These are eye-popping numbers for all of north county – thanks Jerry Ryan!

Percentage of List Price Received

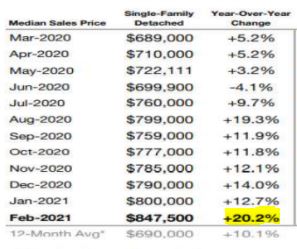

Median Sales Price with Year-Over-Year Change

The latest month-over-month change in median SP was 6%!

Jim Klinge

Klinge Realty Group

Are you looking for an experienced agent to help you buy or sell a home?

Contact Jim the Realtor!

CA DRE #01527365, CA DRE #00873197

Trustindex verifies that the original source of the review is Google. Jim & Donna Klinge helped us sell our home of 30 years in Ocean Hills. We were very happy with their service and would HIGHLY recommend them to anyone looking for an Honest, Knowledgeable, Skilled, Informed Efficient realty team. Both Jim & Donna were so helpful in different ways and complemented each others skills. Please refer to a more detailed review that we wrote on YELP. Thank You Both for all your help!!!Trustindex verifies that the original source of the review is Google. A+ thank youTrustindex verifies that the original source of the review is Google. Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.Trustindex verifies that the original source of the review is Google. We sold a home with Jim and Donna and from beginning to end they were consummate professionals. Their initial walk through the property resulted in a list of items to be repaired or updated. They supplied a list of vendors and job quotes to do the repairs and updates. We originally wanted to sell ‘as is’ and just get it over with. They gave us a selling price for ‘as is’ and options for doing a few updates/repairs to doing it all with the selling price for each option. We agreed to do all they suggested and we sold for the exact price they predicted. For every dollar spent we got back more than $2 back in the selling price. And they got that price in a rising interest rate environment! Donna and Jim are extremely detailed and guide you through ever aspect of the sale. There were no surprises thanks to their guidance. We couldn’t be more pleased with their representation. Thank you Donna and Jim, Jerry and MaryTrustindex verifies that the original source of the review is Google. We have known Jim & Donna Klinge for over a dozen years, having met them in Carlsbad where our children went to the same school. As long time North County residents, it was a no- brainer for us to have the Klinges be our eyes and ears for San Diego real estate in general and North County in particular. As my military career caused our family to move all over the country and overseas to Asia, Europe and the Pacific, we trusted Jim and Donna to help keep our house in Carlsbad rented with reliable and respectful tenants for over 10 years. Naturally, when the time came to sell our beloved Carlsbad home to pursue a rural lifestyle in retirement out of California, we could think of no better team to represent us than Jim and Donna. They immediately went to work to update our house built in 2004 to current-day standards and trends — in 2 short months they transformed it into a literal modern-day masterpiece. We trusted their judgement implicitly and followed 100% of their recommended changes. When our house finally came on the market, there was a blizzard of serious interest, we had multiple offers by the third day and it sold in just 5 days after a frenzied bidding war for 20% above our asking price! The investment we made in upgrades recommended by Jim and Donna yielded a 4-fold return, in the process setting a new high water mark for a house sold in our community. In our view, there are no better real estate professionals in all of San Diego than Jim and Donna Klinge. Buying or selling, you must run and beg Jim and Donna Klinge to represent you! Our family will never forget Jim, Donna, and their whole team at Compass — we are forever grateful to them.Trustindex verifies that the original source of the review is Google. WeI had the pleasure of working with Klinge Realty Group to sell our home in Carmel Valley, and I cannot recommend them highly enough! Jim and Donna demonstrated exceptional professionalism, offering expert guidance on market conditions and pricing strategy, which resulted in a quick and successful sale. Communication was prompt and we were well-informed throughout the entire process. For anyone looking for a dedicated and knowledgeable real estate team, look no further! ---Trustindex verifies that the original source of the review is Google. Donna and Jim Klinge of Klinge Realty Group have our highest possible recommendation. From Donna and Jim’s first visit to our house through closing their advice and counsel was candid and honest in all dealings. They kept us fully informed throughout the process. The house sold less than three days after listing with a two-week closing. My wife and I have sold several houses during our lives. This was by far the best experience. Klinge Reality is a premium service realtor. You can’t make a better choice for someone to sell your home fast and for top dollar.Trustindex verifies that the original source of the review is Google. Donna and Jim provided exceptional support and professionalism throughout the entire process. We couldn't have been happier with their efforts. They made our house shine, and thanks to their expertise, it sold above the listing price in the very first weekend! Truly a fantastic experience from start to finish.Trustindex verifies that the original source of the review is Google. This year has been difficult on our family, mainly due to having to sell our home. Thankfully we knew God had a plan for us and working with the Klinge team was a key part of it. It was an obvious decision to work with them again after such an amazing experience when purchasing the same home we needed to sell. The challenge was, how will we do this in so little time with so much going on? Jim and Donna held our hand every step of the way. Whenever an unexpected issue arose they found and provided a solution. Never once did we feel pressured to make a decision and the Klinges were always reassuring after providing the information that the decision was ours to make. Despite the curve balls, they never panicked and exemplified the “can do” attitude, making us feel optimistic and taken care of. Their expertise and professionalism was superb. But of all the reasons to work with the Klinges, the most impactful and valuable is their compassion and genuine care for their clients. We pray that we can one day purchase our forever home and you better believe that Jim and Donna will be representing us - as long as they will have us of course. Thank you again Klinge team! Your execution, experience, and care are unmatched.Trustindex verifies that the original source of the review is Google. Jim and Donna were fantastic! Jim understanding my needs, recommending potential places, pointing out the pros and cons of each property was invaluable. Then when the offer was accepted Donna’s organized guidance through the inspections, paperwork etc made the whole process seem effortless. So grateful that I had them on my side!Load more

I feel like I’ve watched this movie before though as a much younger man

Dear Old Man. All markets eventually revert to the mean.

Not sure I agree with the comment above. What mean are we talking about? The mean growth in 1980? Today? 40 years ago, San Diego was a local market. 20 years ago it was a national market. Today it’s an international market. As a result, the price growth is spiking. Will it slow down or even drop a little at some point? Sure. Will it ever be as affordable as it was a generation ago? NOPE. The law of supply and demand wins over the law of reversion to the mean.

As John Maynard Keynes said, “the markets can remain irrational longer than you can remain solvent.”

As long as The Fed keeps pumping out cash, reversions to the mean may take a long, long, long while.

The passage of extended periods of can blunt that reversion.

And sometimes markets fundamentally change. All the chatter on next door these days is coming from recent arrivals from the Bay Area looking for dining recommendations.

Or the mean reverts to the market.

Personally I believe this is the result of not building what people want. The plandemic accelerated a decades long trend for traditional exurban SFR homes, lots and neighborhoods. No amount of high density infill is going to fix that except to make the neighbors suffer.

Frenzy = A state or period of uncontrolled excitement.

We are in a period of “greater fool theory “ until prices revert to the mean trend line.

Sorry Josh. Not a new normal.

It may take time to revert, but it always has. By the same token, the San Diego real estate market has never failed to make a new high.

Very dangerous if you have a short term time horizon or less than 5 years.

Such irony that this post followed one on U2.

Uno, dos, tres…quatorce!!