, it’s different this time.”

I know of several 100k+ Jeep Grand Cherokees, swimming pools, and parents that go out every night for dinner that say different.

We’ll see…

I don’t think that most people realize it but they are waiting for the investors to jump back in. Flipping is very risky at this point and until the numbers pencil for investors most people will sit on the sidelines. We are a far way off mortgages covering rents when you can just buy T-Bills and sleep well at night. I’m saying this tongue-in-cheek but overpaying for a home and being upside down is shameful among the well-to-do.

Today’s sellers don’t need to hold out, but how many of them don’t need to be sellers at all? How many of today’s sellers are people who are overpaying and upside down vs people who can go on living comfortably in their homes and will just decide that maybe it’s not the right time to sell after all?

people who can go on living comfortably in their homes and will just decide that maybe it’s not the right time to sell after all?

Thanks GeneK and my guess is this group that you described is at least 80% of the home sellers around here, and probably more like 90%.