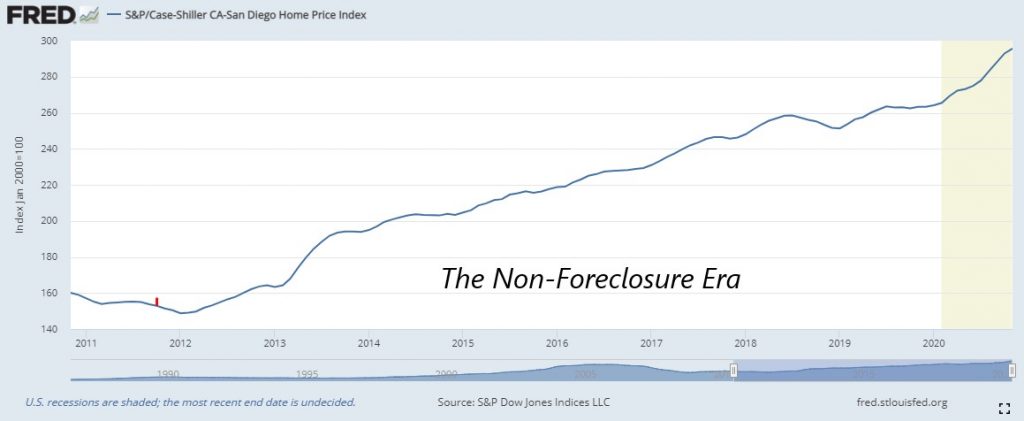

It was in June, 2011 that Ben Bernanke said at a live press conference: We have told the banks to handle their REOs…..long pause………..in an economy-supportive way. Oops. What he was GOING to say was “we have told the banks not to flood the market with REOs.”

Since then, foreclosures dried up, mortgage rates came down, and the local home prices have gone up steadily. Today’s pricing curve looks similar to 2013 – if it repeats, then prices should flatten out this summer. But who knows – there is heavy demand, and few sellers have been lured by these prices!

San Diego Non-Seasonally-Adjusted CSI changes:

| Observation Month | |||

| January ’19 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| June | |||

| July | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov | |||

| Dec | |||

| Jan ’20 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| June | |||

| July | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov |

From cnbc:

Phoenix, Seattle and San Diego continued to show the strongest price appreciation of all the major markets in November. Phoenix led the way with a 13.8% year-over-year price increase, followed by Seattle with a 12.7% increase and San Diego with a 12.3% increase. All 19 cities reported higher price increases in the year ending November versus the end of October.

“Our 2021 outlook expects an eventual moderation to price gains as home construction ramps up and the widespread availability of COVID vaccines bring more flexible sellers back to the housing market, but it will be some time before these changes bring relief,” said Danielle Hale, chief economist with realtor.com.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Shiller draws some key insights from his analysis of long term home prices in his book Irrational Exuberance. Contrary to popular belief, there has been no continuous uptrend in home prices in the US and the home prices show a strong tendency to return to their 1890 level in real terms. Moreover, he illustrates how the pattern of changes in home prices bears no relation to changes in construction costs, interest rates or population.

Shiller notes that there is a strong perception across the globe that home prices are continuously increasing, and that this kind of sentiment and paradigm may be fueling bubbles in real estate markets. He points to some psychological heuristics that may be responsible for creating this perception. He says that since homes are relatively infrequent purchases, people tend to remember the purchase price of a home from long ago and are surprised at the difference between then and now.

However, most of the difference in the prices can be explained by inflation. He also discusses how people consistently overestimate the appreciation in the value of their homes.

The US Census, since 1940, has asked home owners to estimate the value of their homes. The home-owners’ estimates reflect an appreciation of 2% per year in real terms, which is significantly more than the 0.7% actual increase over the same interval as reflected in Case-Shiller index.

Shiller also offers some explanations as to why a continuous uptrend is not observed in real home prices:

Mobility: Shiller argues that “people and business will, if home prices are high enough, move far away, even leaving an area completely”. Land may be scarce locally, but urban land area is only 2.6% of the total land area in the United States.

Easing land restrictions: Increasing prices put pressure on the government to ease restrictions on land in terms of how much can be built on a particular amount of land and also the amount of land available for development.

Technology Improvements: Construction technology has improved considerably making home building cheaper and faster, which puts downward pressure on home prices.

Thus, real home prices are essentially trend-less and do not show any continuous uptrend or downtrend in the long-run. This is not limited to the US as it is also observed in the real home price indices of Netherlands and Norway.

https://en.wikipedia.org/wiki/Case%E2%80%93Shiller_index

In California, for now, buying a house is a good inflation hedge. Watch mortgage rates and inflation expectations. Either rate moving off their lows will push fence sitters into the market.

> “However, most of the difference in the prices can be explained by inflation. He also discusses how people consistently overestimate the appreciation in the value of their homes. ”

It’s no secret I think Shiller is totally wrong in this one aspect of his huge body of otherwise decent work.

Here’s what I’ve said:

“From 1890 through 1990, the return on residential real estate was just about zero after inflation.” – Robert Shiller

Let us examine this through direct comparison rather than average or medians . Anyone care to live in an 1890 original condition home? No garage, several hundred sq feet, maybe a tub and toilet, soapstone sink, wood stove?, coal furnace at 20% efficiency, etc. etc. ? 1950? How about 1970? Ahh now were are getting close. You’d still be looking at a smallish place and be lucky to get the 2 car garage. You might also find yourself with aluminum wiring and that original aluminum siding and some nice formaldehyde insulation and asbestos linoleum tiles and 1 1/2 baths, single pane windows, 60% efficient oil burner heating, etc. etc.

No, Schiller has it all wrong. The median 1890s house has not kept pace with inflation unless it has been subject to continuous homeowner improvements to keep it nearer in quality and size and amenities to the latest medians. Moving target.

—

I wrote that in 2007.

I disagree but for different reasons. CA and specifically SD is a different place than much of the country and behaves differently. That leads to my other reason he and Rob are off. Its not about the house here. Its about the land which is on average about 75% of value along the coast. Higher the closer the you get of course.

looking at this CS index curve tells me two things….

very few people understand the value of Bitcoin and how it works, but a whole lot of us everyday folk understand the value of owning real estate in a seemingly never ending low rate environment.

> “Its about the land which is on average about 75% of value along the coast. Higher the closer the you get of course.”

A relative has a home on several acres of cliffside oceanfront Padaro Ln, Carpinteria, CA 93013. $20-25m? No matter. Who can afford 1% taxes on market value? $200k/yr. Price is dependent upon carrying costs.

Carpinteria is not Carlsbad or North SD County for that matter. Several acres (is it subdividable?) with a single house representative of the single family market here either but thanks for trying.

In San Diego North County Coastal market I usually use about 40% for land value.

Tear Down= $1.5MM/.4= $3.75MM. Crazy, right? Won’t be in 30 months when you finally get permits and finish the project.

Depending on the cycle point you can just about double values every 10 years as well.

Rob Dawg makes some excellent points in his comments.

The last homes from the 1800s in original condition around here didn’t do so well:

https://www.lajollalight.com/news/story/2020-10-26/fire-destroys-la-jollas-historic-red-rest-cottage-and-damages-red-roost

> “Carpinteria is not Carlsbad or North SD County”

I suggest you do a little research on Padaro Lane in “Carpinteria. It is the little oceanfront street across the freeway and railroad tracks from the Polo Grounds. Aka the rich part of Montecito/Summerland.

RE: Red Rest/Red Roost

> “The estimated cost of the damage to the structures is $175,000.”

Ummm, you couldn’t dispose of the rubble for that much. And don’t get me started on all the “interested parties” that will descend should you so much as kick an ash pile.

The wind that kicked up on Monday might have taken care of them!

Rob, I know exactly where it is and what it is. I wasnt commenting on the value of a single property on an oceanfront street with only several others nor the value/desirability of a single unique property. I was referring to a large marketplace. It just isnt comparable or the same as here where we have tons of tract built homes on 5 to 10K lots.

Mozart you are valuing land as a component of building a new custom home. Thats not the same as the relative value of an 10 to 40ish year old mass production tract home on a small piece of dirt. two different worlds

I think the point was that the value of the improvements upon such land is not fixed – it’s what you make of it.

It starts with the cost of maintaining your original structure, and then what you decide to do with it.

Some people can get carried away, like this former Qualcommer – his land value is only 48% of total:

https://www.priceypads.com/splendor-by-the-sea/

Of course there are always exceptions and that one is as exception as you can get. Im referring to the vast and I mean vast majority of North County Coastal homes. Over the last 30 years Ive been in my home, I have seen over and over that the house has a lot less to do with the value. A lousy tract house on a great lot will sell for the same or more than an uber fixed up house in the same tract with mediocre lot/location.

I know how to pick ’em, don’t I?

He tore down 25,000sf to build a new 23,411sf pad!

Im referring to the vast and I mean vast majority of North County Coastal homes. Over the last 30 years Ive been in my home, I have seen over and over that the house has a lot less to do with the value. A lousy tract house on a great lot will sell for the same or more than an uber fixed up house in the same tract with mediocre lot/location.

I agree, though we may see more exceptions with the infill projects because some people want a big new house bad enough that they won’t care if it backs to the freeway.